Editor’s Verdict

Savexa is a young CFD broker, established in 2024 and operated by Trade Tide Ltd, focusing on a proprietary platform and a zero-commission trading model. It is regulated by the Mwali International Services Authority (MISA). Savexa’s core trading costs are competitive. Read on to find out whether Savexa is the right CFD broker for you.

Overview

Savexa is a CFD broker, launched in 2024, and operated by Trade Tide Ltd. The company's legal registration is in the Comoros Union (Registration No. HT00324038), and it is authorized and regulated by the Mwali International Services Authority (MISA) under license number BFX2024065.

The broker's key appeal is centred on a zero-commission trading model, with costs incorporated within the spread, which ranges from 0.9 pips on EURUSD for the VIP account.

The platform offers over 160+ CFDs. While Savexa does not support certain high-frequency strategies, this approach ensures a stable and secure trading environment, making it well-suited for traders who prefer a more structured and risk-conscious approach.

Headquarters | Comoros |

|---|---|

Regulators | MWALI International Services Authority |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2024 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | 0.9 pips |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.9 |

Minimum Commission for Forex | 0 |

Funding Methods | 5+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Savexa Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. Savexa operates under a single regulated entity.

Is Savexa Legit and Safe?

Savexa is a legitimate registered entity (Trade Tide Ltd., Reg. No. HT00324038) and is regulated by the Mwali International Services Authority- MISA.

The MISA license provides oversight and some limited consumer protection. Traders must rely on the broker’s internal safeguards, such as Negative Balance Protection and segregation of client funds, rather than strong external supervision.

Country of the Regulator | Comoros |

|---|---|

Name of the Regulator | MWALI International Services Authority |

Regulatory License Number | BFX2024065 |

Regulatory Tier | 4 |

Fees

Savexa’s fee structure is detailed in the broker's ‘General Fees policy’ available on the website but I struggled to find detail about specific trading pairs.

Average Trading Cost EUR/USD | 0.9 pips |

|---|---|

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.9 |

Minimum Commission for Forex | 0 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | 100 USD after one month, rising to 500 USD after month 12 |

EURUSD trading costs VIP Account

Average Spread (EUR/USD) | Commission per Round Lot | Total Cost per 1.0 Standard Lot |

0.9 pips | $0.00 | $9.00 |

Noteworthy:

Spreads: During my review, I could not verify the average spreads the broker quotes for all the tradable instruments it offers. There does not appear to be a table with this information displayed and I must delve into the trading terms and conditions and look at other reviews to determine what is likely.

Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are not mentioned; therefore, they are assumed to be unavailable.

Withdrawal Fees:

- First withdrawal: Free (for verified clients who have completed a trade)

- Subsequent withdrawals:

- Cards: 3.5%

- Wire transfers: $30

Account Inactivity Fees:

- 1–2 months: $100/month

- 12 months or longer: $500/month

Deposit Fees: None (though third-party processors may charge)

Overall, Savexa’s trading costs are competitive for active traders, but long-term account dormancy can become expensive.

Overnight Swaps

Like most trading brokers, holding a leveraged position overnight will incur a swap fee (or credit). This is the interest rate differential between the two currencies in a pair.

The rates are quoted in pips. The firm operates on a standard industry model where a 3-day swap is charged on Wednesday.

Swap Calculation Example EURUSD for VIP account

Let us calculate the estimated cost of buying 1.0 standard lot (100,000 units) of EURUSD and holding it, assuming the minimum 0.9 pips spread and using the broker's quoted daily swap rates:

- 1-Day Swap Long (Buy): -47.28 pips = -$4.73 USD

- 1-Day Swap Short (Sell): -45.7 pips = -$4.57 USD

Holding a standard one lot EURUSD position for one night:

Direction | Spread Cost (0.9 pips) | Commission | Swap Cost (1 Night) | Total Cost |

|---|---|---|---|---|

Buy | ~$9.00 | $0.00 | -$4.73 | $13.73 |

Sell | ~$9.00 | $0.00 | -$4.57 | $13.57 |

Holding an EURUSD position for seven nights:

Direction | Spread Cost (0.9 pips) | Commission | Swap Cost (7 nights)* | Total Cost |

|---|---|---|---|---|

Buy | ~$9.00 | $0.00 | -$23.64 | $32.64 |

Sell | ~$9.00 | $0.00 | -$22.85 | $31.85 |

Note: These are estimated figures. Actual swap rates vary daily.

*The 7-night swap cost is based on five regular nights plus the triple-swap night for Wednesday. Since both the long and short rates are negative, this position is a costly one to hold over a full week for the standard account.

Range of Assets

Savexa provides a well-rounded selection of assets of over 160+ CFDs, allowing for effective portfolio diversification across different market sectors.

Cryptocurrencies | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Savexa Leverage

The maximum leverage available at Savexa is determined by the regulatory body governing the client's account.

Maximum Leverage across all account types |

Up to 1:400 |

What should traders know about Savexa leverage?

- Leverage magnifies both potential profits and potential losses.

- Negative balance protection ensures retail traders cannot lose more than their account balance.

- Always use risk management tools like stop-loss orders when trading with leverage.

What I would like Savexa to offer

As an experienced trader, the limitations on trading freedom and trading platform choice are the biggest drawbacks here. If Savexa aims to appeal to a more sophisticated or higher-volume client base, I would strongly advise they add the following:

- Remove or Clarify Strategy Bans: The outright prohibition of scalping is overly restrictive. A modern broker should ideally accommodate all legal trading styles.

- Add Advanced Order Types: Introducing essential risk management tools like OCO (One-Cancels-Other) orders would benefit traders by allowing them to automate their entries and exits with a single conditional order, a feature currently unavailable.

- More published details on the tradable instruments, like average spread, trading hours, etc.

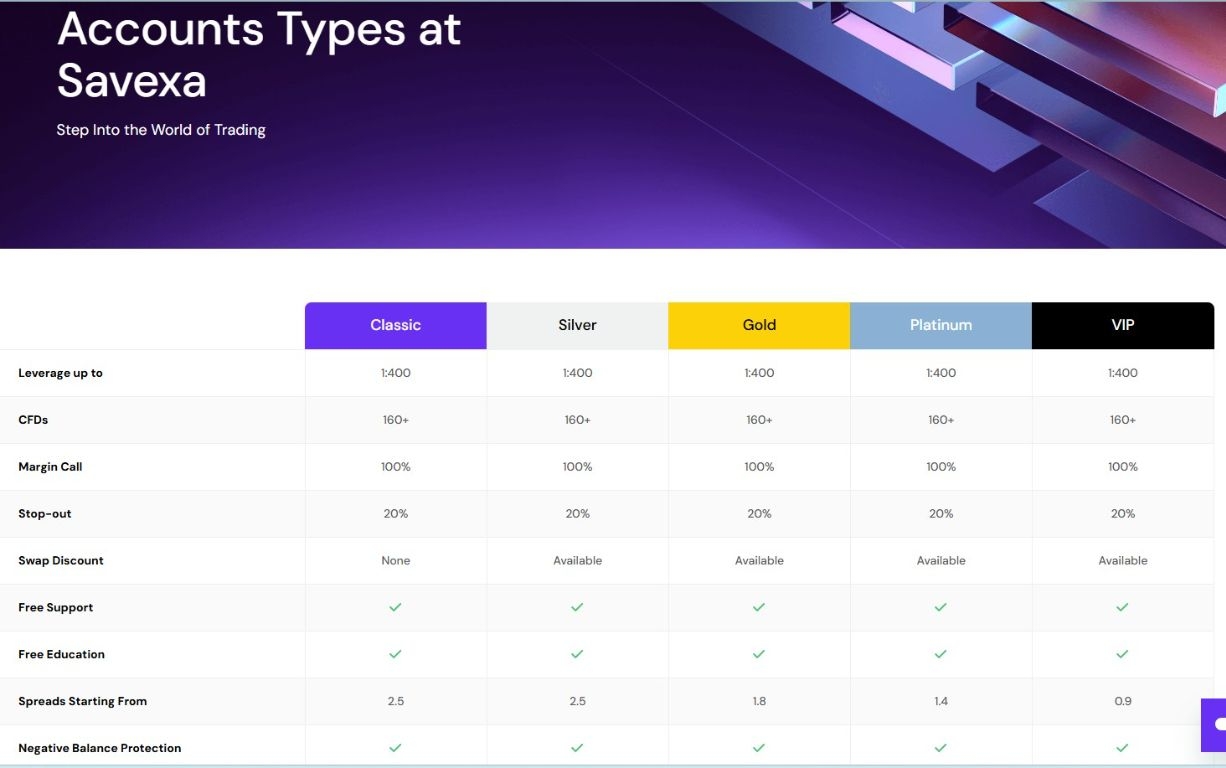

Account Types

Savexa simplifies the account process by offering five account types for all clients. All traders receive the same core features and access to all available trading instruments. The main difference is the pricing.

My observations concerning the Savexa account types are:

- Simple tiered options, classic to VIP

- Spread only competitive pricing is the only real difference

- Islamic (swap-free) version of the account is not available, but the non-classic options mention a Swap discount

Savexa Demo Account

Savexa does offer a free demo account for trading. This feature is mentioned in the broker's promotional materials and is available for testing strategies and familiarising yourself with the trading environment before using live capital.

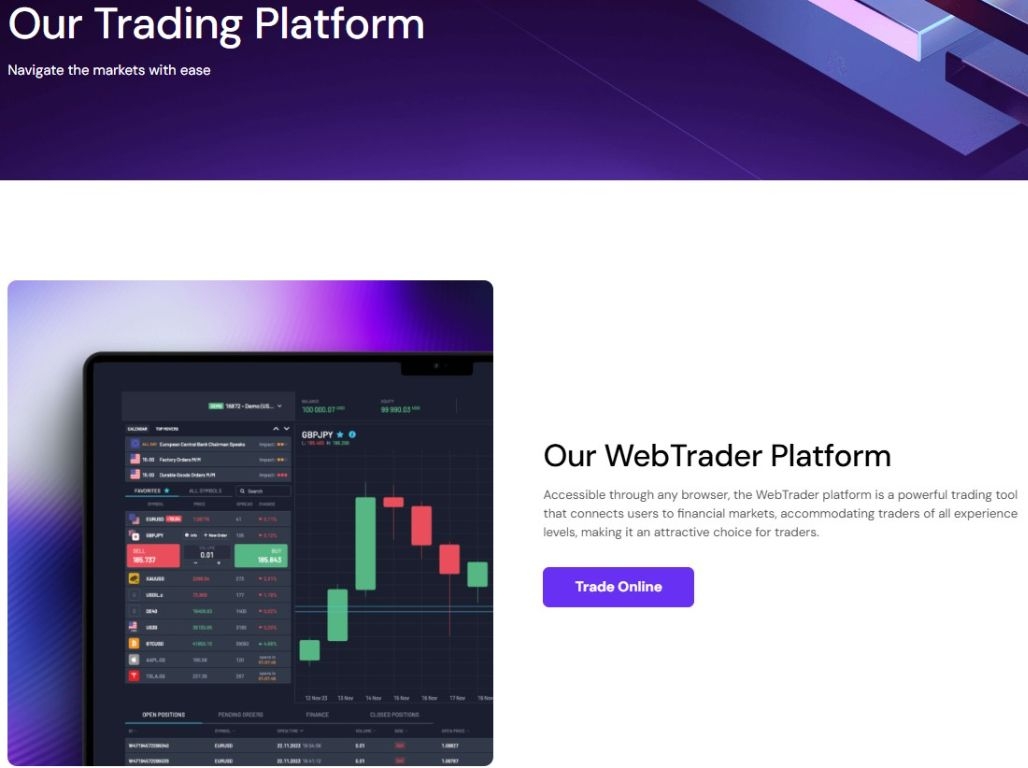

Trading Platforms

Savexa operates on its Proprietary WebTrader platform, available via desktop and mobile browsers. It was designed from the ground up to be intuitive and accessible, removing the steep learning curve associated with more complex platforms and making it ideal for new and intermediate traders. This focus on simplicity is a direct competitor to the often-overwhelming nature of other systems.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Platform Features

- Order Types: One-Click Trading supported (OCO not supported)

- Prohibited Strategies: Scalping, arbitrage, and pip-hunting

- Personalized interface

- Integrated Tools: Advanced charting and analytics

The platform is modern and functional but limits algorithmic and advanced traders who rely on MetaTrader integrations.

Research & Education

Savexa provides basic research tools integrated into its platform, including an economic calendar, market news feeds, and sentiment analysis. However, it does offer good insights via the ‘education tab’ on the website with examples and video walkthroughs of key fundamentals of trading, such as the use of leverage and its impact on trading as well as detailed information on costs of trading - spread and overnight swaps. The firm also provides access to trading eBooks and daily market videos, giving a round-up of the latest market news relevant to traders.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 support |

Website Languages |    |

Savexa offers 24/7 customer support through the following channels:

- Live Chat

- Phone

Support is available in multiple languages: English, Japanese, Korean, and Hindi are specifically quoted in other reviews and appear as options on the website.

Bonuses and Promotions

No bonuses or promotions are offered by Savexa.

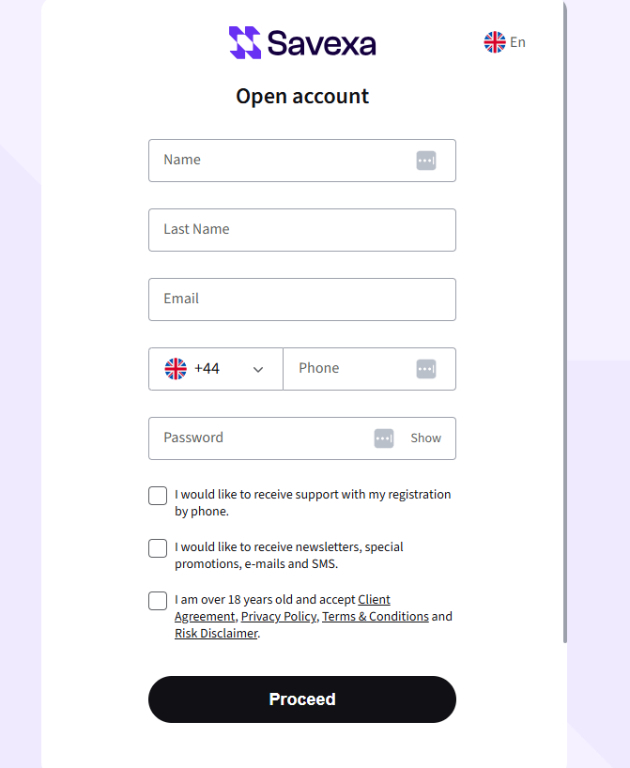

Opening an Account

The account opening process at Savexa is fully digital, fast, and user-friendly.

What should traders know about the Savexa account opening process?

- Savexa adheres to global AML/KYC standards. The Minimum age for registration is 18 years old

- Account verification is mandatory and requires a government-issued ID and a proof of residency document.

- The entire process can often be completed in under 10 minutes. Phone support with the application is offered.

Minimum Deposit

The minimum deposit at Savexa starts at $250.

Payment Methods

Savexa supports a range of modern and traditional payment methods, including the list below.

- Bank Wires (Local and International)

- Credit/Debit Cards (Visa, Mastercard)

- E-Wallets will vary depending on the country

Withdrawal options |     |

|---|---|

Deposit options |   |

Savexa accepts clients from many countries around the world but notably does not provide services to residents of the United States, the UK, Canada, or certain other jurisdictions listed within its website footer.

Deposits and Withdrawals

The client portal manages all financial transactions securely and efficiently.

What are the key takeaways from the deposit and withdrawal process at Savexa?

- Deposits are free of charge (some payment processors may levy a fee)

- Withdrawals: 5–10 business days

- First withdrawal: Free (if verified and active)

- Subsequent withdrawals:

- 3.5% fee for cards

- $30 fee for bank wires

Savexa’s payment system is straightforward but relatively slow compared with major global brokers.

Is Savexa a good broker?

Savexa offers a cost-efficient, zero-commission environment supported by a modern proprietary platform. The spreads are competitive, and Negative Balance Protection is included. While Savexa is regulated offshore by MISA, and certain trading strategies like scalping are restricted, the broker provides strong internal safeguards such as Negative Balance Protection, and clear inactivity policies help ensure account security and compliance. Savexa suits experienced discretionary traders who prefer simple manual execution and understand the risks of trading with an offshore entity. I especially like the education section and the daily market updates.

FAQs

What are the withdrawal fees?

The first withdrawal is free if the account is verified and one trade is completed. Subsequent withdrawal fees are 3.5% for card withdrawals and 30 USD for wire transfers.

Does Savexa support MT4 or MT5?

Savexa does not use MetaTrader 4 or MetaTrader 5, instead offering its own proprietary WebTrader platform and mobile applications. Designed for simplicity and efficiency, WebTrader provides a fully browser-based experience with no software installation required.

Does Savexa allow scalping?

No, Savexa does not permit scalping. The Client Agreement explicitly classifies scalping, along with arbitrage and pip-hunting, as "Abusive Trading."

Is Savexa regulated?

Yes, Savexa (Trade Tide Ltd.) is authorised and regulated by the Mwali International Services Authority (MISA) in the Comoros Union under license number BFX2024065.