Editor’s Verdict

SageFX is an unregulated broker and prop firm offering traders the TradeLocker platform with charting from TradingView. The low minimum deposit of $10 makes SageFX accessible, but this broker has several red flags and above-average trading costs. The prop trading unit features demanding requirements and expensive evaluation fees. On paper, SageFX caters to advanced traders, but a closer look reveals that the management team either lacks knowledge about traders' requirements or opts for an uncompetitive trading environment.

My in-depth SageFX review uncovered the core aspects traders should consider before opening an account. Read on to get the answer to one important question: Can you trust SageFX?

Overview

SageFX is an unregulated broker and prop trading firm with above-average costs.

Headquarters | Marshall Islands |

|---|---|

Regulators | Unregulated |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2020 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $10 |

Negative Balance Protection | |

Trading Platform(s) | Other, Proprietary platform |

Average Trading Cost EUR/USD | 0.5 pips + $8 commission ($13.00) |

Average Trading Cost GBP/USD | 0.8 pips + $8 commission ($16.00) |

Average Trading Cost WTI Crude Oil | 0.03 + $8 commission |

Average Trading Cost Gold | 0.23 + $8 commission |

Average Trading Cost Bitcoin | $70.00 + $8 commission |

Minimum Raw Spreads | 0.1 pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $8.00 per round lot |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

SageFX Five Core Takeaways

- An unregulated broker with rising complaints.

- A prop trading division with near-unrealistic expectations.

- High trading fees, unlike a true ECN broker.

- No algorithmic trading support.

- Cryptocurrency deposits.

SageFX Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by double-checking the provided license with their database. SageFX is unregulated.

Name of the Regulator | Unregulated |

|---|

Is SageFX Legit and Safe?

My SageFX review found no verifiable misconduct or malpractice by this broker but several red flags. It has faced rising complaints since it relocated from St. Vincent and the Grenadines to the Marshall Islands and dropped MT4 as a trading platform. Bank wires are unavailable, but there is a note that it plans to introduce them. Therefore, I recommend caution when traders consider SageFX, as the complaints about deposit issues and trade manipulation stand out.

SageFX regulation and security components:

- An unregulated broker.

- Relocated from St. Vincent and the Grenadines to the Marshall Islands.

- Founded in 2020.

- No bank wire deposits.

- No negative balance protection.

- Segregation of client deposits from corporate funds.

- Two-factor authentication (2FA) and six-digit support PIN.

What Would I Like SageFX to Add?

I find the absence of negative balance protection unacceptable, as traders can leverage up to 1:500. SageFX should also consider membership in the Hong Kong-based Financial Commission, which provides independent audits and a €20,000 compensation fund per claim. This would boost its credibility and confirm its aim to offer a secure trading environment. SageFX could further enhance protection via a third-party insurance package.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. SageFX offers an above-average cost structure, especially for an ECN broker. For a commission of $8.00 per 1.0 standard round lot, the average spread is 0.5 pips, for a total cost of $13.00, at least twice the industry average. This is the most expensive ECN cost structure I have ever reviewed. A commission-free option exists, with average costs above $20.00. SageFX does not levy internal deposit or withdrawal fees but fails to mention how it handles currency conversions. It also does not charge inactivity fees.

Average Trading Cost EUR/USD | 0.5 pips + $8 commission ($13.00) |

|---|---|

Average Trading Cost GBP/USD | 0.8 pips + $8 commission ($16.00) |

Average Trading Cost WTI Crude Oil | 0.03 + $8 commission |

Average Trading Cost Gold | 0.23 + $8 commission |

Average Trading Cost Bitcoin | $70.00 + $8 commission |

Minimum Raw Spreads | 0.1 pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $8.00 per round lot |

Inactivity Fee | FALSE |

Minimum Trading Costs for EUR/USD at SageFX

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips (Mini, ) | $0.00 | $15.00 |

1.8 pips (Var) | $0.00 | $18.00 |

0.5 pips (Pro) | $8.00 | $13.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling EUR/USD, holding the trade for one night, and holding the trade for seven nights in the commission-based SageFX account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.4 pips | $8.00 | $8.53 | X | -$20.53 |

0.4 pips | $8.00 | X | -$1.13 | -$10.87 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.4 pips | $8.00 | $59.71 | X | -$71.71 |

0.4 pips | $8.00 | X | -$7.91 | -$4.09 |

Noteworthy:

- As in the example above, SageFX offers positive swap rates on qualifying assets, allowing traders to earn money.

SageFX Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:05 | Friday 23:59 |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Commodities | Monday 01:00 | Friday 23:55 |

Crude Oil | Monday 01:00 | Friday 23:55 |

Gold | Monday 01:00 | Friday 23:55 |

Metals | Monday 01:00 | Friday 23:55 |

Equity Indices | Monday 01:00 | Friday 23:55 |

Stocks | Monday 16:30 | Friday 23:00 |

Range of Assets

Traders get a small but balanced asset selection consisting of liquid trading instruments. I like the range of assets for Forex and cryptocurrency traders, but all other sectors still need to be represented, and the absence of ETFs is unfortunate. Scalpers and algorithmic traders get adequate assets, but the costs negate availability. Besides Forex and cryptocurrencies, SageFX provides sufficient choices for a sector introduction but needs to be more diverse. SageFX offers the following assets:

- 57 currency pairs

- 23 cryptocurrency pairs

- 8 commodities

- 9 indices

- 1 futures contract

- 37 equity CFDs

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

SageFX Leverage

Maximum Retail Leverage | 1:500 |

|---|---|

Maximum Pro Leverage | 1:500 |

What should traders know about leverage at SageFX?

- Maximum retail Forex, metals, and equity CFDs leverage is 1:500.

- Commodities and index traders get 1:200.

- Futures and cryptocurrency traders max out at 1:100.

- Negative balance protection is unavailable, meaning traders could lose more than their deposit.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

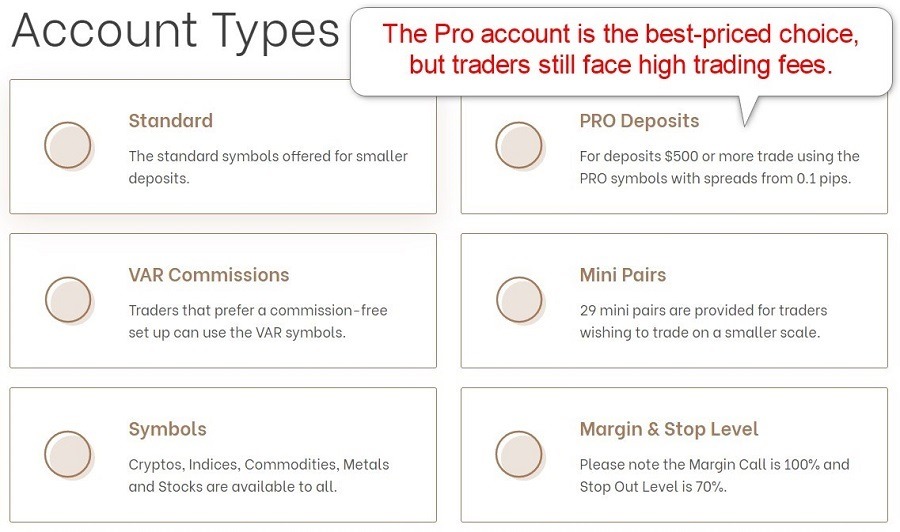

Account Types

SageFX offers a commission-free account with high spreads, which is available with a variable spread structure. A commission-based Pro account lowers trading fees, which remain high, especially by ECN standards. SageFX also offers 29 currency pairs as nano pairs, where the lot size is just 1,000. It is hard to understand why these are offered, as the Pro account minimum trade size is 0.01 lots or 1,000 currency units. During my SageFX review, a swap-free Islamic account was unavailable, and I still needed a volume-based rebate program.

The account types at SageFX feature:

- There is a $10 minimum deposit requirement for the Standard account and $500 for the Pro option.

- Only US Dollar accounts.

- Maximum leverage of 1:500.

- Margin call at 100%.

- Automatic stop-out level at 70%.

- 0.01 lot minimum order size.

SageFX Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the SageFX demo account?

- Traders can fully customize their demo accounts.

- There are no time restrictions on the demo account.

Trading Platforms

SageFX dropped the MT4 trading platform, leaving traders with only the web-based TradeLocker, which is also available as a mobile app. It features charting by TradingView, but besides the charting package, it provides the bare minimum a trading platform should offer, placing traders at a competitive disadvantage. It only supports manual trading, and I find it an unacceptable choice. I fail to understand how SageFX runs a prop trading division without proper tools.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my SageFX review, the prop trading unit offered funded accounts between $25,000 and $200,000, but the evaluation fee between $250 and $1,000 is high compared to other prop trading firms. SageFX asks traders to earn 10% in 30 days during the first evaluation fees and 8% in 60 days during the second, with a minimum of 10 trading days. The former is a tough challenge most traders will fail, allowing SageFX to pocket the performance fee. It tries to attract potential prop traders with a profit share of up to 90% and has a generous 12% maximum drawdown. I cannot recommend the prop trading unit since SageFX does not have a competitive trading infrastructure.

Research & Education

SageFX is an ECN broker and prop trading firm. Therefore, it does not offer research. Given the abundance of free and paid-for research, I do not consider its absence negatively, and I prefer for SageFX to reevaluate its core trading services.

What about Education at SageFX?

SageFX does not offer education and, at its current stage, provides the bare minimum to operate as a broker.

My conclusion

- I recommend beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Traders get 24/7 multi-lingual customer support via live chat. During my SageFX review, I required customer support to answer a few questions about their core trading environment, and the representative provided the answers in less than three minutes. An online ticketing service is also available in English, French, and Spanish, but I recommend traders browse the support section before contacting customer support.

Noteworthy:

- SageFX does not offer a phone number, but traders can request a callback.

- I miss a direct line to the finance department, where most issues can arise.

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Bonuses and Promotions

During my SageFX review, bonuses and promotions were absent. SageFX maintains a high-paying affiliate program with up to $10 per lot in earnings.

Opening an Account

Traders can open an account by providing their name, e-mail address, and desired password. Alternatively, traders can also use their Google ID to register. SageFX will send an e-mail confirmation to complete the registration, but it engages in data mining during the verification process, including unnecessary questions.

What Traders Should Know about the SageFX Account Opening Process

- SageFX is an unregulated broker.

- SageFX complies with global AML/KYC requirements.

- Account verification is mandatory.

- Most traders complete account verification by uploading a copy of a government-issued ID and one proof of residency document.

- SageFX may ask for a source of wealth document.

- SageFX may ask for additional information on a case-by-case basis.

Minimum Deposit

The SageFX minimum deposit requirement is $10 for Standard and $500 for Pro.

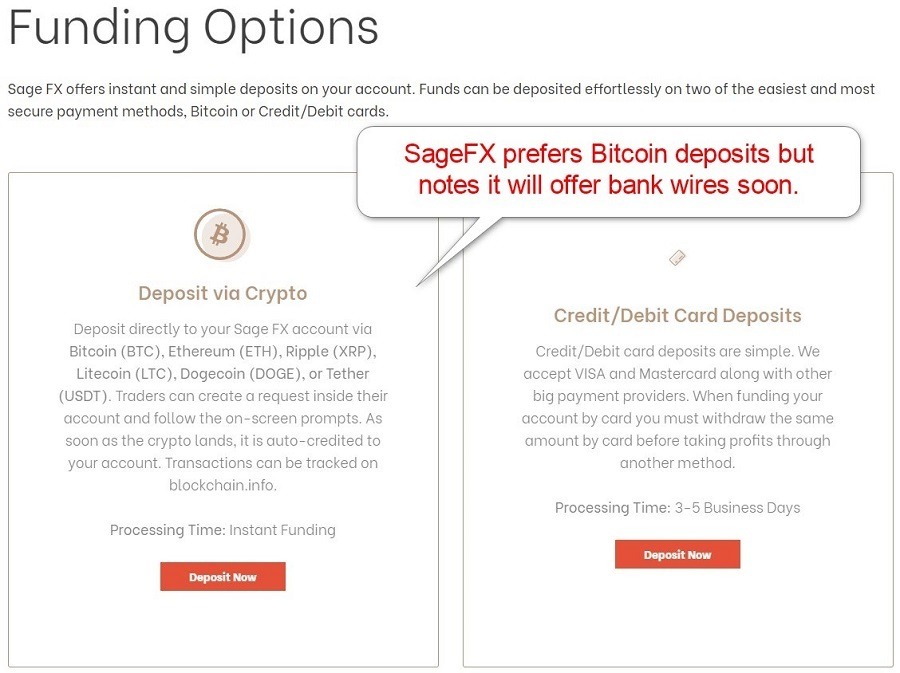

Payment Methods

SageFX accepts credit/debit cards, PayRedeem, VLoad, and cryptocurrencies (Bitcoin, Ethereum, Ripple, Litecoin, Dogecoin, and Tether).

Withdrawal options |    |

|---|---|

Deposit options |    |

Accepted Countries

SageFX accepts traders from most countries except the United States. It further notes that its products and services are “also not intended for distribution to or use by any person in any jurisdiction where such distribution or use would be contrary to local law or regulation.”

Deposits and Withdrawals

The secure SageFX back office handles financial transactions for verified clients.

Key Takeaways from the SageFX Deposit and Withdrawal Process

- SageFX does not levy internal deposit or withdrawal fees.

- The minimum deposit requirement is $10.

- The minimum withdrawal amount is $100.

- SageFX prefers Bitcoin deposits.

- Traders may face third-party payment processing charges.

- Cryptocurrency transactions incur blockchain fees.

- SageFX does not disclose how it handles currency conversions.

- Deposit processing times are instant for cryptocurrencies, VLoad, and PayRedeem and up to five days for credit/debit cards.

- SageFX notes that it will offer bank wires soon.

- The finance department aims to process withdrawal requests within one business day.

- The name on the credit/debit card and SageFX trading account must match and comply with AML regulations.

- Some traders complained about the receipt of withdrawals, but these occurred while SageFX operated from St. Vincent and the Grenadines.

Is SageFX a good broker?

SageFX is an unregulated broker without client protection. It relocated from St. Vincent and the Grenadines to the Marshall Islands in 2024 but never explained its move. The trading environment lacks competitive features, and trading fees are the highest I have seen at an ECN broker. The prop trading unit has unrealistic performance expectations and excessive evaluation fees. During my SageFX review, the only bright spot was a friendly customer support representative with a fast response time. I could not confirm malpractice or fraud by SageFX, but the red flags exist, including its preference for Bitcoin transactions and absence of bank wires. Therefore, I cannot recommend SageFX because of its uncompetitive, opaque trading environment, and I urge traders to proceed cautiously. SageFX accepts credit/debit cards, PayRedeem, VLoad, and cryptocurrencies. The SageFX maximum leverage is 1:500. The SageFX minimum withdrawal amount is $100. The SageFX headquarters are in the Marshall Islands. The SageFX minimum deposit is $10 for the Standard account and $500 for the Pro alternative. Traders can withdraw via credit/debit cards, PayRedeem, VLoad, and cryptocurrencies. SageFX does not qualify as a good broker, as it offers an uncompetitive, expensive, unregulated trading environment without client protection.FAQs

What are the deposit methods for SageFX?

What is the leverage of the SageFX account?

What is the minimum withdrawal from SageFX?

Where is SageFX located?

What is the minimum deposit for SageFX?

How do I withdraw from SageFX?

Is SageFX a good broker?