Editor’s Verdict

Purple Trading is a CySEC-regulated STP/ECN broker promising fair-play trading without requotes, stop-loss hunting, market manipulation, delayed execution, or increased slippage. Traders get MT4 and cTrader, and Purple Trading offers passive investment strategies. I conducted an in-depth review to evaluate trading fees and the trading infrastructure. Does Purple Trading provide a competitive edge at the right price?

Overview

A CySEC-broker with an STP/ECN trading environment and promise of fair trading.

Headquarters | Czech Republic |

|---|---|

Regulators | CySEC |

Year Established | 2015 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, cTrader |

Retail Loss Rate | 74.80% |

Minimum Raw Spreads | 0.3 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $5.00 to $10.00 per 1.0 round lot |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the Purple Trading promise of fair trading, fast order execution for active traders, and passive investment options for investors at Purple Trading. The trading fees for most traders are unreasonably high. It claims to rank among the EU brokers with the most profitable traders, noting 30.50% earn money. At the same time, its risk warning contradicts this by confirming 74.80% lose money when trading with Purple Trading. It results in a profitability rate of 25.20%, placing it sixth on its comparison table.

Purple Trading Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Purple Trading presents clients with one regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | 271/15 |

Is Purple Trading Legit and Safe?

Purple Trading, founded in 2015 by Czech and Slovak traders and owned by LF Investment Limited, presents traders with the standard ESMA-compliant, CySEC-regulated brokerage. It segregates client deposits at EU banks PPF (CZK, USD, EUR, GBP), Unicredit (EUR, USD, PLN, GBP), Sparkasse (EUR), and BNP Paribas (PLN, EUR). Negative balance protection ensures traders cannot lose more than they deposit, and the investor compensation fund protects deposits up to 90% with a €20,000 maximum.

My review did not uncover malpractice or fraud, and Purple Trading welcomes traders to in-person meetings. Therefore, I rate Purple Trading as a legit and safe brokerage.

Fees

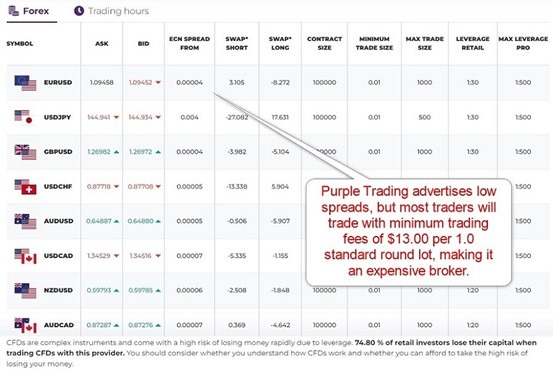

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Purple Trading advertises competitive trading fees in its ECN account, but they remain hidden behind a multi-tier system. Purple Trading does not specify the requirements and asks traders to contact them if they believe they qualify, which I consider unacceptable.

Therefore, despite advertising competitive costs, most traders will deal with unreasonably high fees. The commission-free STP and commission-based ECN accounts offer identical costs. Purple Trading lists minimum spreads for the former at 1.3 pips or $13.00 per 1.0 standard round lot. Costs for the letter are 0.3 pips for a commission of $10.00 for a total fee of $13.00.

Purple Trading promises no market manipulation but claims minimum spreads from 0.3 pips versus genuine raw spreads of 0.0 pips. It classifies its VIP account trading costs as “based on preference,” where the choices are Standard or ECN with more substantial discounts. The Forex page on its website lists actual raw spreads, but I could not determine how traders get to trade with those costs. The lack of clarity is a significant misstep.

Minimum Raw Spreads | 0.3 pips |

|---|---|

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $5.00 to $10.00 per 1.0 round lot |

Deposit Fee | |

Withdrawal Fee |

Here is a snapshot of Purple Trading’s trading fees:

The minimum trading costs for the EUR/USD at Purple Trading are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.3 pips (STP) | $0.00 | $13.00 |

0.3 pips (ECN) | $10.00 | $13.00 |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based ECN account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.30 pips | $10.00 | -$8.272 | X | $21.272 |

0.30 pips | $10.00 | X | $3.105 | $9.895 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.30 pips | $10.00 | -$57.904 | X | $70.904 |

0.30 pips | $10.00 | X | $21.735 | -$8.735 |

Noteworthy:

- Purple Trading offers positive swap rates in qualifying assets, meaning traders get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

Range of Assets

Forex traders get 55+ currency pairs, which is an acceptable choice. Still, the rest of the asset selection introduces sectors without offering broader exposure. Commodity traders get eight CFDs and 12 futures, index traders 10 index CFDs and 1 futures contract, while equity traders get 100+ US and EU blue chip CFDs. I am missing cryptocurrency CFDs, but Purple Trading features 3 bond futures contracts plus the Dollar Index and the VIX.

ETFs are available for the passive strategies Purple Trading offers but not for traders to trade on the platform, which I find disappointing. I like the range of assets for Forex traders. Still, I cannot recommend it to non-Forex portfolios except for scalping and other short-term strategies. While Purple Trading allows them, the trading costs discourage traders from using them.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

Purple Trading Leverage

Purple Trading offers maximum Forex leverage of 1:30 to retail traders, per restrictive ESMA regulations. In contrast, Pro traders get 1:500, the international standard for retail traders at offshore brokers. Commodities and indices max out at 1:20, futures at 1:10, and equity CFDs at 1:5.

Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

Purple Trading’s Trading Hours (GMT +3)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Monday 00:06 | Friday 23:58 |

Commodities | Monday 01:00 | Friday 23:58 |

European Equities | Monday 10:00 | Friday 18:30 |

US Equities | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5.

Account Types

Purple Trading features four account types. The commission-free STP and the commission-based ECN account have similar costs and are expensive, the Pro account requires conditions that retail traders cannot meet, and the investment account caters to passive long-term strategies provided by Purple Trading. The minimum deposit is $100, or a currency equivalent, and supported account currencies are EUR, USD, CZK, GBP, and PLN. Purple Trading issues a margin call at a 100% margin level with an automatic stop-out at 50%.

Besides account types, Purple Trading uses the account status to determine trading fees, where traders must reach VIP status to transition from expensive costs to acceptable ones. The minimum lot size is 0.01 lots or 1,000 currency units. While Purple Trading has no restrictions on trading strategies, its trading fees passively discourage many strategies.

Purple Trading Demo Account

Purple Trading offers customizable demo accounts on the MT4 and cTrader platforms. My review did not uncover a time limit, confirming that Purple Trading understands the requirements of demo trading. The only aspect I dislike is that traders can only manage demo capital from the back office and must e-mail customer support if they have access to PurpleZone. I recommend traders use similar settings to their preferred live portfolios for a more realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic expectations.

Trading Platforms

Traders get the MT4 and cTrader trading platforms. Both are available as customizable desktop clients, lightweight web-based alternatives, and user-friendly mobile apps. MT4 and cTrader fully support algorithmic trading, and each has an embedded copy trading service. MT4 remains the industry leader with 25,000+ custom indicators, plugins, and EAs, but the quality upgrades are not free. cTrader offers a superior out-of-the-box solution versus MT4 and is the second-most popular choice. Purple Trading also upgrades MT4 via five proprietary plugins.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

Purple Trading provides clients with three passive trading and investment opportunities. Strategies is an in-house copy trading service divided into three risk categories. Mini Strategy requires a minimum investment of CZK 2,500 and caters to investors rather than traders. CapitalGuard protects clients in both strategies, allowing them to define risk management profiles. From a minimum investment of only €20, investors can diversify via in-house managed ETF portfolios, where Purple Trading advertises an average annual return between 5% and 8%.

Research & Education

Purple Trading does not publish in-house research but publishes news, overviews, and interviews. Given the amount of research and trading signals available online for free and fee-based services, I do not view the absence as unfavourable. It creates a services gap versus well-established brokers, but traders should be fine with obtaining research elsewhere.

Purple Trading features a trading academy with 25 articles, some with videos, and 8 eBooks. The written content has a read time of between eight to fifteen minutes. While I like the introductory topics Purple Trading covers, it needs some core content added.

Therefore, I advise beginners to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

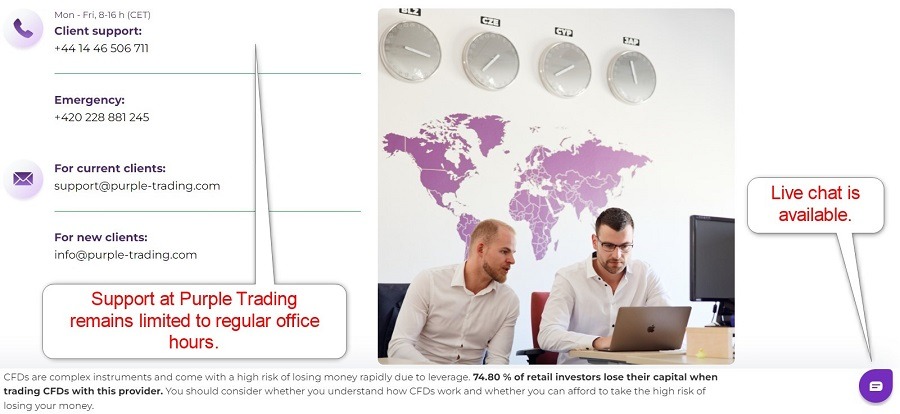

Support Hours | M - F / 08:00 - 16:00 (CET) |

Website Languages |     |

Customer support remains limited at Purple Trading to eight hours per day, following regular office hours rather than trading hours. The FAQ section answers some questions, and Purple Trading explains its products and services well. I appreciate the emergency phone number, but Purple Trading does not disclose its availability. I also need a direct line to the finance department, where most issues can arise.

Bonuses and Promotions

Purple Trading neither offers bonuses nor promotions, as they remain prohibited in the EU per ESMA restrictions.

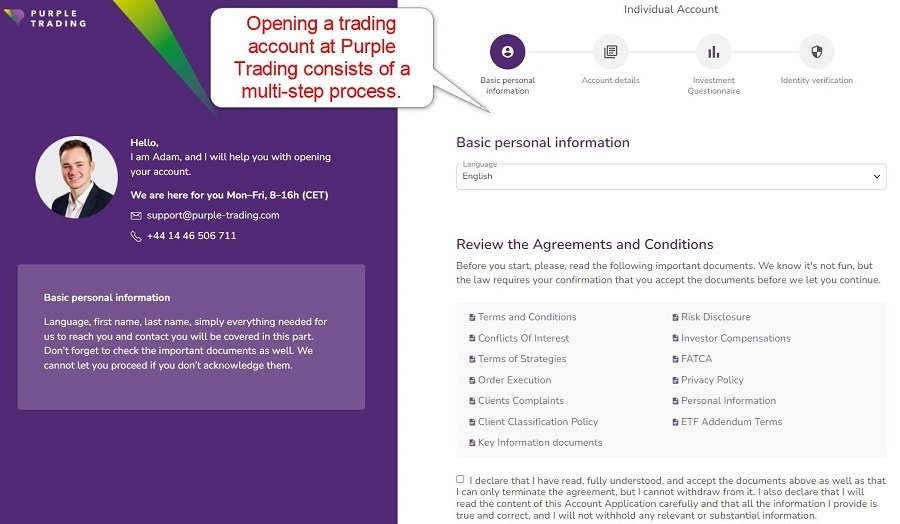

Opening an Account

Purple Trading features a lengthy, multi-step account application typical for ESMA and CySEC brokers. It includes data mining about employment, experience, and finances.

Purple Trading complies with global AML/KYC requirements, meaning account verification is mandatory. Most traders will pass it by uploading a copy of their government-issued ID and one proof of residency document. Purple Trading may ask for additional information on a case-by-case basis.

Minimum Deposit

The Purple Trading minimum deposit is $100.

Payment Methods

Purple Trading supports bank wires, credit/debit cards, Neteller, and Skrill.

Accepted Countries

Purple Trading caters exclusively to EEA-resident clients except for traders in Belgium. It also singles out Switzerland and the USA as restricted countries.

Deposits and Withdrawals

The secure Purple Trading back office handles all financial transactions for verified clients.

- I recommend traders get access to PurpleZone, which makes account management easier. Purple Trading does not levy internal fees on credit/debit card deposits and domestic transfers in EUR, CZK, and PLN. International bank wires incur a 0.50% fee with a €5 minimum and €100 maximum. Skrill and Neteller deposits cost 2%, and all currency conversions at Purple Trade face a maximum currency conversion fee of 1%. The same applies to withdrawals, except for Skrill, where the withdrawal fee drops to 1%.

Internal deposit processing times depend on the payment processor, which range from instant to five business days. Purple Trading processes all withdrawal requests within one business day, but it can take up to fourteen days for traders to receive funds.

Per AML rules, the name on the payment processor and Purple Trading account must match, and traders must withdraw the deposit amount to the same payment processor.

Is Purple Trading a good broker?

I like the Purple Trading trading environment for its passive investment strategies. Still, the high trading fees make it uncompetitive for traders. The five plugins for MT4 are decent, execution times are fast, and education for beginners presents a reasonable introduction but omits core topics. I like the Forex asset selection, but the remaining offerings still need to be improved. My review found nothing alarmingly negative, but Purple Trading lacks the punch most top-tier competitors deliver.

FAQs

What is the minimum deposit for Purple Trading?

The Purple Trading minimum deposit is $100.

Is Purple Trading a legit broker?

Yes, Puple Trading is a legit broker, operational since 2015.

Where is the Purple Trading server located?

Purple Trading uses the London Equinix LD4 server.

Is Purple Trading a regulated broker?

Yes, Purple Trading operates with a license and oversight from CySEC.