Editor’s Verdict

OX Securities presents itself as a jack-of-all-trades in the brokerage world, and for the most part, it succeeds. With an impressive arsenal of platforms, including the popular MT4, MT5, systems, and the institutional-grade IRESS, it caters to both novice and professional traders. The Pro account's razor-thin spreads are genuinely competitive, and the $0 minimum deposit makes it one of the most accessible brokers on the market.

However, this broker isn’t perfect. The dual-regulation structure is a point of contention; while Australian clients enjoy the safety of ASIC, the rest of the world is siloed under the minimal oversight of the FSA in St. Vincent & the Grenadines. This creates a noticeable difference in client protection. Coupled with persistently mixed user reviews that flag issues with customer support, traders need to approach OX Securities with a clear understanding of who they are dealing with and the potential risks involved.

Overview

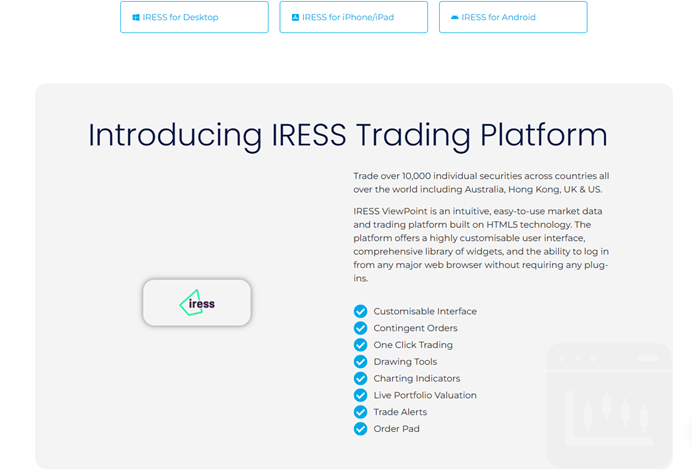

When I first started looking into OX Securities, it was clear that they aim to cater to a wide range of traders. From the beginner drawn in by the zero-dollar minimum deposit to the seasoned professional who needs the advanced functionality of the IRESS platform for share trading, OX seems to have a solution. They don't try to reinvent the wheel with a proprietary platform, instead focusing on providing access to the industry's most popular and powerful trading tools.

Headquarters | Australia |

|---|---|

Regulators | ASIC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2013 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, IRESS |

Average Trading Cost EUR/USD | 1.0 pips (Standard), 0.1 pips + $7/lot round turn (Pro) |

Average Trading Cost GBP/USD | 1.2 pips (Standard), 0.2 pips + $7/lot round turn (Pro) |

Average Trading Cost WTI Crude Oil | Varies by market conditions |

Average Trading Cost Gold | Varies by market conditions |

Average Trading Cost Bitcoin | Varies by market conditions |

Retail Loss Rate | Not disclosed |

Minimum Raw Spreads | 0 |

Minimum Standard Spreads | 1 |

Minimum Commission for Forex | 3.5 per lot half turn |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

OX Securities Core Takeaways:

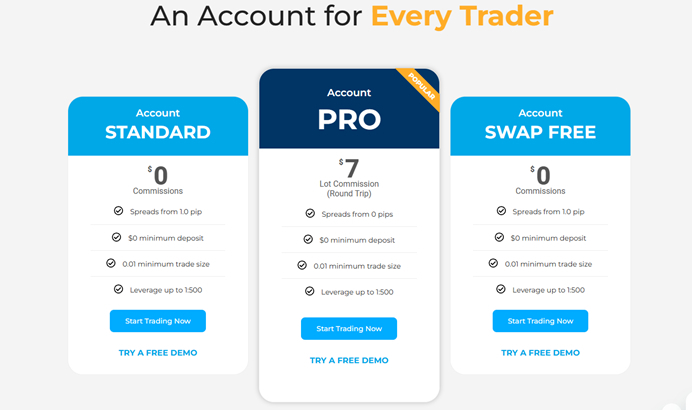

- Hybrid Broker Model: Offers both a commission-free Standard account and a raw-spread Pro account, giving traders a choice on cost structure.

- Platform Powerhouse: Provides the full MetaTrader suite (MT4 and MT5) and the institutional-grade IRESS platform.

- Dual Regulation: This is the most critical point. It holds a strong ASIC license for Australia but uses a weak FSA license (St. Vincent) for its global operations.

- Broad Asset Range: Covers Forex, Indices, Commodities, and Share CFDs, offering good diversification opportunities.

- Accessibility: The $0 minimum deposit removes the barrier to entry for almost everyone.

OX Securities Regulation & Security

When it comes to your money, a broker's regulation is everything. With OX Securities, the safety of your funds depends to some extent on where you live.

Country of the Regulator | Australia |

|---|---|

Name of the Regulator | ASIC, FSA |

Regulatory License Number | 001289978, 25509 BC 2019 |

Regulatory Tier | 1, 4 |

OX Securities Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:05 | Friday 21:55 |

Cryptocurrencies | 24/7 | 24/7 |

Commodities | Sunday 22:05 | Friday 21:55 |

Crude Oil | Sunday 22:05 | Friday 21:55 |

Gold | Sunday 22:05 | Friday 21:55 |

Metals | Sunday 22:05 | Friday 21:55 |

Stocks | varies by eschnage | Friday 16:00 |

Is OX Securities Legit and Safe?

This is a two-part answer. For Australian residents, the answer is a firm yes. They are regulated by the Australian Securities and Investments Commission (ASIC), a top-tier regulator known for its strict enforcement and client protection measures.

However, for the rest of the world, the situation is much less secure. The global entity is registered with the FSA in St. Vincent & the Grenadines. It's crucial to understand that the FSA is a registrar, not a proactive financial regulator. It does not provide the same level of oversight, client fund protection, or dispute resolution mechanisms as ASIC. This means that for international clients, you are trading with what is effectively an offshore broker, which carries a significantly higher level of risk.

While the broker states they use segregated accounts for client funds, the lack of strong regulatory backing for the global entity is a major point of concern that traders must weigh carefully.

Fees

OX Securities gives traders a clear choice: simplicity with wider spreads, or raw pricing with a commission. For active traders, the Pro account is where the real value lies

Average Trading Cost EUR/USD | 1.0 pips (Standard), 0.1 pips + $7/lot round turn (Pro) |

|---|---|

Average Trading Cost GBP/USD | 1.2 pips (Standard), 0.2 pips + $7/lot round turn (Pro) |

Average Trading Cost WTI Crude Oil | Varies by market conditions |

Average Trading Cost Gold | Varies by market conditions |

Average Trading Cost Bitcoin | Varies by market conditions |

Minimum Raw Spreads | 0 |

Minimum Standard Spreads | 1 |

Minimum Commission for Forex | 3.5 per lot half turn |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

The broker operates on a standard two-account model for its costs.

- Standard Account: This is the commission-free option. Spreads are wider, starting from 1.0 pips on major pairs like the EUR/USD. This account is best suited for beginners or casual traders who prefer simplicity.

- Pro Account: This account offers raw ECN spreads, starting from 0.0 pips. In place of a spread markup, you pay a commission of $3.50 per lot, per side ($7.00 round turn). This is a very competitive rate and is ideal for scalpers, day traders, and algorithmic traders.

EUR/USD Trading Costs Example:

Account Type | Average Spread (EUR/USD) | Commission (Round Turn) | Total Cost per 1.0 Lot |

Standard | ~1.0 pips | $0.00 | ~$10.00 |

Pro | ~0.1 pips | $7.00 | ~$8.00 |

My Observation: The Pro account pricing is excellent and competes with the top low-cost brokers in the industry. The Standard account, while simple, is noticeably more expensive.

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are available.

- Individual & Company accounts available.

Overnight Swaps

Like most trading brokers, holding a leveraged position overnight will incur a swap fee (or credit). This is essentially the interest rate differential between the two currencies in a pair. These rates can be checked directly within the MT4/MT5 platform. For traders who cannot pay or receive interest due to religious beliefs, OX Securities offers a Swap-Free Islamic Account type where the below will not apply.

Swap Calculation Example (Pro Account):

Let's calculate the estimated cost of buying 1.0 lot of EUR/USD and holding it, assuming the following swap rates:

- Swap Long: -$8.00 per night

- Swap Short: +$2.00 per night

Holding a standard 1 lot EURUSD position for one night:

Direction | Spread Cost | Commission | Swap Cost | Total Cost |

Buy | ~$1.00 | $7.00 | -$8.00 | $16.00 |

Sell | ~$1.00 | $7.00 | +$2.00 | $6.00 |

Holding EURUSD position for seven nights:

Direction | Spread Cost | Commission | Swap Cost (7 nights) | Total Cost |

Buy | ~$1.00 | $7.00 | -$56.00 | $64.00 |

Sell | ~$1.00 | $7.00 | +$14.00 | -$6.00 (Credit) |

Note: These are estimated figures. Actual swap rates vary daily.

Range of Assets

OX Securities provides a solid range of tradable instruments, covering the most popular markets. While not the most extensive list I've seen, it's more than sufficient for most traders.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

OX Securities Leverage

OX Securities offers high maximum leverage, which can be a powerful tool for increasing market exposure, but it also significantly increases risk. The broker uses a dynamic leverage model, which means the maximum leverage available to you automatically adjusts based on your account's equity.

Account Equity (USD) | Maximum Leverage |

$0 - $300,000 | 1:500 |

$300,001 - $500,000 | 1:300 |

$500,001+ | 1:200 |

What should traders know about OX Securities leverage?

- Magnified Risk: High leverage amplifies both potential profits and potential losses. A small market movement against your position can result in significant losses.

- Dynamic Model: This is a responsible risk management feature from the broker. As your account grows, the reduced leverage helps protect both you and the broker from excessive risk exposure.

- Risk Management is Key: Always use risk management tools like stop-loss orders when trading with high leverage. Never risk more than you can afford to lose.

Account Types

Simplicity is key here. OX offers two main live accounts alongside the specialty Islamic account.

- Standard Account: $0 minimum deposit, spreads from 1.0 pips, zero commission.

- Pro Account: $0 minimum deposit, raw spreads from 0.0 pips, $7 round-turn commission per standard lot size.

- Islamic Account: A swap-free version of the Standard account.

OX Securities Demo Account

Yes, OX Securities offers a free and unlimited demo account. This is a crucial feature that I always look for. It allows new traders to get comfortable with the trading platforms (MT4/MT5) and evaluate their strategies with virtual money before risking any real capital. It is also a great way for experienced traders to evaluate the broker's execution speed and spread stability.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

This is a real standout area for OX Securities. By offering MT4, MT5, and IRESS, they cater to virtually every type of trader.

- MetaTrader 4 (MT4): The global industry standard, loved for its reliability, massive library of custom indicators, and Expert Advisors (EAs) for automated trading.

- MetaTrader 5 (MT5): The successor to MT4, offering more timeframes, advanced charting tools, and access to a wider range of markets. For both Metatrader platforms plugin and upgrades are avalible

- IRESS: This is a premium, institutional-grade platform designed for serious equity traders. It offers advanced features like Level 2 pricing (market depth) and direct market access (DMA) for share CFDs. The inclusion of IRESS sets OX apart from many standard MT4/MT5 brokers.

- PAMM/MAM Accounts: For investors who prefer a hands-off approach, OX Securities supports Percent Allocation Management Module (PAMM) and Multi-Account Manager (MAM) accounts. This allows clients to allocate their funds to be traded by professional money managers.

What I'd Like OX Securities to Add

While OX Securities has a strong core offering, there are several areas where improvements could significantly boost client trust and overall value.

Enhanced Regulatory Transparency: The broker should be much clearer on its global website about the differences in protection between its ASIC and FSA-regulated entities. This would help clients make a more informed decision.

Build Out Educational Resources: To better support the beginners attracted by the $0 minimum deposit, developing a comprehensive library of articles, webinars, and courses on trading fundamentals would be a huge asset.

Improve Support Consistency: The mixed user reviews suggest that customer support and withdrawal processing can be inconsistent. Focusing on providing faster, more reliable service in these areas is crucial.

Clarify Negative Balance Protection: While NBP is mentioned, a clear, legally binding statement confirming this protection for all clients, especially those under the FSA entity, would provide significant peace of mind.

Research & Education

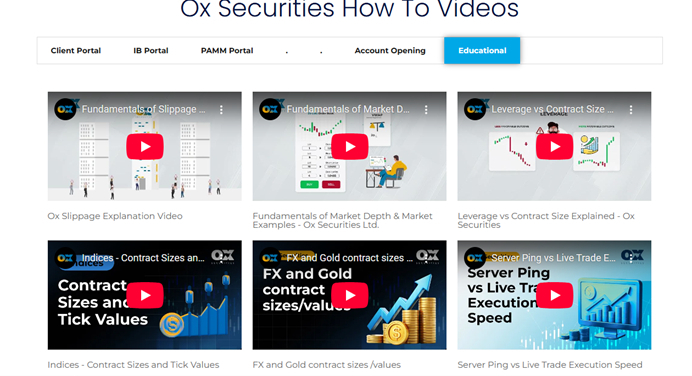

This is an area where OX Securities is functional but not a market leader. The broker provides the essential tools for research but lacks a deep well of structured educational content for newcomers. I do like the how too videos covering some trading fundamentals like handling leverage.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |    |

Support is available 24/5 via the standard channels:

- Live Chat

- Phone

User reviews on other popular review sites suggest that while support can be helpful, response times can sometimes be slow, and resolving complex issues, particularly around withdrawals, can be a challenge for some clients.

Support is available in English, Japanese, and Chinese.

Bonuses and Promotions

At the time of this review, there were no specific deposit bonuses or promotions advertised on the OX Securities website. This is common for brokers who are regulated in strict jurisdictions like Australia, as regulators often prohibit bonuses that can incentivize over-trading. It is always best to check their website or contact support for the most current information.

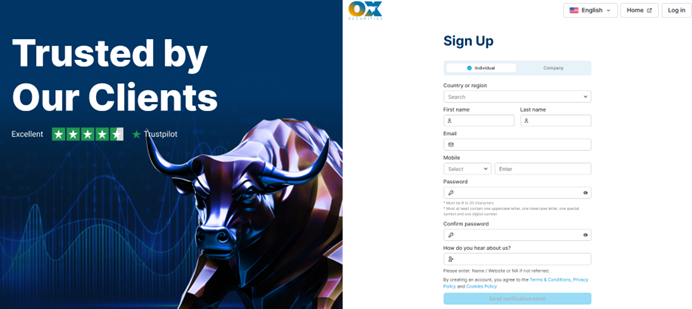

Opening an Account

The account opening process is fully digital and follows industry standards.

What should traders know about the OX Securities account opening process?

- Register: Complete the online application form with your personal details. Traders can register as an individual or company.

- Verify: Submit KYC (Know Your Customer) documents. This typically includes a government-issued ID (like a passport or driver's license) and a proof of address (like a utility bill or bank statement).

- Fund: Once verified, you can fund your account using one of the available methods.

The process is generally quick and can often be completed on the same day.

Minimum Deposit

The minimum deposit is $0 for all account types.

Payment Methods

OX Securities supports a range of modern and traditional payment methods, including the following list.

Withdrawal options |       |

|---|---|

Deposit options |       |

Deposits & Withdrawals: Bank Wire, Credit/Debit Cards, Skrill, Neteller, and Cryptocurrencies.

Deposits and Withdrawals

The process is straightforward, with a good range of modern funding options.

What are the key takeaways from the deposit and withdrawal process at OX Securities?

- Deposit Methods: Bank Wire, Credit/Debit Cards, Skrill, Neteller, and Cryptocurrencies.

- Fees: OX Securities does not charge any internal fees for deposits or withdrawals. However, be aware that third-party payment processors or banks may charge their own fees.

- Withdrawal Speed: While the broker aims for timely processing, this is a point of contention in user reviews. Some users report smooth and fast withdrawals, while others cite significant delays and requests for additional documentation.

Is OX Securities a Good Broker?

For the right trader, yes. If you are an Australian resident, OX Securities is an excellent choice, offering top-tier regulation, great platforms, and competitive fees. For international traders, the decision is more complex. The powerful platforms and low-cost Pro account are very tempting, but you must be comfortable with the risks of dealing with an FSA-regulated entity. If you are an experienced trader who understands these risks and prioritizes platform choice and low commissions, OX Securities is worth considering. However, if safety and regulatory protection are your absolute top priorities, you may want to look at brokers regulated in stronger jurisdictions.

FAQs

Is OX Securities registered with the CFTC?

No, OX Securities is not registered with the CFTC and does not accept clients from the United States.

What is the maximum leverage offered by OX Securities?

The maximum leverage is 1:500, offered on a dynamic basis that adjusts depending on your account's equity.

How to deposit money into OX Securities?

You can deposit funds via bank wire, credit/debit cards, e-wallets like Skrill and Neteller, and various cryptocurrencies.

What is the minimum deposit for OX Securities?

The minimum deposit is $0. You can open a live account without funding it, making it extremely accessible.

Is OX Securities a regulated broker?

Yes, it holds a Tier-1 license from the Australian Securities and Investments Commission (ASIC) for its Australian clients. Its global operations are regulated by the FSA of St. Vincent and the Grenadines, which offers much weaker protection.