Editor’s Verdict

OspreyFX is a proprietary trading firm and ECN forex broker registered in St. Vincent and the Grenadines. Established in 2019, the firm operates under Osprey Ltd (Company Number 25288 BC 2019). OspreyFX offers both traditional FX brokerage services and proprietary trading challenges, providing traders with opportunities to earn funded accounts. The firm operates on a simulated capital model, allowing traders to participate in evaluation challenges with comparatively low entry points. Traders can access the TradeLocker platform, integrated with TradingView, and the firm claims to support various trading strategies, including scalping, hedging, and news trading.

OspreyFX has gained recognition for its prop offering by allowing advanced trading strategies and providing a modern trading infrastructure, appealing to both new and experienced traders.

The Pros & Cons of OspreyFX

Traders should consider the pros and cons of OspreyFX. I have summarized some of the key benefits and potential drawbacks I discovered during my in-depth review of the OspreyFX prop offering.

Overview

OspreyFX has competitively priced prop options, starting at just $59 for a $5,000 challenge. it’s more affordable than many competitors, making it accessible to newer traders.

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Year Established | 2019 |

Trading Platform(s) | Other |

Minimum Evaluation Fee | $59 |

Profit-share | 70% - 90% |

Daily Loss Limit | 5% |

Maximum Trailing Drawdown | 12% |

Funded Account Options | 5 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $200,000 |

OspreyFX positions itself as a broker as well as offering prop trading, it focuses on pricing for its trading instruments, i.e. advertising 0.1 pip spread on EURUSD and good liquidity and a wide range of tradable instruments. The firm also talks a lot about zero restrictions on trading methodology and states it permits scalping and news trading, something other prop firms do not support.

OspreyFX Trustworthiness & Reputation

Because prop firms are unregulated entities, traders engaging with them need to be especially diligent in verifying that their chosen provider is reputable and has a well-established reputation for security and fairness, especially when it comes to payouts and application of trading rules.

Is OspreyFX Legit and Safe?

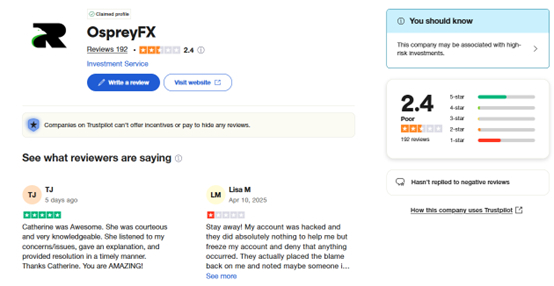

OspreyFX operates a brokerage and prop business without regulation. Its registration with the Financial Services Authority of St. Vincent and the Grenadines does not mean it has regulatory oversight from this agency – it's simply confirmation that the business is located there. As of May 2025, the firm has a 2.4 rating from 192 reviews on Trustpilot, disappointing - it seems the firm either attracts five-star or 1-star review, suggesting customer experiences are at either end of the scale when it comes to satisfaction.

Recent reviews mention delays in payouts, but the firm does seem to engage with negative reviews to investigate specific issues when raised. Equally, there are numerous mentions of payouts working well. The brokerage side of the business has a lower rating on the Forex Peace Army site with just 1.6 out of 5. Positive feedback mentions responsive customer service, praise for the TradeLocker platform with TradingView integration and range of tradable instruments.

OspreyFX Features

OspreyFX follows the best practices established across the prop firm industry, which has meant it has grown in popularity in a short space of time.

The most notable features of OspreyFX are:

- Two-phase evaluation process

- Evaluation accounts from $5k to $200k

- No time limit to reach profit targets

- Profit target: 10% phase 1 and 8% phase 2

- Optional Add-on, account reset feature

- Maximum daily drawdown: 5%

- Maximum total drawdown: 12% static

- 70% profit split (can go up to 90% with progression)

- Challenge fee refunded upon first payout

- Crypto deposit methods only

- Scalping, News trading, EAs, and bots permitted

- The dashboard includes trade analytics, challenge progress and general account management

Evaluation Fees & Profit-Share

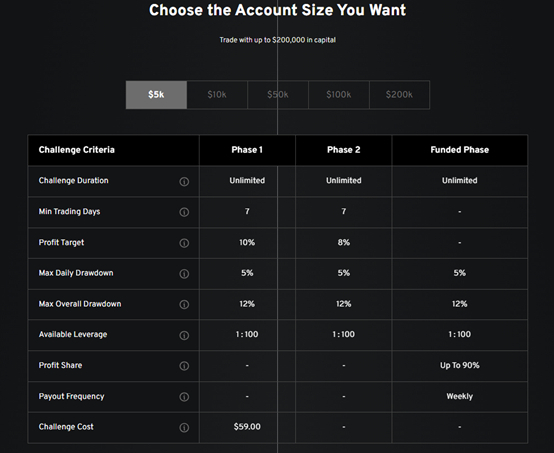

OspreyFX offers a competitively priced entry into proprietary trading, with evaluation fees starting from just $59 for a $5,000 account. The firm uses a two-step challenge format, which is currently the only route to securing a funded trading account. All evaluation fees are charged as a one-off cost and are reimbursed after your first profit split payout once you have successfully passed the challenge and reached the funded phase.

Here is a breakdown of their current pricing:

- $5,000 account – $59

- $10,000 account – $99

- $50,000 account – $299

- $100,000 account – $499

- $200,000 account – $899

Minimum Evaluation Fee | $59 |

|---|---|

Maximum Evaluation Fee | $899 |

Profit-share | 70% - 90% |

The minimum evaluation fee at OspreyFX for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $59 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | Yes. Swap rates apply per instrument |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $59 |

Account Types

OspreyFX offers just one evaluation option as route to trading a funded account.

Two-Step Evaluation, Phase 1 (Initial Challenge) trader needs to achieve a profit target: 10%, phase 2 (Verification stage): 8%. Drawdown stops are at 5% daily and 12% in total on both stages. Minimum trading days – 10 days per phase.

There are additional specific trading rules such as a minimum level of activity per month, despite there being no time limit on passing the challenge, also traders must ensure that no single day's profit exceeds 30% of the total profits earned during phase 2.

What are the Trading Rules at OspreyFX?

The OspreyFX evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. OspreyFX does not list a maximum time limit but requires a minimum of ten profitable trading days for each of the two-step phases. The daily drawdown, and maximum drawdown are the same for each phase.

Violating the maximum overall loss rule results in a hard breach of the rules and cancellation of the challenge. Inactivity for more than 30 days also results in a breach of the terms and termination of the trading challenge.

The trading rules for OspreyFX two-step evaluation are:

- 5% maximum daily loss from the account equity

- 12% maximum static loss permitted, based on both balance and equity

- A minimum of 10 trading days are required for each phase of the two-step evaluation

- Trades are subject to a maximum lot size permitted. There is no consistency rule until you enter phase 2, having passed the initial evaluation phase. Once traders have done so, the maximum daily profit permitted is 30% of account value.

Noteworthy:

- OspreyFX will permit weekend and news trading in all phases of its funded prop offering

- Prohibited strategies OspreyFX does not explicitly list prohibited strategies on their website

- Challenge Reset Option, during Stage 1 of the evaluation, OspreyFX offers a Reset Challenge feature. This allows you to restart the challenge at any point during Stage 1 and repurchase it with a 20% discount

- Comprehensive Performance Dashboard - OspreyFX provides a detailed Challenge Accounts Dashboard where traders can monitor various performance metrics

Trading Platforms

OspreyFX offers the Trade Locker platform only, available on desktop and mobile, this comes with an integration to the popular TradingView application that provides advanced charting and analytical options. OspreyFX does not support other trading platforms such as MetaTrader 4 (MT4), cTrader, or DXTrade.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Education

OspreyFX offers in my view a comprehensive range of educational materials aimed at supporting traders with different levels of experience. Through a partnership with Forex Squad, verified users gain free access to structured lessons covering courses on forex fundamentals, technical and fundamental analysis, trading psychology, and risk management. The firm also maintains a detailed library of articles and content on topics such as scalping, swing trading, and advanced strategy insights as well as general and platform-specific questions and answers. In addition, OspreyFX provides practical trading tools that traders will appreciate, including calculators, an economic calendar, and real-time spreads information.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24 hours a day 7 days |

Website Languages |  |

During my OspreyFX review I found the firm has responsive and accessible customer support, primarily through live chat and email. Their live chat feature is available directly on the website and typically provide prompt responses during business hours. Support is offered in English, and while the firm does not advertise 24/7 availability, is helpful with queries related to account setup, trading issues, and the funded program. The firm also provides a comprehensive FAQ section to help users find quick answers to common questions.

How to Get Started with OspreyFX

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at OspreyFX is $59 for the $5,000 account with the two-step evaluation process. In contrast, a 200k account is $899

Funded Account KYC

Upon successfully passing one of the challenges traders will qualify for a funded account and the profit share, in order for this to be approved by the firm you will need to complete a KYC verification process this is a mandatory step and usually requires you to prove your ID with a passport or government issued ID and a real time selfie as well as proof of your address. This process must be completed before any payouts are made.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

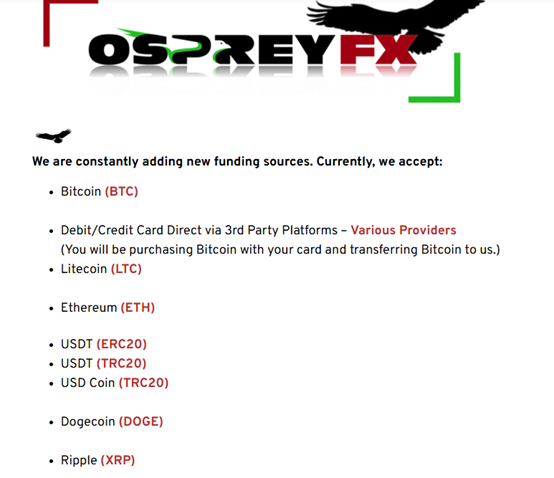

OspreyFX accepts cryptocurrency payments as well as bank transfers for withdrawals. Note that withdrawals attract a $25 fee for amounts up to $5000.

Accepted Countries

OspreyFX accepts most traders that are 18 years or older. It lists 195 countries including most of Europe and the US. It lists a number of other countries where it does not do business generally, those under sanctions or those that limit FX trading. Afghanistan, Botswana, Myanmar, the Democratic Republic of Congo, Cuba, Ethiopia, Iran, Iraq, Japan, Libya, North Korea, Pakistan, Russia, Somalia, Sudan, Syria, Trinidad and Tobago, Tunisia, Yemen, Zimbabwe, and Spain. If your country is not on this list, you are generally eligible to trade with OspreyFX, though it's always best to confirm eligibility through their official support channels as restrictions may change.

How to Pay the Evaluation Fee?

- Cryptocurrencies (e.g., Bitcoin, Ethereum, USDT)

- Credit/Debit cards – when used to purchase cryptocurrencies

The Bottom Line - Is OspreyFX a Good Prop Firm?

OspreyFX offers an appealing entry point for aspiring and experienced traders alike, with low-cost evaluations starting at just $59 and a straightforward two-step challenge model. The firm allows for flexible trading styles—including scalping, news trading, and EAs—with no time limits on challenges, which sets it apart from many competitors. The integration of the TradeLocker platform with TradingView tools provides a modern, accessible trading experience, though traders looking for MT4/MT5 compatibility may find this limiting. Payouts are weekly, with up to 90% profit share. OspreyFX has faced some scrutiny over regulatory clarity, as it operates offshore. User reviews on platforms like ‘Trustpilot are mixed some highlighting good support and a trader-friendly environment and some less complementary. Crypto currency deposits are the only option which may put off some traders. For those comfortable trading with a newer, tech-forward firm that emphasizes flexibility and affordability, OspreyFX can be a solid choice—provided you fully understand the terms, risks, and verification requirements involved.

St. Vincent and the Grenadines. Not to buy into the challenge phase but once you have passed this and are trading a funded account and claiming a profit share then clients will need to run through KYC before making a withdrawal request. This step in mandatory. Yes the US does not appear on the list of restricted countries and other reviews and comments suggest US clients can use the firm. Withdrawals from funded accounts after the challenge phases are passed are typically processed within 24 hours of the request. The exact time it takes for the funds to arrive depends on your chosen method (e.g., crypto, card, or wire), but OspreyFX aims for fast turnaround, particularly with crypto payouts. Note for bank wires, there is a $25 fee for up to $5k withdrawal.FAQs

Where is OspreyFX located?

Does OspreyFX require KYC?

Does OspreyFX allow US traders?

How long does OspreyFX withdrawal take?