Editor’s Verdict

OFP is a retail prop trading firm using virtual funds. The company launched in 2022 with its headquarters in the UK. Traders get three trading platform choices, a maximum profit share of up to 100%, and seven funded account options. My comprehensive OFP review has assessed the competitiveness of its accounts and the ease of requesting and receiving a withdrawal. Should you trust OFP and fund an account there?

Overview

OFP offers a 100% profit split and does not have profit targets.

Headquarters | United Kingdom |

|---|---|

Year Established | 2022 |

Trading Platform(s) | Other, MetaTrader 5 |

Minimum Evaluation Fee | $35 |

Profit-share | 100% |

Daily Loss Limit | 2% to 5% |

Maximum Trailing Drawdown | 10% |

Funded Account Options | 7 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $300,000 |

I like that OFP supports on-demand payouts, but its inconsistency score is likely to prevent most traders from qualifying for a payout. Even its two inconsistency rule examples would prevent a payout. Its account fees appear inexpensive under unrealistic conditions, such as a 2% daily drawdown, but rank among the more expensive options once traders select the standard 5% setting.

OFP Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is OFP Legit and Safe?

OFP, founded in 2022, lacks the operational history of well-established competitors and has a 3.6 out of 5.0 rating on Trustpilot based on 3,471 reviews. Additionally, it has a very high level of one-star reviews totaling more than 23% of all reviews, which is not reassuring.

I found an uncomfortable high level of negative comments during my OFP review concerning receiving payouts. OFP responds to 99% of negative reviews, but its response is basic. Given the high concentration of one-star reviews and low overall rating, I urge prospective traders to approach OFP with extreme caution.

OFP Features

OFP follows a few of the best practices established across the prop firm industry, but its inconsistency score appears designed to prevent traders from qualifying for a payout.

The most notable features of OFP are:

- Instant funding for all account types

- No profit targets

- No minimum trading days

- A maximum profit share of 100%

- Cryptocurrency withdrawals

- 1:100 maximum leverage

- Traders can opt for on-demand, bi-weekly, and monthly payouts, which impacts the one-time fee

- OFP offers a 2%, 3%, 4%, and 5% maximum daily drawdown option

- A 10% maximum drawdown rule

- USD, EUR, and GBP accounts

Account Fees & Profit-Share

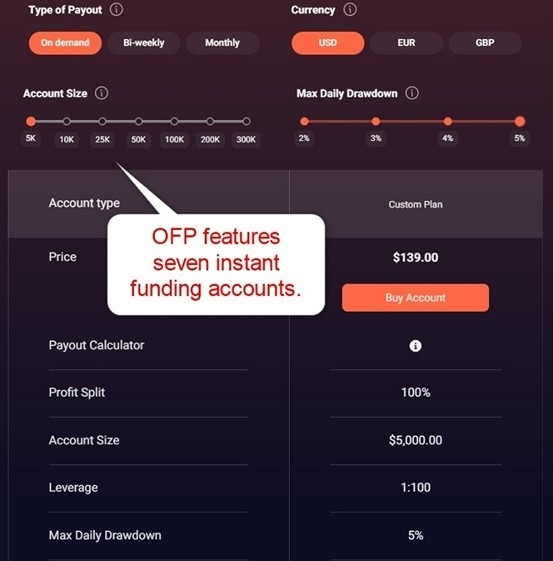

OFP levies a one-time account fee dependent on the desired funded account size and account options. Prospective retail traders have seven instant funding options, three withdrawal options, and four daily drawdown settings with one-time costs between $35 and $1,599.

Please note that traders cannot change the account value after approval. Therefore, if they qualify for a $10,000 account, they will manage a $5,000 portfolio. The profit share is 100%.

Minimum Evaluation Fee | $35 |

|---|---|

Maximum Evaluation Fee | $1,599 |

Profit-share | 100% |

The minimum account fee at OFP for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time account fee | $35 (2% DD, monthly payouts); $139 (5% DD, on-demand payouts |

Monthly account fee | $0 |

Hold-over-the-weekend | $0 |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $35 to $139 |

Account Types

OFP offers instant funding account sizes of $5,000, $10,000, $25,000, $50,000, $100,000, $200,000, and $300,000.

The maximum daily drawdown is between 2% and 5%, which traders must elect during the account creation. The maximum drawdown is 10% for all account types, and the maximum inconsistency score is 20% to qualify for a payout.

What are the Trading Rules at OFP?

OFP offers instant funding, and traders receive their accounts after paying the one-time access fee. Violating the maximum overall loss rule results in a hard breach and cancellation of the account.

The trading rules for the OFP accounts are:

- 2% to 5% maximum daily drawdown

- 10% maximum drawdown

- A maximum inconsistency score of 20% (which prevents most withdrawals)

- Compliance with OFP ethical trading rules (poses an unnecessary hurdle many retail traders fail to overcome)

- Compliance with trading strategy restrictions (they include the ban on news straddling, arbitrage, martingale, hedging, cross-hedging, high-frequency trading, copy trading, publicly available EAs, exploitation of trading platform inefficiencies, and gambling)

Noteworthy:

- OFP will not grant access to live trading accounts

- Accepted prop traders will manage demo accounts, and the OFP software may duplicate them in live trading accounts of OFP managed by professional traders

- It enhances risk management and compliance for OFP

Trading Platforms

Traders can use cTrader, Match Trade, and TradeLocker. It transparently provides logins for all three, allowing traders to evaluate the trading platforms and trading conditions. OFP notes raw spread trading from 0.0 pips, but it fails to disclose commissions and its partner brokers.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Education

I appreciate the availability of the two 1-on-1 mental coaches, but the educational content for beginners remains misguided, as beginners should never consider prop trading. OFP maintains a blog, podcasts, and dozens of short videos. While I understand and support the need for educating, it has no place in prop trading, which is for established traders, and I dislike prop firms targeting beginners.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |     |

During my OFP review, traders received 24/7 customer support via e-mail and live chat. The OFP Help section features 25 articles, and traders should read them before contacting customer support. I am missing a direct line to the finance department, where most issues could arise. Many traders report poor customer service availability and a lack of quality if they manage to reach a representative.

How to Get Started with OFP

Interested prop traders can receive their account after selecting their desired package and paying the one-time fee.

Minimum Fee

The minimum fee at OFP is $35 for the $5,000 account if traders opt for monthly payouts and a 2% daily drawdown.

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |     |

OFP accepts credit/debit cards, cryptocurrency payments, and Google Pay.

Accepted Countries

OFP accepts most traders who are 18 years or older. OFP does not accept traders resident in Russia, Iran, Iraq, North Korea, Syria, Afghanistan, Yemen, and Somalia. The restricted countries are due to reasons OFP does not control.

How to Pay the Account Fee?

Prop traders can pay their fees via credit/debit cards, cryptocurrencies, and Google Pay.

The Bottom Line - Is OFP a Good Prop Firm?

I like OFP for its instant funding approach, 1-on-1 mental coaching, and trading platform selection. Unfortunately, its one-time account fees are high, and it ranks poorly on Trustpilot, with over 23% of one-star reviews. It also has many trading strategy restrictions, and its consistency rule appears specifically designed to disqualify withdrawals. OFP follows the standard operating procedure, with excellent marketing, a few payouts to traders with a decent social media following, and its Save a Trader program, which grants second chances to those who violate its strict trading rules. Therefore, I cannot recommend OFP. OFP does not have a minimum withdrawal amount. OFP is a retail prop trading firm, and like its competitors, it remains unregulated. OFP has a withdrawal infrastructure like other retail prop firms, but its inconsistency rule appears designed to ensure most traders do not qualify for a payout. Even the two examples it provides would result in an ineligibility for payment.FAQs

What is the minimum withdrawal from OFP funding?

Is OFP funding regulated?

Does OFP funding pay out?