NordFX Editor’s Verdict

NordFX is a veteran in the online brokerage space, having been around since 2008. With that kind of history, you expect a certain level of excellence, and in some areas, they deliver. They offer the industry-standard MT4 and MT5 platforms, an exceptionally low $10 minimum deposit, and an ECN-style "Zero Account" with competitive commissions.

Overview

When I first started looking into NordFX, it was clear they’d been in the market for a long time. They don't try to reinvent the wheel with a flashy proprietary platform, instead focusing on providing the core tools traders expect: MT4 and MT5. Their model is split, offering a commission-free account for beginners and a raw-spread ECN account for more serious traders. The biggest story, however, is their regulatory shift away from Europe, which redefines who this broker is for.

Headquarters | Vanuatu |

|---|---|

Regulators | FSA, FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2008 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $10 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.9 pips |

Average Trading Cost WTI Crude Oil | 0.03$ |

Average Trading Cost Gold | 0.24$ |

Average Trading Cost Bitcoin | 328$ |

Minimum Raw Spreads | 1 |

Minimum Standard Spreads | 1 |

Minimum Commission for Forex | 0 |

Funding Methods | 25+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

NordFX Core Takeaways:

- Hybrid Broker Model: Operates as both a Market Maker (Pro account) and an ECN/STP broker (Zero account).

- Platform Focus: Provides the full MetaTrader suite (MT4 and MT5).

- Offshore Regulation: NordFX holds licenses from the FSC (Mauritius), and FSA (Seychelles).

- Broad Asset Range: Covers Forex, Indices, Commodities, Stocks, and Crypto CFDs.

- Accessibility: The $10 minimum deposit on the Pro account makes it very accessible.

- Order execution: This is claimed to be very fast typically less than 0.1 seconds.

- Negative Balance protection: Offered as standard across all account types.

NordFX Regulation & Security

When it comes to your money, a broker's regulation is everything.

Country of the Regulator | Mauritius, Seychelles |

|---|---|

Name of the Regulator | FSA, FSC Mauritius |

Regulatory License Number | SD065, GB24204016 |

Regulatory Tier | 3 |

Is NordFX Legit and Safe?

NordFX is an established broker operating since 2008.

Today, NordFX operates under a purely offshore framework. Here is the breakdown of its current entities and licenses:

Country / Region | Regulator | License Number | Tier |

Seychelles | FSA | SD065 | 3 |

Mauritius | FSC | GB24204016 | 3 |

The firm is registered offshore in St Lucia with reg number 2023-00470, and was also previously regulated in Vanuatu, but no longer.

Fees

NordFX gives traders a clear choice: simply to understand no fee option with wider spreads, or ‘raw pricing’ with a commission ticket fee for trades. For active traders, the Zero account is the one that makes most sense.

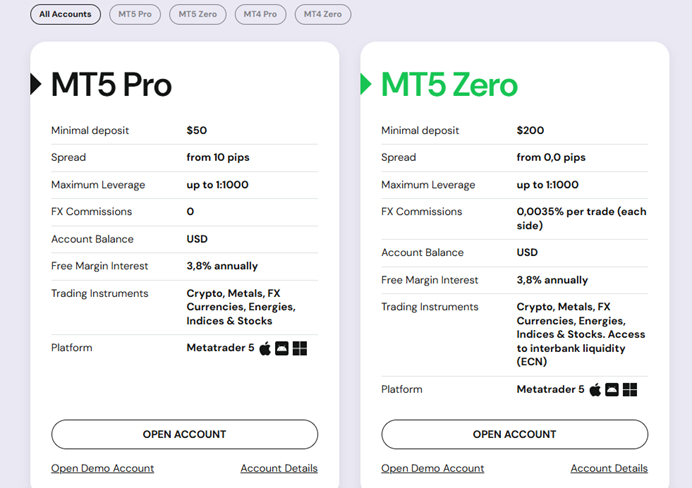

The broker operates on a two-account types model:

- Pro Account: This is the commission-free option. Spreads are advertised as starting "from 10 pips" on Forex.

- Zero Account: This account offers raw ECN spreads, starting from 0.0 pips. In place of a spread markup, you pay a commission of $3.50 per lot, per side ($7.00 round turn). This is an extremely competitive rate.

EUR/USD Trading Costs Example

Account Type | Average Spread (EUR/USD) | Commission (Round Turn) | Total Cost per 1.0 Lot |

Pro | ~1.0 pips | $0.00 | ~$100.00 |

Zero | ~0.1 pips | $7.00 | ~$8.00 |

The Zero account pricing is excellent and competes with top low-cost brokers.

Noteworthy:

- Inactivity Fee: A $20 fee is charged annually, but only after 12 months of no-account activity, which is very reasonable.

- Swap fees: Will apply to open overnight positions and swaps rates are detailed in the account information.

- Deposit/Withdrawal Fees: No fees for deposits. Withdrawals are also free from NordFX's side, but third-party processor fees may apply.

- Interest on free cash: For the MT5 platform the broker pays interest on funds not used for trading of 3.8% annualized.

Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:05 | Friday 21:59 |

Cryptocurrencies | Sunday 22:05 | Friday 21:59 |

Commodities | Sunday 22:05 | Friday 21:59 |

Crude Oil | Sunday 22:05 | Friday 21:59 |

Gold | Sunday 22:05 | Friday 21:59 |

Metals | Sunday 22:05 | Friday 21:59 |

Equity Indices | Sunday 22:05 | Friday 21:59 |

Overnight Swaps

In line with most trading brokers, holding a leveraged position overnight will incur a swap fee (or credit). This is essentially the interest rate differential between the two currencies in a pair. These rates can be checked directly within the MT4/MT5 platform. For traders who cannot pay or receive interest, NordFX offers Swap-Free Islamic Account options. Like other brokers using the Metatrader setup Swaps are increased for trade held open on a Wednesday to account for the weekend break in settlement behind the scenes.

Swap Calculation Example (Zero Account):

Let us calculate the estimated cost of buying 1.0 lot of EUR/USD and holding it, assuming the following swap rates:

- Swap Long: -$6.00 per night

- Swap Short: +$1.50 per night

Holding a standard 1 lot EURUSD position for one night:

Direction | Spread Cost | Commission | Swap Cost | Total Cost |

Buy | ~$1.00 | $7.00 | -$6.00 | $14.00 |

Sell | ~$1.00 | $7.00 | +$1.50 | $6.50 |

Holding EURUSD position for seven nights:

Direction | Spread Cost | Commission | Swap Cost (7 nights) | Total Cost |

Buy | ~$1.00 | $7.00 | -$42.00 | $50.00 |

Sell | ~$1.00 | $7.00 | +$10.520 | -$2.50 (Credit) |

Note: These are estimated figures taken from the website as a snapshot. Actual swap rates vary daily.

Range of Assets

NordFX provides a good range of tradable CFDs, covering the most popular markets and instruments. While not the most extensive list I have seen, it is more than sufficient for most traders.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

NordFX Leverage

NordFX offers high maximum leverage up to 1:1000. Available leverage does not decrease with position size rather the broker limits the maximum position that traders are able to open, for example on the Zero MT4 account this is a 50-lot limit per instrument. This only applies to Forex, Stock and other assets which have a much lower maximum leverage permitted.

What should traders know about NordFX leverage?

- Magnified Risk: High leverage amplifies both potential profits and potential losses.

- Tool for Experts: This level of leverage is a tool for experienced traders who use it for specific strategies and with strict risk management. It is not for beginners.

- Risk Control via Caps: Instead of dynamic leverage, NordFX manages its risk by capping the maximum position size (e.g., 50 lots per trade on an MT4 Pro account).

Account Types

Simplicity is key here. NordFX offers two main live accounts, both available on MT4 and MT5.

- Pro Account: $10 minimum deposit, spreads advertised from 10 pips, zero commission.

- Zero Account: $100 minimum deposit, raw spreads from 0.0 pips, $7 round-turn commission per standard lot.

- Islamic Account: Swap-free versions of the above accounts are available upon request.

NordFX Demo Account

NordFX offers a free and unlimited demo account. This is a crucial feature. It allows new traders to be comfortable with the MT4/MT5 platforms and for experienced traders to test the broker's execution

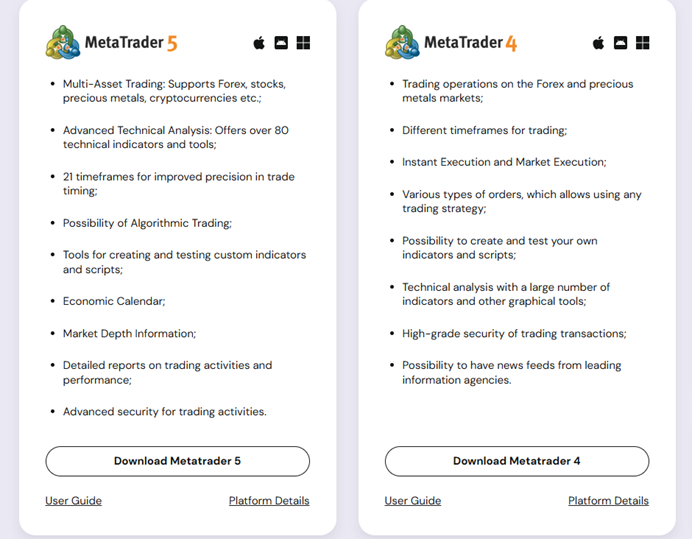

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

This is a strong, reliable area for NordFX. They do not try to reinvent the wheel with a buggy proprietary platform.

- MetaTrader 4 (MT4): The global industry standard, loved for its reliability, massive library of custom indicators, and Expert Advisors (EAs) for automated trading.

- MetaTrader 5 (MT5): The successor to MT4, offering more instrument timeframes, advanced charting tools, and a more modern interface.

- Social Trading: NordFX includes a trade copying facility, whereby account owners can become sellers of trading signals, receiving a monetary reward according to the number of subscribers, or trade copiers, following chosen provider(s) of trading signals for a fee. Signal providers can monetise their trading, while trade copiers can potentially profit from active trading while remaining personally passive.

What I Would Like NordFX to Add

While NordFX has a strong core offering, there are a couple of areas where improvements could boost value.

Better Educational Resources: The current offering is basic. A structured learning academy with courses and webinars would add significant value.

Research & Education

This is an area where NordFX is covering the basics. They provide the essentials well – A news section with market analysis plus an economic calendar.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |           |

Support is available 24/5 via the standard channels:

- Live Chat

- Phone

Their website is available in over 17 languages, catering to their global client base. My research into user reviews from other sites shows that customer support is generally considered a strength for NordFX. Recent feedback from 2024 and 2025 often praises the support team for being responsive, helpful, and knowledgeable. One trader even noted they received a proactive call from a support agent just 10 minutes after registering, who walked them through all the broker's services.

Bonuses and Promotions

At the time of this review, NordFX was not advertising any direct deposit bonuses. Their promotions are more focused on partner/IB programs, affiliate contests, and an internal "Lottery." This is a positive sign, as large deposit bonuses are often prohibited by good regulators and can encourage over-trading. The home page is currently promoting a 50% reduction in gold spreads.

Opening an Account

The account opening process is fully digital and follows industry standards.

What should traders know about the NordFX account opening process?

- Register: Complete the online application form with your personal details.

- Verify: Submit KYC (Know Your Customer) documents. This includes a government-issued photo ID (like a passport) and a recent proof of address (like a utility bill).

- Fund: Once verified, you can fund your account.

- Trade: Download MT4/MT5 and log in.

The process is generally quick and can often be completed on the same day.

Minimum Deposit

The minimum deposit is $10 for the Pro Account and $100 for the Zero Account.

Payment Methods

NordFX supports a range of modern and traditional payment methods, including the following list.

Withdrawal options |        |

|---|---|

Deposit options |        |

Deposits & Withdrawals: This is one of NordFX's strongest features. They offer over 25 payment methods, including:

- Bank Wire

- Credit/Debit Cards

- Skrill

- Neteller

- Perfect Money

- Cryptocurrencies (Bitcoin, Ethereum, USDT, etc.)

- Binance Pay & other local payment systems

Accepted Countries

NordFX accepts clients from many countries around the world. However, due to regulatory restrictions, they do not accept clients from the United States and European Economic Area (EEA) and sanctioned countries like North Korea etc. Their focus is clearly on clients in Asia, Latin America and Africa.

Deposits and Withdrawals

The process is straightforward, with an excellent range of modern funding options

What are the key takeaways from the deposit and withdrawal process at NordFX?

- Deposit Methods: 25+ methods, including crypto, is outstanding.

- Fees: NordFX does not charge internal fees for deposits or withdrawals. This is a huge plus.

- Withdrawal Speed: This is the single most praised feature in recent user reviews. Reports from 2024 and 2025 consistently mention "lightning speed" and "prompt payouts," often processed within a few hours or even minutes. The "automatic withdrawal" feature, especially using USDT (cryptocurrency), is a major highlight for traders.

The only common complaint found was from traders in specific regions (like India) who noted the lack of local bank transfers, forcing them to use e-wallets or crypto instead.

Is NordFX a Good Broker?

For anyone who places regulatory security above all else, NordFX may not be an ideal fit. However, for an experienced trader who understands and is comfortable with the profile of an offshore broker, NordFX presents a very compelling case. The "Zero Account" offers a genuinely competitive ECN trading environment on MT5.

Ultimately, NordFX is for a trader who has made a conscious choice: they are seeking the "practical" benefits of 1:1000 leverage and a system that, according to its users, delivers on its promises of fast, no-fuss withdrawals.

FAQs

What countries does NordFX operate in?

NordFX accepts clients resident many countries around the world. It is easier to list the countries it does not accept. According to its official website, NordFX does not offer its services to residents of the following Countries/Areas: USA Canada EU (European Union) Russian Federation Japan Brazil Ukraine Cuba Sudan Syria Malaysia Panama Indonesia North Korea

What is the minimum deposit for NordFX?

The minimum deposit is $10 for an MT4 Pro account or $100 for an MT4 Zero account.

What is the maximum leverage offered by NordFX?

The maximum leverage offered by NordFX is 1:1000. This is a fixed maximum and does not automatically decrease with larger position sizes.

Is NordFX legit?

Yes, NordFX is a "legit" broker that has been in operation since 2008. It is regulated by several offshore authorities (FSC, FSA, and registered in St. Lucia) and user reviews praise its fast, reliable withdrawals.

What is NordFX?

NordFX is a multi-asset Forex and CFD broker that was established in 2008. It provides access to trading on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Traders can speculate on a range of markets, including Forex, cryptocurrencies, indices, stocks, and commodities like gold and oil.