Moneta Markets Editor’s Verdict

Moneta Markets is the latest subsidiary of the Vantage International Group LTD brand. Despite the fact that this broker is, at the time of this Moneta Markets review, still in its infancy, the interest it draws can largely be attributed to its parent company’s credentials. Vantage International Group has been operational since 2009; it is home to over 70,000 traders, and processes over 1.5 million trades per month valued at over $100 billion.

Overview

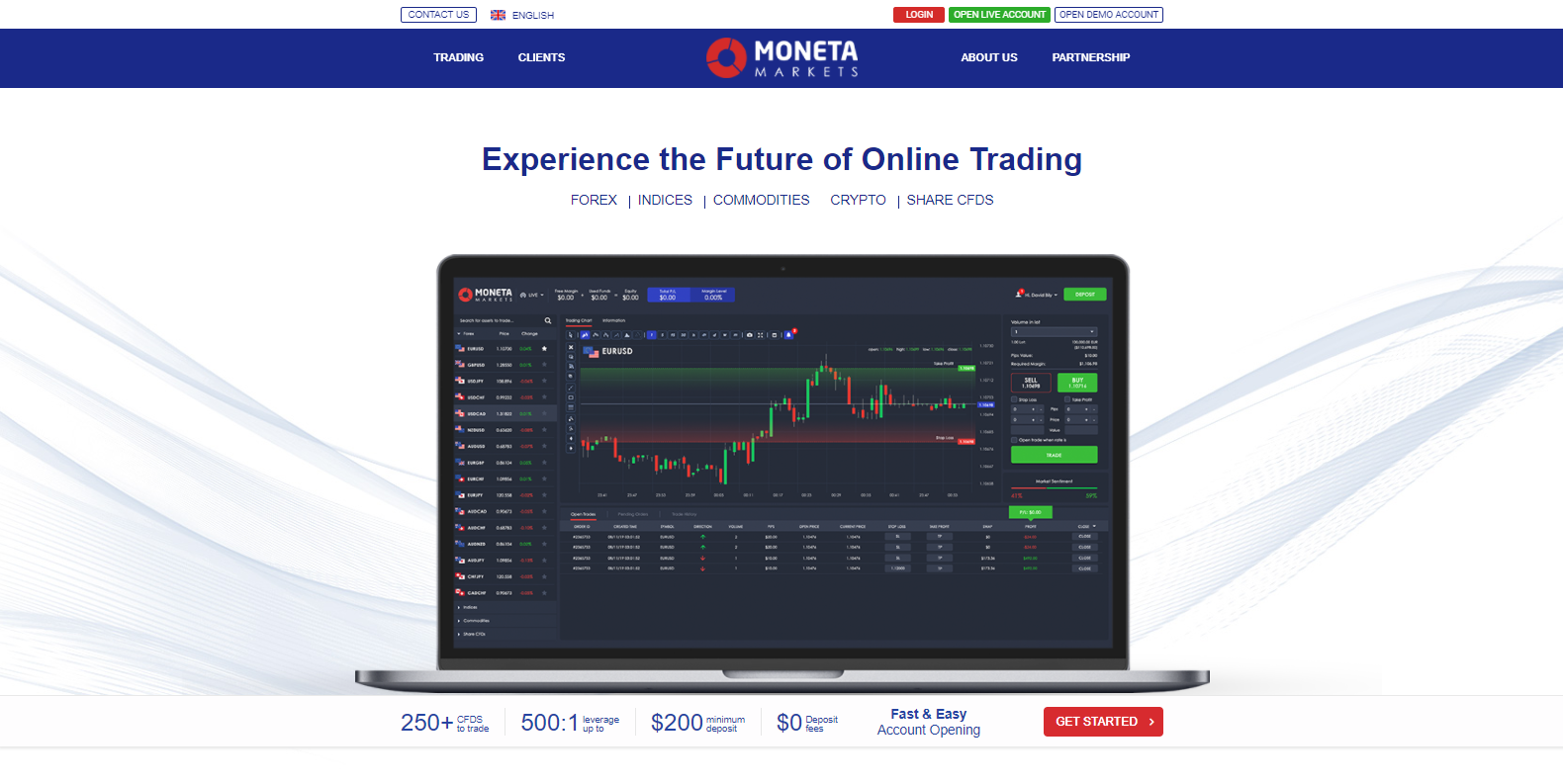

Moneta Markets offers only a proprietary trading platform, the Moneta Markets WebTrader, from where traders have access to over 250 CFDs with a maximum leverage of 1:500 for a minimum deposit of just $200.

Headquarters | Cayman Islands |

|---|---|

Regulators | CIMA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2018 |

Execution Type(s) | Market Maker |

Minimum Deposit | $200 |

Trading Platform(s) | Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

Average Trading Cost GBP/USD | 0.6 pips ($6.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $230.81 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

This broker seeks to replicate the success of its parent company, Vantage International, which was able to build itself around its own trading platform.

Regulation and Security

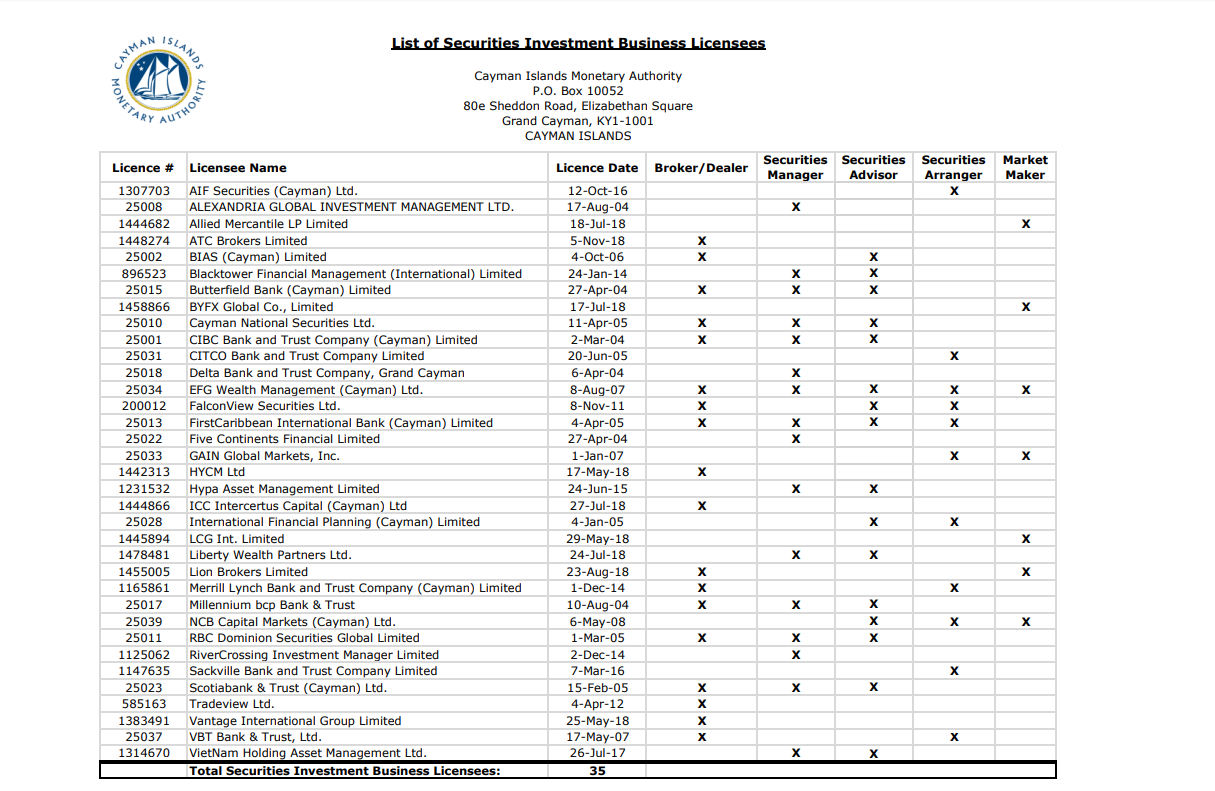

Vantage International Group LTD, the parent company of Moneta Markets, is regulated by the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law (SIBL) number 1383491, since May 2018. This regulator oversees only eighteen brokerages. It should be noted that there is no investor compensation fund which would protect traders against unforeseen financial issues at this broker. All client funds remain segregated at the National Australia Bank (NAB).

Professional indemnity insurance which covers employees, representatives, and other authorized individuals is in place. Insurance that would cover deposits in the event of financial problems at the brokerage would be preferred, as it would add a much-needed layer of security and protection. Overall, the level of transparency and regulation is enough for traders to feel safe and secure depositing their money with Moneta Markets.

Overseeing only 18 brokerages, the Cayman Islands Monetary Authority lacks the prestige (and perhaps the experience) of other regulators but does provide adequate protection.

Fees

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

|---|---|

Average Trading Cost GBP/USD | 0.6 pips ($6.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $230.81 |

We were extremely surprised to find during our Moneta Markets review that information regarding fees is not clearly provided on the company’s website. We suspect that this is likely because the brokerage is still fairly young. No data concerning spreads, commissions, or other costs are listed. Moneta Markets is a market maker and profits directly from losses of traders. Beyond that, the cost structure remains opaque. This broker should take a lesson from another subsidiary of its parent company, Vantage FX, where transparency is excellent.

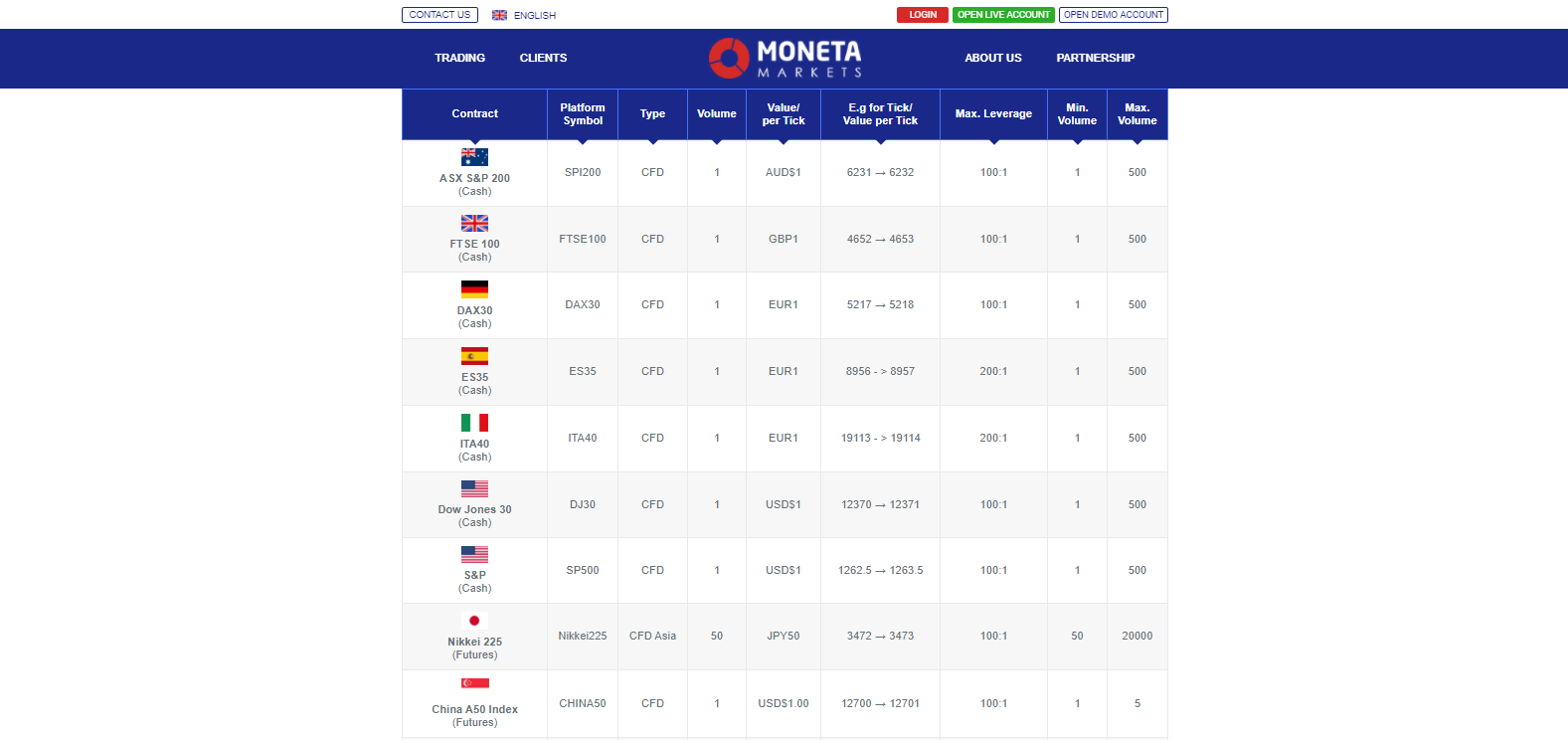

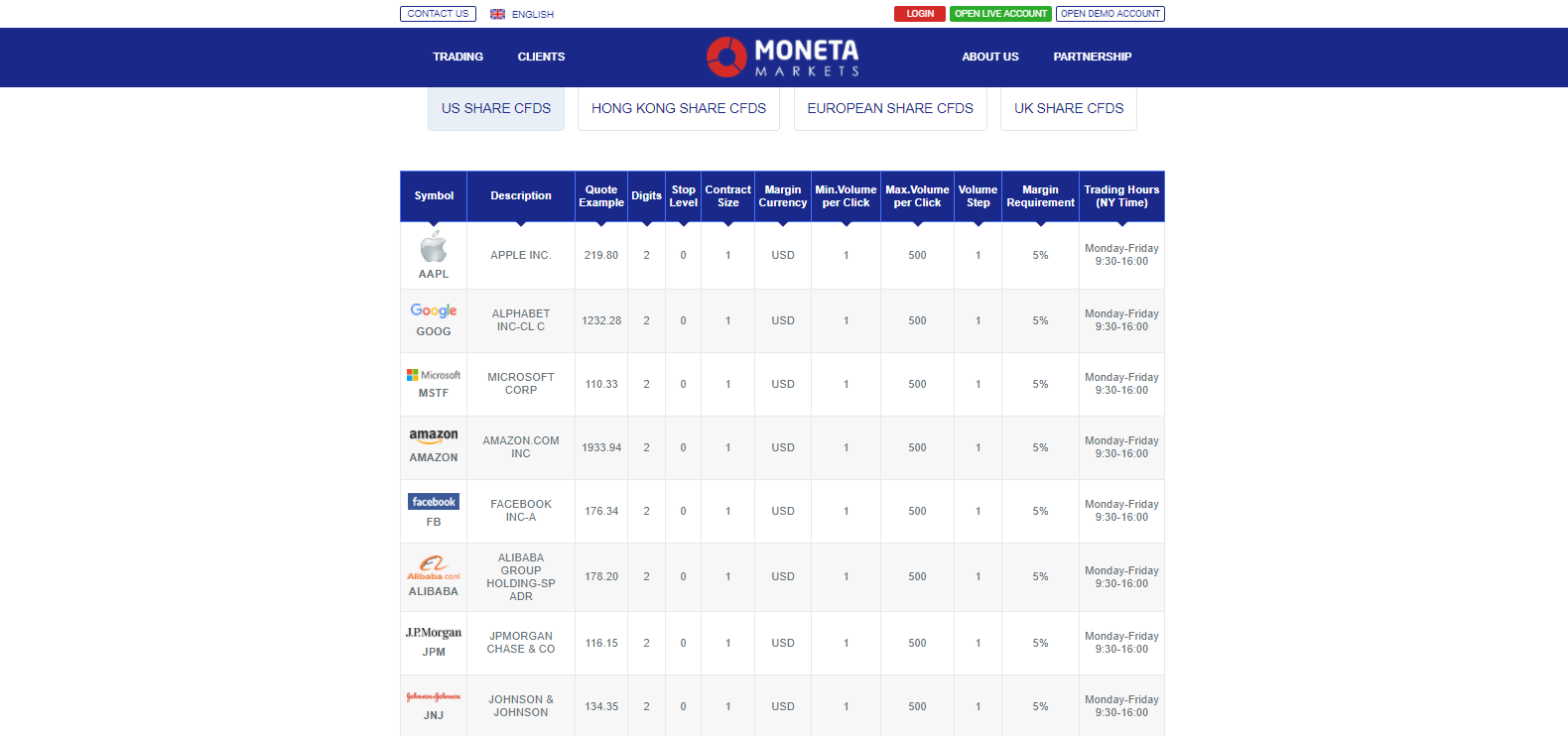

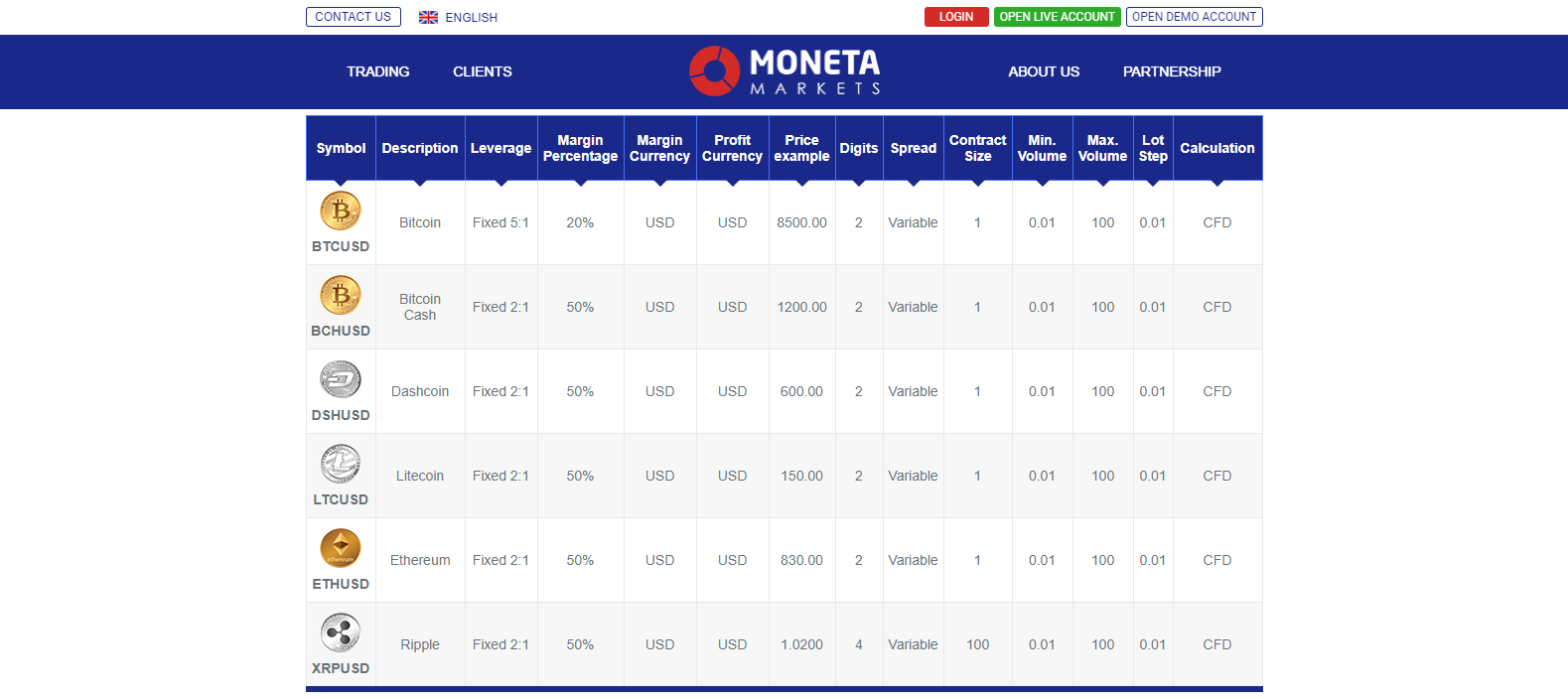

What Can I Trade

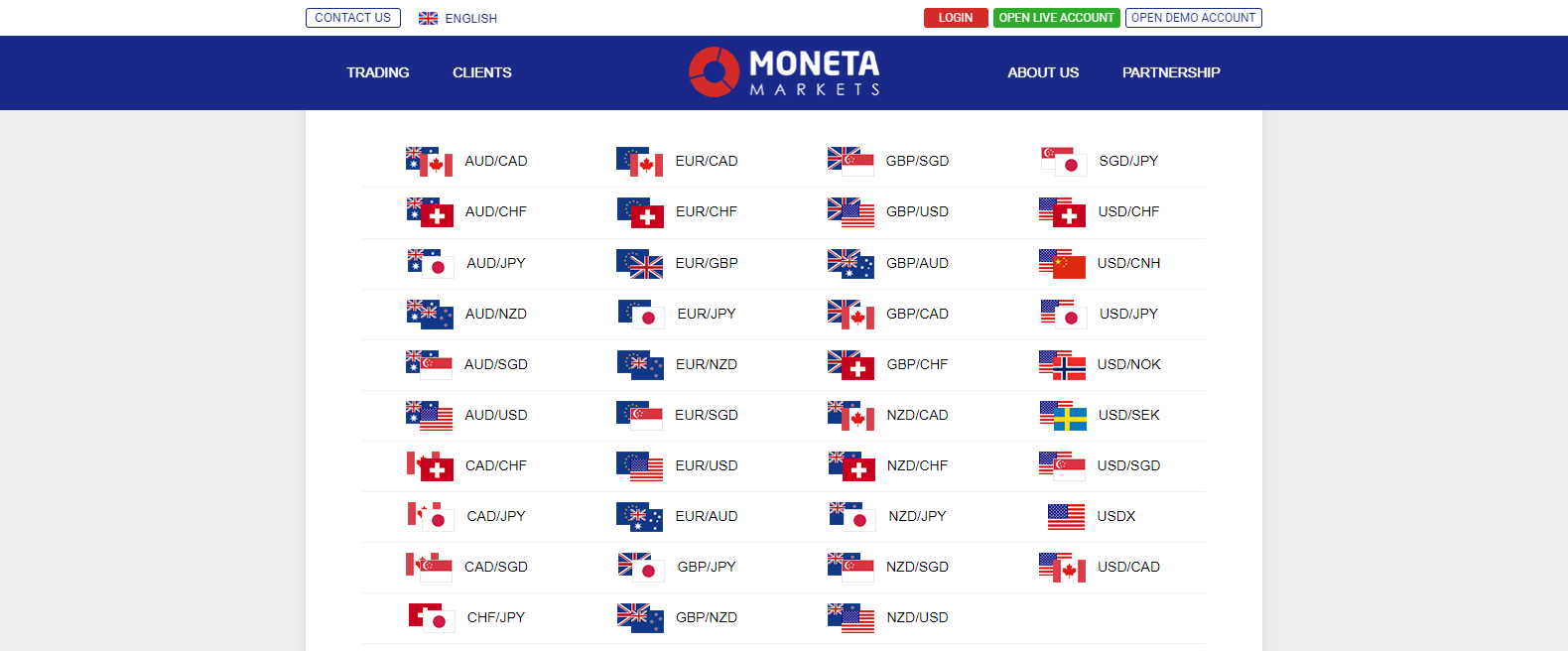

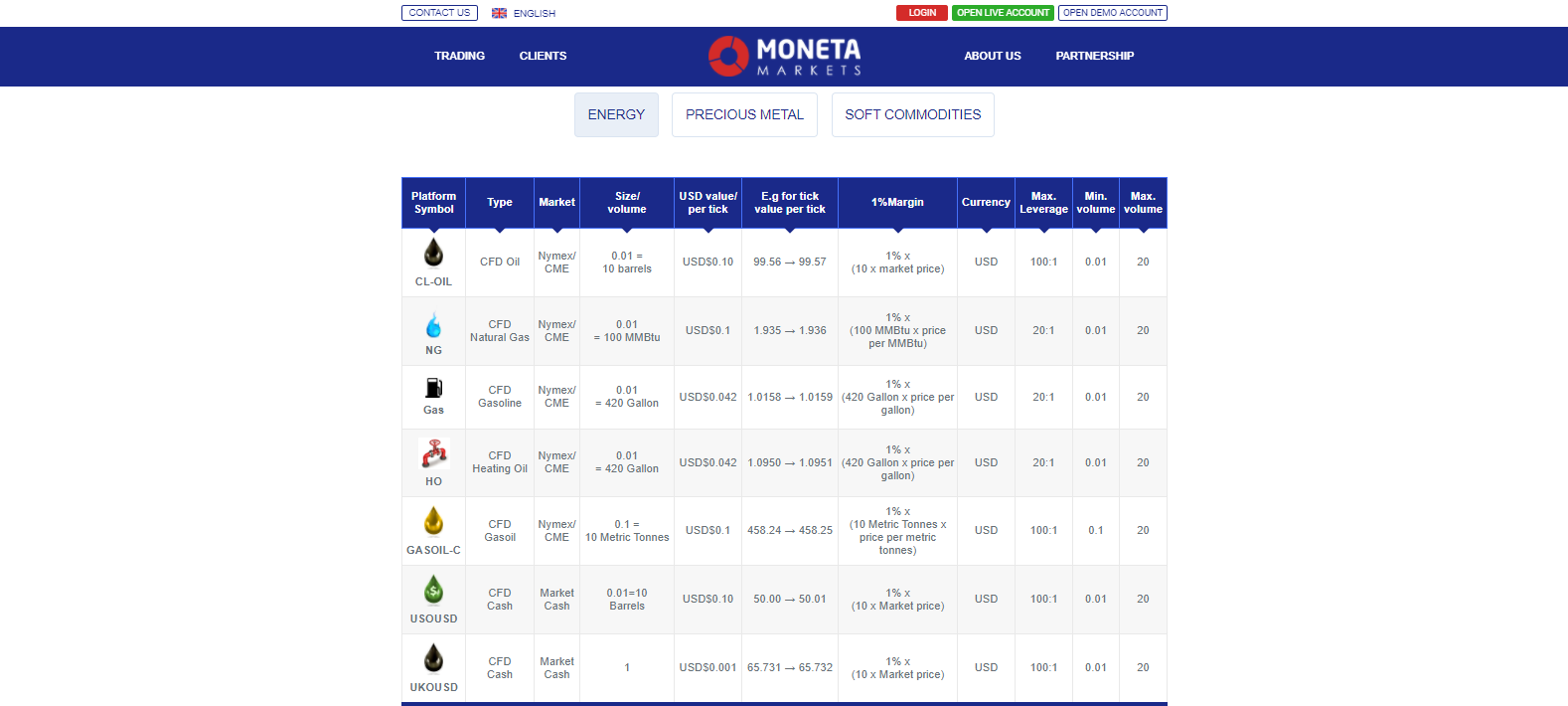

Moneta Markets offers over 250 assets across Forex, commodities, indices, equities, and cryptocurrencies. Traders have plenty of opportunities for cross-asset diversification. Different assets carry distinct leverage specifications, with the maximum noted as 1:500. This offers an advantage for Moneta Markets traders that many brokers can’t offer because of regulatory restrictions in other jurisdictions.

Pure Forex traders have a solid choice of 45 currency pairs.

Fifteen commodity CFDs provide satisfying diversification opportunities.

Another fifteen index CFDs allow traders to explore this attractive asset class.

A total of 185 equity CFDs across four markets cover popular stocks.

Six cryptocurrencies offer traders exposure to one of the more popular sectors.

Account Types

A single CFD account is available to all traders. The democratization of account types is spreading throughout the brokerage industry, which is a welcome development. Trading conditions for all traders remains the same; there is no up-selling for better services, and no marketing tricks to lure more substantial deposits from retail traders. With a minimum deposit of only $200, Moneta Markets has provided an excellent entry point into financial markets for new traders.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

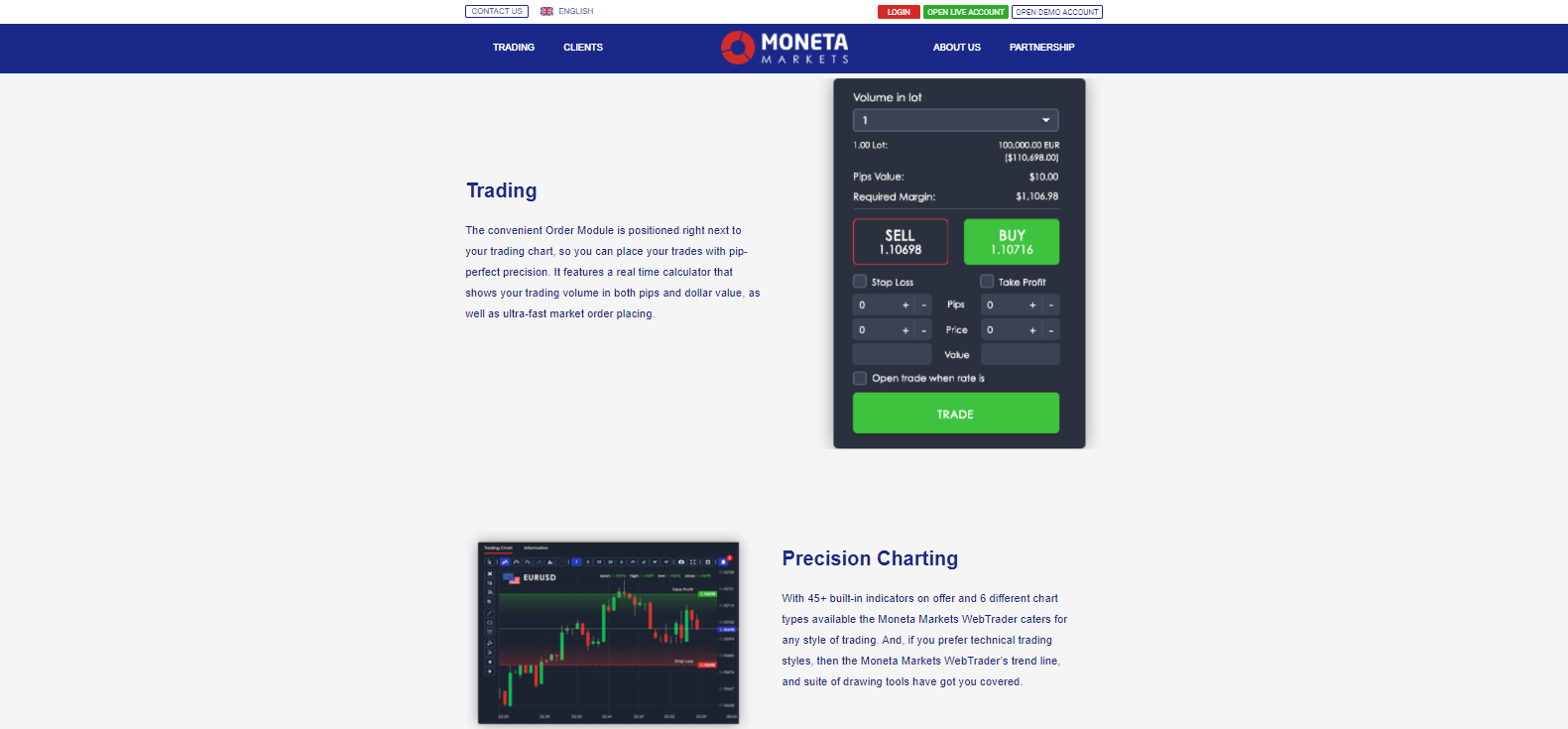

Unfortunately, Moneta Markets only provides its proprietary webtrader. While this platform may be suitable for new retail traders, it may not meet the needs of advanced traders. Automated trading is not supported, and experienced traders will likely miss the availability of the popular MetaTrader 4 platform and all that the platform offers. Third-party plugins or support for custom applications via API is equally absent. While the user-interface appears well-designed, with a charting package for manual trading touted as its prime feature, the overall platform lacks core features deemed necessary in today’s marketplace.

The Order Module is easy-to-understand, but swap rates should be listed here. With 45 technical indicators, this fundamental charting tool is promoted as the prime feature.

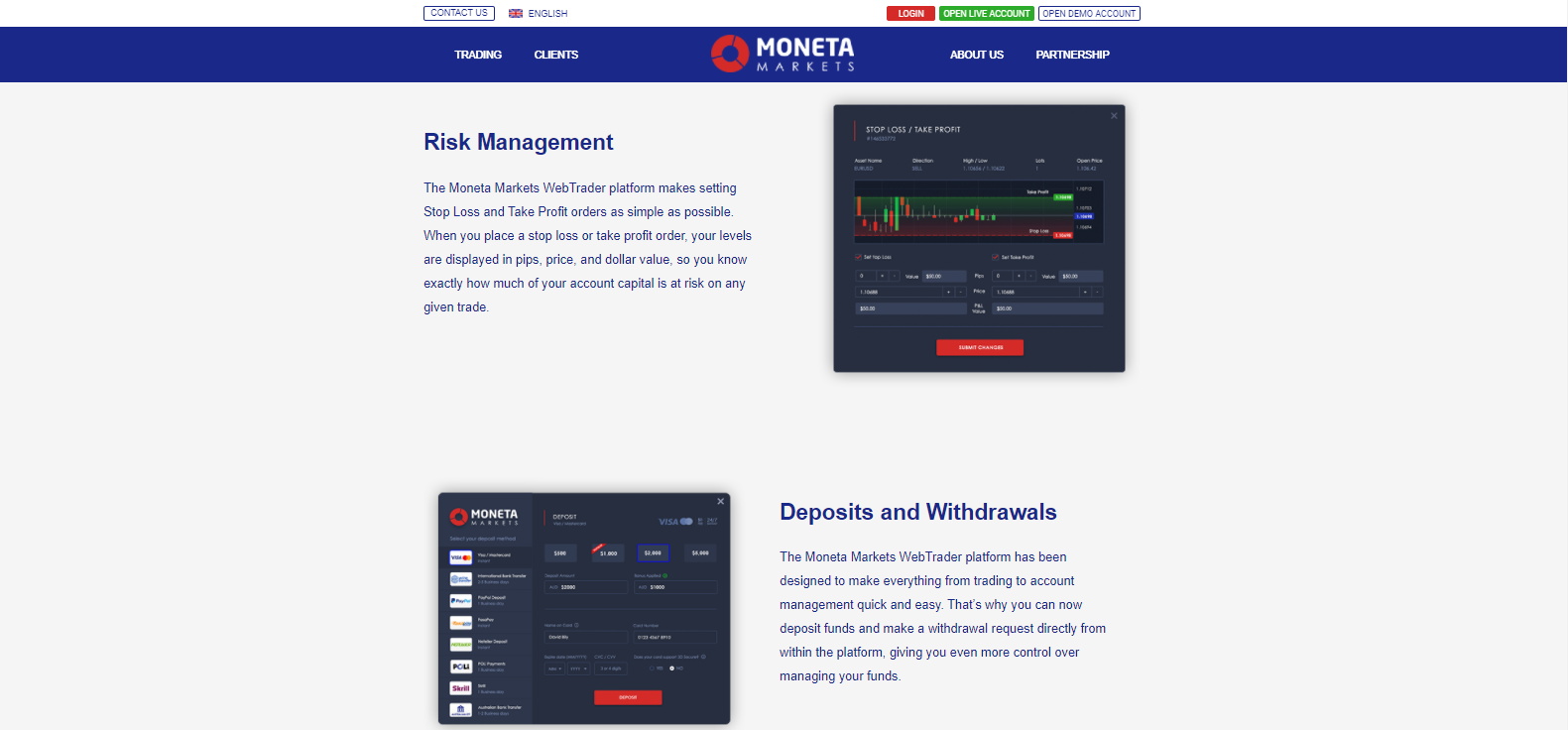

Risk management consists of the most fundamental aspect. The option to perform deposits or request withdrawals from inside the platform is a standard feature.

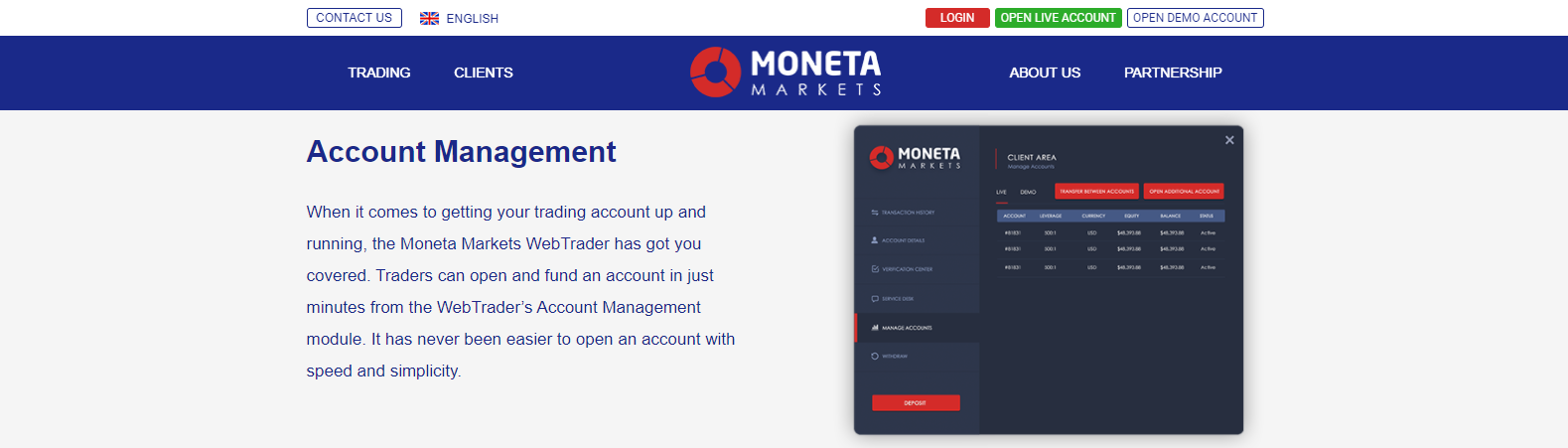

Adding another primary feature is the simple account management option.

Unique Features

This broker is considerably young and underdeveloped, and thus has no unique features of note. The lack of support for automated trading solutions is the most notable feature missing from this broker’s offerings. Following a period of maturity and insight, it is hoped that Moneta Markets' limited operational experience will be improved with the implementation of more relevant features.

Research and Education

Dedicated segments for research and training are currently undeveloped, which is not uncommon for a new broker. The available research consists of a primary economic calendar, provided by TradingView, and a client sentiment indicator, based on positions at this brokerage. Given the absence of services for traders, Moneta Markets may opt to expand its research offering as it increases its operations.

Tutorials for the brokerage's proprietary trading platform are mentioned but curiously absent. One of the most significant areas for Moneta Markets to improve on is education. Moneta Markets' primary trader-base tends to be first-time traders who generally have little knowledge of the importance of more advanced trading platforms. As such, it is paramount that Moneta Markets offers an excellent educational program to ensure retention of new traders. The success of Moneta Markets may depend on the proper implementation and execution of its education department.

An economic calendar is available but requires improvements in design.

The client sentiment is based on positions at this broker only, and will likely become more valuable as more traders choose Moneta Markets as their Forex broker.

Moneta Markets must provide a proper educational section, currently not available.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |            |

Moneta Markets provides multi-lingual customer support 24/5. Traders may send an e-mail or call, while live chat is the most convenient tool. An FAQ section is available and aims to answer the most common questions. Customer support is a feature most traders never require, but since this broker is a somewhat new one, it may be required more frequently. Anyone who needs support should have no issues obtaining it at Moneta Markets.

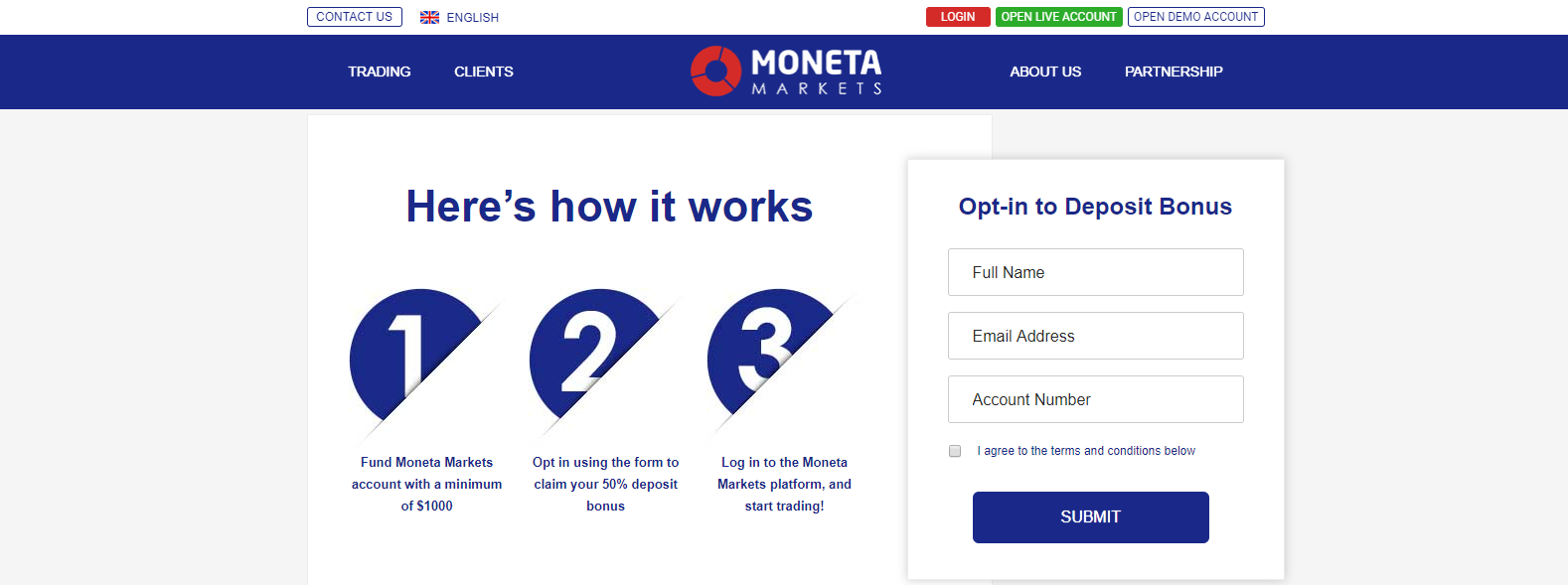

Bonuses and Promotions

Traders may opt-in to receive a 50% bonus, but a $1,000 minimum deposit is required to qualify. Terms and conditions apply, and anyone interested in receiving it must ensure that they are fully understood. The initial deposit can be withdrawn at any time, though the cancellation of the bonus will follow. With a minimum deposit of $200, Moneta Markets implemented this incentive to encourage more substantial deposits. $1,000 may be more than most new traders wish to deposit. A bonus on all deposit sizes is preferred, or no bonus at all. Traders should only deposit as much as they are comfortable with and overlook this marketing scheme.

A $1,000 minimum deposit is required to qualify for a 50% deposit bonus.

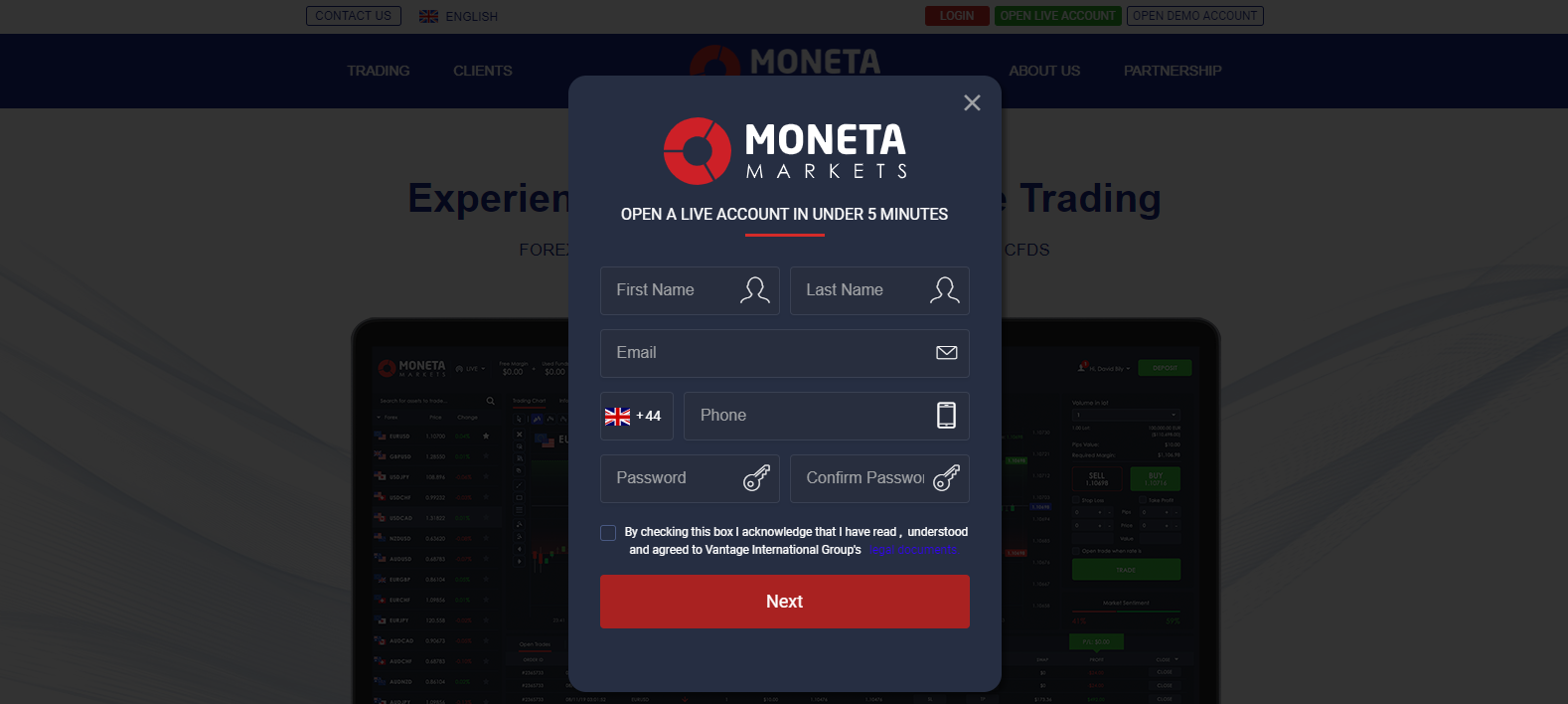

Opening an Account

We were extremely happy to find during this Moneta Markets review that Opening an account is refreshingly simple. A name, e-mail address, phone number, and desired password completes the quick application form. Given the broker’s compliance with anti-money laundering procedures, the application will grant new traders access to the back-office. From there, it is presumed that the account requires verification via a copy of the client’s ID as well as a proof of residency document, which is the standard operating procedure to be AML/KYC compliant.

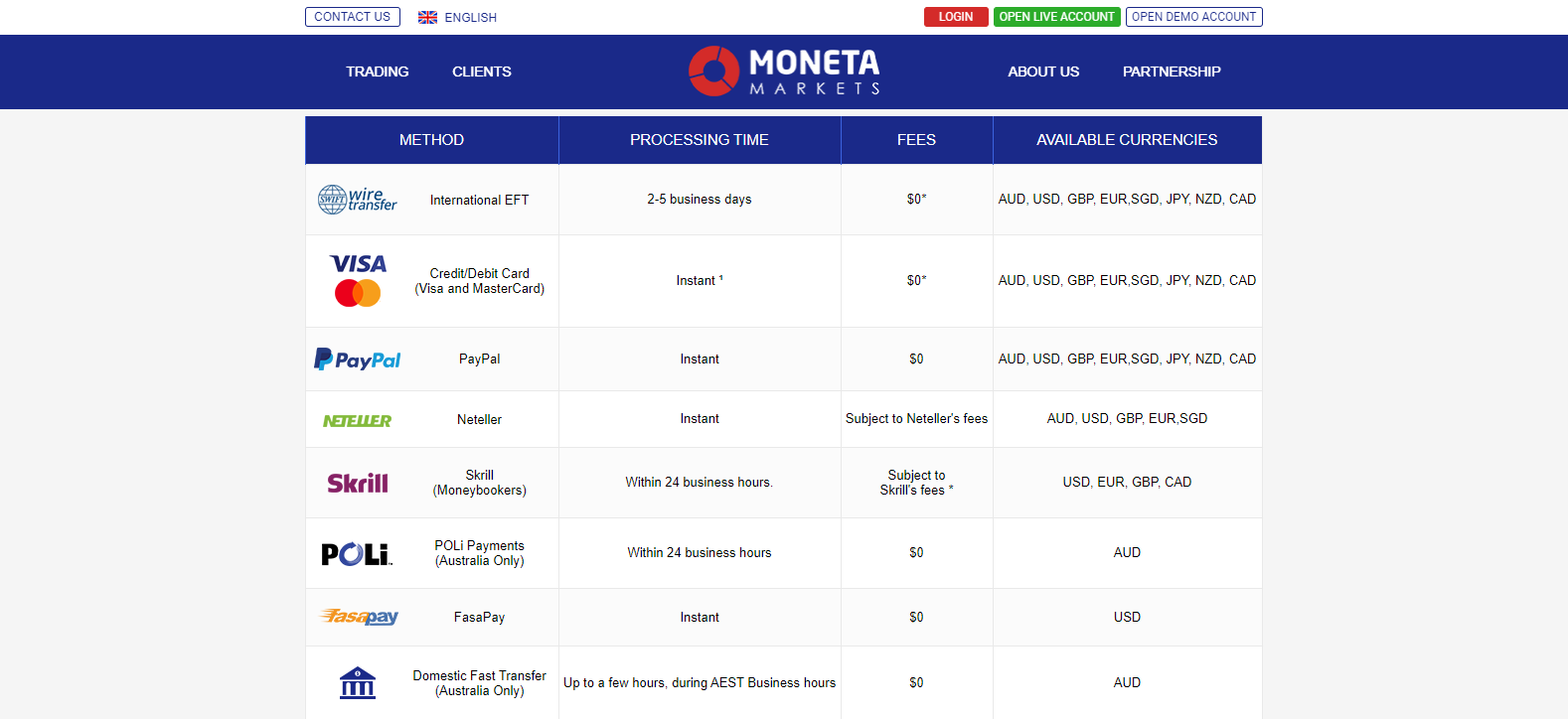

Deposits and Withdrawals

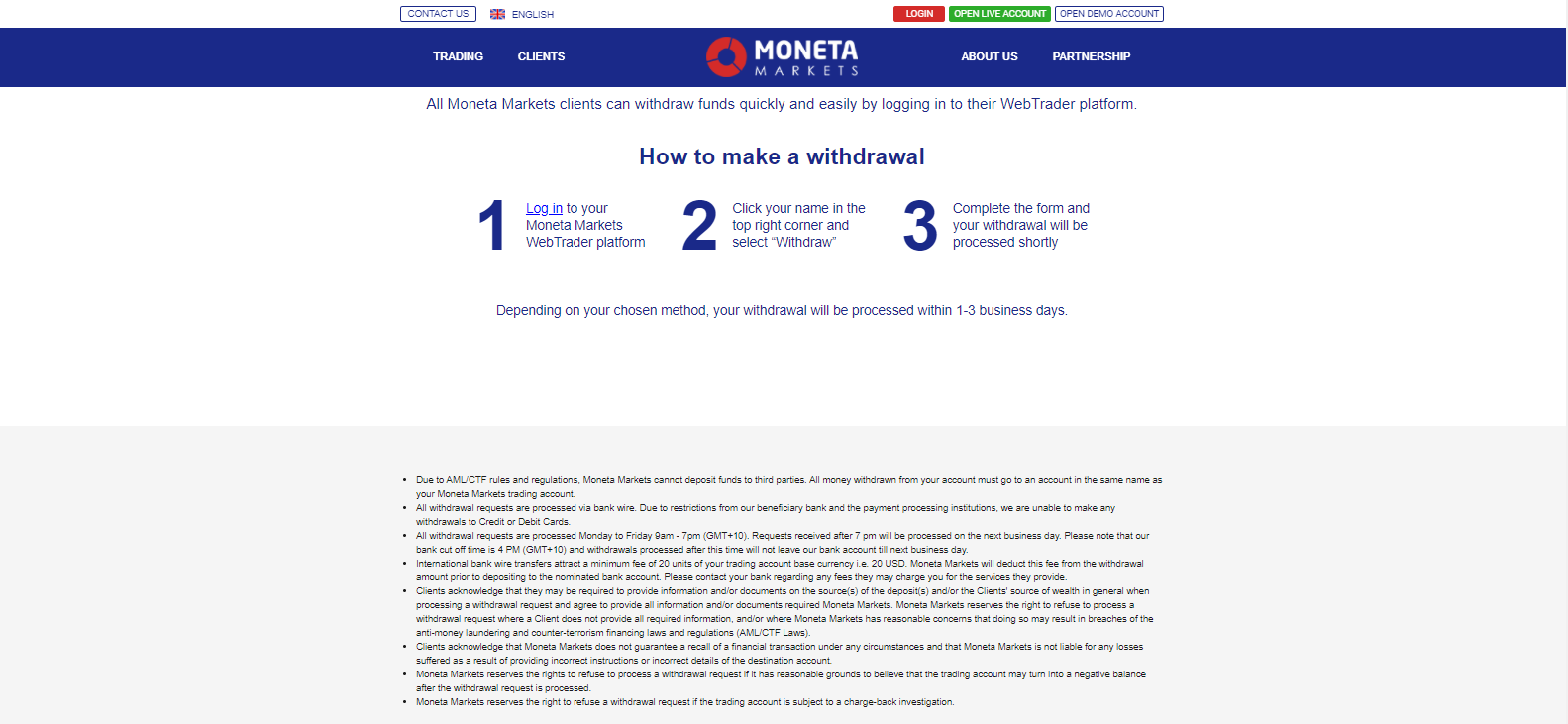

Moneta Markets supports wire transfers, credit/debit cards, PayPal, Neteller, Skrill, and FasaPay for international clients. Australian clients may also choose POLi Payments and Domestic Fast Transfer. Processing times are listed as instant for most options, while bank wires may take up to five business days. Deposit and withdrawals fees, as charged by payment processors are applicable. Multiple currencies are available, and first-time deposits via credit card carry a limit of A$1,000. Bank wires incur a fee of 20 currency units, which will be deducted from the withdrawal amount. In compliance with AML regulations, the account name of the payment processor must match that of the Moneta Markets account.

The supported deposit options offer a suitable mix for all traders to find the best choice.

Withdrawals are processed within one to three business days.

Summary

Moneta Markets is a new brokerage, but its parent company has been operational for over a decade. It appears that this subsidiary was introduced around its proprietary webtrader, as this is the only trading platform available. The account structure has been simplified to one CFD account for all traders, and a hassle-free account opening process was implemented. The target market remains first-time retail traders, i.e., those traders who have little need for more advanced trading features.

While some similarities to Vantage FX exist (both are owned by the Vantage International Group LTD), what stands out at Moneta Markets is the broad asset selection, which allows traders to implement adequate cross-asset diversification. The minimum deposit is $200 for maximum leverage of 1:500, but a $1,000 deposit is required to qualify for the 50% bonus. Moneta Markets is advised to rethink its approach, as this may be out of range for many new traders.

Regrettably, transparency regarding cost structure is notably missing, a significant misstep by Moneta Markets. Information about spreads, commissions, and other trading costs needs to be published for the sake of transparency. Since equity and index CFDs are offered, how corporate actions are treated should also be communicated to traders. Where to obtain swap rates, together with an explanation, must be detailed.

Adding evidence to the lack of experience is the absence of a useful educational section. The website lists education as a category, but it remains empty. Since new retail traders are the target market for this broker, it should develop the educational platform first. It needs to form the core of services provided, as education is paramount to the success of its targeted client base (i.e., new retail traders).

Given its lineage, there is great potential at this brokerage if the management team decides to improve its transparency and trading services. A better introduction of the trading platform features is recommended. With improvements and further development, Moneta Markets may mature into a valid contender to attract first-time traders to its acceptable asset selection featuring high leverage. This broker is part of the Vantage International Group LTD brand, operational since 2009, and home to over 70,000 traders. It processes over 1.5 million trades per month, valued at over $100 billion. While Moneta Markets is a younger operating subsidiary that opened in late 2019, given its parent company, it does seem to be a legit brokerage. Vantage International Group LTD, the parent company of Moneta Markets, is regulated by the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law (SIBL) number 1383491, since May 2018. Moneta Markets supports wire transfers, credit/debit cards, PayPal, Neteller, Skrill, and FasaPay for international clients. Australian clients may also choose POLi Payments and Domestic Fast Transfer. Traders have access to 1:500, but it is asset dependent. No, this broker solely provides traders with its proprietary Moneta Markets WebTrader.FAQs

Is Moneta Markets legit?

Is Moneta Markets regulated?

How do I withdraw money from Moneta Markets?

What is the maximum leverage offered by Moneta Markets?

Does Moneta Markets offer the MT4 trading platform?