Editor’s Verdict

Mitrade is an award-winning, ASIC-regulated broker that excels in providing a simple and intuitive trading experience. Its proprietary platform is clean, user-friendly, and perfect for beginners who may feel overwhelmed by more complex systems like MT4/MT5. While it lacks advanced features like copy trading and automated signals, its commission-free structure, low minimum deposit, and strong regulatory oversight make it a secure and cost-effective choice for self-directed traders.

Overview

Mitrade Core Takeaways:

- Market maker model with a zero-commission, spread-only fee structure.

- Regulated by ASIC, CIMA, and the FSC.

- Offers a Mitrade proprietary trading platform (web & mobile)

- Low minimum deposit from $50 and multiple fee-free funding options.

- Provides access to Forex, Stocks, Indices, Commodities, and Crypto CFDs.

Headquarters | Australia |

|---|---|

Regulators | ASIC, CIMA, FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2011 |

Execution Type(s) | Market Maker |

Minimum Deposit | $50 |

Negative Balance Protection | |

Trading Platform(s) | Web-based |

Average Trading Cost EUR/USD | 1 pips |

Average Trading Cost GBP/USD | 1.2 pips |

Average Trading Cost WTI Crude Oil | 0.05 Pips |

Average Trading Cost Gold | 0.35 points |

Average Trading Cost Bitcoin | 100 dollars |

Retail Loss Rate | 72% for its ASIC entitie |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 |

Minimum Commission for Forex | no commission |

Funding Methods | 5+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Mitrade Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. Mitrade operates under several regulated entities.

Country of the Regulator | Australia, Cayman Islands, Mauritius |

|---|---|

Name of the Regulator | ASIC, CIMA, FSC Mauritius |

Regulatory License Number | AFSL 398528 (for Mitrade Global Pty Ltd) SIB 1612446 (for Mitrade Holding Ltd) GB20025791 (for Mitrade International Ltd) |

Regulatory Tier | 1, 4, 4 |

Is Mitrade Legit and Safe?

Yes. Mitrade is a legitimate and safe broker. Its regulation by tier-1 authority, ASIC, , provides a high level of trust and security for traders. This is further supported by external user reviews, which are generally positive across platforms like Trustpilot and the App Store. Users frequently praise the platform's ease of use, the straightforward deposit and withdrawal process, and the responsive customer service. While some traders complain about the lack of MT4/MT5 support, the consensus points to Mitrade being a trustworthy broker.

Mitrade regulation and security components:

- Regulated by ASIC, CIMA, and the FSC.

- Founded in 2011 with headquarters in Melbourne, Australia.

- Segregation of client deposits from corporate funds.

- Negative balance protection for retail clients.

Country / Region | Regulator | License Number |

Australia | ASIC | AFSL 398528 |

Cayman Islands | CIMA | SIB 1612446 |

Mauritius | FSC | GB20025791 |

What Would I Like Mitrade to Add?

Mitrade offers a lot of what traders will be looking for, but the broker could significantly broaden its appeal by introducing support for the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This would attract advanced traders who rely on the extensive customisation, expert advisors (EAs), and vast library of tools available in the MetaTrader ecosystem.

Furthermore, the addition of social and copy trading features would be a valuable addition to the offering. Creating a system that allows users to follow and automatically replicate the trades of successful investors would provide immense value, especially for beginners looking to learn from the community.

Fees

Mitrade’s fee structure is straightforward and built around its market maker model. There are no commissions on trades; all costs are built into the spread.

EURUSD Trading Costs

Average Spread (EUR/USD) | Commission per Round Lot | Total Cost per 1.0 Standard Lot |

1.0 pips | $0.00 | ~$10.00 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are available.

- Inactivity Fee: Mitrade charges a monthly inactivity fee of €10 after 180 days and balances below $100

- Deposit/Withdrawal Fees: Mitrade does not charge fees for deposits or withdrawals.

Average Trading Cost EUR/USD | 1 pips |

|---|---|

Average Trading Cost GBP/USD | 1.2 pips |

Average Trading Cost WTI Crude Oil | 0.05 Pips |

Average Trading Cost Gold | 0.35 points |

Average Trading Cost Bitcoin | 100 dollars |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 |

Minimum Commission for Forex | no commission |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | 10 EUR/USD/GBP per month. This fee is applied to an account if there has been no trading activity for a period of six consecutive months. |

Overnight Swaps

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the Standard Mitrade account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs (Long/Short) |

1.0 pips | $0 | -$8.00 | +$2.00 | $18.00 / $8.00 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long (7 nights) | Swap Short (7 nights) | Total Trading Costs (Long/Short) |

1.0 pips | $10.00 | -$56.00 | +$14.00 | $66.00 / -$4.00 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are available where these conditions will not apply.

- The broker will credit traders for holding positions that are positive in terms of swap rates

Range of Assets

Mitrade provides a well-rounded asset selection, allowing for effective portfolio diversification across different market sectors.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

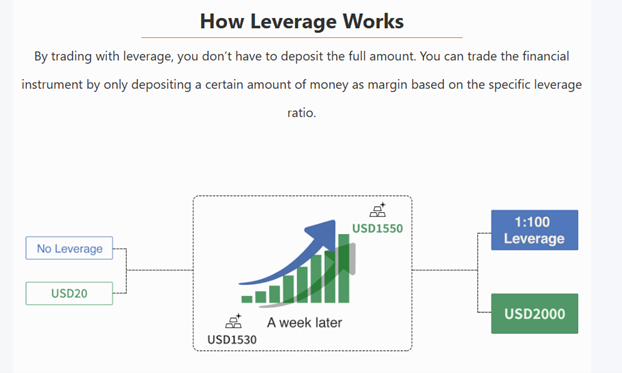

Mitrade Leverage

The maximum leverage available at Mitrade is determined by the regulatory body governing the client's account.

Maximum Retail Leverage (EU/Australia) | Maximum Leverage (International) |

1:30 | Up to 1:200 |

What should traders know about Mitrade leverage?

- Leverage magnifies both potential profits and potential losses.

- Negative balance protection ensures retail traders cannot lose more than their account balance.

- Always use risk management tools like stop-loss orders when trading with leverage.

Account Types

Mitrade simplifies the account process by offering one standard account type for all clients. This ensures that all traders receive the same core features, pricing, and access to all available instruments.

My observations concerning the Mitrade account types are:

- A single, simple, and straightforward option

- Competitive spread-only pricing

- An Islamic (swap-free) version of the account is available

Mitrade Demo Account

A free demo account is available, which is an excellent tool for beginners. It allows new users to explore the proprietary platform and practice trading with virtual funds before committing real capital.

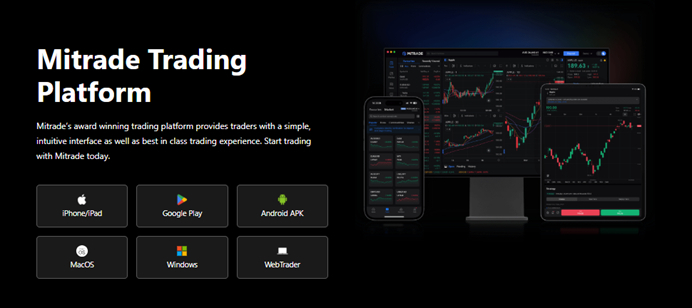

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Mitrade has invested in developing its own proprietary trading platform, which is its sole offering.

- Mitrade WebTrader: A clean, web-based platform that is easy to navigate and includes integrated charts, risk management tools, and market analysis features.

- Mitrade Mobile App: A highly rated mobile app for iOS and Android that provides the full functionality of the web platform for trading on the go.

- No MT4/MT5: It is important to note that Mitrade does not support the MetaTrader 4 or 5 platforms.

Unique Features

Mitrade's primary unique feature is its proprietary trading platform. It was designed from the ground up to be intuitive and accessible, removing the steep learning curve associated with more complex platforms and making it ideal for new and intermediate traders.

Research & Education

Mitrade provides basic research tools integrated into its platform, including an economic calendar, market news feeds, and sentiment analysis. However, it does offer good explanations via the ‘learn tab’ with examples of key trading fundamentals, such as the use of leverage and its impact on trading as well as detailed information on costs of trading -spread and overnight swaps. Whilst this is not a comprehensive training course, it does offer traders unfamiliar with these concepts a good overview and highlights the risks of trading too.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 support |

Website Languages |     |

Mitrade offers 24/5 customer support through the following channels:

- Live chat

Support is available in multiple languages: English, Chinese (Simplified and Traditional), Vietnamese, Thai, Korean, and Spanish, ensuring global accessibility.

Bonuses and Promotions

In compliance with its regulatory obligations under ASIC, Mitrade does not offer bonuses or promotions to incentivize trading.

Opening an Account

The account opening process at Mitrade is fully digital, fast, and user-friendly.

What should traders know about the Mitrade account opening process?

- Mitrade adheres to global AML/KYC standards.

- Account verification is mandatory and requires a government-issued ID and a proof of residency document.

- The entire process can often be completed in under 10 minutes.

Minimum Deposit

The minimum deposit at Mitrade is low, starting from $50, though this can vary slightly depending on the region and chosen payment method.

Payment Methods

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 support |

Website Languages |     |

Mitrade supports a range of modern and traditional payment methods, including the list below;

- Bank Wires (Local and International)

- Credit/Debit Cards (Visa, Mastercard)

- E-Wallets (Skrill, Neteller, Perfect Money, Sticpay)

- QR Code payments

- POLi

Accepted Countries

Mitrade accepts clients from many countries around the world. However, notably Mitrade does not provide services to residents of the United States, Canada, Japan, or certain other jurisdictions.

Deposits and Withdrawals

The client portal manages all financial transactions securely and efficiently.

What are the key takeaways from the deposit and withdrawal process at Mitrade?

- Mitrade does not charge any fees for deposits or withdrawals.

- Deposits are typically instant; the website states an average time of 3 minutes.

- Withdrawals are processed quickly, usually within 1-3 business days.

- Withdrawals must be made back to the original funding source.

Is Mitrade a Good Broker?

Yes, Mitrade is a very good broker, particularly for beginners or those who value simplicity and ease of use. Its strong ASIC regulation provides a high level of trust, and the proprietary platform is exceptionally user-friendly. While advanced traders might miss the customizability of MT5 and features like copy trading, Mitrade's zero-commission model and secure environment make it an excellent choice for self-directed traders.