Markets.com Editor’s Verdict

Markets.com caters to both beginner and advanced traders. It presents its proprietary trading platform alongside MT4/MT5, a competitive commission-free pricing environment, and excellent order execution statistics. It offers a well-regulated trading environment, with the broker owned by the UK publicly listed company Playtech PLC, a constituent of the FTSE 250. Is Markets.com the right broker for you?

Overview

Markets.com - A well-regulated broker with competitive trading tools

United States ASIC, BVIFSC, CySEC, FCA, FSCA 2008 Market Maker $100 Proprietary platform 0.7 pips 1.1 pips $0.05 $0.30 $51.50 79.90% Not applicable 0.6 pips Commission-free 8+(bank wires, credit/debit cards, Skrill, Neteller, PayPal, iDEAL, and Sofort)

The proprietary Markets.com trading platform is ideal for manual traders, but I like that MT4/MT5 are equally available for algorithmic and copy traders.

Key Takeaways:

- Excellent range of asset selection with more than 2,200 CFDs.

- Competitive commission-free CFD pricing environment and high leverage.

- High-quality trading tools.

- The retail loss rate for CFD traders is 80%, ranking among the best in the industry.

Markets.com Main Features

Retail Loss Rate | 80% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $100 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | Yes |

Inactivity Fee | $10 monthly after 90 days |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 8+ |

Markets.com Regulation and Security

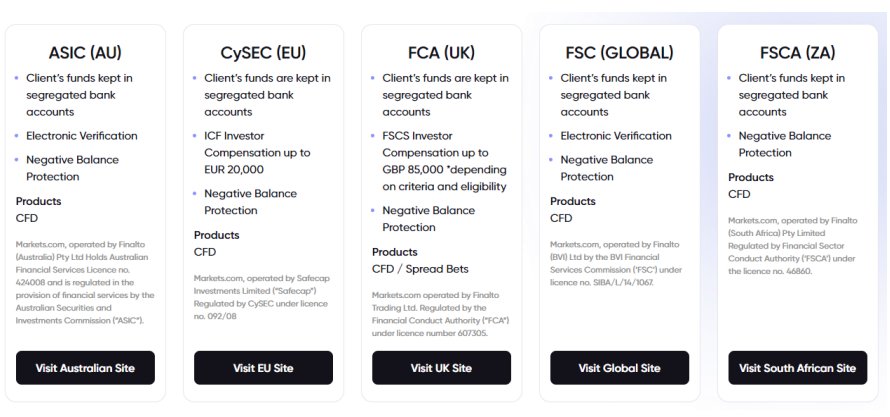

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Markets.com presents clients with five regulated entities, including more than one top-tier regulatory regime.

Country of the Regulator | Australia, Cyprus, United Kingdom, British Virgin Islands, South Africa |

|---|---|

Name of the Regulator | ASIC, BVIFSC, CySEC, FCA, FSCA |

Regulatory License Number | 607305, 092/08, 424008, SIBA/L/14/1067, 46860 |

Noteworthy:

- The Cyprus subsidiary offers an investor compensation fund up to 90% or €20,000 of deposits.

- UK-based traders get a compensation fund up to £85,000 through the FSCS.

- A $1,000,000 insurance coverage exists for all traders at Markets.com,as well as negative balance protection.

- Markets.com is owned by a publicly listed company in the UK and as such is legally required to adhere to strict capital requirements and financial auditing.

Markets.com is one of the most secure and highly regulated brokers in the industry. Spread betting is available through the UK subsidiary, while investors are best serviced from the Cyprus unit.

Markets.com Fees

Average Trading Cost EUR/USD | 0.7 pips |

|---|---|

Average Trading Cost GBP/USD | 1.1 pips |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $51.50 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

Markets.com offers one cost structures:

- Commission-free Forex trading costs start at 0.6 pips or $6.00 per 1 standard lot.

Noteworthy:

- Markets.com implements lower trading costs for CFD trading in its proprietary Markets.com trading platform than it does through its MT4/MT5 trading platforms.

- UK-based traders may be able to minimize tax liability on profits by using spread betting and should favor it over CFD trading.

Here is a screenshot of the Markets.com live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

What is missing at Markets.com?

The average trading costs for the EUR/USD in the commission-free Markets.com account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

Noteworthy:

- It ranks on par with commission-based pricing environments at ECN brokers where traders get raw spreads from 0 pips for a commission of $6.00, not considering volume rebates which usually apply.

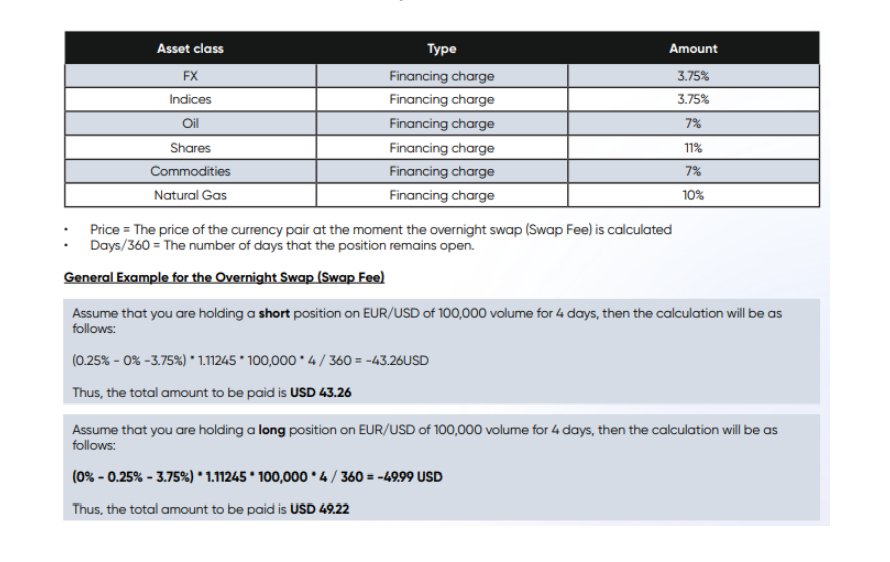

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Markets.com adds different financing charges based on asset class, where Forex and indices remain the cheapest at 3.75% and share CFDs the most expensive at 11.00%.

- Overnight financing costs are transparent but relatively high at Markets.com.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free Markets.com account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$12.3638 | X | $17.444 |

0.6 pips | $0.00 | X | -$10.9687 | $8.770 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$86.5760 | X | $92.5760 |

0.6 pips | $0.00 | X | -$76.7809 | $82.7809 |

My additional comments concerning trading costs at Markets.com:

- Inactivity fee of $10 monthly after 90 days

- Currency conversion fee of 0.60%

What Can I Trade on Markets.com

Markets.com presents traders with an excellent choice of trading instruments. Traders are offered a choice of more than 2,200 CFDs for a well-balanced and diverse asset list spanning nine classes. With 27 cryptocurrency CFDs, Markets.com ranks among the brokers with a more in-depth choice for this maturing asset. I also like the in-house constructed themed portfolios labeled blends.

The broker also offers an extensive set of share CFDs, global indices and more. To support its large offering, Markets.com also provides trading tools so that traders can assess the financial products from different scopes using fundamental, technical as well as sentimental analysis tools.

The overall asset selection depends on the Markets.com entity and trading platform used. Please note that UK-based retail traders cannot trade Cryptocurrency CFDs due to regulatory restrictions.

Additionally, Spread Betting is only available for clients residing in the UK (FCA-regulated).

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Markets.com Leverage

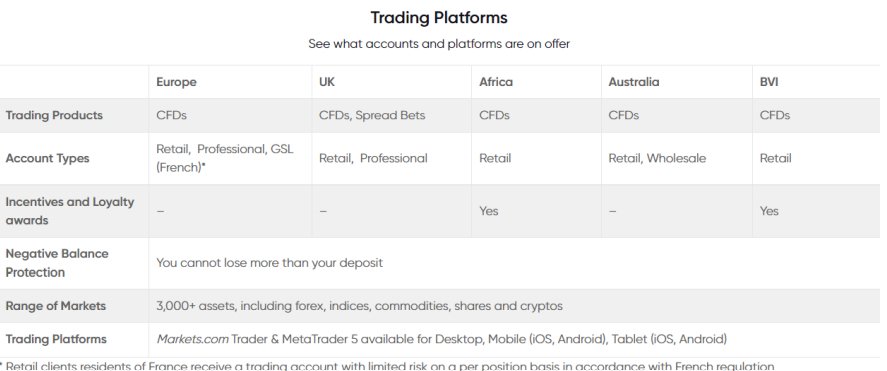

Forex traders operating through the British Virgin Islands as well as the South African subsidiaries get maximum leverage of 1:300. I recommend it for active traders as it presents more overall trading flexibility, which directly impacts profitability.

Other things I want to note about Markets.com leverage:

- The maximum leverage available depends on the sector and individual asset traded.

- Negative balance protection exists, ensuring traders can never lose more than their deposit.

- All other subsidiaries except the BVI and the South African, limit maximum Forex leverage to 1:30 due to regulatory restrictions.

Markets.com Trading Hours (GMT-2 Server Time)

Asset Class | From | To |

|---|---|---|

Commodities | Sunday 22:00 | Friday 20:59 |

Crude Oil | Sunday 22:00 | Friday 20:59 |

Gold | Sunday 22:00 | Friday 20:59 |

Metals | Sunday 22:00 | Friday 20:59 |

Equity Indices | Sunday 22:00 | Friday 20:59 |

Stocks | Monday 13:31 | Friday 19:59 |

Bonds | Sunday 22:01 | Friday 20:59 |

ETFs | Monday 13:31 | Friday 19:59 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following steps for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Markets.com Account Types

Markets.com offers one main account type : the Standard account. All subsidiaries have a professional account option, nevertheless, clients will need to meet certain criteria to be eligible for this account type. that can be found under ‘Professional Trading’ on the Markets.com website.

Traders must decide between the following:

- Are they interested in short-term trading?

- Do they prefer a long-term approach?

My observations concerning the Markets.com account types:

- Traders requiring the MT4/MT5 infrastructure must accept higher trading costs outside of Forex, creating natural bias in favor of the proprietary trading platform and manual trading.

- UK-based traders should opt for the tax-free spread betting account.

- MAM/PAMM accounts for traditional retail account management are not available.

- Markets.com offers corporate and Islamic accounts.

- Scalping is allowed.

- Markets.com allows traders to place buy-stop or sell-stop orders within one hour before the release of financial data related to an asset.

- Traders cannot use an Expert Advisor or auto trading to identify instances of off-market pricing.

- Markets.com allows arbitrage trading on prices offered across its trading platforms, possibly confirming different pricing environments based on trading platforms.

My recommendation:

- CFD traders get the best trading conditions in the Markets.com account through the British Virgin Islands branch.

Markets.com Demo Account

Markets.com offers unlimited demo accounts,each equipped with $10,000 in virtual funds which I find best for testing EAs or different trading strategies. I want to caution that demo trading may promote wrong trading behaviour for beginner traders, especially if the account balance is excessive. It can also create unrealistic trading expectations.

My recommendation:

- MT4/MT5 offers you the choice to select the nominal starting balance of the demo account, and traders should select a balance amount close to what they plan to deposit into a live account for the sake of authenticity.

Markets.com Trading Platforms

Traders get the proprietary Markets.com trading platform, which is available as a web-based trading platform, as well as a mobile app for Android and iOS devices.

Both come equipped with quality trading tools consisting of:

- Bloggers Opinions

- Hedge Funds Investment Confidence

- Insider Trades

- Trading Analyst Recommendations

- Trends In Trading

- Signals

- Related Instruments

- Advanced Charting

- Financial Commentary

- Advanced Alerts

- Thomson Reuters Stock Report

I like that Markets.com also offers the MT4/MT5 trading platforms which are useful for algorithmic and copy trading. They are available as a desktop client, a web-based alternative, and a mobile app.

What is missing?

- MT4/MT5 add-ons are available.

- VPS hosting is not available.

My observations:

- Traders who rely on EAs must use the MT4/MT5 desktop client.

- MT4/MT5 support algorithmic and copy trading.

- Manual traders will benefit from the proprietary trading platform.

- Available assets and trading costs vary between trading platforms, favoring proprietary ones over MT4/MT5.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Markets.com Unique Features

Markets.com offers a CFD Trading Calculator that enables traders to calculate their hypothetical Profit & Loss on any asset class/instrument had they opened a trade at a specific moment. Additionally, Markets.com offers an extensive set of trading tools including Fundamental, Technical and Sentimental analysis mechanisms to help traders while conducting their research.

I also want to note the positive execution statistics at Markets.com, with 79% of orders experiencing zero or positive slippage for 2020. It is down from 86% reported for 2019 and dipped to 69% for 2021 year-to-date, but Markets.com remains transparent about its order execution statistics. Fortunately for very short-term traders, Markets.com allows scalping.

Research and Education

Besides the quality trading tools, Markets.com publishes market commentary analytics on its Insights Trading Blog and under Expert Opinions. The daily written content covers a wide range of financial topics in a well-presented format.

XRay, the personalized financial live-stream service of Markets.com, presents beginner traders with the best value. Free webinars are also available, but the overall educational value remains sub-standard.

I advise traders to seek additional information from trusted third parties free of charge for a more comprehensive overall educational approach. Given the availability of quality education elsewhere, traders should not consider the absence of a quality learning portal as a negative.

Key points:

- Markets.com maintains quality trading tools with educational value.

- The in-house research presents valuable insights.

- XRay is a well-presented service.

My recommendations:

- MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style.

- Traders can also access numerous free research available online.

- Before trading at Markets.com, beginner traders should seek quality education elsewhere.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |          |

Multilingual Customer support is available 24/5, and the FAQ section answers the most common questions.

Since Markets.com explains its products and services well and usually ensures flawless operations, almost all traders will probably not require customer support.

Markets.com also features a Fraud Watch to inform and alert traders of fake websites and spoof e-mails. Traders also get a dedicated complaints section.

My recommendations:

- Traders should read the FAQ section before reaching out to a customer service representative.

- For non-urgent questions, I recommend live chat.

- Markets.com provides phone support, ideal for urgent issues.

Bonuses and Promotions

Incentives and loyalty rewards are offered to clients that trade through the South African and BVI entities.

Markets.com Opening an Account

I like the swift account opening process at Markets.com, which typically takes less than 10 seconds. Traders must only provide their e-mail and their desired password. Account verification is mandatory, and most traders will complete it after sending a copy of their ID and one proof of residency document.

Markets.com Minimum Deposit

The minimum deposit at Markets.com is $100 or the currency equivalent.

Markets.com accepts deposits in the US Dollar, the Euro, the British Pound, and the South African Rand.

It is essential to understand that the earnings potential of a portfolio depends on its balance.

Traders considering the products and services this broker provides should positively evaluate the fourteen trading tools, which are well worth the reasonable minimum deposit requirement of $100. Many brokers ask for minimum deposits even higher than $100 but fail to deliver a competitive trading environment, placing Markets.com in a superior competitive position. With the excellent product and services portfolio, including the cost structure, traders can earn more per transaction, justifying the $100 minimum deposit.

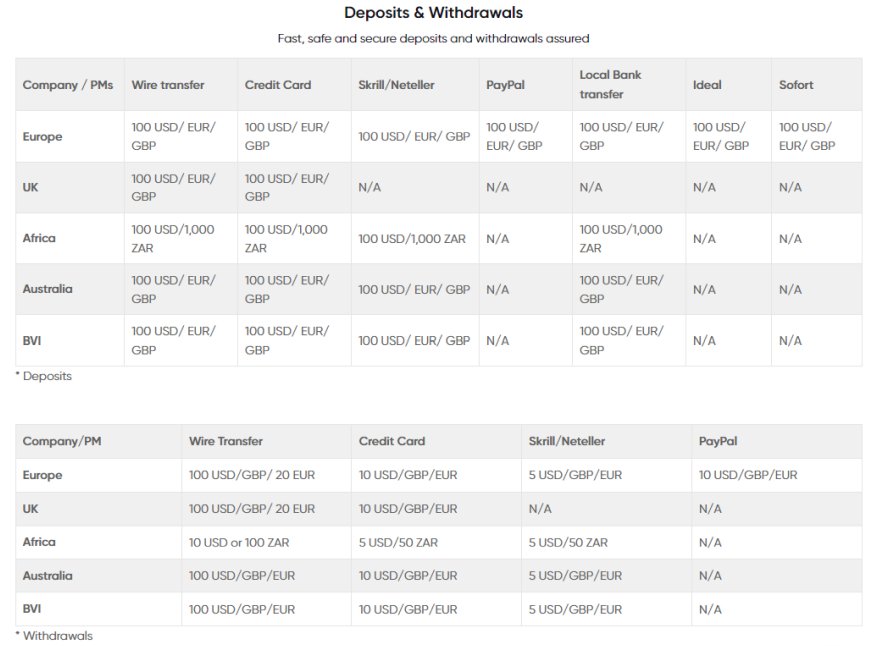

Payment Methods

Markets.com offers bank wires, credit/debit cards, Skrill, Neteller, PayPal, iDEAL, and Sofort.

Withdrawal options |      |

|---|---|

Deposit options |       |

Markets.com Accepted Countries

Markets.com caters to most international traders and does not list country restrictions on its website. However, like almost all Forex brokers outside the USA, US-based clients cannot open trading accounts.

Markets.com Deposits and Withdrawals

All financial transactions take place in the secure back office of Markets.com. I would prefer a greater variety of deposit and withdrawal methods, ensuring traders have a choice to handle their finances effectively.

My observations:

- Markets.com does not levy internal deposits or withdrawals cost, but third-party processing fees may apply.

- A 0.60% currency conversion fee applies.

- The minimum deposit is $100, but the minimum withdrawal amount ranges between $5 and $100, depending on the payment processor.

- Withdrawal times depend on the payment processor, ranging from 24 hours to seven business days.

- The geographic location and regulatory environment will dictate the available deposit and withdrawal methods.

My recommendations:

- Traders should ideally select the payment processor with the lowest fees.

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

Markets.com Withdrawal Review

The minimum withdrawal depends on the payment processor but mostly comes in at $10 or the currency equivalent.

While Markets.com does not levy internal withdrawal fees, third-party charges apply. Bank wires remain the most expensive method, and traders should use an alternate method if possible, except within the European Union, where they are considerably cheaper at only €20. Currency conversion costs are also incurred when the account base currency differ from that of the payment processor. Traders should carefully consider in which currency they wish their Markets.com account.

Despite the low minimum withdrawal amounts for most payment options, traders should refrain from micro-transactions. A withdrawal schedule can assist with it.

Each deduction impacts the margin environment, and appropriate adjustments must follow. It is best to limit withdrawals to just one or two per year, and after the portfolio supports the desired revenue generation. It remains easier to withdraw $100 than to add the necessary capital to boost earnings by $100, a fact most retail traders ignore.

Processing times remain efficient at Markets.com. The fastest method remains e-Wallets like Skrill, Neteller, and PayPal, where the processing time is instant and up to 24 hours. Credit and debit cards may take two to seven business days, while bank wires take two and five business days. Per anti-money laundering (AML) regulations, the name on the Markets.com account and the payment processor must be identical. Markets.com may require additional information before processing a withdrawal request. Should clients not receive their funds within the specified period, the Markets.com support team can assist, available 24/5. The overall withdrawal process remains in line with well-established industry standards.

Bottom Line

I like the trading environment at Markets.com for CFD traders. The asset selection is well-balanced, and the commission-free cost structure remains competitive for day traders, while swap rates on leveraged overnight positions are relatively expensive for longer-term traders. Markets.com has implemented straight-through processing (STP) execution. The quality trading tools add appeal to this well-regulated and trusted broker. Markets.com presents a great asset selection complemented by a safe and secure trading environment. Two proprietary trading platforms, alongside the MT4/MT5, and an excellent selection of trading tools and quality research capabilities validate a top quartile of the industry placement. Full compliance with five global regulators in conjunction with a transparent business model makes it a legit broker. Besides MT4 and MT5, CFD trading is available via Markets.com. A minimum deposit of $100 or a currency equivalent is required. A genuine educational division provides a basic introduction, while 60-minute webinars offer tremendous value to new traders. The in-house research provides fresh trading ideas, and the overall product and service choice makes it a suitable broker for new traders and seasoned professionals alike. After signing up for a trading account with Markets.com, traders may select their trading platform in the secure back office.FAQs

Is Markets.com a good broker?

Is Markets.com legit?

How do you trade on Markets.com?

What is the minimum deposit at Markets.com?

Is Markets.com suitable for new traders?

How to open an MT4 account on Markets.com?