Editor’s Verdict

KOT4X is a relatively new broker offering the MT4 platform and its proprietary TradeLocker trading platform in beta version only currently, including charts by TradingView. Unlike most brokers, KOT4X only accepts cryptocurrencies as deposits and withdrawals, with Bitcoin as the preferred digital option. It also maintains a proprietary trading division, offering funded accounts to traders who pass the evaluation process. I conducted an in-depth review of this broker to evaluate its trading environment. Should you trust KOT4X?.

Overview

A multi-asset broker that only accepts cryptocurrencies as deposits and withdrawals.

I like that KOT4X accepts cryptocurrencies as deposit and withdrawal currencies, but the absence of bank wires raises potential red flags, even if I recommend using something other than bank wires. The proprietary trading division is a nice touch in a resurging sub-sector, and the low minimum deposit requirement ensures traders can grow their portfolios at their own pace.

Regulators | Unregulated |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2019 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $10 - $50 (payment processor dependent) |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | $9.00 |

Average Trading Cost GBP/USD | $8.00 |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.13 |

Average Trading Cost Bitcoin | $55.00 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.4 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Funding Methods | 8 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

KOT4X Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation status and verify it with the regulator by checking the provided license with their database. KOT4X is an unregulated but duly registered broker.

Is KOT4X Legit and Safe?

KOT4X, founded in 2019, lacks operational longevity and operates as an unregulated but duly registered company from St. Vincent and the Grenadines, registration number 118889. It lists its headquarters as Jamaica.

As I conducted this review, I found many negative online customer experiences, especially since the summer of 2022. Some are fake negative reviews, but others describe their bad experiences with the proprietary trading division. Many traders claim they have passed the challenge, but KOT4X denied a funded account, and KOT4X kept the evaluation fee.

I cannot ignore the negative reviews, and the absence of bank wires as a deposit and withdrawal method raises additional red flags. Therefore, I cannot recommend KOT4X and advise caution if you are considering this broker as a counterparty.

Country of the Regulator | Jamaica |

|---|---|

Name of the Regulator | Unregulated |

Regulatory License Number | Unregulated |

Regulatory Tier | Unregulated |

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. KOT4X offers four pricing options, and they are all expensive. The lowest minimum Forex trading fees consist of spreads from 0.4 pips for a commission of $7.00 per 1.0 standard round lot or $11.00, available in its Pro account. Swap rates on leveraged overnight positions are higher than most competitors, and KOT4X does not apply positive swap rates, a sign of extensive mark-ups over actual market rates.

The minimum trading costs for the EUR/USD at KOT4X are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.8 pips (Standard) | $7.00 | $15.00 |

0.4 pips (Pro) | $7.00 | $11.00 |

1.2 pips (Var) | $0.00 | $12.00 |

1.0 pips (Mini) | $1.00 | $11.00 |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading swap fee calculation examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Pro account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.4 pips | $7.00 | -$5.59 | X | $16.59 |

0.4 pips | $7.00 | X | -$0.82 | $11.82 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.4 pips | $7.00 | -$39.13 | X | $50.13 |

0.4 pips | $7.00 | X | -$5.74 | $16.74 |

Noteworthy:

- KOT4X does not pass on positive swap rates on qualifying instruments but levies excessive mark-ups, actively discouraging holding positions past the trading day's close.

Here is a snapshot of KOT4X trading fees:

Average Trading Cost EUR/USD | $9.00 |

|---|---|

Average Trading Cost GBP/USD | $8.00 |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.13 |

Average Trading Cost Bitcoin | $55.00 |

Minimum Raw Spreads | 0.4 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $10 monthly after 90 days |

Range of Assets

KOT4X offers 57 currency pairs, 23 cryptocurrencies, eight commodities, 13 indices, and 38 equity CFDs. The choice for Forex traders is average and sufficient for most strategies, and the cryptocurrency CFD offering ranks above average. I like the commodity and index CFDs selection, which are expected, but the absence of tradable ETFs is notable, especially considering the core trader base of KOT4X.

KOT4X Leverage

KOT4X offers maximum Forex leverage of 1:500, indices and commodities max out at 1:200, cryptocurrencies at 1:100, and equity CFDs at 1:20. It places KOT4X among the cryptocurrency CFD brokers offering the most leverage to clients. I want to caution traders, as KOT4X does not provide negative balance protection, meaning traders can lose more than their deposits. It explains why KOT4X passively discourages short selling.

Traders must always use appropriate risk management to avoid magnified trading losses with any leveraged trading activity.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

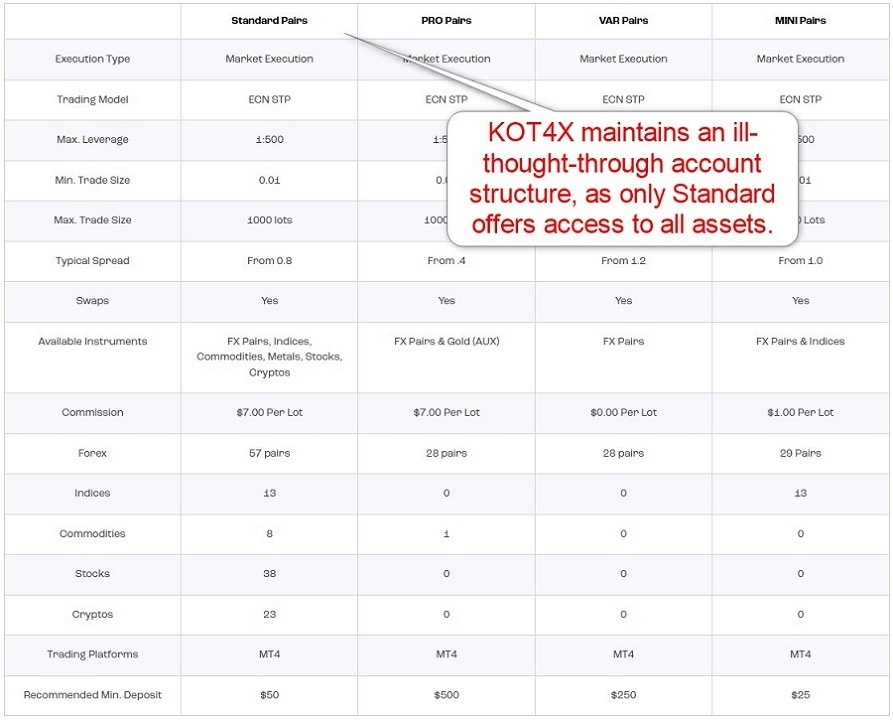

Account Types

KOT4X has four account types, which differ by the composition of trading fees and available trading instruments. I wouldn't say I like the unnecessary complexity, and KOT4X fails to offer something materially different across account types. Trading fees are expensive across all account types, and only the Standard option grants access to all assets. The other three are Forex trading accounts with only 28 currency pairs. Therefore, I consider them obsolete and rate the account structure at KOT4X as an ill-thought-through concept. The minimum deposit is between $10 and $50, depending on the payment processor. KOT4X notes recommended minimum deposits, which are not official minimums. Overall, I am not impressed with the setup the broker currently has in place.

KOT4X Demo Account

KOT4X offers customizable demo accounts for MT4 and its proprietary TradeLocker trading platform. I did not find an expiration time on the KOT4X demo accounts, and I recommend traders use settings similar to their preferred live portfolios for a more realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations of testing. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

KOT4X offers the out-of-the-box MT4 trading platform, the industry leader in algorithmic trading, available as a customizable desktop client and a user-friendly mobile app. The lightweight web-based alternative is also unavailable. KOT4X fails to provide additional MT4 plugins or upgrades, but traders can source them independently, including 25,000+ custom indicators, plugins, and EAs. Please note that quality upgrades are not free. Traders can also sign up for the beta phase of the proprietary TradeLocker trading platform. KOT4X promises similar functionality to MT4 with an upgraded user interface and more advanced charting tools. It connects to the TradingView community and allows clients to connect their KOT4X account to trade directly from TradingView charts.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform |

Unique Features

KOT4X offers PAMM accounts, supporting traditional account management services. It also features a prop trading division, advertising $50,000, $100,000, and $200,000 funded trading accounts. While the profit share is 80:20, the evaluation fee is high comparatively at $350, $650, and $1,000, respectively. It is also the source of dozens of negative reviews, as it appears that KOT4X has been reluctant to deny a funded account after passing an evaluation and seemingly retained the fee.

Research & Education

KOT4X neither provides in-house research nor third-party alternatives. Since it offers PAMM accounts and a prop trading division, offering research falls outside its business model but creates a services gap versus well-established brokers. Given the abundance of free and paid-for research, I do not consider its absence a negative against KOT4X.

KOT4X does not offer any educational content, as beginners are not its core market, and for similar reasons, it does not provide research.

Therefore, I advise beginners to learn how to trade elsewhere via free online educational resources and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

KOT4X offers 24/7 customer support via e-mail, phone, a callback function, live chat, and a web form, but no direct line communication to the finance department, where most issues can arise. I recommend traders consult the FAQ section before contacting customer support, as it answers many questions.

Support Hours | 24/7 |

|---|---|

Website Languages |  |

Bonuses and Promotions

Traders can request a 20% bonus up to $5,000. Traders can withdraw bonus funds by trading 1.0 standard lots per $5 bonus, making it a generous offer. KOT4X also has an affiliate program, paying affiliates between $2.00 and $3.00 per lot, dependent on monthly trading volume.

Terms and conditions apply, and I recommend traders to read and understand them before requesting any bonus or promotion.

Account verification is mandatory at KOT4X, in compliance with global AML/KYC requirements. Uploading a copy of their government-issued ID and one proof of residency document will satisfy account verification for most traders. KOT4X may ask for additional information on a case-by-case basis.

Minimum Deposit

The KOT4X minimum deposit is between $10 and $25, depending on the cryptocurrency and payment processor.

Payment Methods

KOT4X only accepts cryptocurrencies.

Accepted Countries

KOT4X accepts traders from most countries except the US. It also states: “This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.”

Deposits and Withdrawals

The secure KOT4X back office handles all financial transactions for verified clients.

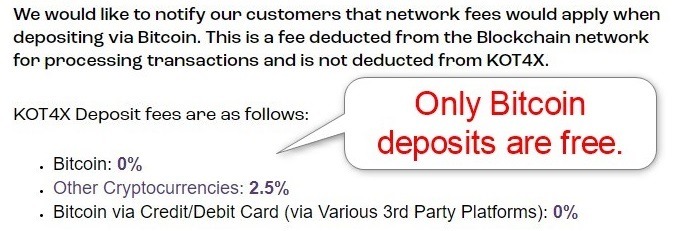

KOT4X does not apply internal deposit fees on Bitcoin deposits, but a 2.00% fee applies on other cryptocurrency transactions. There is no withdrawal fee at KOT4X. Processing times depend on the blockchain and the gas fees traders must pay depending on the chain used. While I do not recommend using bank wires, the absence of traditional banking raises a red flag, as every legitimate business should have fiat bank accounts. I am missing e-wallets, but I appreciate the choice of cryptocurrencies KOT4X accepts.

Is KOT4X a good broker?

I like the KOT4X trading environment for its acceptance of cryptocurrencies as deposit and withdrawal methods, PAMM accounts, and the pending launch of its proprietary TradeLocker trading platform (currently available in beta). Regrettably, the prop trading division appears to operate a scam for evaluation fees, and it is the source of the most negative reviews about KOT4X. The absence of bank wires raises another red flag. KOT4X is an unregulated broker registered as an international business company in St. Vincent and the Grenadines but lists its primary business address in Jamaica. I cannot recommend KOT4X and urge anyone considering this broker to proceed cautiously, as several red flags exist. There is no internal withdrawal fee at KOT4X, but traders must consider blockchain gas fees. KOT4X offers Forex, cryptocurrencies, commodities, indices, and equity CFDs. The maximum KOT4X leverage is 1:500. KOT4X shows several red flags and has had dozens of negative reviews since 2022 concerning its prop trading division. Therefore, traders should not trust KOT4X.FAQs

Is there a withdrawal fee for KOT4X?

What can you trade on KOT4X?

What is the maximum leverage at KOT4X?

Can KOT4X be trusted?