Editor’s Verdict

JustMarkets, formerly JustForex, rebranded to reflect its ongoing expansion, which now includes an in-house developed copy trading service. Traders get the core MT4/MT5 trading platforms, deep liquidity, fast order execution, and modern payment processors, including cryptocurrencies. I conducted a thorough JustMarkets review to determine if its deep liquidity results in tight spreads and low trading costs. Should you trade with JustMarkets?

Overview

Low trading costs within a trusted trading environment

Review

Headquarters | Seychelles |

|---|---|

Regulators | CySEC, FSA, FSC Mauritius, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2012 |

Execution Type(s) | Market Maker |

Minimum Deposit | 1$ |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 0.0 pips |

Average Trading Cost GBP/USD | 0.0 pips |

Average Trading Cost Gold | $0.07 |

Average Trading Cost Bitcoin | $0.36 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.3 pips |

Minimum Commission for Forex | $6.00 per round lot |

Funding Methods | 29 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the deep liquidity, tight spreads, and fast order execution at JustMarkets, making it ideal for algorithmic traders and scalpers. It is also one of the most accessible multi-asset brokers with a minimum deposit of $1. JustMarkets provides modern payment processors, including cryptocurrencies and localized methods, for its core markets in Asia and Africa.

JustMarkets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. JustMarkets presents clients with four regulated entities and maintains a secure trading environment.

Country of the Regulator | Cyprus, Mauritius, Seychelles, South Africa |

|---|---|

Name of the Regulator | CySEC, FSA, FSC Mauritius, FSCA |

Regulatory License Number | SD088, 401/12, GB22200881, 51114 |

Is JustMarkets Legit and Safe?

JustMarkets, founded in 2012, complies with four well-known regulators, where it maintains a clean track record. It maintains a third subsidiary in Vanuatu, unregulated but duly registered with the Vanuatu Financial Services Commission, company registration number 700565.

EEA-based traders will deal with the CySEC-regulated entity. It complies with the Financial Instruments Directive 2014/65/EU or MiFID II and the EU 5th Anti-Money Laundering Directive, while the EU Directive 2014/49/EU mandates an investor compensation fund protecting 90% of client deposits up to a limit of €20,000.

Traders get negative balance protection and segregation of client deposits from corporate funds. JustMarkets also offers data transfer protection using SSL security connections, internal company procedures based on the PCI DSS security standard, a multilevel system of servers for uninterrupted infrastructure functionality, and data storage protection.

Given its operational track record, JustMarkets established itself as a legit and safe broker that continuously seeks to improve its trading environment.

Fees

Average Trading Cost EUR/USD | 0.0 pips |

|---|---|

Average Trading Cost GBP/USD | 0.0 pips |

Average Trading Cost Gold | $0.07 |

Average Trading Cost Bitcoin | $0.36 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.3 pips |

Minimum Commission for Forex | $6.00 per round lot |

Deposit Fee | |

Withdrawal Fee |

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. JustMarkets offers a competitive pricing environment in a mostly commission-free trading environment. It advertises raw spreads from 0.0 pips for a commission of $6.00 per 1.0 standard round lot. The commission-free trading accounts with minimum costs of 0.6 pips or $6.00 result in lower trading fees, which is unusual. Overall, competitiveness depends on the asset, where traders can get competitive to average costs.

JustMarkets also maintains lower than-average swap rates, adding an advantage to traders who keep leveraged positions overnight.

Here is a screenshot of JustMarkets fees during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD at JustMarkets are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.6 pips (Standard, Pro) | $0.00 | $6.00 |

0.6 pips (Raw Spread) | $6.00 | $12.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Pro account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread in the commission-free Pro account and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.6 pips | $0.00 | -$4.44 | X | $10.44 |

0.6 pips | $0.00 | X | $-0.09 | $6.09 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread in the commission-free Pro account and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.6 pips | $0.00 | -$31.08 | X | $37.08 |

0.6 pips | $0.00 | X | -$0.63 | $6.63 |

Range of Assets

The asset selection depends on the account type but consists of a maximum of 260+, where the 65 currency pairs ensure Forex traders have an above-average choice, complemented by 14 cryptocurrency pairs. With 11 indices and 11 commodities, traders get an introduction to both sectors, while the 165 equity CFDs focus on liquid blue-chip names. The overall choice of trading instruments at JustMarkets is ideal for Forex traders and cross-asset strategies that require fewer but liquid assets.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

JustMarkets Leverage

The maximum Forex leverage at JustMarkets is 1:3000, but most traders will use far less. It ensures traders have flexibility, but irrelevant to the amount of leverage, traders must use strict risk management protocols, which keep the risk identical to all leverage settings. For example, a 4% loss on a $3,000 portfolio is $120 with leverage of 1:1 or 1:3000. Negative balance protection ensures traders cannot lose more than their deposits.

JustMarkets Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Commodities | Monday 01:00 | Friday 23:59 |

Crude Oil | Monday 01:00 | Friday 23:59 |

Gold | Monday 01:00 | Friday 23:59 |

Metals | Monday 01:00 | Friday 23:59 |

Equity Indices | Monday 10:00 | Friday 22:59 |

Stocks | Monday 10:00 | Friday 22:59 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

JustMarkets provides traders with four MT4 and three MT5 account types. The Standard, Pro, and Raw Spread options offer identical trading conditions on their respective platforms. Traders get a Standard Cent alternative on MT4, ideal for beginners learning how to trade. The minimum deposits are $1 for Standard and Standard Cent and $100 for Pro and Raw Spread accounts.

JustMarkets supports 11 account base currencies, 27 payment options, and swap-free Islamic accounts. Margin call and stop-out levels for all account types are 40% and 20%, respectively.

JustMarkets Demo Account

Traders get unlimited and fully customizable demo accounts at JustMarkets. It makes them ideal for beginners to familiarize themselves with trading platforms and tools, seasoned traders to modify strategies, copy traders to evaluate signal providers, and algorithmic traders to bug-fix and test trading solutions. Traders must only provide their country of residence, e-mail, and desired password to open a demo account. The secure back-office handles demo account additions, and there is no limit to how many a trader can open.

I recommend traders use similar deposit balances and leverage settings as what they intend for their planned live account. I want to caution beginner traders when using demo trading as a simulation tool, and they should consider the limitations of paper trading. Demo trading does not grant exposure to trading psychology and can create unrealistic expectations.

Trading Platforms

JustMarkets offers the out-of-the-box MT4 and MT5 trading platforms. They are available as a desktop client, lightweight web trader, and mobile app, but JustMarkets does not list the web trader for MT5 under its product listing. Both trading platforms fully support algorithmic trading and have embedded copy trading services. MT4 remains the gold standard for online trading, especially for Forex traders, due to its versatile infrastructure, as evident by the existing 25,000+ EAs and customizations.

While JustMarkets does not list the MT4 API, which allows advanced algorithmic traders to connect their solutions, it is available as an open-source solution, enhancing the potential of MT4.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

JustMarkets developed a proprietary copy trading service, which complements the embedded MT4/MT5 solutions. It includes an investment protection mechanism.

It also notes VPS hosting, ideal for algorithmic traders requiring low-latency 24/5 market access or traders with spotty internet connections but does not offer it.

The MT4 MAM module is available, catering to asset managers, which requires a $5,000 minimum deposit plus two investors with at least $5,000 in total capital commitments. I view the $5,000 requirement by the account manager as smart, as it aligns the manager with clients, ensuring that the accounts remain under the best possible management driven by sustainable profitability.

Research & Education

JustMarkets publishes daily market news, a market overview, and a daily Forex market forecast, which includes actionable trading signals. The three reports are well-written and presented, especially the daily Forex market forecast which is a hidden gem. Traders may always source research from third parties or rely on available services within the MT4/MT5 trading community.

Beginner traders can benefit from quality educational content consisting of articles, videos, webinars, and a glossary. JustMarkets presents its quality content in an easy-to-understand format, providing an excellent introduction to trading. JustMarkets makes past webinars available on its YouTube channel, which shows its commitment to education, even for non-clients.

I recommend traders begin learning the material available at JustMarkets before seeking more in-depth content for specific topics, including trading psychology, from trusted sources online, available for free. Beginners should be extremely sceptical of paid-for courses.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |            |

JustMarkets provides customer support 24/7 in English, Malaysian, and Indonesian. I recommend traders read the FAQ section before reaching out to support, as it may answer some questions. JustMarkets describes its products and services well, making additional support less frequent. Live chat is ideal for non-urgent matters, while phone support is best for pressing issues, and I also like that JustMarkets has a dedicated contact e-mail for the finance department, where most questions and problems occur.

Bonuses and Promotions

EEA-based traders do not qualify for bonuses and incentives.

JustMarkets has a $30 Welcome Bonus, a non-deposit bonus where traders can withdraw their profits. It is an ideal incentive for beginners to learn how to trade risk-free.

An unlimited deposit bonus between 50% and 120% exists, and traders can withdraw the bonus amount once they reach the necessary transaction volume. It represents an outstanding offer for high-volume traders and those building long-term portfolios. The bonus is unique as many brokers allow them only as a non-withdrawable capital trading injection without the ability to withdraw it.

A refer-a-friend program pays the referrer $50 per friend, while the referee receives a 150% deposit bonus. A high-paying affiliate program complements the passive income opportunities at JustMarkets.

Opening an Account

Registering for a JustMarkets account takes less than 15 seconds and requires the provision of country of residence, e-mail address, and desired password. EEA-based traders must complete further questionnaires, making it a regulatory-mandated nuisance which has nothing to do with JustMarkets. Non-EEA-based clients get a hassle-free onboarding process.

JustMarkets is a regulated and fully compliant broker. Therefore, account verification is mandatory. Most traders will pass it after sending a copy of their ID and one proof of residency document. JustMarkets might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at JustMarkets is $1 for the Standard Cent and Standard accounts and $100 for the Pro and Raw Spread options.

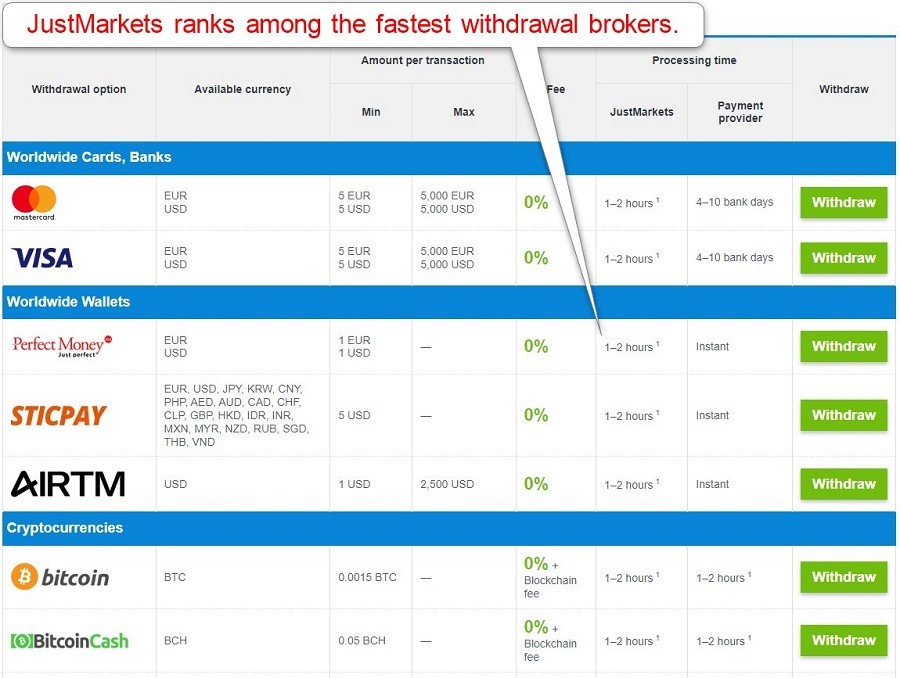

Payment Methods

JustMarkets supports bank wires, credit/debit cards, Perfect Money, SticPay, IRTM, Pay Retailers, Boleto, MoMo, FasaPay, localized banking methods, and cryptocurrencies.

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

JustMarkets accepts traders from most countries except the US and Belgium.

Deposits and Withdrawals

The secure JustMarkets back office handles all financial transactions for verified clients.

JustMarkets is one of the most accessible multi-asset brokers with low minimum deposits, 29 funding methods, and 39 supported deposit currencies. Minimum and maximum deposit limits depend on the payment processors with instant deposits from JustMarkets. Processing times for payment processors range between instant for most options except for two, which take up to one business day, while cryptocurrencies are between one and three hours.

Internal withdrawal processing times are extremely fast, typically one to two hours, while payment processors handle requests within two hours, except for banking-related methods, which can take up to ten business days.

Is JustMarkets a good broker?

I like the trading environment at JustMarkets for its accessibility and trading costs. With low minimum deposits, 29 funding methods, 39 deposit currencies, and 11 account base currencies, JustMarkets ensures the necessary flexibility a global multi-asset broker must have. Deep liquidity keeps trading costs low and allows clients to place trades at tight spreads. Fast order execution and high maximum leverage provide demanding algorithmic traders, scalpers, and high-frequency traders with necessary tools.

Beginners can benefit from quality educational content and research, which includes actionable trading signals, while the withdrawable bonuses provide a quality long-term boost. JustMarkets requires account managers to deposit a minimum of $5,000, a well-thought-through requirement. Overall, JustMarkets, formerly JustForex, has established itself as one of the highest-quality brokers catering superbly to its core client base, displaying a deep understanding of the needs and requirements of its clients. Yes, JustMarkets is regulated in South Africa by the Financial Sector Conduct Authority, license number 51114. JustMarkets is not regulated in Malaysia but features dedicated support to Malaysian traders, one of its core markets. The Seychelles subsidiary onboards Malaysian clients. JustMarkets is one of the most accessible multi-asset brokers, supporting 29 funding methods, 39 deposit currencies, and 11 account base currencies. It features low minimum deposits, fast order processing, deep liquidity, high leverage, and withdrawable bonuses. JustMarkets complies with two regulators and has nearly ten years of experience with a clean track record. Therefore, JustMarkets is a legit broker that established itself as a leading choice as it caters excellently to its core markets.FAQs

Is JustMarkets regulated in South Africa?

Is JustMarkets regulated in Malaysia?

Who is JustMarkets?

Is JustMarkets (formerly JustForex) legit?