Editor’s Verdict

IronFX has 1.5 million clients from 180 countries, making it a leading Forex and CFD broker since 2010, its founding year. Traders get the trusted MT4 trading platform, and benefit from low IronFX trading fees in the Absolute Zero account type. I reviewed IronFX to determine if traders get a competitive edge with this broker. Is IronFX the right broker for you?

Overview

Low trading fees and quality education for beginners from an industry leader.

Headquarters | Cyprus |

|---|---|

Regulators | FCA, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4, Proprietary platform |

Average Trading Cost EUR/USD | 1.8 pips |

Average Trading Cost GBP/USD | 1.7 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.35 |

Retail Loss Rate | 69.80% |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.3 pips |

Minimum Commission for Forex | $18 per 1.0 standard round lot |

Funding Methods | 7 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the trading fees in the IronFX Absolute Zero account, where traders get commission-free spreads from 0.3 pips. The upgraded MT4 trading platform is ideal for manual traders. VPS hosting exists for algorithmic traders and copy trading services are also available with a balanced asset selection and active trading community.

IronFX Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. The IronFX group presents clients with two regulated trading entities and maintains a secure trading environment.

Country of the Regulator | United Kingdom, South Africa |

|---|---|

Name of the Regulator | FCA, FSCA |

Regulatory License Number | 585561, 45276 |

However it's important to note that this review focuses specifically on IronFX offered by Notesco Limited and registered in Bermuda.

Is IronFX Legit and Safe?

The IronFX group has 10+ years of experience more than 1,5M clients worldwide and offers negative balance protection. SSL encryption also secures all transactions and customer data.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

The commission-free Absolute Zero account lists minimum spreads for major currency pairs between 0.3 and 0.5 pips or $3.00 to $5.00 per 1.0 standard lot, making it one of the most competitively priced trading account types. Since the IronFX minimum deposit is $50 for most account types, I highly recommend the Absolute Zero account

Average Trading Cost EUR/USD | 1.8 pips |

|---|---|

Average Trading Cost GBP/USD | 1.7 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.35 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.3 pips |

Minimum Commission for Forex | $18 per 1.0 standard round lot |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at IronFX are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.8 pips (Live Floating) | $0.00 | $18.00 |

2.2 pips (Live Fixed) | $0.00 | $22.00 |

0.0 pips (Live Zero Fixed) | $36.00 | $36.00 |

1.6 pips (Zero Commission) | $0.00 | $16.00 |

0.3 pips (Absolute Zero) | $0.00 | $3.00 |

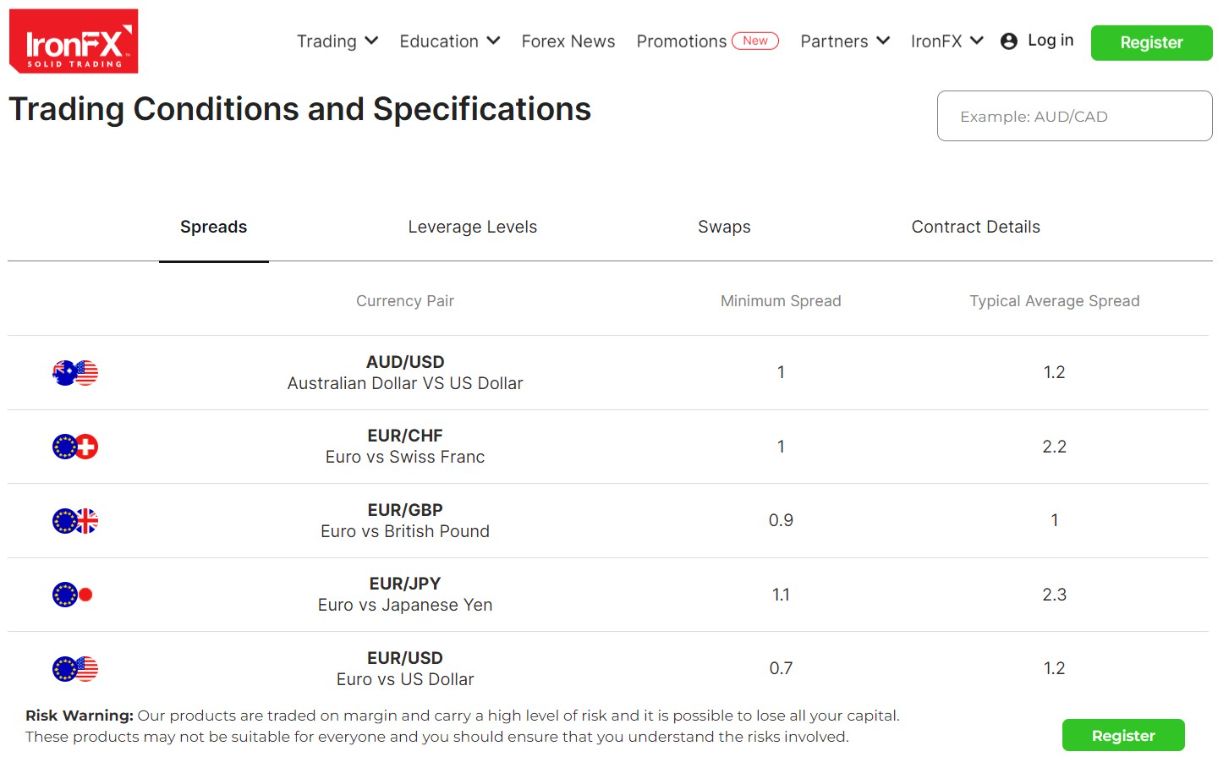

Here is a screenshot of IronFX minimum fees.

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Absolute Zero account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.3 pips | $0.00 | -$11.75 | X | $14.75 |

0.3 pips | $0.00 | X | $2.01 | $0.99 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.3 pips | $0.00 | -$82.25 | X | $85.25 |

0.3 pips | $0.00 | X | $14.07 | -$11.07 |

Noteworthy:

- IronFX offers positive swap rates in qualifying assets, meaning traders can get paid for holding leveraged overnight positions.

- Traders should consider swap rates, which they can avoid by closing trades before the cut-off time, usually 17:00 EST.

Range of Assets

The range of assets at IronFX exceeds 500+ trading instruments. IronFX notes the availability of 80+ currency pairs, making it an ideal Forex broker. Traders also get 15+ commodity CFDs, 20+ index CFDs, 30+ futures, and 150+ equity CFDs. I find the well-balanced asset selection suitable for most retail Forex and equity traders requiring fewer but highly liquid trading instruments, like day traders. I also like the IronFX fractional share dealing, which is excellent for smaller portfolios.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

IronFX Leverage

The IronFX leverage depends on the operating subsidiary and asset class. Forex traders get a maximum of 1:500 in South Africa, and 1:30 in Cyprus and the UK. Commodities max out between 1:10 and 1:20, while equities get up to 1:20. IronFX offers a leverage maximum of 1:1000 in IronFX offered by Notesco Limited and registered in Bermuda.

Traders must ensure they execute risk management to avoid magnified losses. IronFX offers negative balance protection, meaning traders can never lose more than their deposits.

IronFX Trading Hours (GMT + 2)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:00 | Friday 24:00 |

Metals | Monday 01:00 | Friday 24:00 |

Equity Indices | Monday 01:05 | Friday 00:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5

Account Types

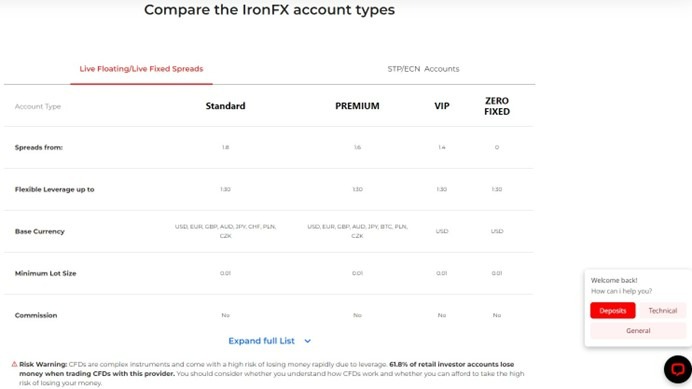

Traders have eight account options at IronFX, where the minimum deposit is $0 for most.

IronFX Demo Account

IronFX offers two demo accounts, the Demo Floating Spread and the Demo STP/ECN Absolute Zero. The former is fully customizable, while the latter is only available as a USD option with a default balance of $100,000, where traders can select their desired leverage. IronFX lists no expiry times, which is great, as all demo traders require unlimited access. While I recommend the Absolute Zero account for traders, the Demo Floating Spread offers the most realistic demo trading environment.

I want to caution beginner traders when using demo trading as a simulation tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

IronFX offers the core MT4 trading platform, the leading platform in algorithmic trading. It also notes that MT5 will become available soon.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Awards

IronFX received numerous awards for various aspects of its competitive trading environment.

Among the most recent ones are:

- Best Online Trading Platform (2019)

- Best Global Online Currency Trading Platform (2019)

- Best Broker of the Year (2019)

- Most Trustworthy Forex Broker - Global (2019)

- 2019's Leading Digital Global Currency Trading Specialists (2019)

- Most Outstanding Online Trading Solutions Provider (2019)

- International Markets- Best Practice Operator of the year (Forex) Iron FX (2020)

- Best Online Trading & Financial Services Company (2020)

- Best Online Forex Trading Platform (2021) / ACQ5

- International Online Currency Trading Platform of the Year - Iron FX (2021) / ACQ5

- Most Outstanding Online Trading Partners Program (2021) / AI GLOBAL MEDIA LTD

- Most Outstanding Online Trading Partners Program (2022) / 2022 Global Excellence Awards

- Best Educational Broker for 2023 by Global Business Awards 2023

- LAWYER INTERNATIONAL LEGAL 100 2023 Best Multi-Asset Broker 2023

- LAWYER INTERNATIONAL LEGAL 100 2023 Best CFD Broker 2023

- GLOBAL FOREX AWARDS 2023 Best Trading Experience Europe

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |             |

IronFX provides customer support 24/5 in Arabic, Bulgarian, Chinese, Czech, Dutch, English, French, German, Greek, Hebrew, Indonesian, Italian, Japanese, Korean, Polish, Portuguese, Romanian, Russian, Spanish, Turkish, Vietnamese, Persian, and Indian. The FAQ section answers the most common question, and live chat is available with fast response times for basic questions. It asks to e-mail more specific inquiries.

Opening an Account

Traders can open an IronFX account via the online application form, which follows well-established industry standards. It asks for name, e-mail, phone number, country of residence and knowledge and experience. The application also asks traders to select their account type, base currency, followed by the desired password for the back office. Some options depend on the geographic location and account type.

IronFX is a multi-regulated broker, and account verification is mandatory. Most traders will pass verification after submitting a copy of their ID and one proof of residency document. IronFX might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at IronFX is $50 for most accounts, except for the Zero Spread option, which requires $500.

Payment Methods

IronFX supports bank wires, credit/debit cards, e-wallet and local payment solutions

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

IronFX accepts traders resident in most countries except the USA, Iran, Cuba, Sudan, Syria, and North Korea. IronFX has traders from 180 countries, making it one of the most accessible brokers.

Deposits and Withdrawals

The secure IronFX back office handles all financial transactions for verified clients.

The IronFX minimum deposit is $50. Processing times depend on the geographic location and the payment processors, which IronFX lists as between one and ten business days. There are no internal deposit or withdrawal fees, except for traders who request a withdrawal without placing a trade, which carries a 3% fee.

Traders should also consider potential third-party processing costs and currency conversion fees. Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the IronFX account name. Some payment processors have geographic restrictions, but the IronFX back office will only list the ones available to traders.

Is IronFX a good broker?

I like the trading environment at IronFX in the Absolute Zero account due to its competitive trading fees. IronFX is an ideal broker for Forex traders due to its above-average choice of currency pairs. The well-structured trading environment and dedicated customer support team, make it a great broker to register with. An FX withdrawal takes between one and ten business days, dependent on the payment processors and the geographic location of traders. IronFX is a legit broker with three regulated subsidiaries and an operational track record exceeding ten years. Yes, different entities in the IronFX Group have two regulatory licenses in the UK, and South Africa.FAQs

How long does IronFX withdrawal take?

Is IronFX legit or not?

Is IronFX a regulated broker?