Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Year Established | 2009 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $1 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

INFINOX is a multi-asset Forex broker founded in 2009 that currently operates out of the UK. Per its own account, ambition, integrity, inspiration, and excellence are the four pillars on which it stands. INFINOX has received several awards over the past three years and has a dedicated unit for the Chinese market. Clients have access to three trading platforms at this market maker. INFINOX recently added Gold-i’s Matrix Net as a liquidity channel, expanding its network. This broker possesses the proper foundation from where it can increase its market share. Currently, 82.57% (SCB) and 69.89%(FCA) of retail traders operate their portfolio at a loss, placing Infinox ahead of most competitors.

Regulation and Security

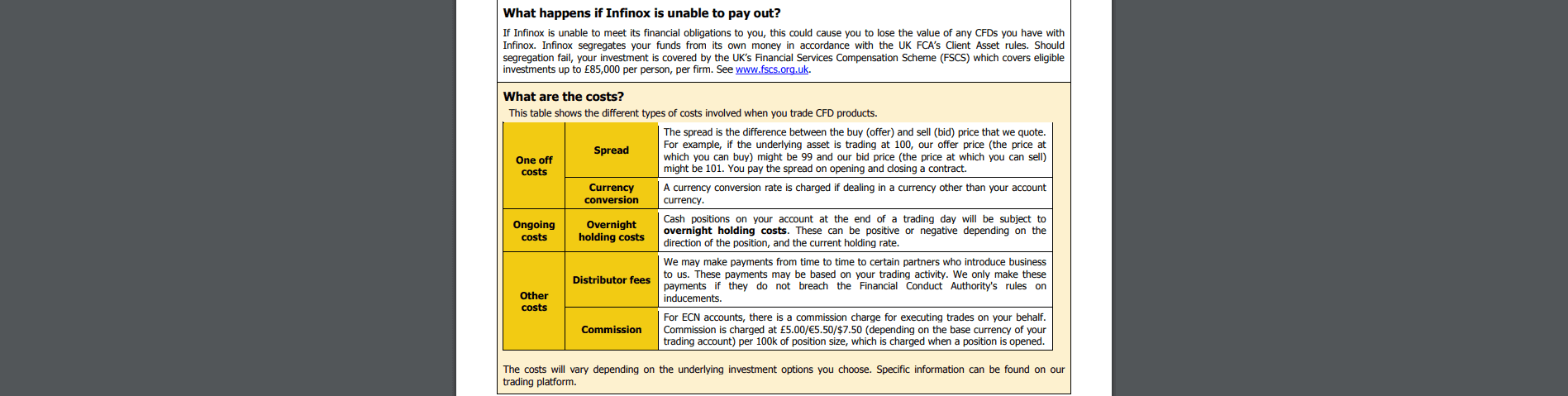

The UK Financial Conduct Authority (FCA) authorizes Infinox and maintains oversight of operations. This broker remains fully compliant with all regulations and has a clean track record. Segregation of client deposits from corporate funds, as mandated by the FCA, offers protection in case of an unlikely default by Infinox. The Financial Services Compensation Scheme (FSCS), the UK’s statutory deposit insurance, covers deposits up to £85,000, and negative balance protection ensures traders cannot lose more than they deposit. It has also taken out an additional insurance policy of up to £500,000 per client, underwritten by QBE Underwriting Limited and other participating syndicates at Lloyd’s of London. INFINOX is aslo registered under the Commonwealth of The Bahamas.It is authorised and regulated by The Securities Commission of The Bahamas (‘the SCB’).INFINOX offers $1,000,000 USD Insurance. The insurance policy became effective 1 May, 2020 and will continue until 30 April, 2021. Up to USD $1,000,000 per claimant, subject to and in accordance with the limits and the terms and conditions of the Policy.

The FCA regulates Infinox, which maintains a spotless record.

INFINOX Review SCB regulator

INFINOX offers $1,000,000 USD Insurance. The insurance policy became effective 1 May, 2020 and will continue until 30 April, 2021. Up to USD $1,000,000 per Claimant, subject to an in accordance with the limits and the terms and conditions of the Policy. INFINOX has additional coverage of up to £500,000 per client, offering market-leading deposit protection. INFINOX is also regulated by the Financial Sector Conduct Authority (FSCA) and the Financial Services Commission (FCS).

Fees

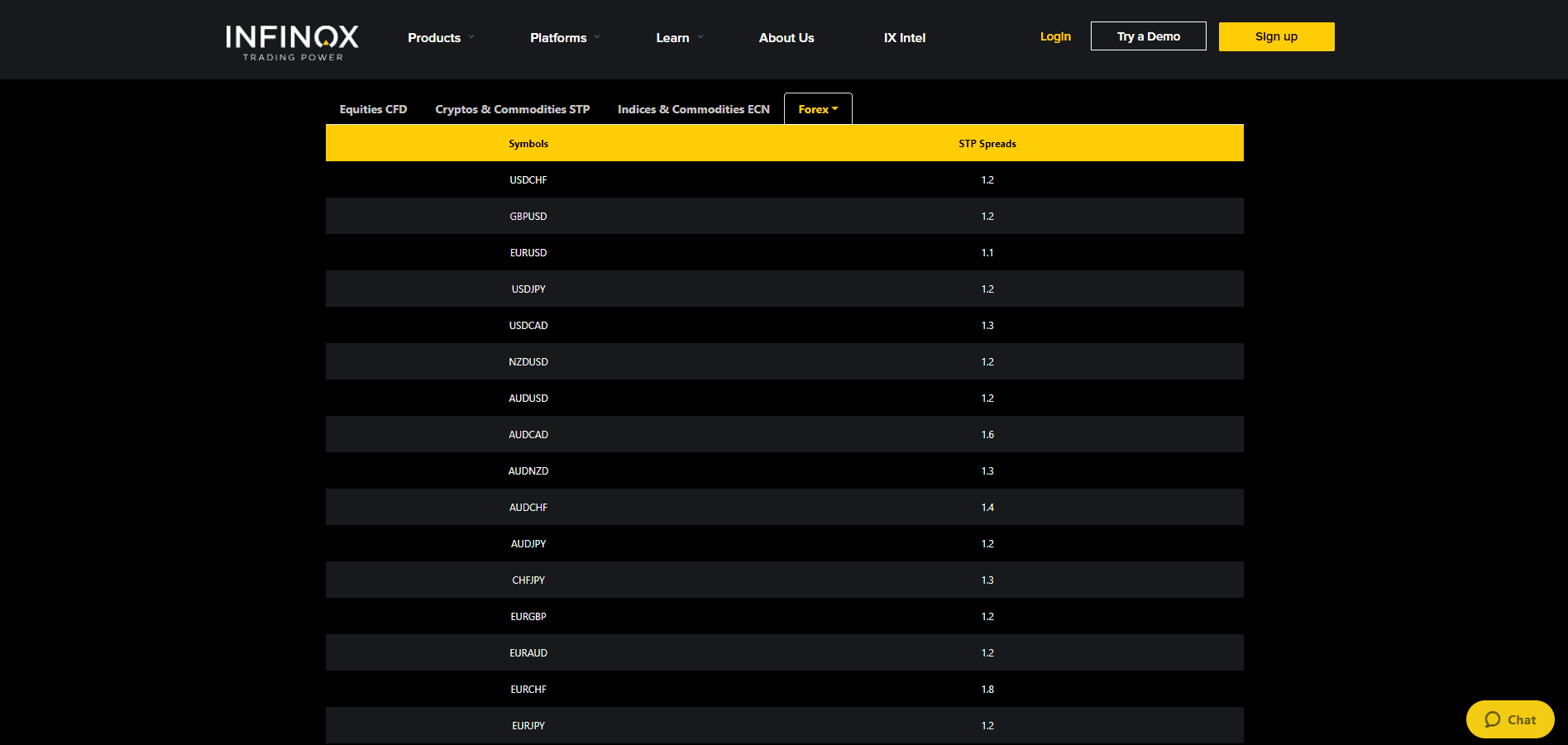

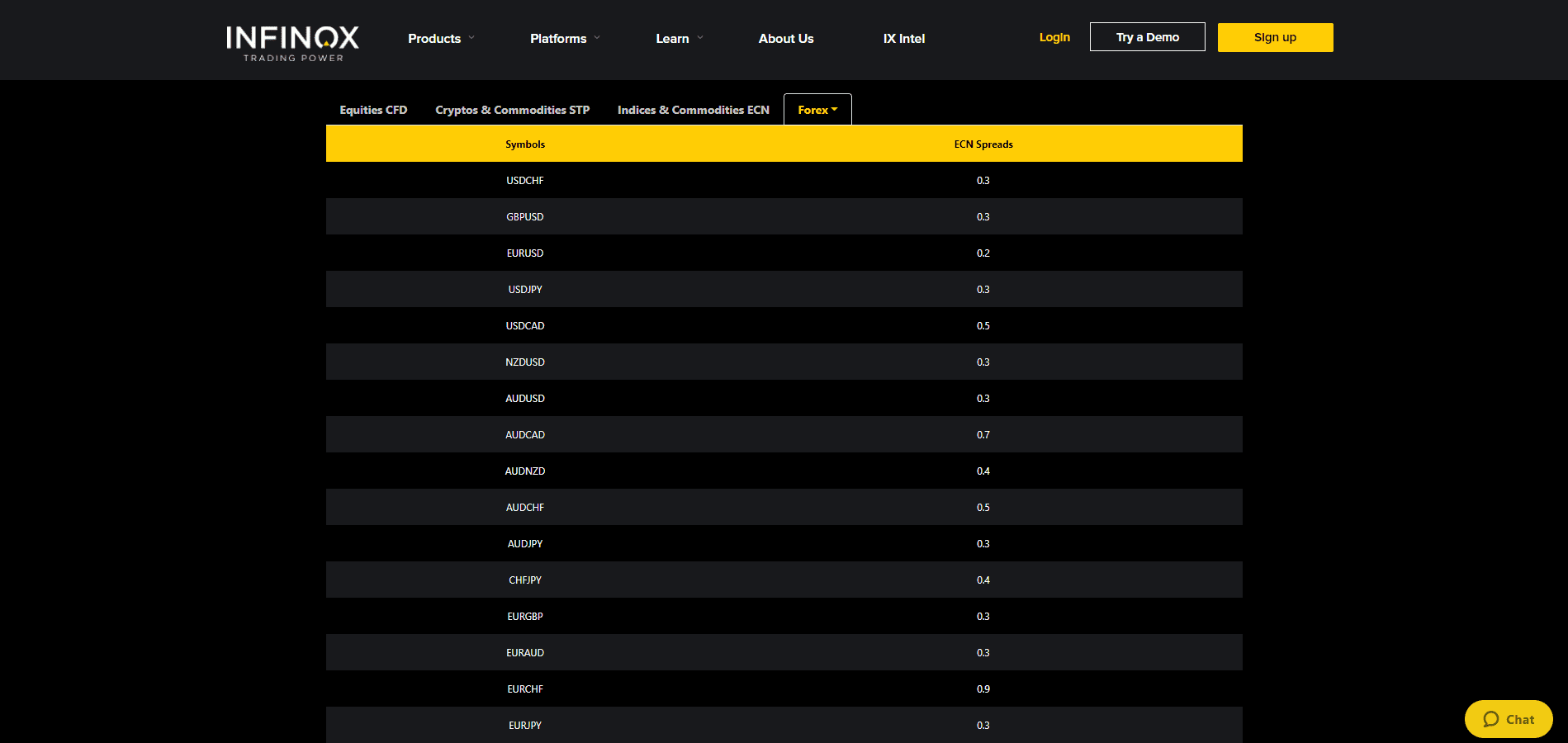

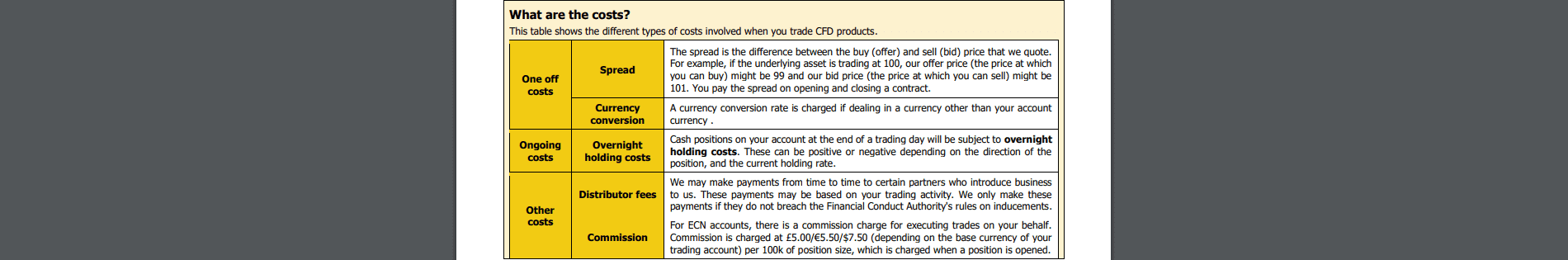

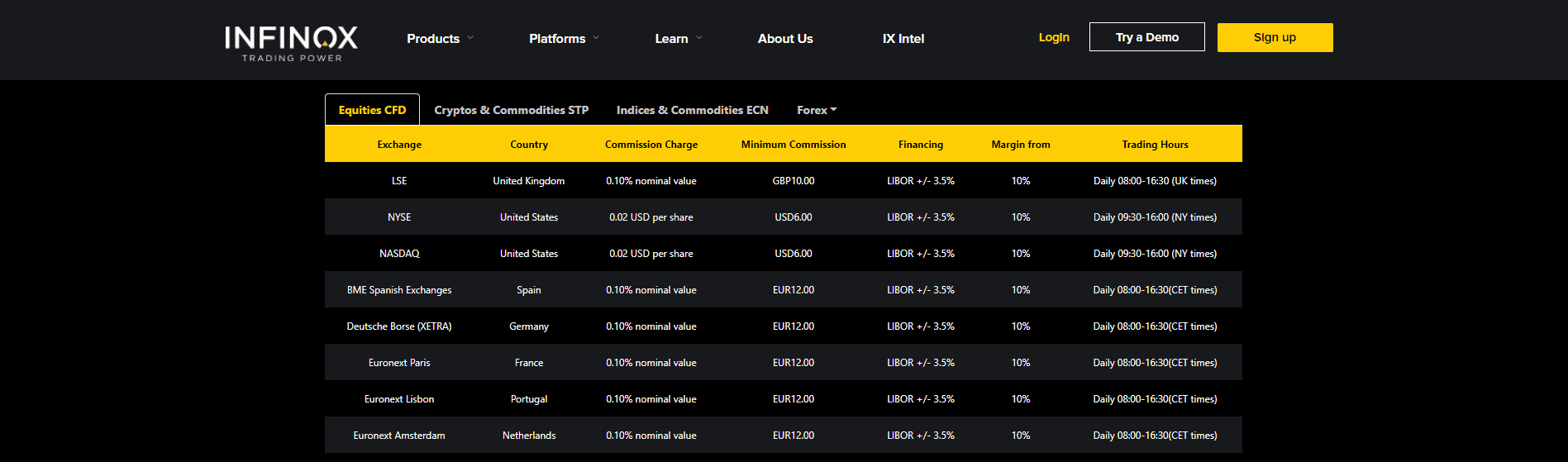

INFINOX earns most of its revenues from spreads and commissions. The EUR/USD carries a commission-free mark-up of 1.1 pips in the straight-through processing (STP) account, which is lowered to 0.3 pips in the electronic communications network (ECN) alternative for a commission of $7.50 per 1.0 standard lot, or €5.50/£5.00, depending on the base currency of the account. Equity CFDs cost 0.10% for all exchanges, except for the US, where the fee is $0.02 per share. A minimum charge of €12/£10/$6 applies. Based on trading costs, Infinox is squarely in the middle of its competition.

Leveraged overnight positions incur swap rates, and traders with equity or index positions face effects from corporate actions such as dividends, splits, and mergers, which Infinox passes on accordingly. Third-party payment processor costs also apply, together with a currency conversion cost. Infinox does not list its fees transparently on its website, and potential clients must read through the 42-page client agreement. The document lists all applicable fees, with a more precise summary in the Key Information Document (KID) for each asset. A more direct overview of all trading costs is, unfortunately, missing, and Infinox should consider adding it to increase price transparency.

MT4 STP mark-ups are above-average, placing clients at a disadvantage.

MT4 ECN spreads are more acceptable but, with a commission of $7.50 per round lot, the overall cost structure is expensive.

Infinox is not transparent about all costs, which traders must source from the available legal documents.

Equity CFDs remain acceptably priced.

INFINOX offers competitive pricing for their clients.

Traders should be aware that the commission cost for equity CFDs as listed on the website and within the KID document are contradictory.

What Can I Trade

The overall asset selection remains limited at Infinox, consisting of over 200 assets across six sectors. Confusingly, three different sections of the website list a disparate number of total currency pairs available for trade, ranging from 39 pairs to more than 50. Fifteen index CFDs and 14 commodity CFDs grant average exposure to both sectors, while Infinox added five cryptocurrency pairs. An unspecified number of futures and equity CFDs exist but, given the math, the total cannot greatly exceed 130 unless Infinox failed to update the 200+ assets mentioned earlier.

New retail traders may find the overall asset selection acceptable, but advanced traders may demand more.

Account Types

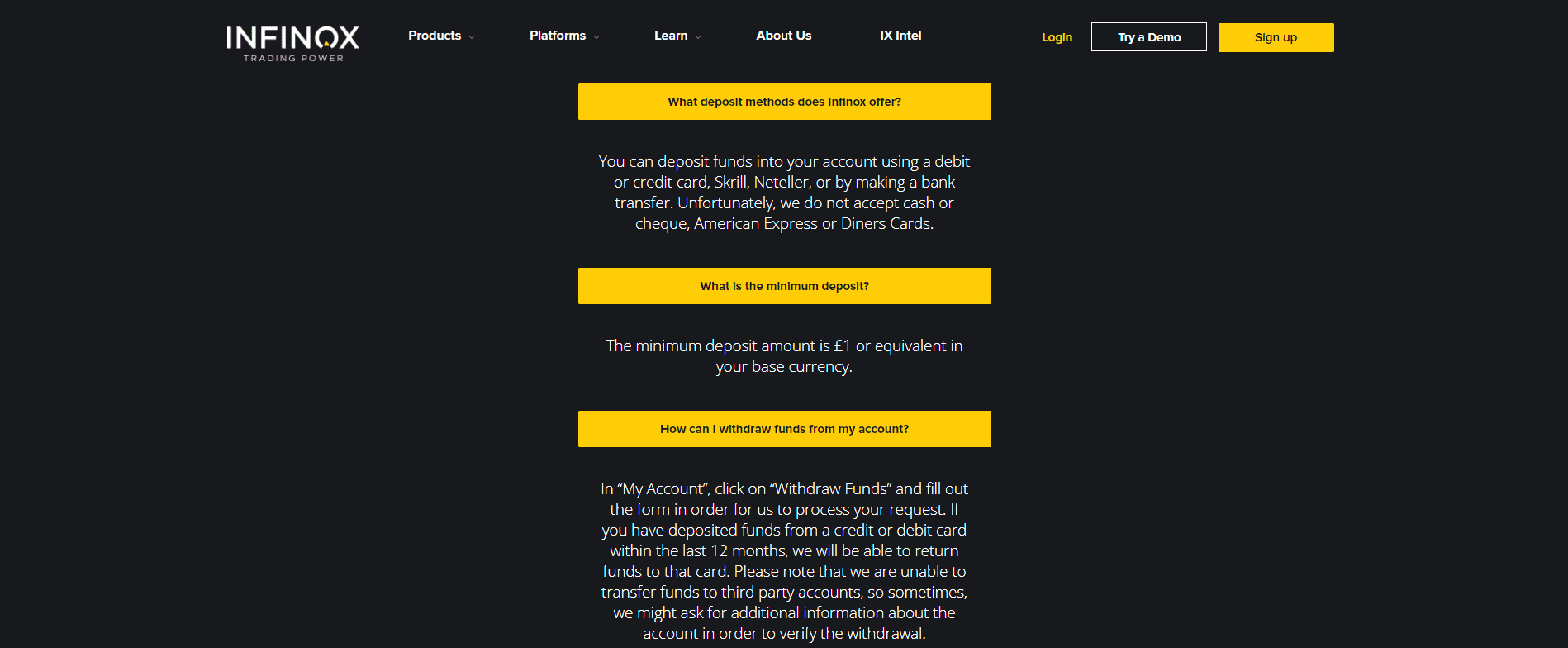

We discovered two different account types during this Infinox review. Clients may choose between the commission-free straight-through processing (STP) account or a commission-based electronic communication network (ECN) alternative. A minimum deposit of £1 or a currency equivalent is required, per details provided in the FAQ section.

Infinox's FAQ section provides traders with information about account types.

Trading Platforms

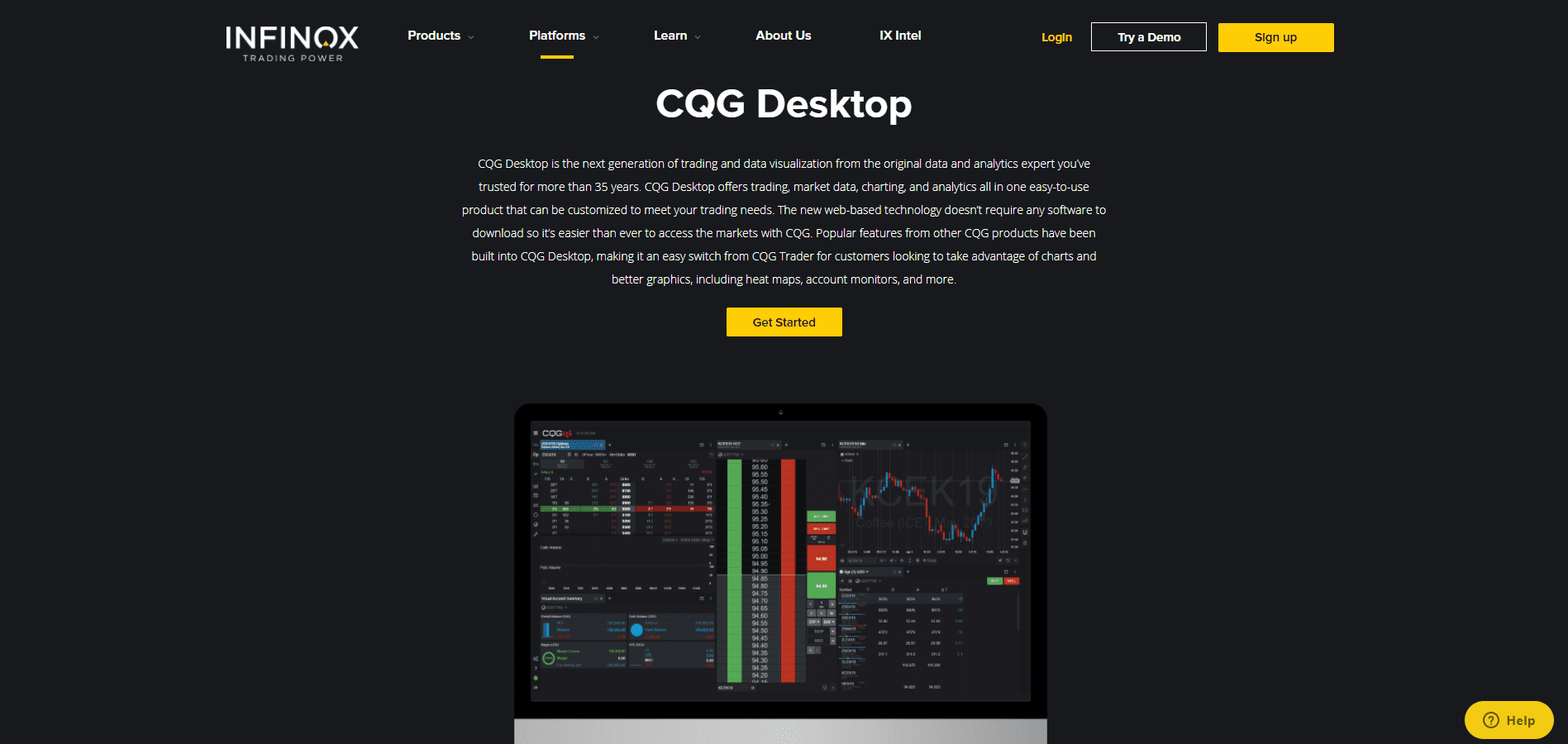

Two trading platforms are available at Infinox, the MT4, and CQG. During this Infinox review the company's website also noted the impending addition of MT5, which would expand client choice to three. While each platform has a dedicated section on the website, the introduction of it is inadequate with just one short paragraph. MT4 established itself as the global standard and primary trading platform for automated trading solutions, and Infinox would be better served if they properly and adequately outline the core elements of its trading environment.

MT4 remains the number one trading platform, trusted by tens of millions of clients for over fifteen years.

IX Social

Infinox also offers the IXSocial app where traders can connect with each other and share trades using the MT4 platform.

MT5 trading platform

Most Powerful trading platform which is an advanced version of MT4, for the modern trader. MT5 has advanced charting & orders and a larger selection of indicators.

Clients may choose to trade on the CQG Desktop which, despite its name, is also available as a mobile version.

Unique Features

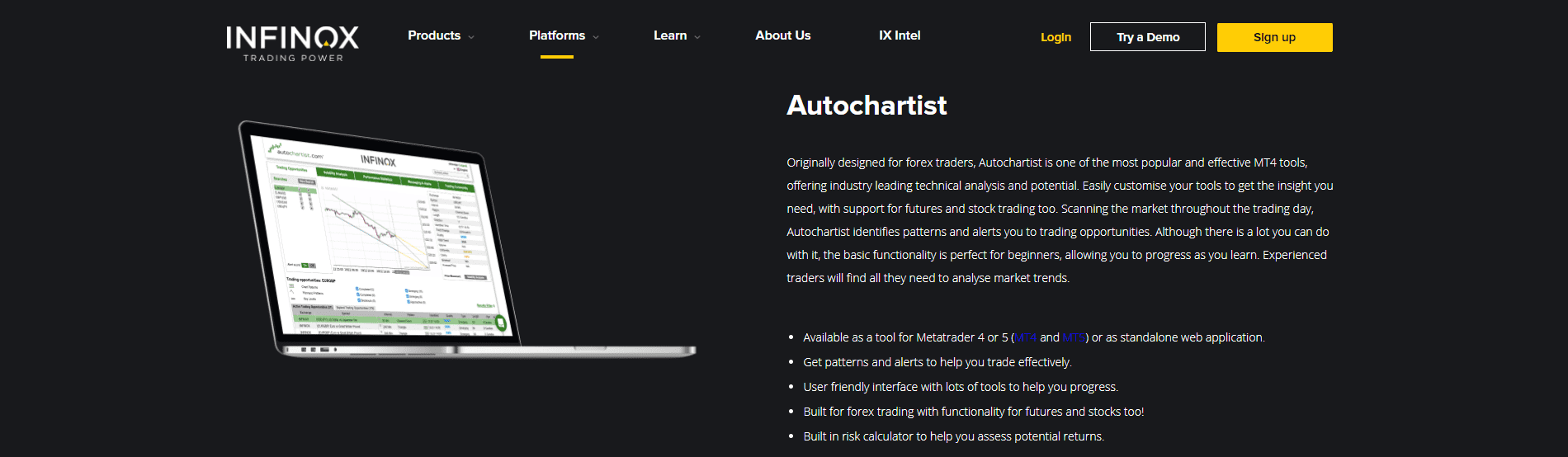

Infinox offers its clients the Autochartist upgrade as an MT4 or MT5 plugin and as a standalone web application. Its automated chart pattern recognition software ranks among the most popular trading tools, especially for the MT4 trading platform. Autochartist is an excellent analytical tool for manual traders, providing them with a competitive edge. The build-in trading alert service ensures traders do not miss potential opportunities.

The Autochartist MT4 plugin significantly upgrades the trading platform.

Research and Education

INFINOX offers educational content and daily market news in their IX Intel section. The research articles are written by an experienced market analyst and cover all major markets. Educational content is also available for beginner and intermediate traders in the Education section. IX Intel has grown dramatically since it was created and is quickly becoming a great source for all things trading education. It offers their clients added value and boosts their trading experience.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |     |

Customer support is available 24/5 in various languages to ease the communication, as well offering Live chat, phone lines or email support. On the website there is a contact page with all the international phone numbers that you might need to contact respective support teams. An FAQ section answers a handful of questions. INFINOX arranges personal account managers for its clients who provide dedicated support.

Bonuses and Promotions

Currently the Broker is offering two types of bonuses under the SCB

- 20% Cashback & $2 Rebate

Participants who wish to claim the bonus, deposits funds into their trading account with INFINOX and receives a 20% Cash Back.

- $25 Cashback

The $25 Cash Back will be credited to your INFINOX trading account within five (5) business days.

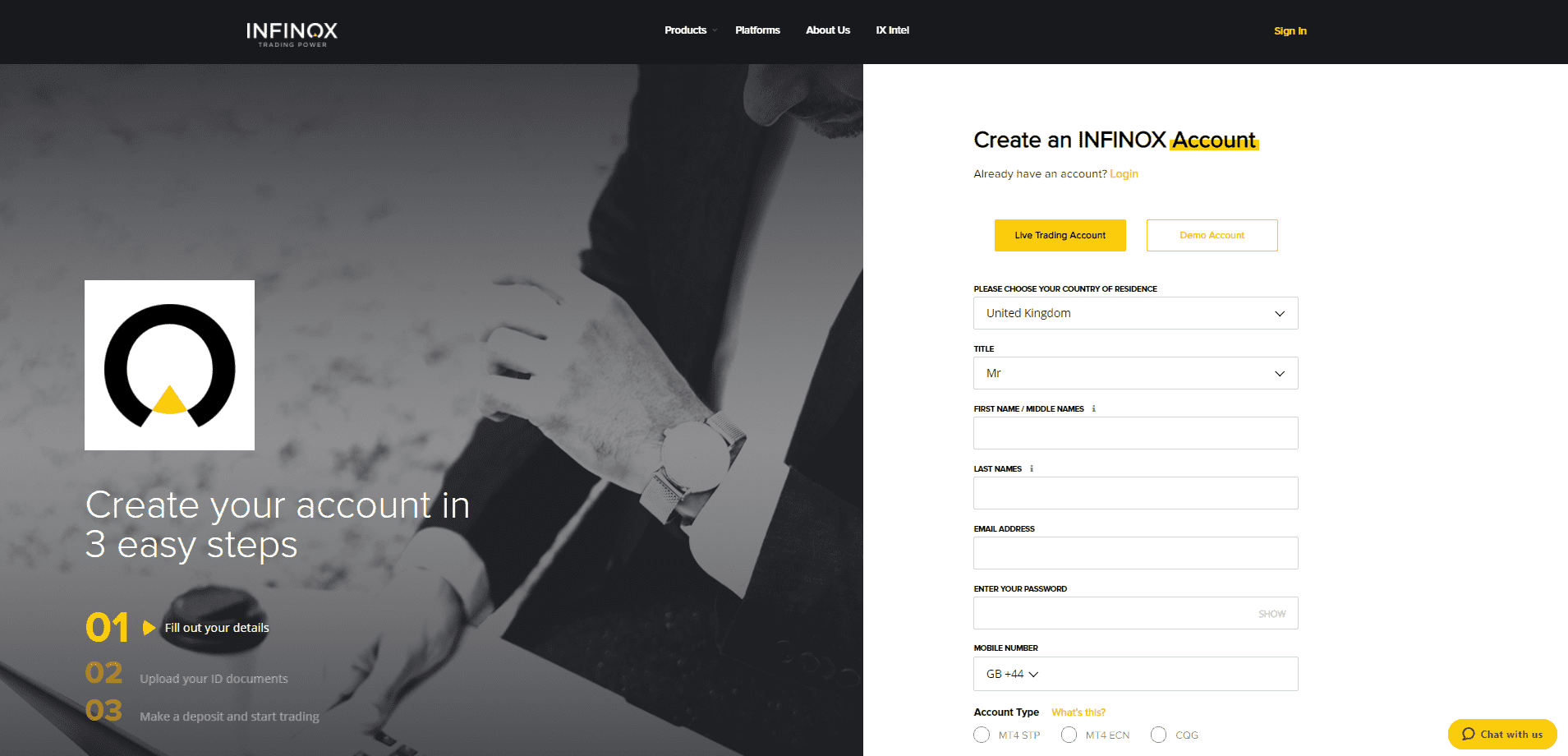

Opening an Account

An online application form processes new account applications. The three-step process at Infinox follows well-established industry standards, consisting of personal information, ID uploads, and a deposit. The verification process is mandatory, as stipulated by regulatory requirements. A copy of the trader’s ID and one proof of residency document, not older than three months, usually satisfies AML/KYC rules. Infinox maintains a trustworthy trading environment, and new clients can safely submit the necessary documentation.

The account opening procedure conforms to regulatory requirements.

Deposits and Withdrawals

The sole mention of deposits and withdrawals exists only in the FAQ section, where this broker answers three questions. One of the questions notes supported payment options as bank wires, credit/debit cards, Skrill, and Neteller. Another question lists the minimum deposit as £1 or a currency equivalent, and the final question describes the withdrawal process, which is possible from the trader’s back office. Processing times or applicable costs are missing from the too-brief description. Infinox should make an effort to properly introduce and describe the requisite information needed by clients.

Infinox answers three questions regarding deposits and withdrawals in the FAQ section.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Infinox, regulated by the FCA, has a sound operational foundation but will require some fine-tuning to attract new clients. Traders have access to the MT4 trading platform and CQG as an alternative, and the inclusion of the MT5 trading platform is currently in the pipeline. The best asset Infinox offers is the Autochartist MT4 plugin, which provides traders with a competitive edge. Infinox maintains a clean regulatory track record and a secure trading environment. Infinox management would be wise to provide potential clients with a proper introduction to core trading aspects. As regards costs, while all of the information is available on the Infinox website, clients must source it from lengthy legal documents; a more open approach by Infinox management would significantly improve the transparency of products and services.

Most retail traders will find the Infinox asset selection acceptable, but with just above 200 assets across six sectors, more advanced traders may find the selection too limiting. Infinox does offer quality in-house trading ideas and market commentary. Unfortunately, the educational section includes only four brief articles. Infinox must consider an expansion on the introduction and explanation of its products and services. Overall, this broker has great potential with the implementation of a few key changes. At minimum, management at Infinox may want to consider enlarging the asset selection, as well as an overhaul of the website, resurrection of the IX Intel section (in conjunction with an improved education section). The implementation of any or all of those changes would make Infinox considerably more attractive to new clients. INFINOX is a multi-asset broker operating out of the UK. There are no signs of fraudulent behavior at Infinox, which maintains a spotless regulatory record with the FCA, SCB, FSCA and FSC. INFINOX offers a commission-free STP account and a commission-based ECN account. UK-based traders may also open a SIPP and an SSAS account. Yes, INFINOX provides traders with a demo account.FAQs

What isINFINOX?

Is INFINOX a scam?

What accounts does INFINOX offer?

Does INFINOX offer a demo account?