iForex Editor’s Verdict

With a history stretching back to 1996, iFOREX is one of the most established players in the online brokerage world. After decades in the business, they've built a solid reputation, but in a constantly evolving market, does this veteran broker still have what it takes to compete? We decided to take a fresh look under the hood to see what they offer traders today.

iFOREX operates with a global footprint, with its international arm headquartered in the British Virgin Islands and its European entity based in Cyprus. What stands out immediately is its purpose-built proprietary trading platform, an impressive range of over 800 CFD instruments, covering all the main assets and a straightforward fee structure. Adding to its global brand visibility, the broker recently announced an official partnership with the top-tier Dutch football club, PSV Eindhoven, and has other notable partnerships with the clubs Ferencváros in Hungary and Lech Poznań in Poland.

Overview

iFOREX has over 25 years of market experience, suggesting financial stability and a well-executed business plan.

British Virgin Islands BVIFSC, CySEC 1996 Market Maker $100 Proprietary platform 1.1 pip 1.6 pips 2.97 pips $60.00 0.6 pips 11

Regulation and Security

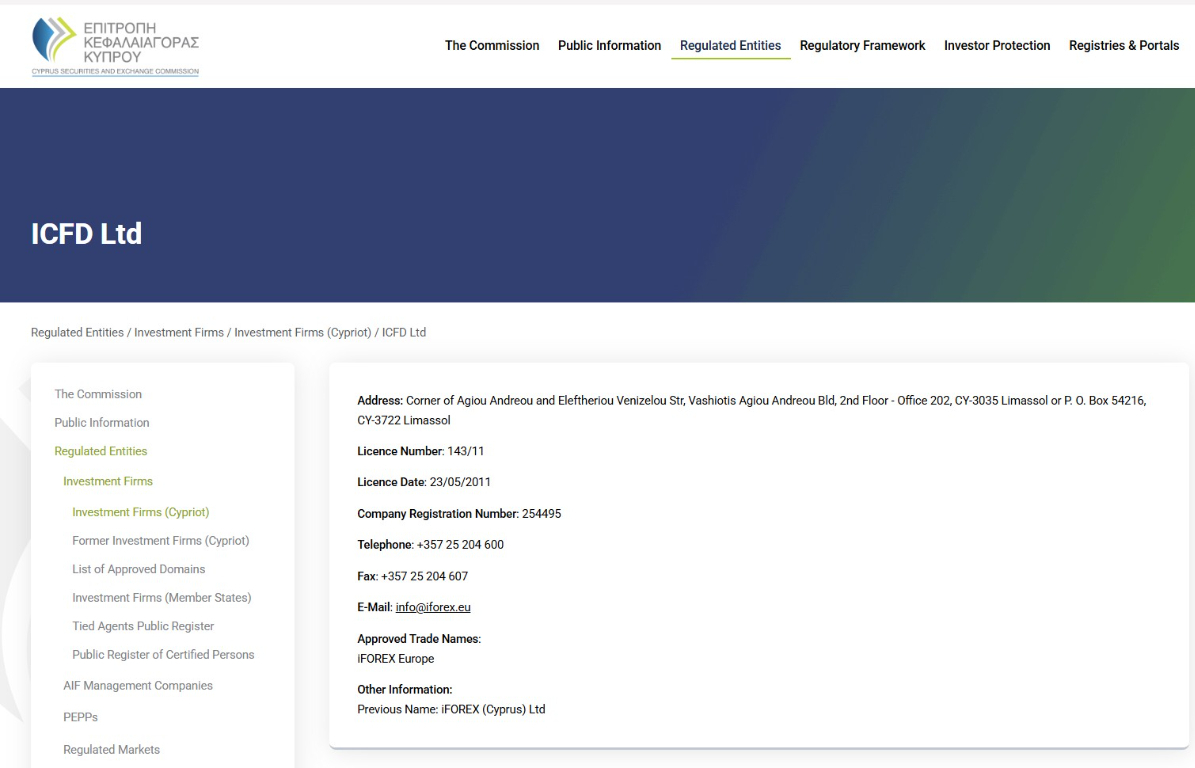

From a trader's perspective, regulation and security is non-negotiable, and this is an area where iFOREX has made significant strides. The broker operates under a robust dual-regulation framework, which provides a solid layer of security for its clients:

- For its European operations, it is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 143/11. As a top-tier European regulator, CySEC enforces strict financial standards, including MiFID compliance, which is a major confidence booster.

- For its international clients, it is licensed by the British Virgin Islands Financial Services Commission (BVI FSC).

This dual-license structure, combined with the broker's long history and the practice of keeping client funds in segregated accounts, creates a trustworthy trading environment. It's also worth noting that iFOREX provides ‘negative balance protection’, a crucial feature that ensures you can never lose more than the money in your account.

Fees

Average Trading Cost EUR/USD | 1.1 pip |

|---|---|

Average Trading Cost GBP/USD | 1.6 pips |

Average Trading Cost WTI Crude Oil | 2.97 pips |

Average Trading Cost Bitcoin | $60.00 |

Minimum Standard Spreads | 0.6 pips |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $15 per quarter after 12 months |

iFOREX keeps things simple and transparent with a spread-only fee structure, meaning there are no hidden commissions on trades.

- Standard Spreads: The spreads are fixed, which can be a real advantage during volatile market news when other brokers' variable spreads might widen significantly. We found the minimum fixed spread for EUR/USD to be a reasonable 1.1 pips and GBP/USD at 1.6 pips. For commodities, the average spread for WTI Oil is around 2.97 pips.

- 'Dynamic Spreads' Campaign: At the time of this review, iFOREX is running a limited-time promotion offering significantly reduced spreads on major forex pairs, with EUR/USD going as low as 0.3 pips during peak hours. This is a very competitive offer worth looking into.

- Deposit & Withdrawal Fees: The broker charges no fees for deposits. While iFOREX doesn't charge for withdrawals itself, you should be aware that third-party banks or payment processors might impose their own fees.

- Inactivity Fee: Like many brokers, iFOREX charges an inactivity fee. An account that has been dormant for 12 months will be charged $15 per quarter.

What Can I Trade?

Traders have access to over 800 assets across 6 categories. The coverage of the Forex market is superior to many competitors, with over 100 currency pairs. Complementing the Forex pairs are over 20 commodities. Also available to trade are over 15 cryptocurrency crosses. The bulk of the assets at iFOREX consists of CFDs on hundreds of equities, together with over 30 index CFDs, and over 30 ETFs.

Overall, the choice is excellent. Given the broad choice of CFDs, retail traders and asset management firms alike will benefit from the asset selection.

- Forex: A huge selection of over 100 currency pairs.

- Shares: CFDs on hundreds of shares from top global markets.

- Indices: Over 30 of the world's most popular stock indices.

- Commodities: CFDs on more than 20 soft and hard commodities.

- Cryptocurrencies: Over 15 of the leading cryptocurrencies.

- ETFs: More than 30 popular Exchange-Traded Funds.

Account Types

iFOREX asks prospective clients to contact their customer service team to find out about the account types available. We, from our side, would have preferred if the information was readily available on the site.

While this broker maintains its proprietary webtrader, their site doesn’t go into too many details about its functioning. From the website page, it appears that key features include an integrated economic calendar and trading signals, advanced live charts and indicators, and a customizable and user-friendly interface. It seems that the platform does not support automated or social trading and may only be suitable for manual traders.

Trading Platform & Unique Features

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Rather than offering the standard MT4/MT5, iFOREX has invested in its own proprietary web-based platform, FXnet. It’s intuitive and very easy to use, with no download or installation required, making it accessible from anywhere. While some power users might miss MetaTrader, the platform is clean, fast, and has been recently upgraded with some genuinely useful tools:

- Pulse: This is a real-time newsfeed integrated directly into the platform. It provides live market updates, professional analysis, and breaking news as it happens, which is fantastic for staying on top of market-moving events.

- Traders' Activity: This tool works as a market sentiment indicator, showing you the percentage of iFOREX clients who are currently buying or selling an instrument. It’s a great way to get a quick snapshot of community sentiment and can be a helpful tool for confirming your own trade ideas.

Research and Education

Education is where iFOREX has created an excellent service for new traders. The Education Center features many articles that cover various topics. Each one consists of quality written content with proper explanations and examples, while a video is equally available. A basic and advanced category divides the depth of the educational content. A free PDF guide for beginners is available upon registration, and 1-on-1 training lessons exist, increasing the value of this section. This broker offers two promotion packages centered on education, namely, the iFOREX Education Package, and the iFOREX Pro Package. The latter includes free trading signals, while iFOREX does not list any requirements. Overall, this is the best-developed category at this broker.

iForex notes that it does not offer investment advice.

In a different section, this broker prides itself on trading signals.

The Education Center is a must-read for new traders.

The iForex Education Package offers more courses and 1-on-1 trading.

The iForex Pro Package adds free trading signals.

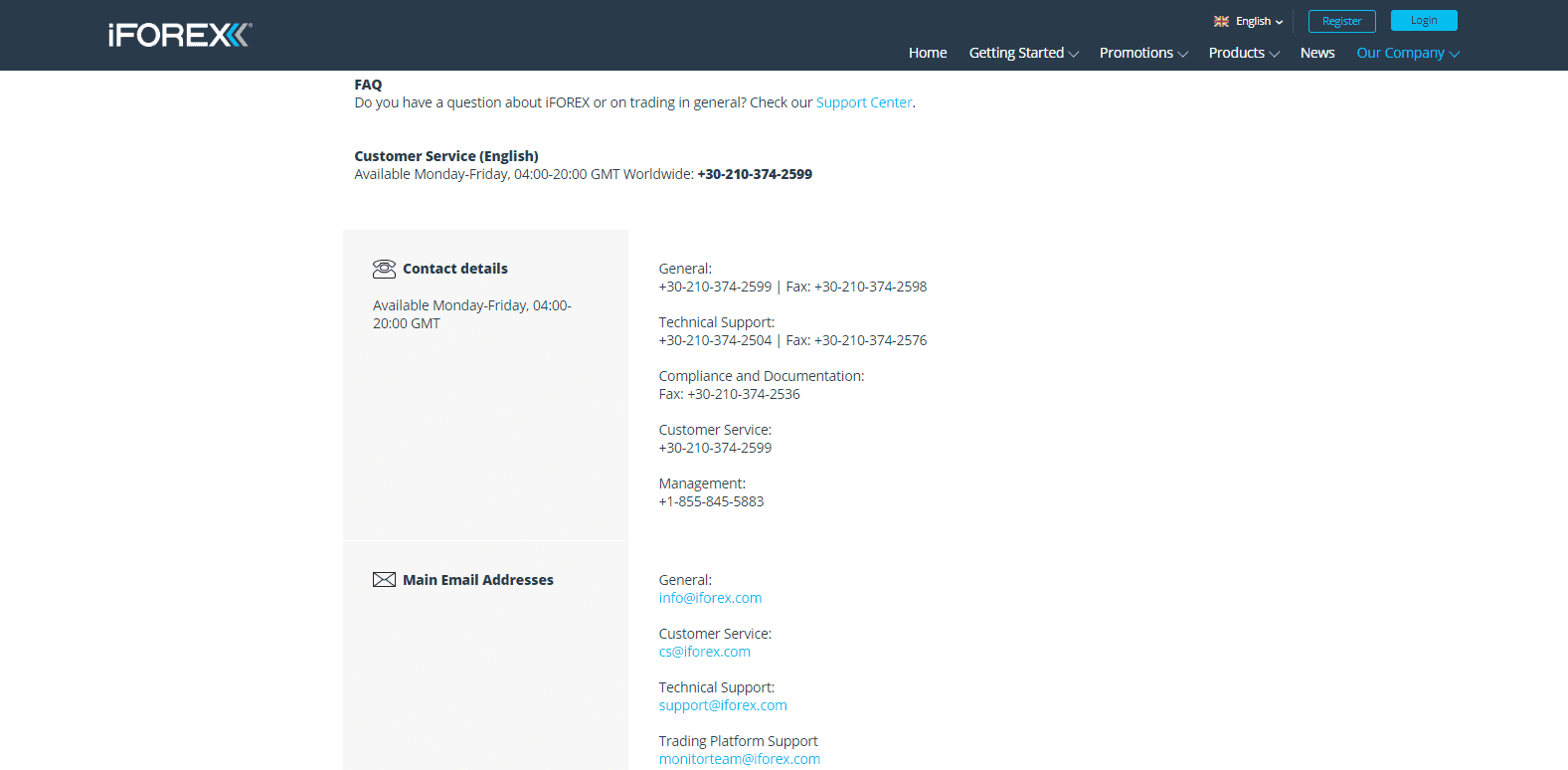

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | M-F, 04:00 - 20:00 GMT |

Website Languages |         |

Customer service, in English, is available from Monday to Friday between 04:00 and 20:00 GMT. The FAQ section attempts to answer the most common questions, while those in need of more assistance may either call one of the fifteen phone numbers, write an e-mail, or use live chat.

Bonuses and Promotions

iFOREX offers new traders a welcome deposit bonus to help them increase their starting funds. These bonuses can reach up to 100% of the deposit, while terms and conditions apply. We recommend traders read and understand them before requesting a bonus.

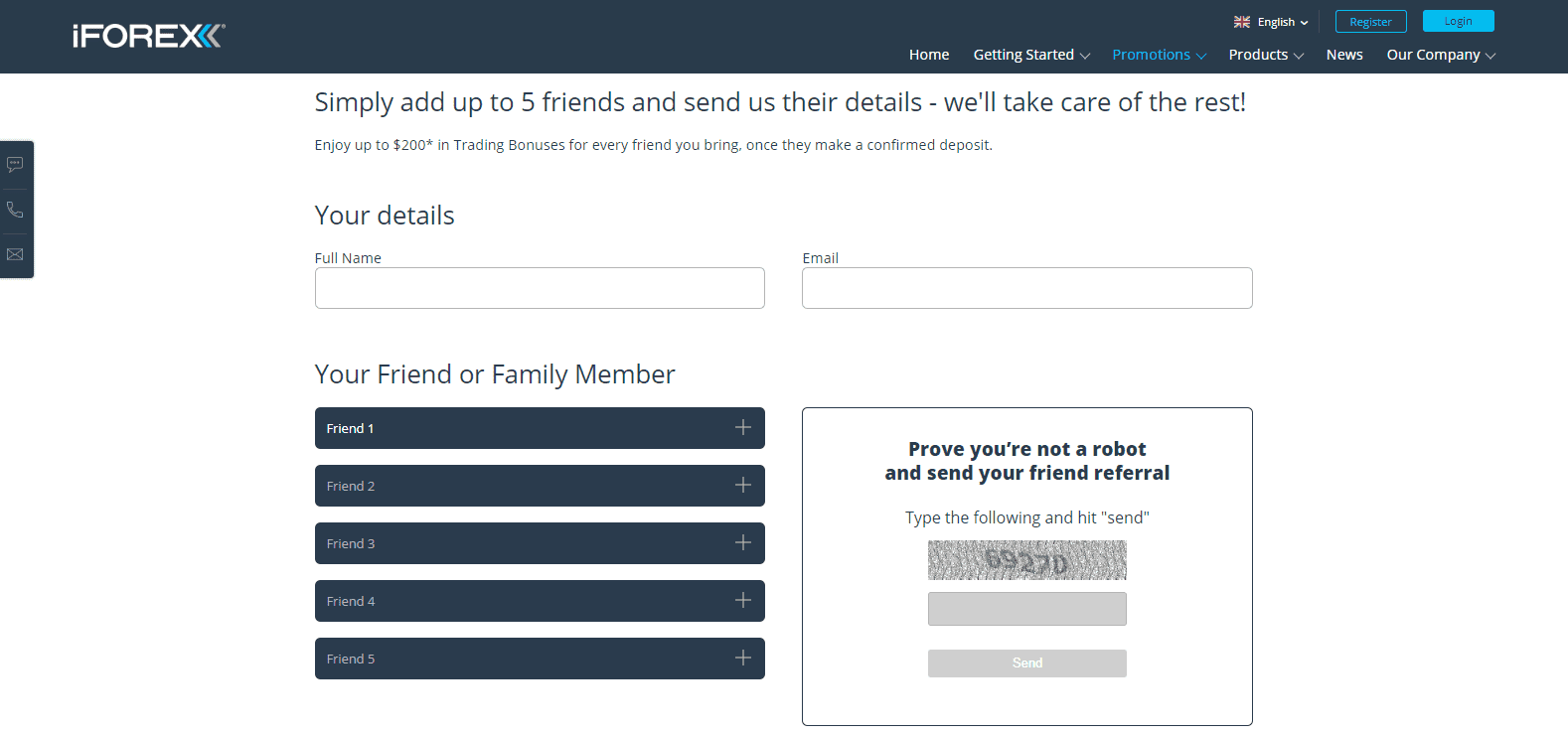

Besides the two educational promotions, iFOREX maintains a refer-a-friend campaign. Referring new traders may earn up to $300. The bonus is applied after the account is verified and funded. While family members count, same-household family members do not.

A refer-a-friend campaign exists at iFOREX.

Opening an Account

Per established industry standards, an online application will process new accounts. iFOREX merely asks for name, e-mail, and valid phone number to complete the first step. Being a regulated broker, iFOREX must satisfy AML/KYC requirements, as stipulated by the BVIFSC. A copy of the trader’s ID and one proof of residency document (not older than three months) usually completes this second step.

The Account Opening process adheres to AML/KYC requirements.

Deposits and Withdrawals

iFOREX supports bank wires, credit/debit cards, and e-wallets. Per information gathered from the support section, CashU, Alipay, Neteller, PayPal, and Skrill are available. Detailed information regarding processing times and fees does not seem available. This broker notes that no internal costs apply except a fee of $20 for bank wires, while third-party charges will depend on the payment processor.

A question in the support section reveals several supported e-wallets.

iForex applies a $20 fee for all withdrawals via bank wires.

Summary

iFOREX has clearly managed to stay relevant as a leading broker by combining its long-standing experience with modern innovations. The strong CySEC regulation is a massive plus, and the sheer number of tradable assets is impressive. The addition of the Pulse and Traders' Activity tools shows a real commitment to providing traders added value within their proprietary platform.

While the absence of MT4/MT5 might be a drawback for some, traders who appreciate a clean, easy-to-use platform with fixed spreads and a wide range of tradable instruments will find a lot to like here. Overall, iFOREX proves that it's still a solid choice in a crowded brokerage market.

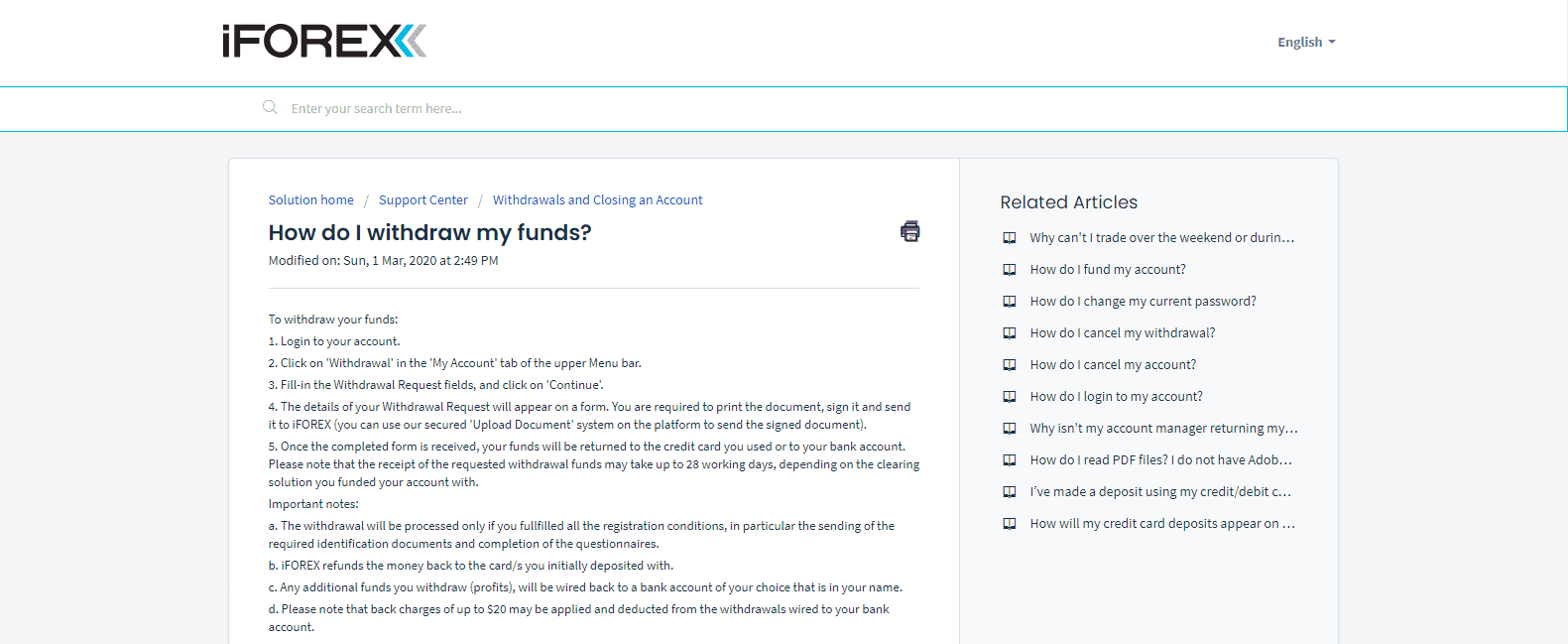

Yes, it does. The British Virgin Islands Financial Services Commission (BVIFSC) regulates Formula Investment House Ltd, the international subsidiary, and the Cyprus Securities and Exchange Commission (CySEC), regulates the European subsidiary, iFOREX Europe. Go to the “My Account” tab on the website and click “Withdrawal”. Fill in the required fields and click “Continue”. Print, sign, and send the form that then pops up. Yes. iFOREX is a regulated and licensed trading brokerage, licensed and supervised by the British Virgin Islands’ Financial Services Commission. They’ve been operating with a clean record in the business since 1996.FAQs

Does iForex offer a demo account?

Where is iForex regulated?

How do I withdraw money from iForex?

Is iForex safe?