FXCM Editor’s Verdict

FXCM remains one of the most competitive choices for traders especially those looking for algorithmic trading solutions. Besides its proprietary Trading Station, FXCM offers MT4 and ZuluTrade. Capitalise AI, its latest addition, allows traders to automate strategies using an intuitive, code-free environment. FXCM also presents six specialty platforms for algorithmic traders and fully supports API trading. FXCM Plus provides clients with quality research, while beginner traders receive valuable educational content. I reviewed FXCM to evaluate if this broker delivers on its client-first, trader-driven mission statement. Does FXCM maintain trading conditions beneficial to traders?

Overview

A competitive choice for algorithmic traders and scalpers

Headquarters | United Kingdom |

|---|---|

Regulators | ASIC, CySEC, FCA, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1999 |

Execution Type(s) | Market Maker, No Dealing Desk |

Minimum Deposit | $50 |

Trading Platform(s) | Other, MetaTrader 4, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.6 pips |

Average Trading Cost GBP/USD | 1.0 pips |

Average Trading Cost WTI Crude Oil | 0.034 pips |

Average Trading Cost Gold | 0.30 pips |

Average Trading Cost Bitcoin | $40 |

Retail Loss Rate | 70.0% |

Minimum Raw Spreads | 0.2 pips |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | $5.00/round lot |

Funding Methods | 12 (Bank wires, Credit/debit, PayPal, Google Pay, Apple Pay, Open Banking, Skrill, Neteller, Klarna, Rapid Transfer, China UnionPay, and Cryptocurrencies) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that FXCM invested heavily into its algorithmic trading environment, and I rank it among the industry leaders in this category.

First Look:

- FXCM is a Leucadia Company owned by US-based and publicly listed financial firm Jefferies Financial Group Inc

- Excellent trading platforms focused on algorithmic trading

- Trading conditions vary between regulatory jurisdictions, and not all traders have identical choices of cost structure

- Quality research and education

- Commission-free equity trading and an expanding asset list

- Dedicated app store and numerous free trading platform upgrades

- VPS hosting and volume-based rebate program

FXCM Forex Trading Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. FXCM presents clients with four well-regulated entities.

Country of the Regulator | New Zealand, Seychelles |

|---|---|

Name of the Regulator | ASIC, CySEC, FCA, FSCA |

Regulatory License Number | 403326, SD045 |

Noteworthy:

- FXCM operates four well-regulated units, is under excellent corporate ownership, and has a reputation to maintain, which is why I am not concerned about the lack of regulation at its St. Vincent and Grenadines subsidiary.

- FXCM Israel, registrar number 515234623, is the latest addition to FXCM, supervised by the Israeli Securities Authority.

- The South African subsidiary offers a similar trading environment but has a capable regulator, while cryptocurrency deposits and welcome bonuses are not available

Reasons I prefer the St. Vincent and Grenadines subsidiary:

- Higher leverage

- Negative balance protection

- Segregation of client deposits from corporate funds

- Cryptocurrency deposits

- Flexible trading conditions

What could be better?

- Third-party insurance or

- Financial Commission membership

- Profiles of core management

Noteworthy:

- The UK subsidiary has an investor compensation fund of up to £85,000

- The CySEC subsidiary offers an investor compensation fund up to 90% or €20,000 of deposits but under less flexible trading conditions

- FXCM as a Leucadia company has a clean regulatory track record

Does FXCM accept US clients?

Yes, FXCM is fully authorized under U.S. law and is registered with both the CFTC and NFA. View other licensed U.S. forex brokers.

FXCM Broker Fees

Average Trading Cost EUR/USD | 0.6 pips |

|---|---|

Average Trading Cost GBP/USD | 1.0 pips |

Average Trading Cost WTI Crude Oil | 0.034 pips |

Average Trading Cost Gold | 0.30 pips |

Average Trading Cost Bitcoin | $40 |

Minimum Raw Spreads | 0.2 pips |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | $5.00/round lot |

Deposit Fee | |

Withdrawal Fee |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

FXCM offers traders a choice between two cost structures:

- Commission-free trading costs average a minimum of 1.2 pips or $12.00 per 1 standard round lot

- Commission-based accounts commence with an average spread of 0.2 pips and a commission of $50 per $1,000,0000 in nominal trading value, comparable to $5.00 per lot

Noteworthy:

- The pricing environments differ, and FXCM deploys a more complex cost structure than many competitors, but equity trading is always commission-free.

- The St. Vincent and Grenadines and South African subsidiaries only offer the commission-free option, where average spreads for the EUR/USD are 1.2 pips.

- The UK subsidiary has a commission-based alternative with average EUR/USD spreads of 0.2 pips for a commission of $5.00 for a total cost of $7.00

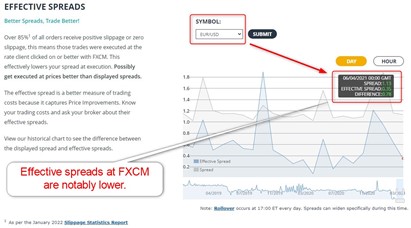

- FXCM deploys a price improvement model, delivering lower effective spreads versus published spreads, allowing traders in the commission-free account to achieve spreads as low as 0.03 pips in the EUR/USD, with an average of 0.7 pips or $7.00, identical to the commission-based alternative

- High-frequency traders at the St. Vincent and Grenadines and the South African subsidiaries receive rebates between $5.00 and $25.00 per $1M in trading volume, or roughly 10.0 standard Forex lots, but the minimum to qualify is $10M or approximately 100 lots.

- The FXCM homepage, irrelevant of the regulatory jurisdiction, displays spreads available for the commission-based accounts, which are notably lower but not available to most international traders

Which pricing environment should Forex traders select?

I recommend the following:

- Most international traders have no choice but to start with the commission-free cost structure, but the price improvement mechanism lowers high visible spreads to effective competitive spreads

- High-frequency traders using algorithmic trading solutions can achieve competitive trading costs at FXCM

Here is a screenshot of the FXCM Trading Station platform during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

What Could Be Better?

- FXCM delivers a highly competitive pricing environment for high-frequency traders using algorithmic trading solutions, but not all traders have access to the same cost structure

FXCM offers floating spreads, but without the price improvement, average ones can be somewhat high. Therefore, traders should consider the trading time to ensure placing most trades during high liquidity times.

The average trading costs for the EUR/USD in the commission-free FXCM account without price improvement:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

1.2 pips | $0.00 | $12.00 |

The average trading costs for the EUR/USD in the commission-free FXCM account with price improvement:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.7 pips | $0.00 | $7.00 |

The average trading costs for the EUR/USD in the commission based FXCM account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.2 pips | $5.00 | $7.00 |

Noteworthy:

- FXCM has a five-tier volume-based rebate program with a minimum monthly trading volume requirement of $10M

- Tier 1 requires a minimum of $10M in nominal monthly trading volume for a rebate of $5 per $1M, lowering trading costs by $0.50 per 1 standard lot

- Tier 2 requires a minimum of $25M in nominal monthly trading volume for a rebate of $10 per $1M, lowering trading costs by $1.00 per 1 standard lot

- Tier 3 requires a minimum of $75M in nominal monthly trading volume for a rebate of $15 per $1M, lowering trading costs by $1.50 per 1 standard lot

- Tier 4 requires a minimum of $200M in nominal monthly trading volume for a rebate of $20 per $1M, lowering trading costs by $2.00 per 1 standard lot

- Tier 5 requires a minimum of $400M in nominal monthly trading volume for a rebate of $25 per $1M, lowering trading costs by $2.50 per 1 standard lot

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- FXCM offers a positive swap on qualifying short positions, meaning traders can get paid money to hold trades overnight

- While swap rates on buy orders are higher than at several competing brokers, FXCM offers generous rates on short positions

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free FXCM account with and without the average price improvement excluding rebates.

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the average spread without the average price improvement, and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

1.2 pips | $0.00 | -$6.00 | X | $18.00 |

1.2 pips | $0.00 | X | $2.00 | $10.00 |

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the average spread without the average price improvement, and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

1.2 pips | $0.00 | -$42.00 | X | $54.00 |

1.2 pips | $0.00 | X | $14.00 | -$2.00 |

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the average spread with the average price improvement, and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.7 pips | $0.00 | -$6.00 | X | $13.00 |

0.7 pips | $0.00 | X | $2.00 | $5.00 |

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the average spread with the average price improvement, and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.7 pips | $0.00 | -$42.00 | X | $49.00 |

0.7 pips | $0.00 | X | $14.00 | -$7.00 |

My additional comments concerning trading costs at FXCM:

- Short sellers in qualifying assets can earn money for holding trades, discounting moves in price action, offering long-short portfolios a notable cost advantage, and lowering final overall trading costs

- FXCM levies a $50 annual inactivity fee after twelve months

- Currency conversion fees range between 0.10% and 1.50%, dependent on the size, with most traders paying an excessive 1.50% for volumes below $10,000

What Can You Trade On FXCM?

The asset selection at FXCM remains somewhat limited but sufficient for trading strategies requiring fewer highly liquid assets. It is unfortunate there is not a wider choice of Forex currency pairs as the infrastructure implemented by FXCM provides excellent trading conditions.

What is missing?

- I would prefer a wider offering of currency pairs and cryptocurrencies

- Equity CFDs remain limited to large-cap names, skipping mid-cap and small-cap stocks

- ETFs are missing, but FXCM offers almost 20 thematic equity baskets which can fulfil a similar role

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

FXCM Leverage And Margins

Retail traders at the St. Vincent and Grenadines and the South African subsidiaries get maximum Forex leverage of 1:400, ideal for committed traders, increasing trading flexibility and profit potential. The other three operating subsidiaries limit retail Forex leverage to 1:30, the legal limit for retail traders in these places.

Other things I want to note about FXCM leverage:

- Negative balance protection exists, ensuring traders never lose more than their deposit

- Some assets have lower maximum leverage, which FXCM lists on its website

FXCM Trading Hours (GMT Server Time)

Asset Class | From | To |

|---|---|---|

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:00 | Friday 24:00 |

Metals | Monday 01:00 | Friday 24:00 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 13:30 | Friday 20:00 |

Stocks (non-CFDs) | Monday 13:30 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex or cryptocurrencies

- FXCM does not offer 24/7 cryptocurrency trading, but crypto runs on identical times to the Forex market.

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

FXCM Account Types

FXCM caters to most traders from its CFD account type, with the primary difference being by regulatory jurisdiction.

My observations concerning the FXCM account types:

- Most retail traders will manage their portfolios in the commission-free account at either the St. Vincent and Grenadines or the South African subsidiary.

- The minimum deposit is $50 or a currency equivalent

- UK based traders can take advantage of the Spread Betting account, featuring tax-free trading

- High-volume traders qualify for a rebate program, lowering final trading costs

- Various assets have a different margin requirement, impacting leverage, but FXCM maintains a detailed list

- FXCM caters to institutional clients through its prime brokerage unit labeled FXCM Pro

FXCM Demo Account

FXCM offers demo accounts for its Trading Station and MT4. I could not find any time limitations on these accounts which is excellent, making them ideal for testing algorithmic trading solutions and new strategies. I want to caution beginner traders against using a demo account as a full educational tool. It can create unrealistic trading expectations, and the absence of trading psychology negates the educational value. Although it can be helpful, new traders should complete their education with a real money account before becoming overly confident.

My recommendation:

- MT4 offer flexible deposits, and traders should select a nominal account size similar to what they plan to deposit in their eventual live trading account

FXCM Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

FXCM maintains an excellent choice of trading platforms with a distinct focus on algorithmic trading. Besides MT4, traders may use the proprietary Trading Station. Social traders may connect to ZuluTrade, and FXCM offers services by TradingView Pro free of charge for one year to all new clients. Trading Station is equipped with a charting package, intensive support for automated trading solutions, advanced indicators, and market data provided free of charge.

I like the six specialty trading platforms for advanced algorithmic traders, while Capitalise AI presents a market-leading approach offering traders a code-free environment to create automated trading solutions.

Third-party plugins are available in the FXCM Apps Store. They offer traders the possibility to customize trading platforms, and FXCM offers 35 free plugins.

Unique Features

FXCM is fully committed to automated trading solutions, professional traders, and institutional clients. FXCM provides four free API solutions for traders across the spectrum to develop automated trading solutions that communicate directly with the FXCM trading server. The fast order executions and deep liquidity further support demanding trading requirements.

The FXCM Python package is offered exclusively for the REST API and consists of CFD Python wrappers to simplify algorithmic trading solutions. This broker also provides market data, further supporting third-party automated trading solutions. Entry-level data is free of charge, while premium data comes at a (reasonable) price.

Automated trading solutions often require a VPS service to operate effectively around the clock. FXCM offers two VPS solutions, charged at $30 or a currency equivalent per month. Traders who exceed $500K notional trading volume for three consecutive months will get the fee reimbursed.

A broad range of free and paid plugins for all trading platforms are hosted by this brokerage, completing the extensive support for automated trading solutions from retail accounts through professional traders to asset management firms. FXCM provides a great example of how to enrich your offerings and is truly a leader in this sector.

Research and Education

Since FXCM houses a prime brokerage unit, research and education are available for all clients. Besides an incredibly detailed economic calendar and third-party market news, FXCM Plus provides traders with exclusive trading signals free of charge for all live account holders. The Market Scanner allows traders to select a series of technical indicators and returns buy and sell recommendations based on the input. FXCM also added services by FinTech firm eFXplus, featuring simulation and Forex trading recommendations by sell-side analysts from major banks, Quant models, and insights. Traders must trade 5.0 standard lots monthly for free access.

Education exists via free online forex trading courses, webinars hosted by FXCM Senior Market Specialist Russel Shor, and written content with exceptional quality. The Trading Guides provide more detailed educational content, and new traders get considerable material to deepen their knowledge base. FXCM is conducting research and education seriously while executing them well.

My takeaways:

- FXCM Plus presents excellent research and quality trading tools

- Beginner traders have access to a high-quality educational section

My recommendations:

- Traders can evaluate the copy trading feature embedded in MT4 and ZuluTrade

- MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style

- The FXCM Apps Store has numerous indicators and strategies

- Traders can also access free research available online and seek educational material to supplement the quality material available at FXCM

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

FXCM provides 24/5 customer support, but traders should access the help center before contacting support, as it covers the most common topics.

Should traders require assistance, they may call the toll-free numbers provided, use messaging app WhatsApp, e-mail the support team, engage via live chat, or contact the trading desk. The extensive support system in place is superior to most competitors, but very few traders will be likely to ever require it.

My recommendations and observations:

- Traders should read the FAQ section before reaching out to a customer service representative

- For non-urgent questions, I recommend live chat

- FXCM has a trading desk but no dedicated finance department hotline

Bonuses and Promotions

FXCM offers a refer-a-friend bonus consisting of two tiers. For deposits between $300 and $4,999, the referrer gets a $100 bonus, which doubles to $200 for deposits from $5,000. The referee must trade 200 or 500 contracts, respectively, within 90 days, making it a challenging low-payout bonus to receive. Only the St. Vincent and Grenadines subsidiary offers bonuses. I recommend traders read and understand the terms and conditions before accepting incentives.

Awards

Since 2010, FXCM has received 35 industry awards from well-respected sources. It confirms their commitment to continue investing and improving their trading environment and maintaining a competitive edge for its clients.

Among the most notable 62 awards are:

- Money Am 2010 - Online Finance Awards - Winner Best Online FX Broker

- FX Street 2010 - Best Sell-Side Analysis Contributor

- FX Street 2011 - Best Broker Research Team

- Forex Magnates 2012 - Best Proprietary FX Platform

- Investment Trends 2012 - Largest Forex Provider

- Forex Magnates London Summit Award 2013 - Winner Best Retail Broker Execution

- Money Am 2013 - Best Online FX Provider

- UK Forex Awards 2015 - Best Forex Trading Automation

- FX Street 2015 - Best Sell-Side Analysis Contributor

- FX Empire 2017 - FXCM - Best Customer Support

- Global Forex Awards 2020 - Best Forex Trading Platform - Global

- Personal Wealth 2020 - Best Education

- Shares Awards 2020 - Best Trading Tools and Research

- Ultimate Fintech Awards 2021 - Broker of The Year

- Shares Awards 2021 - Best Forex Trading Platform

- ADVFN International Financial Awards 2021 - Best Zero Commission Broker

Opening an Account

A simple online application form handles new account applications. New traders go through a quick three-step account application process at FXCM, including account verification. Most traders will easily satisfy it by sending a copy of their ID and one proof of residency document, satisfying regulatory KYC/AML requirements.

FXCM Minimum Deposit

The minimum deposit at FXCM is only $50 or a currency equivalent.

Payment Methods

FXCM offers a choice of payment methods consisting of Bank wires, Credit/debit, PayPal, Google Pay, Apple Pay, Open Banking, Skrill, Neteller, Klarna, Rapid Transfer, China UnionPay, and Cryptocurrencies. Only the St. Vincent and Grenadines subsidiary supports them all, while other branches offer have fewer options.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

FXCM caters to most international traders, including residents of UK, Australia, South Africa, and Malaysia. Like most international brokers, FXCM does not accept US traders.

Deposits and Withdrawals

All financial transactions occur in the secure back office of FXCM, MyFXCM. The deposit and withdrawal options offered by the St. Vincent and Grenadines subsidiary are the best, while others offer limited choices.

My observations:

- There are no deposit fees, but third-party withdrawal costs may apply, except for bank wires, where FXCM levies a charge between $25 and $40

- FXCM delivers the best payment options through its St. Vincent and Grenadines subsidiary.

- Traders may request withdrawals swiftly from their back office, and FXCM processes requests within two business days

- Costs and processing times depend on the payment processor

- FXCM supports broker-to-broker transfers

- Unfortunately, the currency conversion fee is a bit high, with most traders paying a 150-pip mark-up

- The minimum deposit is $50, but no minimum withdrawal amount is stated

My recommendations:

- Traders should select the payment processor with the lowest fees

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

The Bottom Line

I like the trading environment at FXCM, especially for high-volume traders using algorithmic trading solutions. FXCM is a very well-regulated global Forex broker with a large client base and a big reputation to maintain. All trading platforms fully support algorithmic trading, and FXCM provides four free APIs to developers on top of a wide selection of third-party plugins. The research section offers a tremendous asset to all traders and warrants an account opening to retrieve free access to it. Education is also taken very seriously with daily webinars and an excellent selection of very well-written content. FXCM ranks among the most competitive brokers industry-wide, especially for high-volume traders using algorithmic trading solutions. FXCM processes withdrawal requests within two business days. London, UK, is the location of the FXCM headquarters. FXCM earns money primarily from spreads and commissions. FXCM offers bank wires, credit/debit cards, Skrill, Neteller, UnionPay, and cryptocurrencies. Only the Bermuda subsidiary supports them, while all others have fewer options. The minimum transaction size for currencies is 0.01 lots and 1 lot for CFD contracts. A margin call is issued when the equity margin level contracts below 50%. The UK Financial Conduct Authority (FCA) is the primary regulator of FXCM under license number 217689. Additional regulation exists in Cyprus by the CySEC, in Australia by the ASIC, and in South Africa by the FSCA. Retail clients have access to maximum leverage of 1:400 at the Bermuda and the South African subsidiaries, while FXCM limits it to 1:30 elsewhere. FXCM has an online application form, which is the standard operating procedure. FXCM provides traders with its proprietary Trading Station, the MT4 trading platform and ZuluTrade. It also maintains six specialty trading platforms for algorithmic traders and Capitalise AI. For credit cards or debit card, there are no withdrawal fees, but third-party providers or banks may cost up to 40$. The minimum deposit is $50 or a currency equivalent FXCM levies a $50 annual inactivity fee after twelve monthsFAQs

Is FXCM a good broker?

How long does it take to withdraw money from FXCM?

Where is FXCM based?

How does FXCM make money?

How can I deposit into an FXCM account?

What is the minimum lot size at FXCM?

When does a margin call take place at FXCM?

Is FXCM regulated?

What is the maximum leverage offered by FXCM?

How do I open an account with FXCM?

What trading platforms does FXCM offer?

FXCM withdrawal fees

What is the minimum deposit for FXCM?

When will I be charged the inactivity fee?