Editor’s Verdict

FundingPips is a Dubai-based proprietary trading firm founded by Khaled Ayesh in 2020. Known for its innovative tech-first approach and trader-centric evaluation structure, the firm has quickly gained popularity within the prop trading community. With a simple challenge model, instant funding for experienced traders via its Zero program, and rapid withdrawals, it aims to position itself as a market leader for modern traders looking for transparency and freedom.

The Pros & Cons of FundingPips

Traders should consider the pros and cons of FundingPips as a proprietary trading firm.

Here is a brief summary of some key benefits and potential drawbacks I discovered during my in-depth FundingPips prop firm review.

Overview

FundingPips has low evaluation fees and scales portfolios up to $2M with a 100% profit share for traders that reach the Hot Seat (Elite trader) level.

Headquarters | United Arab Emirates |

|---|---|

Year Established | 2020 |

Trading Platform(s) | Other, MetaTrader 5, cTrader |

Minimum Evaluation Fee | $29 |

Profit-share | 80% - 100% |

Daily Loss Limit | 3% - 5% |

Maximum Trailing Drawdown | 5% - 10% |

Funded Account Options | 4 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $100,000 |

FundingPips stands out for its efforts to be trader-focused, with a “built by traders for traders” approach. This can be seen in the simplicity of its model and its low-cost entry to the evaluation stage, with $29 for a 5k account size, as the lowest entry. I also like that there are no time limits on challenges or trading method restrictions.

FundingPips Trustworthiness & Reputation

Because prop firms are unregulated entities, traders engaging with them need to be especially diligent in verifying that their chosen provider is reputable and has a well-established reputation for security and fairness when it comes to payouts.

Is FundingPips Legit and Safe?

FundingPips operates under the name "FP Funding LLC" and is headquartered in Dubai. It has rapidly gained popularity for its transparency and favourable trading conditions. As of 2025, it boasts a 4.5-star Trustpilot rating based on over 23k reviews.

Payout reviews are mainly positive, with many highlighting the speed of the withdrawal process (usually within 48 hours).

The firm’s community engagement, through its Discord channel with 163k members and regular updates, reinforces its image as a trader-first operation. Unlike many prop firms, FundingPips allows the use of Expert Advisers (EAs), bots, and other trading automations, which is a major plus for quant-style traders. The firm also boasts 3 ISO accreditations. FundingPips has an average rating on TrustPilot of 4.5 out of 5, with over 35,000 verified reviews.

FundingPips Features

FundingPips follows the best practices established across the prop firm industry, which has continued its rapid expansion.

The most notable features of FundingPips are:

- One-phase evaluation (also called "1-step challenge")

- Evaluation accounts from $5k to $200k

- No time limit to reach profit targets

- Profit target: 10%

- Maximum daily drawdown: 5%

- Maximum total drawdown: 10% (static)

- 80% profit split (can go up to 90% with scaling)

- Instant funding option for qualified traders

- Evaluation fee refunded upon first payout

- Crypto and credit card deposit methods

- API trading, EAs, and bots permitted

- The dashboard includes analytics, payout history, and trading metrics

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $29 |

|---|---|

Maximum Evaluation Fee | $499 |

Profit-share | 80% - 100% |

FundingPips evaluation fees are competitive and start at $29 for a $5k account, making it one of the more affordable firms with which to start prop trading. All fees are one-time charges and are refundable once the challenge phase has been completed, upon the first profit split payout.

Examples for the 2-step challenge:

Account Size | One-Time Evaluation Fee |

|---|---|

$5,000 | $55 |

$10,000 | $88 |

$50,000 | $235 |

$100,000 | $400 |

Traders who pass both the challenge steps get to keep 80% of the profits, with scaling paths that allow them to further increase this percentage if they achieve Elite trader status.

The minimum evaluation fees at FundingPips for a $5,000 account are:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $29 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | Swap rates apply per instrument |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $29 |

Account Types

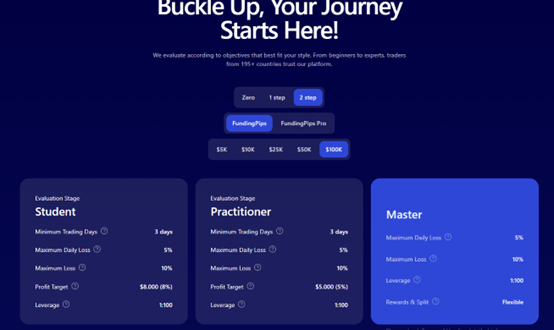

FundingPips offers four different evaluation options.

Two-step Evaluation:

The phase-1 profit target is 8%, and the phase-2 target is 5%. Drawdown stops are at 5% daily and 10% in total. Minimum trading days are 3 days per phase, and the profit split is 80%.

Two-step Pro Evaluation:

The profit target is 6% in both phases, drawdown limits are 3% daily and 6% in total

The profit split starts at 80%, and this option has no time limit.

One Step Evaluation:

The profit target is 10%, drawdown stops at 5% daily and 10% in total

There are 3 minimum trading days, and the profit split is up to 100%.

Zero Program:

This option lets traders skip the evaluation and offers an instant funding profit split of 95%. Drawdown limits are 5% daily and 10% in total.

Traders can choose between three platform types, the leverage available is the same, and some of the specific trading rules will differ depending on the account option selected and the progress through the distinct phases.

What Are the Trading Rules at FundingPips?

The FundingPips evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. FundingPips does not list a maximum time limit but requires a minimum of three profitable trading days for the one and two-step evaluation options (excluding the pro-option, which is 1 day). The profit target, daily drawdown, and maximum drawdown equally depend on the evaluation type selected.

Violating the maximum overall loss rule results in a hard breach of the rules and cancellation of the evaluation phase. Inactivity for more than 30 days also results in a breach of the terms and termination of the trading challenge.

The trading rules for the most popular FundingPips two-step evaluation are:

- 3% maximum daily loss from the starting balance

- 6% maximum static loss permitted, based on both balance and equity

- A required minimum of three profitable trading days for each phase of the two-step evaluation

- Trades are subject to a maximum lot size permitted. There is no consistency rule until you enter the funded stage, having passed the evaluation phases. Once traders have done so, the maximum daily profit permitted is 45% of account value.

Noteworthy:

- FundingPips will not permit weekend and news trading in funded (Master) accounts

- Prohibited strategies include high-frequency trading and latency arbitrage

- Regardless of the stage or the type of trading account, only demo or simulated trading is performed. No live trading occurs or allocation of actual funds, but traders can still earn profits based on their performance

- FundingPips Pro is an option offering the 2-step challenge but with 1 minimum trading day and reduced permitted losses, making it harder to pass the challenge. This also reduces the fee slightly

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

FundingPips offers 3 platforms for traders, Metatrader 5 (MT5) was added in 2025, as well as Ctrader (which incurs a surcharge of $20), and Match-Trader. All platforms can be used for either account type and offer mobile as well as desktop access.

Education

Whilst FundingPips does not offer an official training academy, the company has an active blog covering the basics for less experienced traders, introducing them to the fundamentals of trading, and providing useful step-by-step guides. It discusses various trading strategies, explores how to deploy leverage, offers guidance on trading psychology, and provides specific trading platform guides. The firm also delivers webinars that cover some of these subjects, and there is an active Discord community where traders can share information and updates. External courses are also mentioned, such as the free Babypips School of Pipsology

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24 hours a day 7 days |

Website Languages |   |

During my FundingPips review, I noticed a 24/7 live chat support function that worked well. There is also a detailed FAQ in the FundingPips help center where you can search for articles on almost any topic. The Discord channel and community are also a good source of support, although caution is required when relying on third-party answers, so it's best to check with the help center. Support is available in multiple languages.

How to Get Started with FundingPips

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at FundingPips is $29 for the $5,000 account and the two-step evaluation process. In contrast, a $100k account is $399.

Master Account KYC

Upon successfully passing one of the challenges, traders will qualify for a Master account and profit share. For this to be approved by FundingPips, traders will need to complete a KYC verification process - a mandatory step that usually requires proof of ID, with a passport or government-issued identification document, plus proof of address. Only one verified account per trader is allowed.

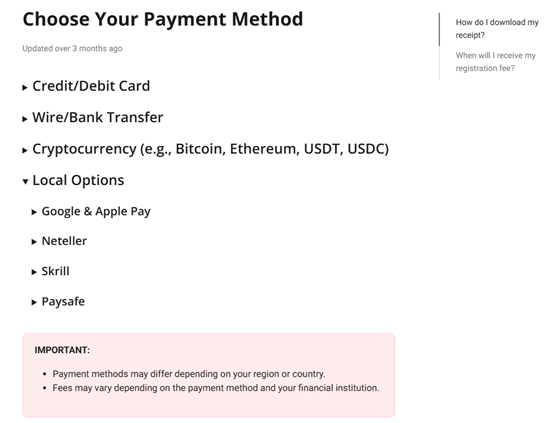

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

FundingPips accepts credit/debit cards and cryptocurrency payments as well as bank transfers and popular E-wallets (e.g., Neteller, Skrill).

Accepted Countries

FundingPips accepts most traders who are 18 years or older. It lists 195 accepted countries, including most European countries. Notably, the firm explicitly states it does not permit US-based customers to use its services and lists several other countries, generally those under sanctions or those that limit FX trading, as ineligible. Residents of Afghanistan, Burundi, Central African Republic, Cuba, Republic of the Congo, Democratic Republic of the Congo, Crimea region of Ukraine, Eritrea, Guinea, Guinea-Bissau, Iraq, Iran, Israel, Laos, Liberia, Libya, Myanmar (Burma), North Korea, Palestinian Territories, Papua New Guinea, Somalia, South Sudan, Sudan, Syria, Vanuatu, Venezuela, Vietnam, and Yemen are prohibited from accessing FundingPips services. This includes both evaluation and funded accounts.

How to Pay the Evaluation Fee

- Cryptocurrencies (e.g., Bitcoin, Ethereum, USDT)

- Bank transfers

- Credit/Debit cards

- E-wallets (e.g., Neteller, Skrill)

Bottom Line - Is FundingPips a Good Prop Firm?

I like FundingPips for its low evaluation fees and the option for a one-step challenge phase. I also like the fact that the firm offers three good platform choices, including MT5. Generally, the public reviews and trader feedback are good. The firm does not impose consistency rules during the evaluation stages, uses static (not trailing) drawdowns, and permits EAs, bots, and automated strategies, which give traders considerable freedom. US traders cannot use FundingPips. Forex, metals, indices, energies, and crypto can all be traded with raw spreads. While crypto, indices, and oil are commission-free, Forex and metals have a per-lot commission that varies depending on the chosen model. Leverage also depends on the selected model. The minimum evaluation fee at FundingPips is $29, one of the lowest. FundingPips is a legitimate company registered in Dubai and ranks among the longest-operating retail prop firms within the industry. Due to its unregulated status and reported transparency issues, it is crucial to thoroughly read and understand all terms and conditions and consider starting with smaller evaluations to gauge the firm's operations firsthand. FundingPips is a well-established retail prop firm that offers paid challenges for access to demo accounts only, which pay real cash to qualifying traders. FundingPips has a profit share between 80% and 100%.FAQs

What trading instrument can I trade at FundingPips?

What is the evaluation fee at FundingPips?

Is FundingPips legit?

What is FundingPips?

What is the profit share at FundingPips?