Editor’s Verdict

Funder Pro is a Maltese firm owned by the Red Acre family office. The prop business has been running since 2023 and is in the top three in terms of size. The firm has developed its own proprietary trading platform and supporting challenge-engine technology. It has also white-labelled this technology to other prop trading companies.

Overview

Funder Pro has a low starting evaluation fee for a 5k account, the options are not too complicated, and the profit share is a standard 80% across all challenges.

Headquarters | Malta |

|---|---|

Year Established | 2023 |

Trading Platform(s) | Other, cTrader |

Minimum Evaluation Fee | $79 |

Profit-share | 80% |

Daily Loss Limit | 4% to 5% |

Maximum Trailing Drawdown | 7% to 10% |

Funded Account Options | 7 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $200,000 |

I like the fact that Funder Pro offers a simple, straightforward approach to its challenges. It appears to allow most types of trading methods and doesn’t impose a time limit for completing its challenges. The knowledge base and FAQs are also very comprehensive compared to competitors, and serious traders will appreciate the level of detail it offers.

Funder Pro Trustworthiness & Reputation

Because prop firms are unregulated entities, traders engaging with them need to be especially diligent in verifying that their chosen provider is reputable and has a well-established reputation for security and fairness when it comes to payouts.

Is Funder Pro Legit and Safe?

Funder Pro started offering trading challenges in 2023, and it is considered one of the most popular prop firms operating today.

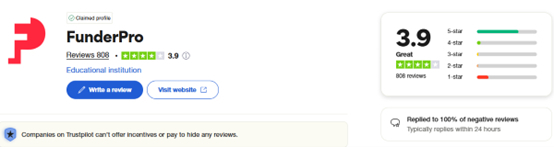

Funder Pro reviews show that the firm scores 3.9 /5 with 800 reviews on TrustPilot, and 3.3/5 with 26 reviews for its Google profile. The reviews mention that payouts are timely and that the support is good. On the negative side, some traders complain about the trading terms and slippage. The firm does seem to engage with poor reviews, however, and asks for detailed feedback, which I took as a positive sign.

Funder Pro Features

I have listed some of the key features of the Funder Pro prop trading service below:

- All challenges require passing an evaluation stage

- Traders can choose between a one-step and a two-step evaluation

- An evaluation target of 14% is required to pass the one-step phase

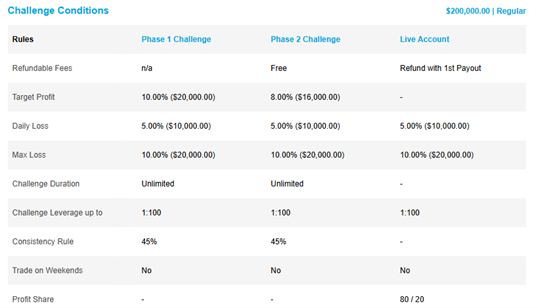

- A profit target of 10%, then 8% on the two-phase challenge, is required to get to the live account

- A maximum daily drawdown of 4% is permitted for the one-step evaluation, and 5% for the two-step evaluation

- A maximum drawdown of 7% is allowed for the one-step evaluation, and 10% for the two-step evaluation

- No time limit is applied to the trading challenge phase

- A profit share of 80% applies to all account types

- Cryptocurrency deposits and withdrawals are supported

- Trading platforms support API connectivity, and there appear to be no strategy restrictions

- Up to $200k funded accounts are allowed per trader

- Evaluation fees are low, from $79, and they are refunded with the first live account payout

- Traders must adhere to consistency rules to avoid single, large position trades - the rule states that the profits on any trading day cannot exceed a certain percentage

- Live accounts can scale to 5m USD

- The firm also offers prop futures trading in addition to its core offering

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $79 |

|---|---|

Maximum Evaluation Fee | $1,099 |

Profit-share | 80% |

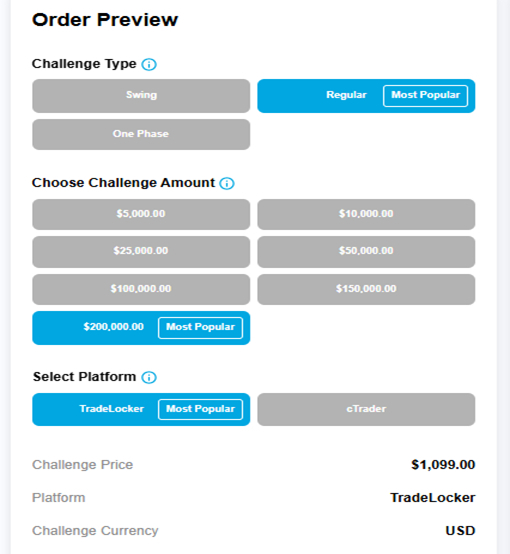

Funder Pro charges an initial challenge fee based on the desired account size. This fee starts at $79 (USD is the challenge currency). Leverage is a maximum of 100:1 for the “Regular” challenge type.

Please note that traders cannot change the account value once approved. Therefore, if they qualify for a $10,000 account, they will manage a $10,000 portfolio. The profit share is 80% if the trader reaches the live account stage. The initial challenge fee is refunded with the first payout. The firm states that it offers 0% commission on trades. Available instruments include Forex, crypto, metals and indices.

The minimum evaluation fee at Funder Pro for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $79 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | Not applicable |

Increased leverage | Not applicable |

Entering a trade without a stop-loss | Not applicable |

Total fees for a $5,000 account | $79 |

Account Types

Funder Pro Traders can choose from 3 challenge types – “Swing”, “Regular”, and “One Phase”. There are 7 options for the challenge amount, ranging from 5k to 200k (USD). Challenge amounts are as follows, 5k, 10k, 25k, 50k, 100k, 150k, 200k.

The different account types have the same permitted leverage ratios, but some of the rules will differ, such as the maximum drawdown and daily drawdown allowed. The “Swing” challenge option is slightly more expensive, with a maximum leverage allowed of 30:1, and 0.5 lots as the maximum trade size.

Two platform choices are also available - TradeLocker (a proprietary platform) and CTrader.

What Are the Trading Rules at Funder Pro?

The Funder Pro evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee.

Funder Pro does not have a time limit on passing its challenge phases, but traders are required to trade a minimum amount per month. There is also a consistency rule, which determines the maximum profit allowed on any single trading day. This is to prevent large one-sided bets and to encourage a more balanced trading methodology. The trader must hit a profit target to progress to step two or the live account. The maximum permitted drawdowns per day and overall will vary slightly depending on the chosen challenge.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation.

The trading rules for the Funder Pro “Regular” evaluation are:

- 7% maximum loss from the starting balance for the one-step challenge

- 10% maximum loss for the two-step evaluation

- a 45% consistency rule, i.e., a limit of 45% profit (of the account value) on any single trading day

- a 4% daily loss limit for the one-step, and a 5% daily loss limit for the two-step evaluation

Noteworthy:

- Funder Pro says it grants access to live trading accounts.

- The firm states that different trading methodologies are allowed, including API trading.

- There are some rules in the terms and conditions traders should be aware of such as limitations on news trading and no high frequency trading (HFT).

- The permitted drawdown is static, not trailing.

- The website mentions you can scale the funded account up to 5m (USD).

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Funder Pro offers two trading platforms - its proprietary TradeLocker (TL) platform and Ctrader.

There is detailed support available in the knowledge base for how to use the TL platform.

Education

Whilst Funder Pro does not offer a trading academy, it does offer a significant amount of information and tools for traders. The knowledge base covers all the specifics around the trading challenge, answering common questions. For those opting to use the firm’s TradeLocker platform, there is a detailed guide to using the system. Traders also have access to a community blog and a Discord channel. There is also an economic calendar. Other tools are available from the FunderPro lab, which are free for registered users and offer data-driven analysis and signals.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24 hours a day 7 days |

Website Languages |    |

During my Funder Pro review, I chatted with the online chatbot, which offered an option to connect to a live agent. The firm states its support is 24/7 and seems to support English, Spanish, and Arabic. You can also email the form or create a support ticket but there does not appear to be a phone number for customer support.

How to Get Started with Funder Pro

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at Funder Pro is $79 for the $5,000 account and the two-step evaluation process.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |     |

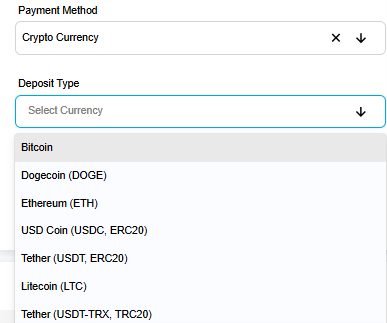

Funder Pro accepts credit cards, bank transfers, Paypal and cryptocurrency payments.

Accepted Countries

Residents of almost all countries are accepted, including the US. Exceptions are noted below:

“Funder Pro accepts most traders who are 18 years or older. Funder Pro does not accept traders from Afghanistan, Belarus, the Central African Republic, Congo (the Democratic Republic of), Cuba, Haiti, Iran, Iraq, Libya, Mali, Myanmar (Burma), North Korea, Somalia, Sudan, Syria, the Russian Federation, the Donetsk Region of Ukraine, the Zaporizhzhia Region of Ukraine, the Luhansk Region of Ukraine, the Kherson Region of Ukraine, the Crimea Region of Ukraine, the Sevastopol Region of Ukraine, Venezuela, and Yemen.”

How to Pay the Evaluation Fee

Prop traders can pay their evaluation fee via bank wires, credit cards, Paypal, and selected cryptocurrencies.

Bottom Line - Is Funder Pro a Good Prop Firm?

Funder Pro has a comprehensive prop trade offering. I like the wide range of instruments you can trade, plus the option to trade futures separately. The account selections are straightforward, and the rules are not too complicated, while the profit share is in line with other market competitors. The TradeLocker platform is good, and the client dashboard area is clear. Supporting information in the knowledge hub and customer service accessibility are additional advantages. Overall, it is a solid option for prop traders that looks to be constantly improving and innovating. The minimum evaluation fee at Funder Pro is $79. Funder Pro is a legitimate company registered in Malta, and it ranks amongst the most popular operating retail prop firms in the industry. Funder Pro is one of the most established retail prop firms, offering paid challenges for access to live accounts that pay real cash to qualifying traders. Funder Pro has a profit share of 80%.FAQs

What is the evaluation fee at Funder Pro?

Is Funder Pro legit?

What is Funder Pro?

What is the profit share at Funder Pro?