Editor’s Verdict

FTUK is a US-based prop firm offering scaling plans for all accounts. Traders can customize their accounts with four add-ons, trade on three trading platforms, and scale their portfolios to $6.4M with an 80% profit split. Traders can participate in a free trial or decide to get instant funding. My in-depth FTUK review evaluated its trading conditions. Should you pay for an evaluation at FTUK?

Overview

FTUK offers instant funding and scalable portfolios up to $6.4M.

Headquarters | United States |

|---|---|

Year Established | 2021 |

Trading Platform(s) | Other, DX Trade |

Minimum Evaluation Fee | $99 |

Profit-share | 50% to 80% |

Daily Loss Limit | 4% to 6% |

Maximum Trailing Drawdown | 6% to 10% |

Funded Account Options | 5 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $100,000 |

I like that FTUK offers three trading platforms, but the 14-day free trial is useless, as it does not result in a challenge for a funded account. The best feature is the instant funding option, which includes a small $5,000 portfolio, but the costs rank among the highest industry-wide. The profit share starts at 50%, and traders must meet scaling requirements six times to increase it to 80%, which is unacceptable.

FTUK Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles the account and that the prop firm is reputable.

Is FTUK Legit and Safe?

FTUK, founded in 2021, has a 4.0 out of 5.0 rating on Trustpilot based on 580 reviews.

My FTUK review found several negative reviews about account breaches and withdrawals, but I could not verify them. I advise traders to consider the negative comments sceptically, as they could come from traders who have failed or breached trading rules in funded accounts. So, I cautiously rate FTUK as a prop trading firm interested traders might try to establish a rapport with.

FTUK Features

FTUK follows best practices established across the prop firm industry, which continued its rapid expansion.

The most notable features of FTUK are:

- One-step, two-step evaluation, and instant funding

- A minimum of three trading days for the one-step challenge and three days for the two-step alternative

- A profit target of 10% for the one-step evaluation

- A profit target of 10% and 5% for the two-step evaluation

- A maximum daily drawdown between 4% and 5%

- A trailing drawdown of 8% for the one-step evaluation

- A static drawdown of 10% and 5% for the two-step evaluation

- A maximum profit share of 80% after scaling six times

- Cryptocurrency withdrawals

- Three trading platform choices

- Up to $6.4M funded accounts per trader

- Weekly payouts and news trading via paid-for add-ons

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $99 |

|---|---|

Maximum Evaluation Fee | $1,499 |

Profit-share | 50% to 80% |

FTUK levies a one-time evaluation fee dependent on the client’s desired funded account size and evaluation type. Traders can also purchase add-ons to increase their payout frequency to weekly, enable news trading, and unlock scaling level 7.

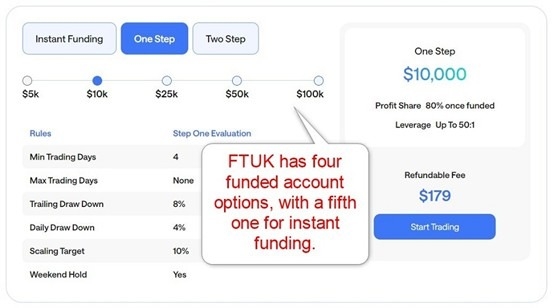

Prospective retail traders have four funding options: one-step and two-step evaluations with fees, without add-ons, ranging between $99 and $649, and five for instant funding, without add-ons, between $119 and $1,499. Please note that traders cannot change the selected account value once it is confirmed, meaning if they qualify for a $10,000 account, they will manage a $10,000 portfolio.

The profit share starts at 50% at Level 1 and scales to 60% at Level 2, 70% at Level 4, and 80% at Level 6.

The minimum evaluation fee at FTUK for a $10,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $179 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $10,000 account | $179 ($205.85 with weekly payouts, $241.65 with news trading, and $259.55 with scaling Level 7) |

Account Types

FTUK offers four funding options for the one-step and two-step evaluations and five for instant funding. Prop traders can choose account types of $10,000, $25,000, $50,000, and $100,000. The instant funding option includes a $5,000 account. Prop traders can scale portfolios up to $6.4M. The maximum leverage starts at 1:10 at Level 1, increases to 1:20 at Level 2, 1:30 at Level 4, and 1:50 at Level 6.

The maximum daily drawdown is 4% for the one-step evaluation, 5% for the two-step alternative, and 6% for instant funding. Instant funding has a maximum trailing drawdown of 6% and 8% for the one-step evaluation, while the two-step alternative has a static maximum drawdown of 10% and 5%. Weekend holding is allowed on all accounts.

What are the Trading Rules at FTUK?

The FTUK evaluation starts when prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. FTUK does not list a maximum time limit but requires a minimum of three to four trading days per evaluation, depending on the evaluation type. The profit target, daily drawdown, and maximum drawdown also depend on the evaluation type.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation.

The trading rules for the FTUK evaluation are:

- 6% maximum trailing loss from the starting balance for instant funding

- 8% maximum trailing loss from the starting balance for the one-step evaluation

- 10% and 5% static maximum trailing loss from the starting balance for the two-step evaluation

- 4% daily loss limit for the one-step evaluation, 5% daily loss limit for the two-step and instant funding alternatives

- A minimum of four trading days for the one-step evaluation and three days for the two-step option

Noteworthy:

- FTUK will not grant access to live trading accounts

- Accepted prop traders will manage demo accounts, and the FTUK software may duplicate them in live trading accounts of FTUK managed by professional traders

- It enhances risk management and compliance for FTUK

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Traders can manage their demo prop accounts using TradeLocker, DXtrade, and Match Trader. FTUK provides demo logins for all three trading platforms, allowing traders to evaluate the trading infrastructure and spreads.

Education

FTUK does not offer education, and beginner traders should never consider prop trading. I appreciate the absence of tools to encourage beginners to attempt prop trading, but the in-house blog features content that can help interested prop traders.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

During my FTUK review, live chat was available 24/7, while the FTUK office hours are Monday through Friday from 09:00 to 18:00 HMY. I recommend the FAQ section as the first point of support interaction, as it answers many questions. I am missing a direct line to the finance department, where most issues could arise.

How to Get Started with FTUK

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at FTUK is $99 for the $10,000 account and the two-step evaluation process.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |    |

FTUK accepts credit/debit cards and cryptocurrency payments.

Accepted Countries

FTUK claims it has traders from 133 countries, but its homepage footer notes: “Democratic People’s Republic of Korea, Russia, Vietnam, Democratic Republic of Congo, Iran, Libya, Somalia, South Sudan, Sudan, Morocco, Yemen, ISIL (Da’esh) and Al-Qaida List, UN 1988 Taliban List and all other persons identified in the First Schedule of the Terrorism (Suppression of Financing) Act. The content on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to the local laws or regulations.”

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards and cryptocurrencies.

The Bottom Line - Is FTUK a Good Prop Firm?

I like FTUK as it allows traders to scale portfolios up to $6.4M, but I cannot recommend this retail prop firm. While it markets itself well, the trading conditions place it far behind its competitors. It starts by offering a profit share of 50%, the lowest I have seen among retail prop firms. Even after scaling it six times, the maximum profit share is 80%, well below the 90%+ available at the best retail prop firms. FTUK also has expensive evaluation fees, and the Profit Locker system for requesting withdrawals is an unnecessarily complex burden under the guise of expecting consistency. Therefore, I rank FTUK among the worst retail prop firms after reviewing dozens of competitors based on its trading conditions. The minimum evaluation fee at FTUK is $99. FTUK is a legitimate company registered in the US. FTUK is a retail prop firm that offers paid challenges for access to demo accounts that pay real cash to qualifying traders. FTUK has a starting profit share of 50%, which scales to 80% at Level 6.FAQs

What is the evaluation fee at FTUK?

Is FTUK legit?

What is FTUK?

What is the profit share at FTUK?