FOREX.com Editor’s Verdict

FOREX.com, founded in 2001 and now part of US-based publicly listed StoneX Group Inc, offers active traders a competitive pricing environment. Traders may use MT4, MT5, or the high-quality proprietary web-based and desktop alternatives. I conducted an in-depth review to determine whether the trading costs and order execution offered are really as good as this broker claims them to be. Is FOREX.com the right broker for you?

Overview

Low trading costs and quality trading tools from a leading broker

FOREX.com – at a glance:

- Fast order execution.

- The core MT4/MT5 trading platforms are available, alongside a cutting-edge proprietary trading platform.

- Transparent trading environment with low trading costs in the commission-based accounts.

- Quality trading tools and performance analytics.

- VPS hosting for algorithmic traders.

- Research and education for traders.

FOREX.com Regulation and Security

Trading with regulated forex brokers will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. FOREX.com’s affiliates/sister companies are regulated in multiple jurisdictions globally. The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

Country of the Regulator | Australia, Canada, Cyprus, Japan, Cayman Islands, Singapore, United Kingdom, United States |

|---|---|

Name of the Regulator | ASIC, CFTC, CIMA, CIRO, CySEC, FCA, FSA, NFA |

Regulatory License Number | 0339826,291, Undisclosed, 446717, 400/21, 25033, 345646, Undisclosed |

Reasons I prefer GAIN Global Markets Inc. (“FOREX.com GGMI”) trading as FOREX.com, which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.

- Higher leverage*

- Segregation of client funds from own funds

- Flexible trading conditions

*Increase leveraged leverage increases risk.

Noteworthy:

- FOREX.com has a clean regulatory track record.

- Parent company StoneX Group Inc. remains a NASDAQ-listed company in the US.

- Depending on the geographic location, FOREX.com may direct traders to CityIndex, also owned by StoneX. The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

FOREX.com established itself as an industry leader and is an overall trustworthy broker. FOREX.com’s affiliates/sister companies are regulated in multiple jurisdictions globally. Traders should carefully consider which subsidiary they are allowed to trade with.

Does Forex.com accept US clients?

Yes, Forex.com is fully regulated by the CFTC and NFA, making it one of the few brokers legally available to U.S. residents. Discover more licensed U.S. forex brokers.

Fees

Average Trading Cost EUR/USD | 1.1 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.035 |

Average Trading Cost Gold | $0.63 |

Average Trading Cost Bitcoin | $60 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $5 per $100K |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $15 monthly after 12 months |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

FOREX.com offers traders three cost structures, the followings are some of the trading costs of FOREX.com GGMI:

- Commission- free trading costs list spread as low as 0.8 pips or $8.00 per 1.0 standard lot for FX pairs.

- Commission-based accounts – Raw spread account commence with the spread as low as 0.0 pips and a commission of $5.00 per round lot for major FX pairs, Reducing trading costs by up to 15% via the six-tier Active Trader Program.

Noteworthy:

- Equity CFDs cost a minimum of $10 per trade or $0.018 per share per side for US-listed assets.

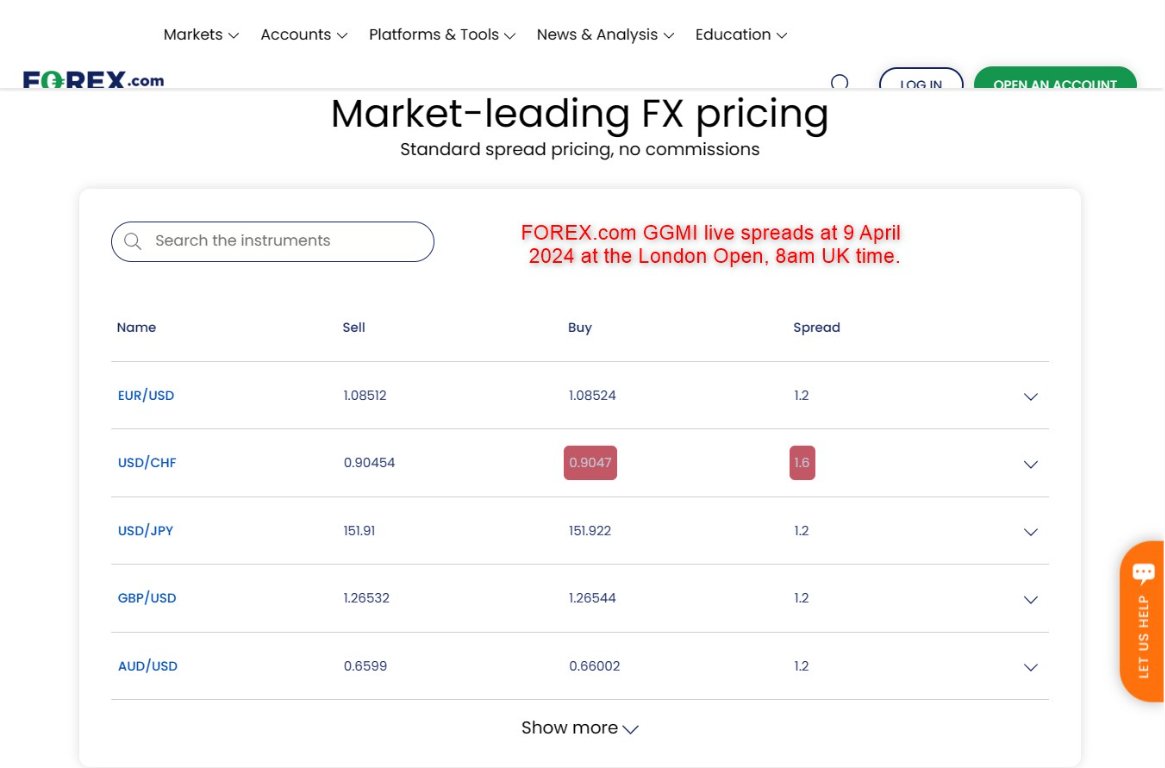

Here is a screenshot of live quotes at FOREX.com during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

Spreads will vary based on market conditions, including volatility, available liquidity, and other factors.

The average trading costs for the EUR/USD in the commission based FOREX.com GGMI account:

Minimum Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $10.00 | $5.00 |

Noteworthy:

- The Active Trader Program reduces trading costs by up to 15%.

One of the most ignored trading costs is daily swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

- FOREX.com offers a positive swap on assets where market conditions warrant.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short for a specific day.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night (after 5PM EST) and seven nights, in the commission based FOREX.com account. Swap rates are as of March 7th, 2024.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night (after 5PM EST) will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $5.00 | -$1.2610 | X | $6.2610 |

0.0 pips | $5.00 | X | $1.2490 | $3.7510 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights (after 5PM EST) will cost the following, according to a hypothetical calculation in which the overnight financing fee remained the same for the next 7 days:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $5.00 | -$8.827 | X | $13.8270 |

0.0 pips | $5.00 | X | -$8.7430 | -$3.7430 |

My additional comments concerning trading costs at FOREX.com:

- $15 monthly inactivity fee after twelve months of dormancy.

- Requirements for the Active Trader program are either a $10,000 minimum deposit or trade the minimum for each asset class in a calendar month.

What Can I Trade at FOREX.com?

I like the 84 currency pairs FOREX.com GGMI offers, ranking it among the top brokers in the choice of Forex category. Besides the eight cryptocurrencies CFDs, FOREX.com maintains a high-quality and well-balanced asset selection, suitable for all types of traders.

The choice for equity traders depends on the geographic location. FOREX.com offers a competitive list of assets for those with access to all available instruments. Otherwise, the choice is certainly good enough for beginner traders.

What could be better?

- Small-cap alternatives in the equity CFD list.

- A wider choice of cryptocurrency CFDs.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

FOREX.com Leverage

Traders at FOREX.com GGMI can get maximum leverage up to 1:400.

FOREX.com Trading Hours (GMT Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 21:00 | Friday 21:00 |

Commodities | Sunday 22:00 | Friday 21:00 |

Crude Oil | Sunday 22:00 | Friday 21:00 |

Gold | Sunday 22:00 | Friday 21:00 |

Metals | Sunday 22:00 | Friday 21:00 |

- Equity markets open and close each trading day and are not operational continuously like Forex and cryptocurrencies.

- The asset selection consists of Forex, and CFDs which have cryptocurrencies, commodities, including gold and silver, indices, and equities.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

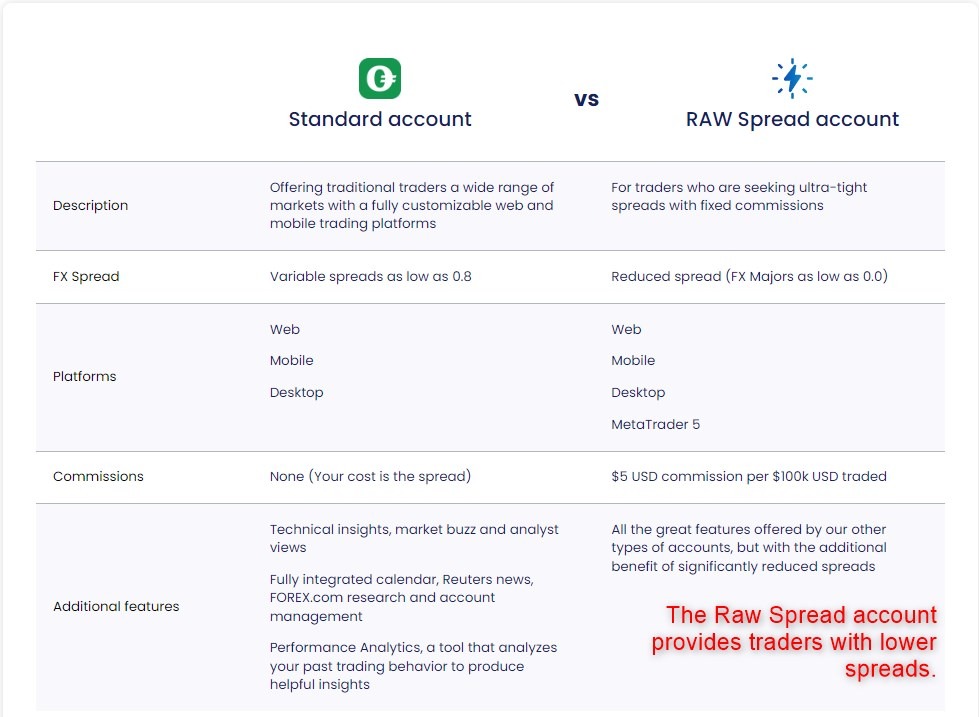

Traders may choose from three account types at FOREX.com GGMI, but one requires higher deposits. I recommend traders carefully consider trading costs at each account, as the difference can make a notable impact on profitability.

Traders must decide between the following:

- Commission-free versus commission-based account.

My observations concerning the FOREX.com GGMI account types:

- MT4 platforms are only available in the MetaTrader account.

- Traders can get the MT5 platforms on Raw Pricing account structure.

- The commission-based alternative features marginally higher base costs versus many competitors, but the Active Trader Program may reduce the trading costs by up to 15% if the requirements are met. For a new client, this Program requirement is an initial deposit of at least $10,000 or trade the minimum for each asset class in a calendar month. Existing clients need to maintain total quarterly trade volume at tier 1 or an average account balance of at least $25,000.

- The minimum deposit is $100, However, FOREX.com recommends depositing at least $1,000 to allow you more flexibility and better risk management when trading your account.

- The maximum Forex leverage is 1:400 and 1:25 for equity traders.

- Islamic and corporate accounts are available.

Demo Account

FOREX.com offers a 30-day time-limited demo account through the MT4 or MT5 trading platforms, or for 90 days through any other trading platform. FOREX.com does not allow multiple demo accounts for the same user, and traders cannot request extensions to het time limit. Demo accounts begin with a national value of $50,000.

My recommendations:

- Competing broker offer unlimited demo accounts.

- MT4/MT5 offer flexible deposits, and traders should select an amount similar to what they plan to deposit in a live trading account.

FOREX.com Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

FOREX.com offers clients the out-of-the-box MT4 and MT5 trading platforms, best suitable for automated trading. The well-designed Advanced Trading Platform, available as a desktop and a web-based option, presents an excellent alternative. It supports algorithmic trading solutions and features 100+ templates and a Development Studio to create custom solutions. All trading platforms also come as mobile apps, popular among millennial retail traders.

The competitive choice of trading platforms receives an upgrade through Trading Central. FOREX.com ensures that its clients access financial markets with a competitive edge.

A guaranteed stop loss is offered in certain markets on FOREX.com GGMI AT platform.

FOREX.com Unique Features

FOREX.com presents a series of quality trading tools. The Performance Analytics tool powered by Chasing Returns helps clients become better traders. The SMART Signals Engines scans 800+ price action patterns using more than 100,000 data points and delivers higher accuracy trading signals.

FOREX.com also offers clients the Market Strategist service. It is a personalized service for trades that meet the requirements. VPS hosting is available. To qualify for free EA VPS hosting, you must maintain a minimum of $5,000 in your FOREX.com GGMI account and must execute at least 10 round trip mini lots or the equivalent per calendar month.

Please note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Research and Education

The four-member in-house global research team publishes quality market commentary, research notes, and trading ideas throughout each session. The presentation is professionally structured with well-described content, delivering value to readers. Research is accessible under Latest Research, Market Insights, Trade Ideas, and Week Ahead. A pivot point calculator and an economic calendar, plus a Popular Topics section, complete the competitive research section at FOREX.com.

The same high-quality approach extends to education, where FOREX.com provides beginner traders with seven themes, including risk management. Each category consists of YouTube videos, charts, images, and written content. Three trading courses, divided into Beginner, Intermediate, and Advanced, are also available, and webinars increase the educational value.

- Overall, research and education remain among the most valuable industry-wide, as FOREX.com maintains an excellent service.

My recommendations:

- Traders should evaluate copy trading features embedded in MT4/MT5.

- MT4/MT5 has thousands of EAs, and traders may explore them to determine if they suit their trading style.

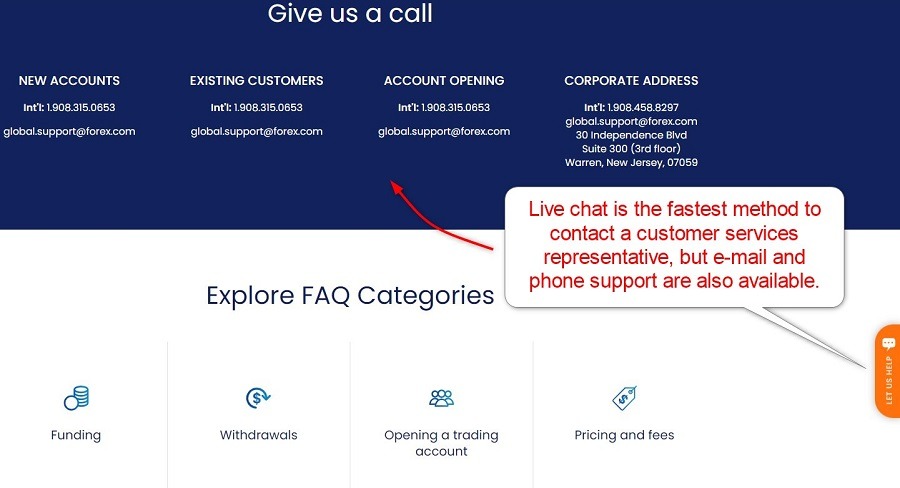

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

Customer support is available from Sunday 10:00 ET through Friday 17:00 ET. Live chat is the best option for non-urgent matters, but FOREX.com offers e-mail and phone support.

The following is FOREX.com GGMI info:

The FAQ section answers many questions, and I recommend traders look for answers there before reaching out to a customer services representative. FOREX.com explains its products and services well and strives for operational excellence. It lowers or eliminates the need for customer support and reduces it to emergencies only.

My recommendations:

- Traders should read through the FAQ section before reaching out to a customer service representative.

- For non-urgent questions, I recommend live chat.

Bonuses and Promotions

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account. Bonuses and promotions may vary with different entities. I want to note the quality affiliate program with competitive payouts, which is ideal for traders seeking passive income opportunities.

FOREX.com Opening an Acoount

The online application at FOREX.com remains lengthier and collects more personal details than many competitors. The first section is straightforward and often suffices for other brokers, but FOREX.com demands more information under the About You and Trading Experience sections. Traders must provide their name, address, date of birth, and tax ID number. Account verification is mandatory, and new traders usually pass after sending a copy of their ID and one proof of residency document. FOREX.com attempts to verify submitted documents instantly, but if they cannot, they will reach out and request additional documentation.

Minimum Deposit

The FOREX.com minimum initial deposit is 100 of your selected base currency, but the recommended amount is $1,000 to allow you more flexibility and better risk management when trading your account.

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |    |

Supported Countries

FOREX.com caters to most international traders from its GAIN Global Markets Inc. (“FOREX.com GGMI”) , which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033,and does not provide a list of supported or restricted countries.

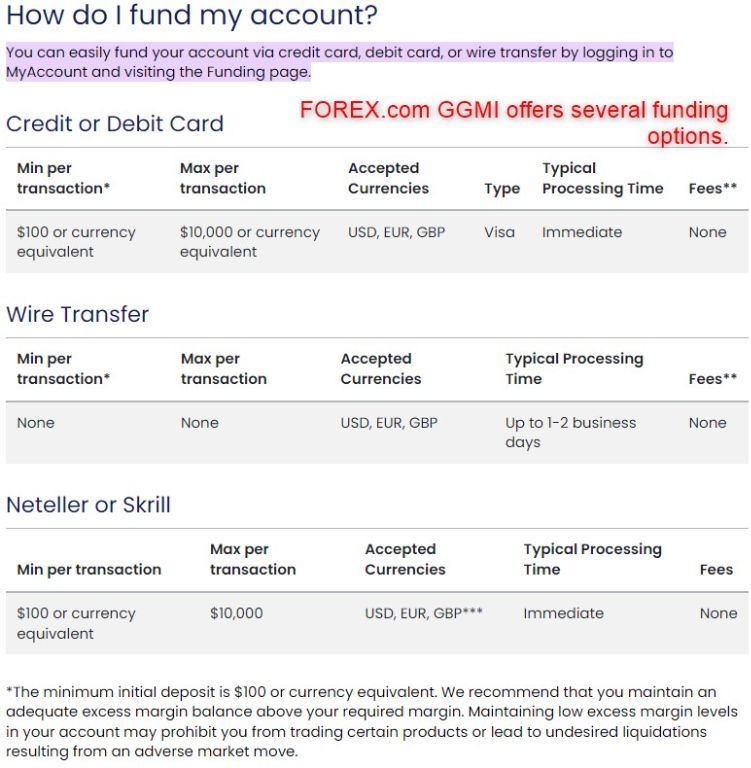

Deposits and Withdrawals

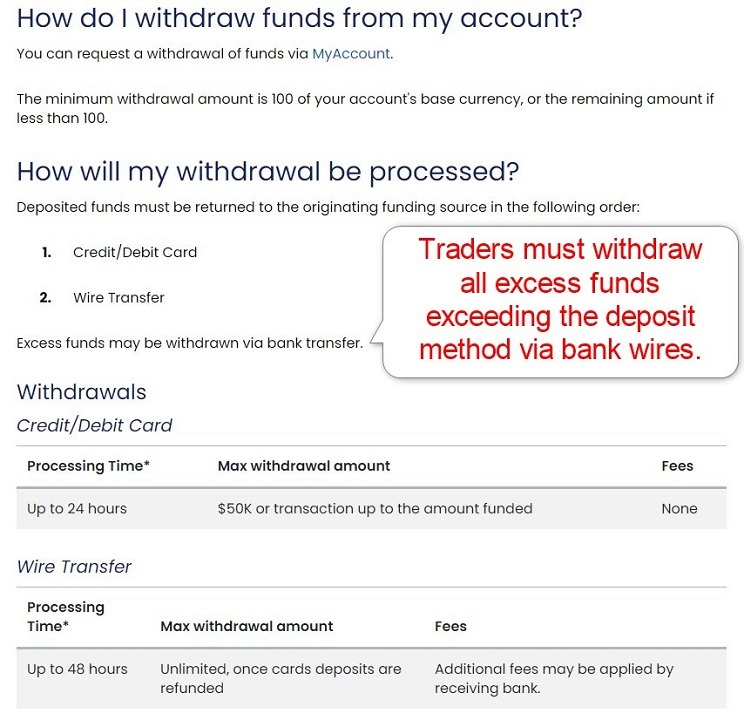

Traders will conduct all financial transactions from the secure portal of FOREX.com. Currently, FOREX.com GGMI offers funding options by credit card, debit card, wire transfer and e-wallet: Neteller and Skrill.

My observations:

- FOREX.com does not levy internal financial transaction costs, but third-party processing fees may apply.

- Not all deposit methods are available to all traders, dependent on the geographic location.

- Deposit processing times for bank wires are between one and two business days.

- Withdrawal processing times are between 24 and 48 hours.

- The minimum withdrawal amount is $100, or a currency equivalent unless less is available.

- Cryptocurrency deposits and withdrawals are not available.

My recommendations:

- Traders should select the payment processor with the lowest fees.

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use a payment option separate from the bank or credit/debit card used for day-to-day financial operations.

The following info is for FOREX.com GGMI accounts:

Bottom Line

I like the trading environment at FOREX.com for high-frequency, high-volume traders, and scalpers, as they can lower trading costs via volume-based rebate programs. FOREX.com offers clients a competitive trading environment starting with three trading platforms, which support algorithmic trading solutions. The well-balanced asset selection serves both beginner traders and professionals well. Research and education rank among the best-quality services industry-wide. Operational since 2001, FOREX.com established itself as one of the most trustworthy brokers in the industry. FOREX.com has a high-quality educational platform and market research, including tradeable ideas. Therefore, it ranks among the best-equipped brokers for beginner traders. The commission-free trading account lists a minimum mark-up of 0.8 pips with an average of 1.1 pips. It results in a fee of $11.00 per 1.0 standard lots. The commission-based alternative commences with a spread of 0.2 pips for a commission of $5.00 per lot or a cost of $7.00. Active traders can lower trading fees between 4% and 15% via the volume-based Active Trader rebate program. FOREX.com is regulated in the US by the CFTC and owned by a US-based publicly listed company. The secure back office of FOREX.com processes all financial transactions. Withdrawals must follow the deposit path up to the deposit amount and any excess amount via bank wires.FAQs

Can I trust FOREX.com?

Is FOREX.com good for beginners?

What are the fees for FOREX.com?

Is FOREX.com regulated in the USA?

Is FOREX.com a good platform?