For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Exness Editor’s Verdict

Exness is a leading tech-driven multi-asset broker with exceptional order and volume statistics. It also ranks highly in the client withdrawal category. Traders get to enjoy the MT4/MT5 trading platforms plus two proprietary alternatives, ultra-low trading fees, and flexible leverage. I conducted a comprehensive Exness review to evaluate if the Exness trading environment offers traders a competitive edge. Should you open an account with Exness?

Overview

A leading multi-asset broker with ultra-low trading fees.

Headquarters | Cyprus |

|---|---|

Regulators | CMA, CySEC, FCA, FSA, FSC Belize, FSC Mauritius, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2008 |

Execution Type(s) | Market Maker |

Minimum Deposit | $10 (based on the account type) |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 0.6 pips |

Average Trading Cost GBP/USD | 0.7 pips |

Average Trading Cost WTI Crude Oil | 6.7 pips |

Average Trading Cost Gold | 11.3 pips |

Average Trading Cost Bitcoin | 161.1 pips |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.3 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Funding Methods | 7 global and numerous local solutions |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the trading fees at Exness and the absence of swap rates on leveraged overnight positions on several assets. It ensures that traders can have a competitive edge, by minimizing potential fees when holding positions open for longer versus more expensive brokers. Exness also has a cutting-edge trading environment and infrastructure.

Exness Highlights for 2025

- A well-regulated trading environment, including the Hong Kong-based Financial Commission membership, with its compensation fund maxed at €20,000 per claim.

- Cutting-edge trading infrastructure supporting 1 million+ active traders from the largest retail multi-asset broker.

- Ultra-low trading fees for a reasonable $10 minimum deposit requirement.

- Swap-free trading on many assets for all traders.

- Low and stable spreads, especially on popular assets like gold, bitcoin, and USOIL.

- MT4/MT5 trading platforms for algorithmic traders.

- User-friendly web-based Exness Terminal.

- Exness Trade mobile app optimized for frequent traders.

- In-house copy trading service, available in the trading app.

- Actionable trading signals from Trading Central and market news from FX Street.

- 24/7 in-app support via the mobile app Exness Trade App.

- 1:unlimited leverage with negative balance protection, 0% hedged margin, a margin call at a 30% margin level, and an automatic stop-out at 0%.

- PCI DSS certified for payment card security by Exness.

- Instant deposits and withdrawals without manual processing for verified clients.

- Exness Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always advise traders to check for regulations and verify them with the regulator by checking the provided license with their database.

Country of the Regulator | Cyprus, Kenya, Mauritius, Seychelles, United Kingdom, British Virgin Islands, South Africa, Curaçao |

|---|---|

Name of the Regulator | CMA, CySEC, FCA, FSA, FSC Belize, FSC Mauritius, FSCA |

Regulatory License Number | SD025, 0003LSI, SIBA/L/20/1133, 51024, GB20025294, 178/12, 730729, 162 |

Is Exness Legit and Safe?

Exness has eight regulated entities and maintains a secure trading environment. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Exness has eight regulated entities and maintains a secure trading environment.

I like that Exness offers an investor compensation fund to all clients via the Hong Kong-based Financial Commission, the primary independent external dispute resolution (EDR) organization for the Forex market, covering claims up to €20,000.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Exness features an above-average commission-free cost structure but a highly competitive commission-based alternative. Equity CFD traders get low commissions and tight swaps, and Exness offers swap-free trading on selected assets, which extends its cost advantage. Therefore, Exness is ideal for demanding short-term traders, like scalpers, to medium-to-long-term leveraged strategies.

Average Trading Cost EUR/USD | 0.6 pips |

|---|---|

Average Trading Cost GBP/USD | 0.7 pips |

Average Trading Cost WTI Crude Oil | 6.7 pips |

Average Trading Cost Gold | 11.3 pips |

Average Trading Cost Bitcoin | 161.1 pips |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.3 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

The average trading costs for the EUR/USD at Exness are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.0 pips (Standard) | $0.00 | $10.00 |

0.0 pips (Raw Spread) | $7.00 | $7.00 |

0.0 pips (Zero) | $7.00 | $7.00 |

0.6 pips (Pro) | $0.00 | $6.00 |

Here is a screenshot of Exness fees during the London-New York overlap session, considered as the most liquid session, where traders usually get the lowest spreads.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I highly recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD and holding the trade for one night and seven nights in the commission-free Pro account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.6 pips | $0.00 | -$5.70 | X | $11.70 |

0.6 pips | $0.00 | X | $0.00 | $6.00 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.6 pips | $0.00 | -$39.39 | X | $45.90 |

0.6 pips | $0.00 | X | $0.00 | $6.00 |

Range of Assets

Forex traders might consider Exness as an ideal multi-asset broker choice, with 96 currency pairs, complemented by 11 cryptocurrency pairs. Equity traders get 98 blue-chip names, while 18 commodities and 10 indices complete the asset selection. Non-Forex traders have sufficient trading instruments, especially for strategies that require fewer but highly liquid trading instruments, like scalpers.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Exness Leverage

Unlike many brokers who restrict equity leverage to between 1:5 and 1:20, Exness’ leverage ranges from a minimum of 1:2 to unlimited, depending on the geographic jurisdiction of the trader, the asset, and the account balance. Given its flexible and dynamic approach to leverage, Exness adds another layer of competitiveness, but traders must ensure they execute risk management to avoid magnified losses. Exness offers negative balance protection, meaning traders can never lose more than their deposits

Exness Trading Hours (GMT + 0)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:05 | Friday 20:59 |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Commodities | Sunday 22:05 | Friday 20:59 |

Crude Oil | Sunday 22:05 | Friday 20:59 |

Gold | Sunday 23:05 | Friday 21:57 |

Metals | Sunday 22:05 | Friday 20:59 |

Equity Indices | Monday 13:40 | Friday 19:45 |

Stocks | Monday 13:40 | Friday 20:45 |

*Different assets have different trading hours

Noteworthy:

- Equity markets open and close each trading session, unlike forex and commodities, which essentially trade 24/5, and cryptocurrencies, which trade 24/7.

Exness Account Types

Exness offers five account types plus a demo account for each account type, except for Standard Cent. The commission free Standard and Standard Cent accounts are ideal for casual and beginner traders. The margin call level is at 60%, and the minimum trade size is 0.01 lots and cent lots, respectively. The Standard Cent account is also a good option for traders to test new strategies, EAs, and signal providers. The minimum deposit is $10, depending on the payment method, and Exness notes that 80% of clients select the Exness Standard account.

The Exness Pro account is commission-free while the Zero and Raw Spread accounts include commission but have very low spreads down to 0 pips. The margin call level is at 30%, the minimum trade size is 0.01 lots, and the minimum deposit is $200, which is low considering the competitive pricing environment.

The account base currencies are AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, and ZAR. The list represents the most comprehensive availability versus all competitors.

Exness Demo Account

Exness automatically opens an MT5 standard demo account upon registration, and traders can open up to 100 MT4 and 100 MT5 demo accounts from their Exness Personal Area. They are entirely customizable, and traders can manage multiple accounts via the back office. Exness will archive MT4 demo accounts after 180 days of inactivity and MT5 accounts after 21 days (for some servers it can be 14 days). I like that Exness understands the requirements of demo usage for advanced and algorithmic trades by offering customization and unlimited access.

I want to caution beginner traders in using demo trading as a simulation tool, and they should consider the limitations.While the market conditions are real, demo trading does not provide exposure to real trading psychology and can create unrealistic trading expectations.

Exness Trading Platforms

Exness deploys its lightweight, user-friendly, and web-based proprietary Exness Terminal, complemented by the mobile trading alternative Exness Trade App for Android and iOS devices. The former features 50 drawing tools and 100 indicators, while the latter has 24/7 in-app support, but both are only available for MT5 accounts and only support manual trading strategies.

Traders can also rely on the market-leading MT4, the primary choice for algorithmic trading, and MT5. Both trading platforms feature built-in copy trading services, and the MT4 trading infrastructure remains the most versatile, with 25,000+ add-ons, custom indicators, and EAs.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Exness Web Terminal

The Exness Web Terminal (a MetaTrader product) offers traders the full functionality of the MetaTrader platforms without the need to download or install any software. Accessible directly from any web browser and using the trader's usual login credentials, it provides a convenient way to manage your account, open and close trades, and perform technical analysis with a comprehensive suite of charting tools and indicators. This makes it an ideal solution for traders who need to access their accounts from different devices or prefer a simple-to-use, browser-based trading experience.

Exness MT5

Exness provides full support for the MetaTrader 5 (MT5) platform, the successor to the globally popular MT4. MT5 offers traders a more powerful and feature-rich environment, including more timeframes, additional built-in technical indicators, and an integrated economic calendar. It also supports more order types and allows for trading a wider range of instruments, such as stocks and futures, making it the preferred choice for multi-asset traders looking for advanced analytical tools and superior performance.

Exness Social Trading

Exness offers a dedicated Social Trading app that allows clients, especially beginners, to benefit from the experience of others. The platform enables users to browse through a list of successful traders (known as "Strategy Providers"), view their historical performance, and automatically copy their trades. This feature provides a simple way to enter the markets by following the strategies of more seasoned investors, with full control over your own capital and risk settings.

Exness Trading App

The Exness Trading App is a powerful, all-in-one mobile solution that allows traders to manage their accounts and trade from anywhere. Available for both iOS and Android, the app provides full access to trading functionalities, including advanced charting, order management, and secure in-app deposits and withdrawals. Its intuitive design makes it easy to navigate, ensuring you can react to market movements and manage your portfolio whilst on the go.

Exness Margin Calculator

The Exness Margin Calculator is an essential risk management tool that helps traders plan their position sizing effectively. By inputting an instrument, leverage, and trade size, the calculator instantly shows the amount of margin required to open and maintain that position. This helps traders avoid margin calls and auto liquidation and ensures they have sufficient equity in their account to support their trading strategy.

Exness Profit Calculator

The Exness Profit Calculator is a useful tool for estimating the potential outcome of a trade before taking a position live in the market. Traders can input details such as the instrument, nominal trade size, and open and close prices to calculate the potential profit or loss for that position. This helps in assessing the risk-to-reward ratio of a trade and making more informed trading decisions.

Unique Features

Exness upgrades its trading environment with services by Trading Central, including the MT4 plugin TC Technical Analysis Indicator. I like the free VPS offer, which only requires a total deposit of $500, a minimum free margin of $100, and trading activity within the past 14 days. It is one of the most generous offers and ideal for demanding traders who require low-latency 24/5 market access without running their PC, like scalpers and algorithmic traders.

Awards

Exness received numerous awards for various aspects of its competitive trading products and services.

Among the most recent awards are:

- Global Broker of the Year and Most Innovative Broker of the Year at the Forex Traders Summit Dubai 2023.

- Broker of the Year at the Jordan Financial Expo and Awards (JFEX) 2023.

- Best Multi-asset Broker and Most Trusted Broker at the Smart Vision Investment Expo 2023 in Egypt.

Research and Education

Exness relies on Trading Central services and FXStreet for trading signals, market coverage, and economic news. I find that approach ideal, which allows Exness to focus on maintaining and improving its core trading environment while delivering value-added services via trusted third-party providers. Traders can access them via the Exness Personal Area, within the proprietary trading platforms, or MT4.

Education content is not available as Exness targets experienced traders, making the absence of educational content irrelevant to the business model of Exness.

I recommend beginners who want to trade with Exness seek in-depth free education from third parties available for free, including trading psychology, before opening an Exness trading account. Beginners should always avoid paid-for courses.

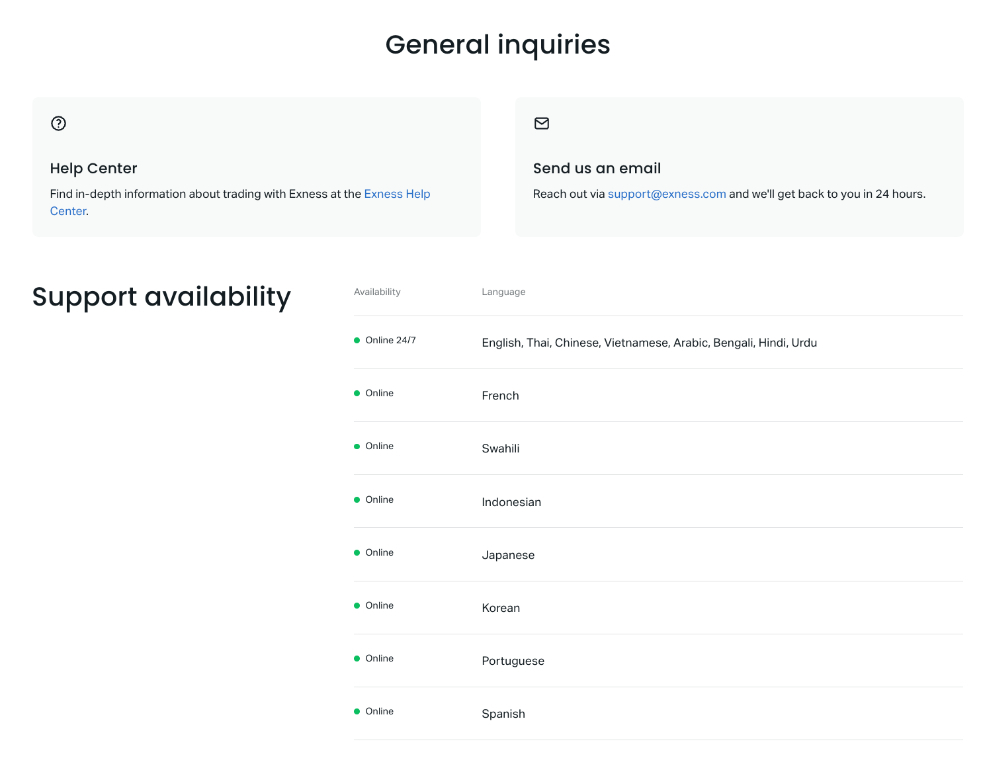

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |         |

Exness provides 24/5 customer support in French, Swahili, Indonesian, Japanese, Korean, Spanish, and Portuguese while 24/7 customer support is available in English, Chinese, Thai, Vietnamese, Arabic, Bengali, Hindi and Urdu.The Help Center attempts to answer the most common questions, while the live chat offers the most convenient method for non-urgent matters. I like that Exness provides phone support, which is ideal for emergencies.

Bonuses and Promotions

Exness doesn't offer bonuses or promotions, but it maintains a high-paying partnership and affiliate program with up to 40% revenue share or $1,850 per client. Exness notes 119,000 partners, $1B+ in affiliate payouts, and $2.9M as the top monthly affiliate payout.

Opening an Account

Opening an Exness trading account follows well-established industry standards via an online application. The first step consists of providing the country of residence, e-mail address, and the desired password, which loads the Exness Terminal. It also grants access to the secure and user-friendly Exness Personal Area from where traders can add, customize, and manage trading accounts, access trading recommendations, and engage in social trading as a strategy provider.

Exness is a multi-regulated broker, and account verification is mandatory. Most traders will pass verification after submitting a copy of their ID and one proof of residency document. Exness might ask for additional information on a case by case basis.

Minimum Deposit

The minimum deposit at Exness is $10 for Standard accounts and $200 for Professional accounts. But this may differ depending on your region.

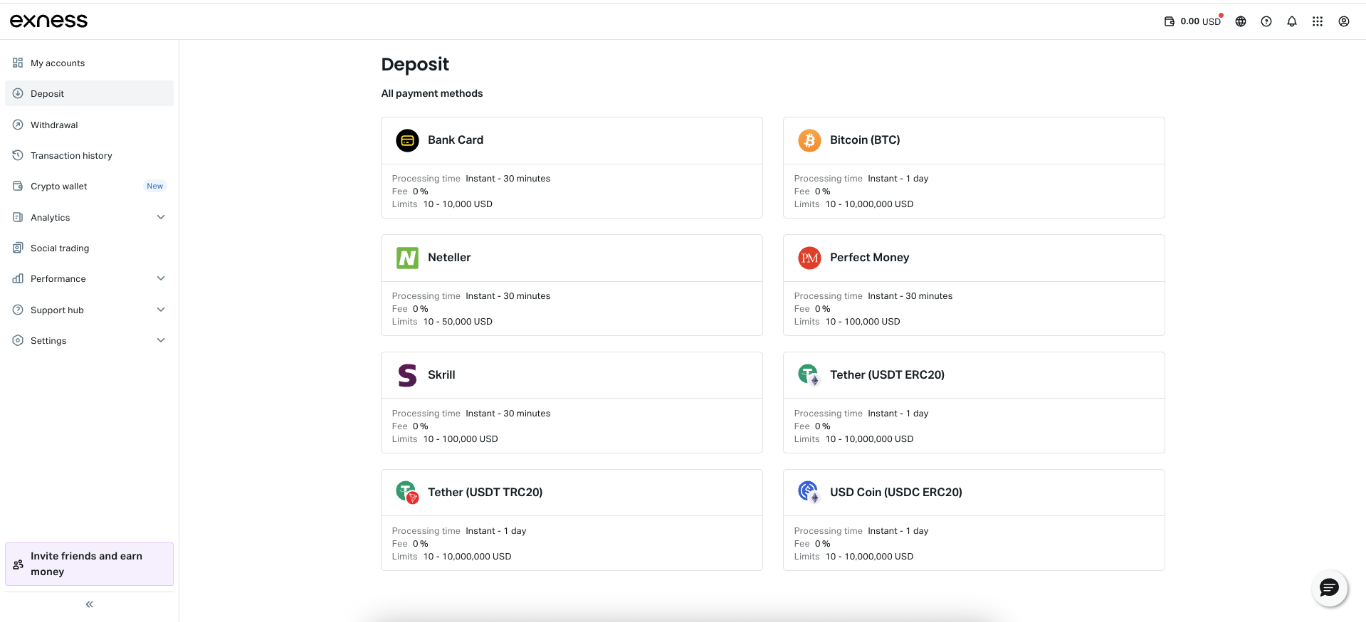

Payment Methods

Deposits and Withdrawals

The secure Exness Personal Area handles all financial transactions for verified clients

Exness does not levy internal deposit or withdrawal fees and processes most withdrawal requests automatically, meaning they are processed in seconds by Exness, but the ultimate time may depend on your payment provider. Bank wires can take up to three business days, and credit/debit card withdrawals up to five days. The name on the payment processor and the Exness account must match, and if traders use multiple payment processors to deposit, they must withdraw in equal proportions.

For example, making a $700 deposit via debit card and $300 via Skrill means a trader must withdraw 70% of profits via the same debit card and 30% via Skrill. Exness will highlight recommended payment processors, identifying the best methods filtered by the geographic location of traders and withdrawal experience by Exness.

Exness Deposit Methods

Exness provides a wide variety of deposit methods to suit its global client base, ensuring quick and secure account funding. Options typically include traditional methods like bank wire wires and credit/debit cards (Visa/Mastercard), as well as a large selection of popular e-wallets such as Skrill, Neteller, and Perfect Money. Exness is also known for supporting local payment methods in many regions and offering cryptocurrency deposits too, providing flexibility and convenience.

Exness in Indonesia

Exness has established a significant presence in Indonesia, catering to local traders by offering convenient and accessible trading services. This includes providing local payment methods for deposits and withdrawals, allowing for easy funding in Indonesian Rupiah (IDR). The broker's platform is popular in the region for its user-friendly interface, competitive trading conditions, and dedicated customer support that understands the needs of the Indonesian market.

Is Exness a Good Broker?

I like the trading environment at Exness for its low trading fees, flexible leverage, swap-free trading on selected assets, choices of account-based currencies, supported payment processors, and order execution statistics. I rank Exness among the most trusted brokers, and the investor compensation fund adds a layer of safety. Exness is an excellent multi-asset broker due to its broad-based sector coverage with 96 currency pairs. The partnership program is an outstanding and high-paying option for those seeking passive income opportunities. The Exness minimum deposit is $10 for commission-free accounts and $200 for commission-based alternatives. Exness is a market maker but offers ECN-like execution in its commission-based trading accounts. Exness remains regulated by the FCA (United Kingdom), CySEC (Cyprus), FSCA (South Africa), FSA(Seychelles), CBCS (Curaçao and Sint Maarten), FSC (Mauritius), and FSC (BVI). Exness ranks among the best choices for a Forex broker, as it is one of the few that offers almost 100 currency pairs. It also allows flexible leverage and has ultra-competitive trading fees, including swap-free trading. Exness, founded in 2008, is legal and has an excellent track record. It complies with six regulators, including one central bank, and offers a template for competitors in managing a trusted and competitive broker. Exness is an excellent broker for all traders. Beginners who seek in-depth educational content from their Forex broker will not find it at Exness, as beginners are not the core market of this industry leader. While Exness offers two account types with a $10 minimum deposit, enabling trading with $10, traders should consider the viability of doing so. It requires the same effort and resources to trade $10 as $5,000, but the profit potential is notably higher. Therefore, trading with $10 is not worth the input, but technically possible. No Exness ban exists in the US, but it does not operate in the US, has no US license, and does not accept US-resident traders. Earning money depends 100% on traders, their understanding of the markets, their trading tools, and their ability to trade. Exness provides the necessary infrastructure to trade and maintains a cutting-edge trading environment that provides traders with a competitive edge from a trusted source. Exness ranks among the industry leaders and is the largest retail Forex broker by trading volume. The well-regulated trading environment includes oversight by one central bank and Hong Kong-based Financial Commission membership, with its compensation fund maxed out at €20,000 per claim. Therefore, traders can trust Exness with their capital.FAQs

What is the minimum deposit for Exness?

Is Exness an ECN broker?

Is Exness regulated?

Is Exness a good Forex broker?

Is Exness legal?

Is Exness good for beginners?

Can I trade with $10 on Exness?

Why is Exness banned in the US?

Can I earn money with Exness?

Can we trust Exness?