Editor’s Verdict

Eightcap Challenges is a proprietary trading product that benefits from the regulatory stability of Eightcap, the globally regulated broker. Established by the Eightcap Group (founded in Melbourne, Australia, in 2015), the prop offering has quickly gained attention for its flexible and low-cost entry model. It offers something unique in the prop trading space - Day Trader Challenges starting from a $5 stake, alongside traditional One-Phase and Two-Phase options that most will be familiar with. The firm’s prop product is structured to reward skilled, active traders quickly, with the potential for simulated capital allocation up to $600,000 and a high maximum profit split.

Overview

Eightcap Challenges delivers a robust, trader-focused offering that stands out in a competitive market

Headquarters | Australia |

|---|---|

Year Established | 2015 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5 |

Minimum Evaluation Fee | $99 or $5 with DT |

Profit-share | 80% - 90% |

Daily Loss Limit | 4-5% |

Maximum Trailing Drawdown | 8-10% |

Funded Account Options | 2 |

Minimum Funded Account | $10,000 |

Maximum Funded Account | $600,000 |

The prop product, operated by the multi-regulated broker Eightcap, combines the credibility of a regulated financial institution with the high rewards of the proprietary trading model.

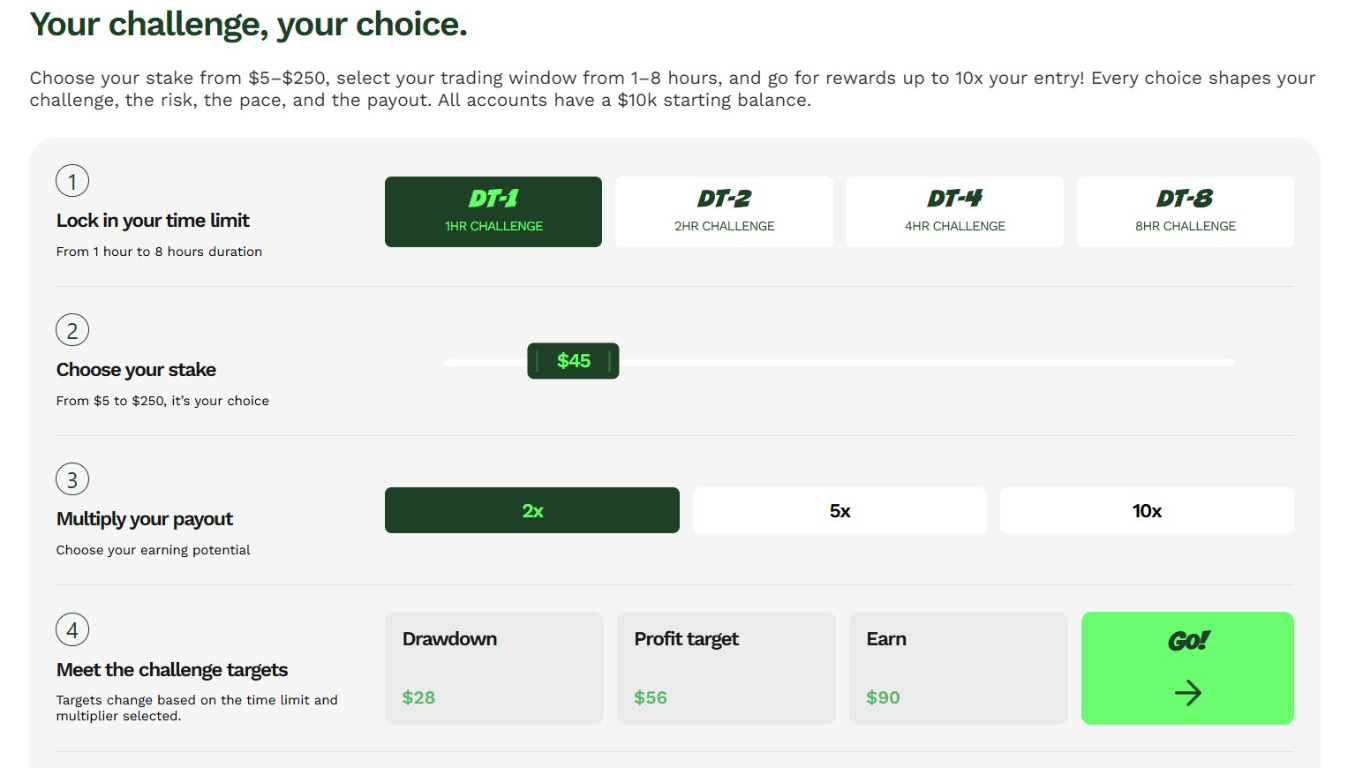

The firm's entry-level evaluation fee is competitive, especially with the $5 minimum stake for the Day Trader Challenge, but its primary attraction lies in the structure and flexibility of its programs. The nature of the Day Trader challenges lets traders have an extremely high level of flexibility and control. They can choose the challenge duration (1, 2, 4, or 8-hour challenges), the stake, and the payout multiplier. In addition, the ability for traders to operate without the pressure of a deadline in the usual One-Phase and Two-Phase challenges allows for a focus on sound strategy rather than rushed execution to try and achieve profit targets.

The firm's excellent reputation, as it is operated by Eightcap the globally regulated broker , provides a necessary layer of confidence in the security and fairness of payouts. While its drawdown conditions, like any prop trading firm, require a careful understanding of the rules—specifically the fixed maximum loss and news trading—the overall package is decent, positioning Eightcap Challenges as a great choice for both new and experienced traders seeking funded account trading.

Eightcap Challenges Trustworthiness & Reputation

Because prop firms are unregulated entities, traders engaging with them need to be especially diligent in verifying that their chosen provider is reputable and has a well-established reputation for security and fairness when it comes to payouts.

Is Eightcap Challenges Legit and Safe?

Eightcap Challenges benefits significantly from being a product launched by the globally established broker. Eightcap was founded in Melbourne, Australia, in 2015).

The underlying security and reputation are built upon Eightcap's multi-jurisdictional regulatory compliance, which includes licenses from top-tier bodies like the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA). This licensing ensures the firm operates under strict oversight for its brokerage services, providing client protections like fund segregation and negative balance protection across its entities. This level of institutional backing makes Eightcap Challenges comparatively safe and legitimate.

The firm reports 1.74% of withdrawals were previously denied for reasons of fraud, KYC refusal and intentional gaming of their systems.

Its Trustpilot score is good, standing at 4.1 out of 5 stars from over 3,300 reviews (as of late 2025 for the parent broker). This high volume of positive feedback is noteworthy. Traders frequently mention fast payouts, helpful customer service, and the straightforward nature of the trading rules.

The team behind the firm also engages directly with traders through Discord and other social channels, which adds an extra layer of transparency and trust. Eightcap provides clear information on management, listing Executive Directors and Founders.

The few negative reviews usually relate to misunderstandings of the drawdown rules, a common issue across the prop firm sector. The Eightcap team actively responds to reviews, proving a clear commitment to customer satisfaction and issue resolution, which is a positive factor of the firm's operational integrity.

Eightcap Challenges Features

Eightcap Challenges offer many similar features expected in the prop trading world, and a new approach called ‘day trader’ which I have not seen before. Some of the key facts and features are listed below.

- Fixed-Odds Model: The Day Trader Challenges function as a fixed-odds contract with a pre-defined risk (stake) and payout (multiplier).

- Low Entry Price: Day Trader Challenges are accessible, starting from as little as $5.

- Same-Day Payouts: Traders can complete challenges within hours and earn payouts on the same day.

- Customisation and Control: Traders can choose their trading duration (1 to 8 hours), stake ($500), and reward multiplier (up to 10x).

- Institutional Backing: The firm is operated by the multi-regulated parent broker, Eightcap.

- Regulatory Oversight: Eightcap holds licenses from major global regulators, including the FCA (UK) and ASIC (Australia).

- Traditional Prop offering: The firm also offers the usual one to two-phase funded trader programs.

- Award-Winning Platform: The parent broker, Eightcap, was recognized as TradingView's Best Global CFD Broker for 2024, reinforcing its reputation for reliability and technology.

Evaluation Fees & Profit-Share

Eightcap Challenges utilises the standard one- and two-phase challenge model that is are common in the space. We will focus on this aspect of the offering here rather than the Day Trader fixed odds model.

The profit share is 80% upon passing the challenges, this can be upped to 90% with purchasing add-ons, the initial fees range from $99 to $1299 for the largest $200k account. Unlike other prop firms, the initial fee is not refundable upon passing the initial challenge phases. Traders are permitted to pass multiple evaluations and scale up, but the firm's total commitment of simulated funds must not exceed $600k to any one trader.

Minimum Evaluation Fee | $99 or $5 with DT |

|---|---|

Maximum Evaluation Fee | $1,299 |

Profit-share | 80% - 90% |

The minimum evaluation fee at Eightcap Challenges for a $10,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $99 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $10,000 account | $99 |

Account Types

Eightcap Challenges maintains clear and distinct program choices. On the traditional funding model, they offer two primary routes to getting funded - a one or two-phase challenge, with account sizes ranging from $10,000 to $200,000 and leverage up to 100:1. In addition to this, there is a new Day Trader Challenges offering.

1. Two-Phase Challenge (Standard Model)

This is the classic, most affordable, and most flexible path to becoming a funded trader with Eightcap Challenges.

- Structure: Requires passing two distinct phases of evaluation.

- Profit Target: Phase 1 requires a 10% profit, followed by 8% in Phase 2.

- Risk Limits: Allows for higher risk tolerance, with a 5% Maximum Daily Loss and 10% Maximum Total Loss.

- Fees: This has the lowest Access Fee for a given account size $99 for the $10,000 account

2. One-Phase Challenge (Accelerated Model)

This is an accelerated, yet stricter, path to funding.

- Structure: Requires passing only one phase of evaluation.

- Profit Target: Requires a single 10% profit target.

- Risk Limits: Has tighter limits, with a 4% Maximum Daily Loss and 8% Maximum Total Loss.

- Fees: The Access Fee is slightly higher than the Two-Phase option.

3. Day Trader Challenges (Fixed-Odds Model)

This is the firm's most unique and accessible offering, designed for high-speed, short-duration trading.

- Structure: This model is not an evaluation for a funded account; it is a fixed-odds contract. Traders stake a fee for a chance at a fixed payout multiplier.

- Entry Fee/Stake: Starts from as little as $5.

- Time Limit: Challenges are time-limited, with sessions lasting 1, 2, 4, or 8 hours.

- P&L: Traders choose a reward multiplier (2x, 5x, or 10x).

- Payout Speed: Designed for same-day payouts.

- Leverage: Lower leverage is used in this model (1:30 for Forex).

What are the Trading Rules at Eightcap Challenges?

The trading rules are transparent and designed to identify consistent and disciplined traders. The evaluation begins after a trader selects a program and pays the one-time fee.

The key rules for the standard prop challenge model and day trader options are similar, and the highlights you should be aware of are below.

- Profit Target: 10% in Phase 1 and 8% in Phase 2 when opting for this.

- Maximum Daily Loss: 5% or 4% of the starting day's balance, depending on the number of stages

- Maximum Overall Loss: 10% drawdown. This is a static drawdown based on the initial balance in the challenge account

- No Time Limits: Traders may take as much time as needed to meet the profit targets.

- Distribution / Consistency Rules: The firm does impose rules on how profits are generated and paid out in a single session, which varies between 25% & 30%

Violation of either the daily or overall loss limit results in the account being breached and therefore, closed. It is crucial for traders to fully understand the drawdown mechanism before commencing the evaluation.

Noteworthy:

- A good selection of trading platforms is available in comparison with peers

- The lack of a time limit is good, but there is an inactivity fee that kicks in after 30 days

- No Mandatory Stop Loss

- EAs are permitted – with some restrictions on trading methods (see below)

- Trading methodologies that are not permitted - news trading, fast-scalping, hedging across accounts and martingale. Violation of the rules may result in failure of the challenge or account closure

- Copy trading is not permitted with other users.

Trading Platforms

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Eightcap Challenges supports MT5, MT4 and TradeLocker platforms.

These platforms provide reliable execution, full mobile and desktop access, and support for custom indicators and automated strategies. All trading is conducted on simulated accounts.

Assets: Forex (56 pairs), Indices, Commodities, Shares, and Cryptocurrencies.

Education

Eightcap Challenges, while not primarily an educational institution, provides its traders with substantial resources, leveraging the knowledge base of its parent company and the support of its active trading community.

Extensive FAQ/Help Centre: The firm offers a detailed and extensive FAQ section. This is the primary resource for new and existing traders to find quick, reliable answers regarding rules, fees, payouts, platform setup, and account breaches.

Discord Community and Social Channels: Eightcap maintains an active presence on Discord and various social channels. This community engagement allows traders to share information, discuss strategies, and receive updates directly from the firm, fostering a supportive environment.

Parent Broker Resources: As a product of the Eightcap group, traders have access to the broker's educational ecosystem. This includes:

- TradingView Integration: The seamless integration with TradingView allows traders to utilize professional charting and analysis tools, which are essential for continued learning and strategy development.

- Educational Content: The main Eightcap broker website often provides resources such as market analyses, webinars, and educational articles, there is a good section of the site called Eightcap Labs that provides this content and is designed to help traders understand risk management, technical analysis, and global market events.

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

Customer support is robust, seeming to align with the standards expected from a regulated broker.

Support Hours: 24 hours a day, 5 days a week (24/5)

Support Methods: Chatbotand Email

Website Languages: 10+ languages supported, including English, Spanish, Italian, and French

How to Get Started with Eightcap Challenges

The sign-up process is efficient and straightforward.

- Navigate to the official Eightcap Challenges website.

- Choose the desired funding program and account size

- Select the account size and preferred trading platform, and choose from some extras like extra profit payouts

- Complete the payment for the one-time evaluation fee.

- Account credentials for the chosen platform will be delivered via email, at which point trading can commence.

Minimum Evaluation Fee

The minimum evaluation fee at Eightcap Challenges is $99 for the $10,000 account and the two-step evaluation process.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |    |

The firm accepts program payments via credit cards and a wide range of cryptocurrencies via Coinpayments. Withdrawals are processed in the same way and can include bank wires. Withdrawals are typically processed the same day and for amounts less than $100 you must use crypto.

Accepted Countries – The vast majority of countries of residence are accepted, although notably not Australia, where the parent firm is based. Due to international regulations, services are not available to clients resident in the typical restricted countries, Cuba, Iran, North Korea, Syria, and the Russian Federation.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit cards and selected cryptocurrencies, see below.

The Bottom Line: Is Eightcap Challenges a Good Prop Firm?

Eightcap Challenges is an excellent proprietary trading offering and a strong contender in the industry, benefiting from being owned and operated by a multi-regulated broker. The firm excels by focusing on both credibility and choice.

The combination of program flexibility—including the no maximum time limits on traditional challenges and the unique, rapid Day Trader Challenges—along with a wide choice of trading platforms (MT4, MT5, TradeLocker), creates a very compelling offering.

The high potential profit share of up to 90% and a clear pathway for scaling accounts up to an aggregate of $600,000 provide a chance for long-term, successful trading and the ability to earn a decent return. While the drawdown rules require attention—specifically the non-refundable fee and the restriction on certain trading methods like scalping—they are fair and transparent. Supported by an outstanding reputation and the infrastructure of a strong financial group, Eightcap Challenges is a highly recommended firm for any serious trader seeking capital funding. Eightcap Challenges supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradeLocker. No, the Access Fee for Eightcap Challenges is non-refundable. Yes, the use of Expert Advisors (EAs) and automated trading is permitted on the MT4/MT5 platforms and Tradelocker. No, the traditional One-Phase and Two-Phase challenges do not have a maximum time limit. However, the Day Trader Challenges are time-limited (e.g., 1 hour, 2 hours, 4 hours, 8 hours). The maximum profit split at Eightcap Challenges is 90%, achievable by selecting the profit split add-on during the purchase of a challenge.FAQs

What trading platforms does Eightcap Challenges support?

Is the evaluation fee refundable at Eightcap Challenges?

Does Eightcap Challenges allow the use of Expert Advisors (EAs)?

Are there time limits on the Eightcap Challenges?

What is the maximum profit split at Eightcap Challenges?

Trading Platforms

Trading Platforms