Editor’s Verdict

EasyEquities, founded in 2014, is a multi-asset CFD broker that offers trading in equities, currencies, commodities, and direct (non-CFD) cryptocurrency trading. EasyEquities offers in-house trading platforms for equities and cryptocurrency trading, as well as MT5 for other asset classes. This review evaluates its services, so read on to see if it is the best broker for you.

Overview

EasyEquities offers CFDs on stocks, equities, and commodities, as well as direct crypto trading through EasyCrypto.

Headquarters | South Africa |

|---|---|

Regulators | FSP |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2014 |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 5 |

Average Trading Cost EUR/USD | R20 per contract added onto spread |

Average Trading Cost GBP/USD | R20 per contract added onto spread |

Average Trading Cost WTI Crude Oil | R4 per contract added onto spread |

Average Trading Cost Gold | R4 per contract added onto spread |

Average Trading Cost Bitcoin | 0.325% (0.25% + 0.075% VAT) |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | R20 added to spread for Majors |

Funding Methods | 2: Electronic Funds Transfer and Credit Cards |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

EasyEquities’ five core takeaways:

- 1:25 Forex leverage on EURUSD and 1:20 on other Forex majors

- CFDs across equities, currencies, commodities, and direct crypto trading

- South African-based and regulated in South Africa

- Also accepts non-South African clients

- EasyEquities has an in-house platform for equities and MetaTrader 5 (MT5) for other asset classes

EasyEquities Regulation and Security

EasyEquities is regulated in South Africa.

Is EasyEquities Legit and Safe?

My review found no evidence of misconduct or malpractice by this broker during its decade-long history.

EasyEquities regulation and security components:

- Regulated by the FSCA

- Authorized Financial Services Provider (FSP) and licensed over-the-counter derivatives provider

- Founded in 2014

- Segregation of client deposits from corporate funds

What Would I Like EasyEquities to Add?

I want EasyEquities to offer ECN accounts, in addition to their CFD products. ECN accounts are ideal for scalping and very short-term trading, as well as for traders who prefer dealing with a broker that is impartial to client orders.

I would also like to see them add phone support.

Fees

For equity and ETF trades, EasyEquities charges a 0.25% commission, plus a 0.31% clearing fee on each trade, and VAT on costs.

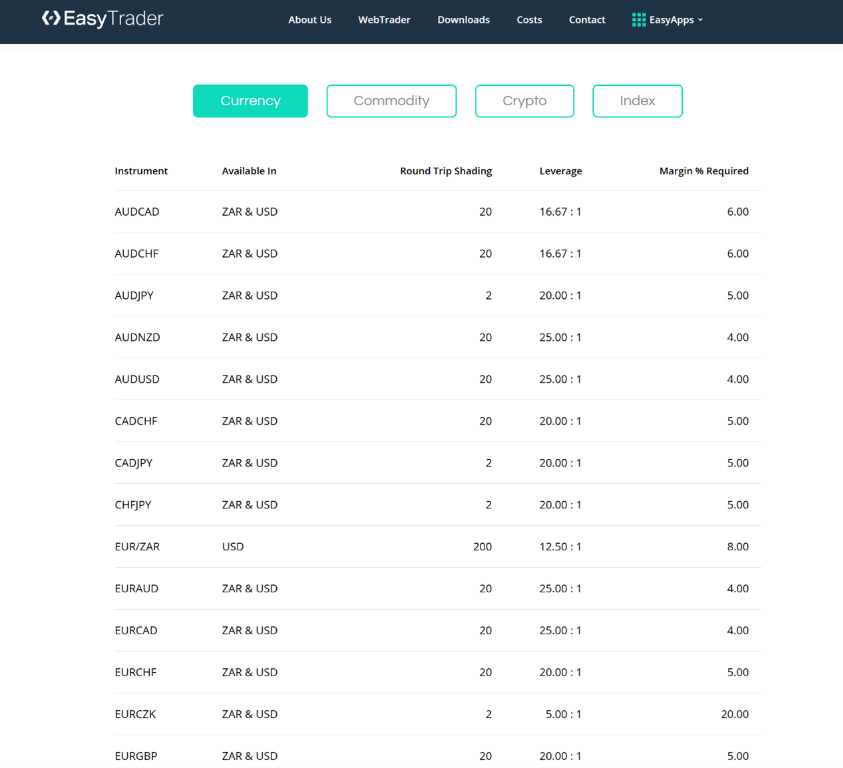

For Forex, commodity, and equity index trades, they charge a spread, which includes a commission referred to as “Round Trip Shading” that they disclose on their site for each instrument.

EasyEquities charges a monthly “Thrive fee” of R25. They eliminate the fee if a client meets specific conditions, such as depositing more than they withdraw in a particular month. Completing “Thrive levels” also results in reduced brokerage fees.

The broker does not charge internal deposit fees. However, withdrawal fees and third-party processing costs can apply. They recommend deposits and withdrawals to be carried out by Electronic Funds Transfer rather than by credit/debit card to reduce costs.

The broker applies a $10 or R120 monthly inactivity fee after 12 months of dormancy (i.e., no trades placed).

Average Trading Cost EUR/USD | R20 per contract added onto spread |

|---|---|

Average Trading Cost GBP/USD | R20 per contract added onto spread |

Average Trading Cost WTI Crude Oil | R4 per contract added onto spread |

Average Trading Cost Gold | R4 per contract added onto spread |

Average Trading Cost Bitcoin | 0.325% (0.25% + 0.075% VAT) |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | R20 added to spread for Majors |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | Yes |

On Forex CFDs, EasyEquities charges a “round-trip shading” fee of R20 per CFD contract, which is built into the spread.

Many traders overlook overnight swap fees on leveraged positions. MT5 users can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

- Equity CFD trading on popular South African, US, Australian, British and European equities

- ETFs

- Equity Indexes

- 70 Currency pairs

- Gold and silver

- Crude oil and natural gas

EasyEquities Leverage

- EasyEquities lists the leverage for each instrument on its site.

- EURUSD receives 25:1 leverage.

- Other Forex Majors receive 1:20 leverage (including USDJPY, USDCAD, GBPUSD, AUDUSD, NZDUSD, USDCHF)

- S&P 500 receives 38:1 leverage

EasyEquities Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 17:00 | Friday 17:00 |

Account Types

The broker has three account types: EasyEquities, EasyTrader and EasyCrypto. Traders use the account type depending on the asset classes they wish to trade.

Asset class | Account Type |

Equities | EasyEquities |

ETFs | EasyEquities |

Forex | EasyTrader |

Commodities | EasyTrader |

Equity Indexes | EasyTrader |

Crypto | EasyCrypto |

EasyEquities Demo Account

Unusually by broker standards, EasyEquities does not offer demo accounts.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Three platforms are available depending on the asset class.

Asset class | Account Type |

Equities | EasyEquities proprietary trading platform |

ETFs | EasyEquities proprietary trading platform |

Forex | MT5 |

Commodities | MT5 |

Equity Indexes | MT5 |

Crypto | EasyCrypto proprietary trading platform |

Having MT5 available for Forex and commodity trading is good news for those traders. It enables traders to tap into the vast MetaTrader community, including custom indicators and Expert Advisors (EAs).

Unique Features

- The EasyProperties product allows fractional ownership of physical properties.

- EasyEquities offers products tailored for South African residents, including Tax-Free Savings Accounts, retirement products with tax breaks on retirement contributions, Retirement Annuities, Preservation Funds, and Living Annuities.

Research and Education

Easy Blog and the EasyAcademy learning resources

The EasyEquities Easy Blog is regularly updated with new articles and market updates. Their EasyAcademy is a learning resource to help novice traders learn the basics quickly. However, some of the content is about how their products work rather than general market knowledge.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

EasyEquities offers an FAQ search and an automated chatbot to answer questions. Individuals can also submit a ticket or query through the site for a staff member to provide help.

Bonuses and Promotions

The company offers a loyalty program called “Thrive” that results in reduced fees by meeting specified criteria, such as reaching certain deposit levels and completing financial education modules.

Opening an Account

The company has a standard online account opening process for clients.

- South African applicants over the age of 18 will not need to upload documents unless their automated checks require it.

- Foreign nationals will need to upload a form of ID and a copy of their passport.

Minimum Deposit

EasyEquities does not have a minimum account balance.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

EasyEquities accepts Electronic Funds Transfers and credit/debit cards. The company prefers Electronic Funds Transfers because credit/debit card deposits have more third-party charges.

Accepted Countries

EasyEquities does not list excluded countries. South African residents have the option to open a ZAR or USD account. Non-South African residents must have a USD account.

Deposits and Withdrawals

- There is no minimum deposit amount

- The broker does not list a minimum withdrawal amount for South African accounts.

- International accounts have a minimum withdrawal of $20.

- The cutoff for withdrawals is 14:00 Monday to Friday. If your withdrawal is requested after this time or on a public holiday, it will be processed on the next business day.

- Your bank account must be verified before making a withdrawal.

- As part of the broker’s fraud prevention, recently deposited funds may be subject to specific locked periods (5 days to 40 days) stated on their website, depending on the type of deposit. For example, if I made a recent credit card deposit, I must wait 10 days before receiving the withdrawal amount.

- Third-party payment processing costs and currency conversion fees may apply.

Is EasyEquities a Good Broker?

EasyEquities is properly regulated in South Africa and offers accounts to South African resident and international clients. It offers a wide range of asset classes, including equities, equity indexes, currencies, commodities, and cryptocurrencies, all of which are CFDs, except for the cryptocurrencies. Their fees are reasonable, but they are not low-cost.

EasyEquities is not the most sophisticated broker, but it does offer unique features for South African clients, such as tax-free and retirement accounts, as well as property investing. Its other strength is to make the process of getting started with trading simple. It also does not require a minimum deposit. There is no minimum deposit requirement at EasyEquities EasyEquities is headquartered in Johannesburg, South Africa. Yes, EasyEquities is regulated by the FCSA in South Africa. EasyEquities withdrawals can be made via electronic Funds Transfer or credit/debit card withdrawal.FAQs

What is the minimum deposit for EasyEquities?

Where is EasyEquities located?

Is EasyEquities regulated?

How do I withdraw from EasyEquities?