Editor’s Verdict

DNA Markets is a new broker headquarters in Australia, offering traders the MT4/MT5 trading platforms and an excellent choice of Forex and cryptocurrency pairs. The minimum deposit is $100, and its payment processor choices include cryptocurrency transactions. DNA Markets is a new broker founded in 2023. I like its core trading environment, and I can recommend the commission-based Raw account to traders, especially those who combine Forex and cryptocurrency portfolios.

Overview

DNA Markets offers traders a super asset selection for Forex and cryptocurrency traders.

Headquarters | Australia |

|---|---|

Regulators | ASIC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2023 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

Average Trading Cost GBP/USD | 1.3 pips ($13.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.12 |

Average Trading Cost Bitcoin | $13.50 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $6.00 per 1.0 standard round lot |

Funding Methods | 9 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

DNA Markets Five Core Takeaways:

- MT4/MT5 trading platforms.

- An excellent choice of Forex and cryptocurrency pairs.

- For Global clients, Third-party copy trading provider Signal Start.

- The choice of payment processors includes cryptocurrency deposits and withdrawals.

- Short operational history, founded in 2023.

DNA Markets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by double-checking the provided license with their database. DNA Markets has one regulated subsidiary with a clean track record.

Country of the Regulator | Australia |

|---|---|

Name of the Regulator | ASIC |

Regulatory License Number | 514425 |

Regulatory Tier | 1 |

Is DNA Markets Legit and Safe?

My DNA Markets review found no misconduct or malpractice by this broker, but it lacks lengthy operational history.

DNA Markets regulation and security components:

- Regulated by ASIC

- Founded in 2023

- Segregation of client deposits from corporate funds

- Negative balance protection

- All non-Australian resident clients will deal with the unregulated but duly registered St. Vincent and Grenadines subsidiary.

- Insufficient operational history

What would I like DNA Markets to add?

I would like for DNA Markets to consider membership with the Hong Kong-based Financial Commission, which provides third-party audits and a €20,000 compensation fund per claim. DNA Markets may also consider a third-party insurance package to enhance protection.

Fees

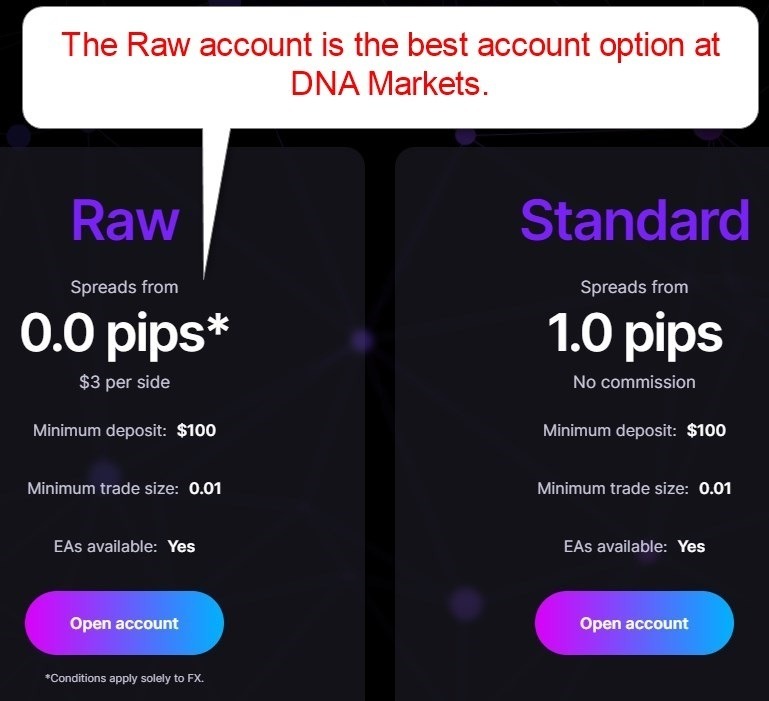

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. DNA Markets maintains one competitively priced commission-based account type and one more expensive commission-free alternative.

During my DNA Markets review, the minimum raw spreads were 0.0 pips for a commission of $6.00 per 1.0 standard round lot versus 1.0 pips or $10.00 per lot in the commission-free account.

DNA Markets charges no deposit fees except on bank wires, but all withdrawals are free, and DNA Markets does not levy any inactivity fee. Third-party payment processing costs or currency conversion fees, which DNA Markets does not control, may apply.

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips ($13.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.12 |

Average Trading Cost Bitcoin | $13.50 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $6.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

The minimum trading costs for the EUR/USD at DNA Markets are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.0 pips (Standard) | $0.00 | $10.00 |

0.0 pips (Raw) | $6.00 | $6.00 |

Here is a snapshot of DNA Markets trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free DNA Markets Standard account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the DNA Markets Classic account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

1.1 pips | $0.00 | $6.6624 | X | -$17.6624 |

1.1 pips | $0.00 | X | -$2.4706 | -$8.5294 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the DNA Markets Classic account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

1.1 pips | $0.00 | $46.6368 | X | -$57.6368 |

1.1 pips | $0.00 | X | -$17.2942 | $6.2942 |

Noteworthy:

- DNA Markets offers positive swap rates on qualifying assets, allowing traders to earn money.

DNA Markets Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 23:58 |

Cryptocurrencies | Sunday 00:00 | Saturday 23:55 |

Commodities | Monday 03:00 | Friday 23:59 |

Crude Oil | Monday 03:00 | Friday 23:59 |

Gold | Monday 01:01 | Friday 23:58 |

Metals | Monday 01:01 | Friday 23:58 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Sunday 00:00 | Friday 22:00 |

Range of Assets

DNA Markets maintains a balanced asset selection of highly liquid trading instruments. During my DNA Markets review, I liked the choice of cryptocurrency CFDs. The equity selection offers a choice of Australian and US companies.

Overall, I like the range of assets for traders, as they get plenty of liquid trading instruments. While I would like more diversification, I believe most traders will find the range of assets more than sufficient.

DNA Markets offers the following assets:

- 40+ currency pairs

- 60+ cryptocurrency pairs

- 4 commodities

- 8 indices

- 500+ equity CFDs

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

DNA Markets Leverage for Global Clients

Maximum Retail Leverage | 1:500 |

|---|---|

Maximum Pro Leverage | 1:500 |

What should Global traders know about leverage at DNA Markets?

- Maximum retail Forex leverage is 1:500.

- Cryptocurrency CFD traders get 1:20.

- Commodity traders get 1:100.

- Index traders can only take unleveraged positions at 1:1.

- Equity traders max out at 1:20.

- Negative balance protection exists, ensuring traders cannot lose more than their deposit.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

DNA Markets offers two account types: one expensive commission-free option and one commission-based alternative. Not all account features are identical either. The spreads are different. which will affect profit/loss of the trade. The minimum deposit is the same at $100 for both Raw and Standard accounts.

The account types at DNA Markets feature:

- Minimum trade size of 0.01 lots

- Maximum trade size of 100 lots

- Margin call level at 100%

- Stop out level at 50%

- AUD, USD, EUR, GBP, NZD, CAD, and SGD as account base currencies

- No restrictions on trading strategies

DNA Markets Demo Account

Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders against using demo trading as any more than an educational tool.

What stands out about the DNA Markets demo account?

- DNA Markets offers customizable MT4/MT5 demo accounts.

- Traders get a $100,000 demo account balance.

- Traders can open up to 5 demo accounts.

- Demo accounts have no expiry as long as traders use them.

Trading Platforms

Traders at DNA Markets can choose between the industry-leading algorithmic trading platform MT4 and the equity-favorite MT5. Both trading platforms support algorithmic trading and have an embedded copy trading service. MT4/MT5 are available as powerful desktop trading platforms, lightweight web-based alternatives, and user-friendly mobile apps.

Traders can upgrade MT4 through 25,000+ custom indicators, templates, and EAs, 10,000+ for MT5, but DNA Markets does not provide platform upgrades. DNA Markets ensures deep liquidity, resulting in tight spreads in the commission-based Raw account, fast order execution via trading servers positioned across global financial centers, and the only thing missing for active algorithmic traders is VPS hosting for low-latency 24/5, 24/7 for cryptocurrencies, market access.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my DNA Markets review, I found the availability of fee-based third-party copy trading provider Signal Start a unique feature. It allows copy traders under the Global entity to diversify their strategies outside the MT4/MT5 ecosystem with a professional service. DNA Markets pays for the first three months of service, allowing its traders to explore and test Signal Start.

Research & Education

DNA Markets is a new broker and does not provide research. Given the abundance of free and paid-for services, I do not consider its absence against DNA Markets. As a new broker, DNA Markets focuses on its core trading infrastructure, which I appreciate.

What about education at DNA Markets?

DNA Markets does not offer education for beginners. I prefer the absence of educational content versus a section that exists without thought. I like that DNA Markets builds its brokerage and reputation by focusing on its core trading environment from where it can grow and add more products and services.

My conclusion:

- I recommend beginners seek in-depth education from third parties, focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

DNA Markets customer support is available 24/5 via e-mail and phone. I did not find an FAQ section during my DNA Markets review, but DNA Markets explained everything well, and I did not require customer support.

Noteworthy:

- DNA Markets offers phone support, but I miss a direct line to the finance department, where most issues can arise.

Bonuses and Promotions

During my DNA Markets review, traders received three months of free Signal Start copy trading services.

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Opening an Account

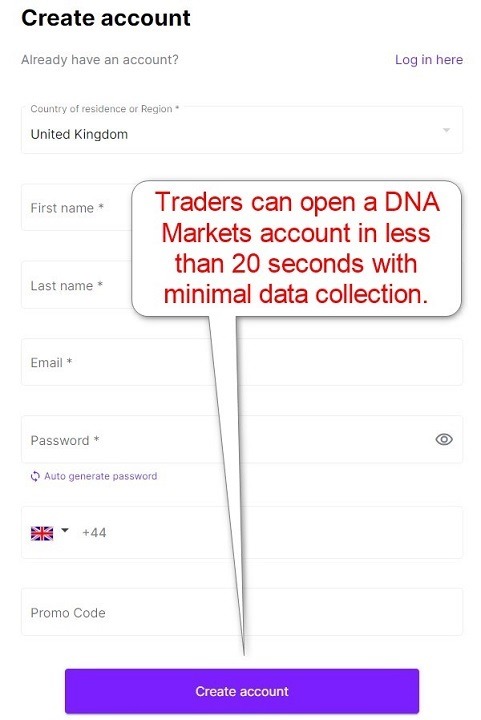

The DNA Markets account application asks for country of residence, a name, e-mail, desired password, and valid phone number. Clicking “Create account” completes the registration. DNA Markets will send a confirmation link via e-mail and the applicant will be required to upload documentation before granting access to the client portal.

What should traders know about the DNA Markets account opening process?

- DNA Markets complies with global AML/KYC requirements.

- Account verification is mandatory.

- Uploading a copy of a government-issued ID and one proof of residency document satisfies account verification for most traders.

- DNA Markets does not collect unnecessary data or involves additional steps like questionnaires.

- DNA Markets may ask for additional information on a case-by-case basis.

Minimum Deposit

The DNA Markets minimum deposit is $100.

Payment Methods

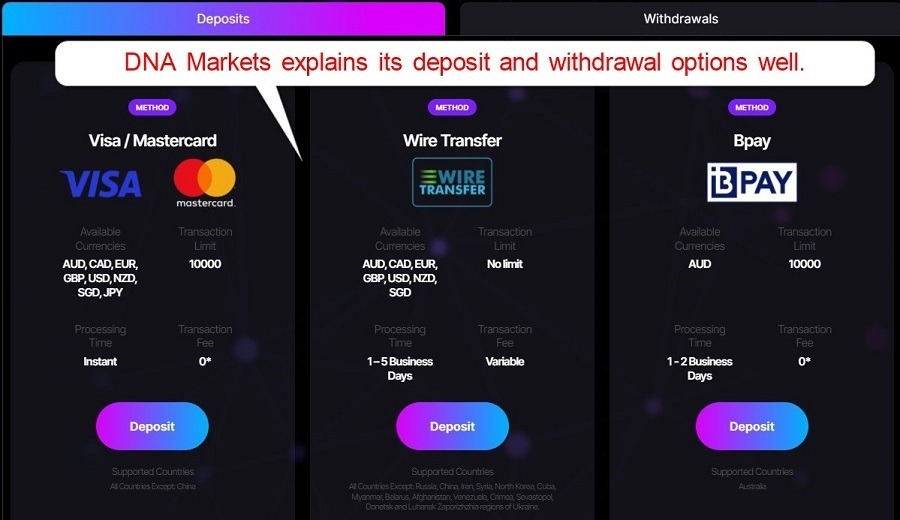

DNA Markets accepts bank wires, credit/debit cards, BPay, Skrill, Neteller, cryptocurrencies, QR Code, Bitwallet, and AstroPay.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

DNA Markets does not provide an accepted or restricted countries list but adds that its services are “not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements.”

Deposits and Withdrawals

The secure DNA Markets client portal handles financial transactions for verified clients.

What are the key takeaways from the DNA Markets deposit and withdrawal process?

- DNA Markets levies internal deposit fees on bank wires, Skrill, Neteller, cryptocurrencies, and AstroPay.

- No DNA Markets withdrawal fees apply.

- The minimum deposit requirement is $100.

- Deposit currencies are AUD, CAD, EUR, GBP, IDR, MYR, VND, USD, NZD, SGD, JPY, and THB.

- All payment processors have a deposit limit between 3,000 and 10,000 currency units except for bank wires.

- Deposit processing times are instant except for bank wires and BPay.

- No minimum withdrawal amount exists, but a maximum exists on all payment processors except bank wires, credit/debit cards, and BPay.

- The availability of payment processors depends on the geographic location of traders.

- The name on the payment processor and DNA Markets trading account must match in compliance with AML regulations.

- It can take up to five days for funds to arrive, but some payment processors have near-instant processing once DNA Markets approves a withdrawal.

- Traders may face third-party payment processing charges.

Is DNA Markets a good broker?

I like the trading environment at DNA Markets for traders as they benefit from liquid trading instruments, fast order execution, and algorithmic trading via MT4/MT5. Copy traders can diversify via embedded MT4/MT5 services or fee-based Signal Start. The minimum deposit requirement of $100 ensures all traders can access DNA Markets, and the payment processor choices include localized methods for its core markets and cryptocurrency transactions. Verified traders can withdraw their funds via the secure and user-friendly client portal , which lists all available withdrawal methods, including cryptocurrencies. DNA Markets is a legit broker headquartered in Australia regulated by ASIC. The DNA Markets minimum deposit is $100 or a currency equivalent. The ASIC regulates DNA Markets for Australian traders, but all non-Australian clients are onboarded under the unregulated but duly registered St. Vincent and the Grenadines subsidiary.FAQs

How can you withdraw money from DNA Markets?

Is DNA Markets legit or a scam?

What is the DNA Markets minimum deposit?

Is DNA Markets regulated?