cTrader Trading platform, continues to gain market share from MT4, and is designed for STP and ECN execution models.

cTrader supports both automated & social trading. Want to learn more about the best cTrader options? See below.

- Pepperstone, Great ECN execution on MT4/5, cTader, TradingView and Pepperstone proprietary platform.

- BlackBull Markets, 1:500 maximum leverage with ultra-low trading fees and deep liquidity.

- FxPro, Choice of great platforms + top-tier technology.

- PipFarm, Industry-leading scalability up to $1.5M, 95% profit share, and crypto withdrawals.

- IC Markets, a top choice for active traders.

Top Ctrader Brokers

Best cTrader Brokers Comparison

|  |  | .webp) |  | |

Regulators | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | FMA, FSA | N/A | N/A | ASIC, CySEC, FSA |

Year Established | 2010 | 2014 | 2006 | 2023 | 2010 |

Execution Type(s) | No Dealing Desk, NDD | ECN/STP, No Dealing Desk | No Dealing Desk | N/A | ECN/STP |

Minimum Deposit | |||||

Average Trading Cost EUR/USD | 1.1 pips | 1.1 pips | 1.3 pips | N/A | 0.0 pips ($0.00) |

Average Trading Cost GBP/USD | 1.4 pips | 1.55 pips | 1.5 pips | N/A | 0.0 pips ($0.00) |

Average Trading Cost Gold | $0.15 | 0.12 pips | $0.29 | N/A | $0.05 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Trading View+ | MetaTrader 4, MetaTrader 5, cTrader, Trading View | Other, MetaTrader 4, MetaTrader 5, cTrader+ | cTrader | MetaTrader 4, MetaTrader 5, cTrader |

Islamic Account | N/A | ||||

Negative Balance Protection | N/A | N/A | N/A | N/A | |

Get Started Visit Website75-95% of traders on margin lose | Visit Website | Read Review | Read Review | Read Review |

Pepperstone

In Summary Great ECN execution on MT4/5, cTader, TradingView and Pepperstone proprietary platformFP Markets ranks among the best cTrader Forex brokers due to a well-balanced asset selection, including cryptocurrencies, ETFs, and bonds. The reasonable $100 minimum deposit requirement ensures accessibility, and traders benefit from competitive, commission-based fees starting with raw spreads from 0.0 pips for a commission of $6.00 per 1.0 round lot.

Algorithmic traders can use cAlgo, coded in C#, and copy traders can use the embedded cTrader copy trading service. Each FP Markets cTrader account gets a unique cTID, allowing traders to use one cTrader platform for all cTrader accounts across all Forex brokers offering the trading platform.

Pros & Cons

- Excellent choice of trading platforms consisting of MT4/MT5, cTrader, TreadingView and Pepperstone Platform

- Market-leading MT4/MT5 upgrade package, Autochartist, and API trading

- Social trading support via Signal Start, MetaTrader Signals, Copy Trading by Pepperstone, DupliTrade

- Leverage of up to 1:400 depends on jurisdiction and superb trade execution

- Demo accounts have 60-day time limits

BlackBull Markets

In Summary 1:500 maximum leverage with ultra-low trading fees and deep liquidityBlackBull Markets was founded in 2014 in New Zealand. Like many antipodean Forex brokers, BlackBull Markets is an ECN broker, offering raw spreads and commissions. They are regulated in New Zealand by the Financial Services Providers Register (FSPR) and offer a maximum leverage on some Forex currency pairs as high as 500 to 1. In addition to their global headquarters in New Zealand, BlackBull Markets also has presences in the form of branch offices in New York and Malaysia. BlackBull Markets offers a relatively tight range of tradable assets: 27 Forex currency pairs and crosses, gold, silver, crude oil, natural gas, and 6 major equity indices. That should be sufficient for those traders with more focused strategies not requiring wide diversification.

Pros & Cons

- ECN/NDD execution model with deep liquidity

- Institution-grade pricing for retail traders via proprietary price aggregation

- ZuluTrade and Myfxbook for social trading

- Leverage of up to 1:500

- Limited deposit options

FxPro

In Summary Choice of great platforms + top-tier technologyFxPro remains one of the best overall Forex brokers and the most critically acclaimed, with more than 80 international awards. This broker is headquartered in the UK but serves international traders from its subsidiary in the Bahamas. Retail clients may use the MT4 and MT5 trading platforms, while cTrader and the proprietary FxPro Trading Platform are equally available. FxPro primarily benefits high-frequency traders, including scalpers, from its competitively priced commission-based account, while the commission-free alternative carries an above-average cost structure.

The FxPro News section receives multiple updates throughout each trading day, consisting of market commentary and trading ideas. The Trading Central MT4/MT5 plug-in upgrades the trading experience, while cTrader offers an excellent alternative with custom cTrader indicators and cTrader bots. Expanding the competitive trading environment is high-quality educational content. The minimum deposit of $100 ensures FxPro remains accessible to all retail traders who seek maximum leverage of 1:500, VPS hosting, deep liquidity, ultra-fast execution, and competitive pricing.

Pros & Cons

- Quality education for beginners and trading tools for advanced traders

- Excellent asset selection and high leverage with negative balance protection

- Competitive commission-free and commission-based trading fees

- Excellent NDD order execution, including positive slippage and requotes

- Limited payment processors and no crypto deposits/withdrawals

PipFarm

In Summary Industry-leading scalability up to $1.5M, 95% profit share, and crypto withdrawalsPipFarm offers all its accounts in partnership with TopFX and supports 20+ payment processors, including cryptocurrencies. The five-tier rank promotions slash trading fees and improve trading conditions. Prop traders can scale their profit share from 75% to 95% and the maximum funds under management to $1.5M. So, I rank PipFarm among the best prop firms.

Prop traders can choose a one-phase evaluation with a trailing maximum drawdown of 12% and a profit target of 12% or opt for the two-phase alternative with a static maximum drawdown of 9% and a 6%-6% profit target. The daily loss limit is 3%.

Pros & Cons

- Maximum funded accounts of up to $1.5 million

- Challenges provided on the popular cTrader platform.

- Low minimum evaluation fee starting from $50

- Profit share of up to 95%

- Does not offer stock trading

IC Markets

In Summary a top choice for active tradersPros & Cons

- Leverage of up to 1:500, deep liquidity, and superb trade execution

- Market-leading MT4 upgrade package, MAM/PAMM accounts, and VPS hosting

- Excellent choice of trading platforms consisting of MT4/MT5, and cTrader

- Social trading support via Myfxbook, MetaTrader Signals, and ZuluTrade

- Minimum deposit slightly higher but within a reasonable range

cTrader Brokers Explained

MetaQuotes and its MT4 trading platform remain the most popular choice among retail traders due to the versatile and excellent infrastructure. Its design and out-of-the-box functionalities are sub-standard. Spotware Systems LTD embarked on a journey to deliver a superior alternative with its cTrader platform. cTrader delivers the best out-of-the-box trading experience, and a "Traders First" mindset drives Spotware development. The cTrader platform earned a reputation as a premium product offered by brokers seeking to deliver the best trading environment to clients. cTrader brokers provide access to raw spreads for a commission, and interests remain aligned with traders, as they are never the counterparty to clients. High-frequency traders and Forex scalpers prefer the cTrader platform due to its execution speed, access to Level II data, and advanced order ticket.

Spotware Systems and MetaQuotes operate out of Cyprus, the former hub for international brokers, which lost its competitiveness due to rules and regulations enforced by the European Securities and Markets Authority (ESMA). The competitive cTrader universe also includes cAlgo for automated trading solutions, an in-depth broker reporting tool in cBroker, cMirror for copy trading, and cXchange for cryptocurrencies. With 100% uptime over the past seven years, an internal processing time of three milliseconds, and 14,000 processed orders per minute, the cTrader trading platform displays its superior technology backed by over $40 million in infrastructure investments. Thousands of strategy providers, tens of thousands of developers, and more than 10,000 active members form the cTrader community. It rapidly expands as traders seek superior quality from their brokers, which cTrader delivers.

Dedicated traders who favor a complete trading solution with an excellent interface, reliability, and choices to modify and upgrade from a premium trading platform will select cTrader over any other out-of-the-box alternative. Unlike MetaTrader with its MQL4 and MQL5 coding languages, developers of cTrader bots and apps can code in C#. Many custom cTrader indicators already exist, and independent developers add more as the cTrader trading platform continues to evolve and displace MT4 and MT5. cTrader platform brokers remain among the most competitive and trustworthy ones, another fact traders should consider. Since cTrader brokers do not trade against their clients, unlike market makers who favor MT4 and MT5, clients can manage portfolios with a broker that seeks to deliver the best trading environment for them, as they remain compensated by trading commissions and therefore seek profitable traders.

Unlike MT4 brokers, cTrader platform brokers are not market makers and do not trade against their clients. This is the most significant difference: aligning broker and trader interests. cTrader brokers deploy STP/ECN execution models, offering clients access to raw spreads without broker mark-ups for a commission. Therefore, the more successful a client at a cTrader broker is, the more profitable it is for the broker. The trading environment remains superior and geared towards high-frequency and high-volume traders. Many cTrader brokers also grant a cash rebate or loyalty program, lowering the final cost structure. Usually, cTrader platform brokers rank among the best online brokers with superior technology, ideal for automated trading solutions.

Pros and Cons of the cTrader Platform

I recommend considering the pros and cons of any platform before deciding which one to use. There is no such thing as a perfect trading platform that suits all traders, but some alternatives can offer a cutting-edge solution following a few upgrades. The better the out-of-the-box version is, the fewer investments a trader must commit. In this regard, cTrader represents the best trading platform without customizations and add-ons, leaving MT4 as a distant second.

The Pros of the cTrader Platform

- Excellent user interface, making cTrader the best out-of-the-box trading platform.

- Outstanding charts and technical analysis tools.

- Superior execution speed and technology.

- Growing community of developers creating cTrader indicators and cTrader bots.

- C# coding language allows development without learning a platform-specific language.

- APIs support third-party development.

- cAlgo and cMirror fully support automated and mirror trading.

- No dealing desk (NDD), straight-through processing (STP), electronic communication network (ECN) execution models.

The Cons of the cTrader Platform

- New traders may struggle with the range of features.

- Less automated trading solutions compared to MT4.

- Availability of cTrader remains limited.

Speed and Customization

The lightweight design of the cTrader platform offers lightning-fast execution as fast as three milliseconds. It is customized for high-speed trading and expands its market share in this sub-sector. Chart trading is responsive, and traders can modify existing positions or orders by dragging elements on the chart, eliminating order tickets. Traders have nine chart types and 54 timeframes, making it superior to other trading platforms. Over 70 pre-installed technical indicators offer traders comprehensive options, expanded by custom cTrader indicators. cTrader supports multi-screen trading, allowing traders to detach charts from the trading platform and dragging them onto other screens. ChartShots enables traders to capture and share trading charts with ease. cTrader remains the best out-of-the-box trading platform and expands on it with excellent speed and customization options.

cTrader & Market Depth

Another useful feature at cTrader is the Depth of Market (DOM). Besides granting traders access to Level II pricing, three DOM options provide greater flexibility and trading options. The default option is Standard DOM. The other two include the more detailed Price DOM and the Volume-Weighted Average Price (VWAP) DOM. The cTrader market depth adds to the competitive advantage of this trading platform with ECN traders. With the cTrader market depth, clients get essential liquidity information, a defining insight for several trading strategies, including scalping.

cTrader Scalping

The superior technology of cTrader delivers ultra-fast execution times, which is a requirement for profitable scalping strategies. Our cTrader review shows that all cTrader brokers we evaluated grant clients access to raw spreads with competitive commissions. Level II pricing and fast order entry execution combined with swift order management directly from advanced charts provide manual scalpers with an advantage. cTrader bots deliver a necessary competitive edge to committed professional scalpers and high-frequency trading firms. The choice of order trigger methods, advanced order protection and quick trade functionality offer scalpers additional tools to benefit from market volatility.

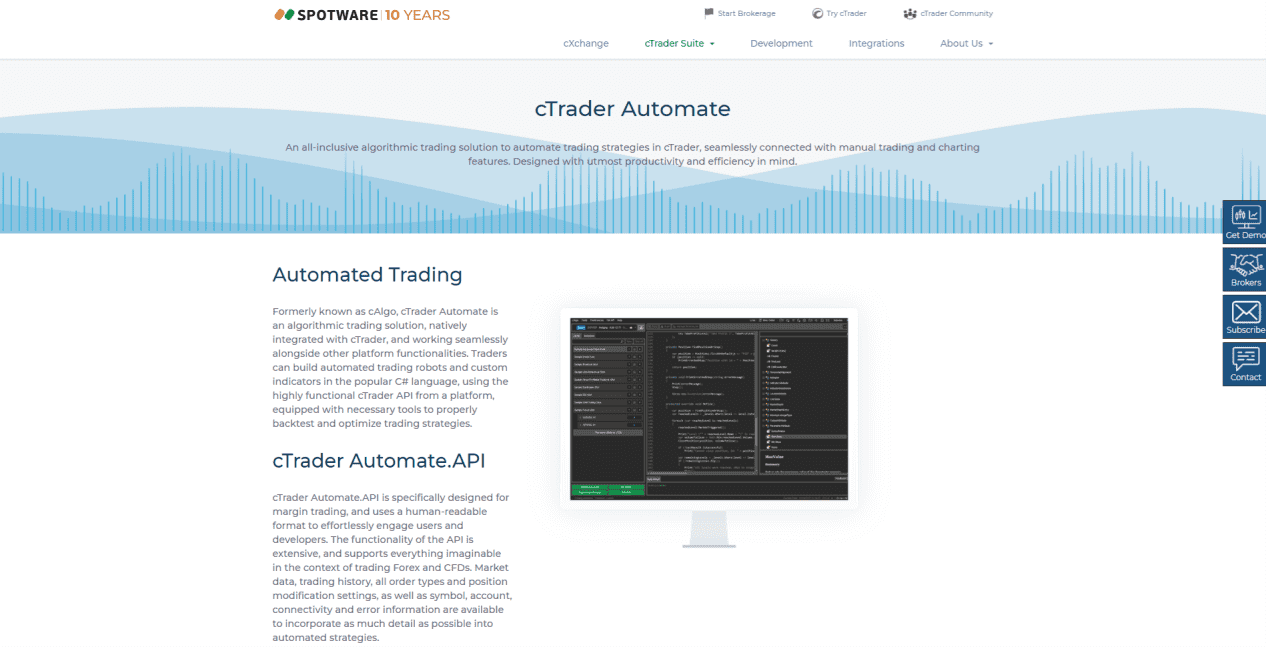

Automated Trading with cTrader and Custom Indicators

cAlgo supports automated trading solutions that run directly on the cTrader trading platform as cBots or as independent solutions connecting to it via APIs. Developers do not have to learn a platform-specific coding language like in MT4/MT5 and can use C#. The back-testing option delivers in-depth historical results, trade statistics, and optimization. Developers can code custom cTrader indicators, cTrader bots, and independent automated trading solutions via the build-in code editor or Visual Studio. Tens of thousands of cAlgo developers already joined the community, which continues to expand rapidly to meet the demand from tens of thousands of traders seeking cutting-edge solutions. While MT4 remains the market leader for automated trading, cTrader enjoys the fastest growth rate in the sector, slowly narrowing the gap.

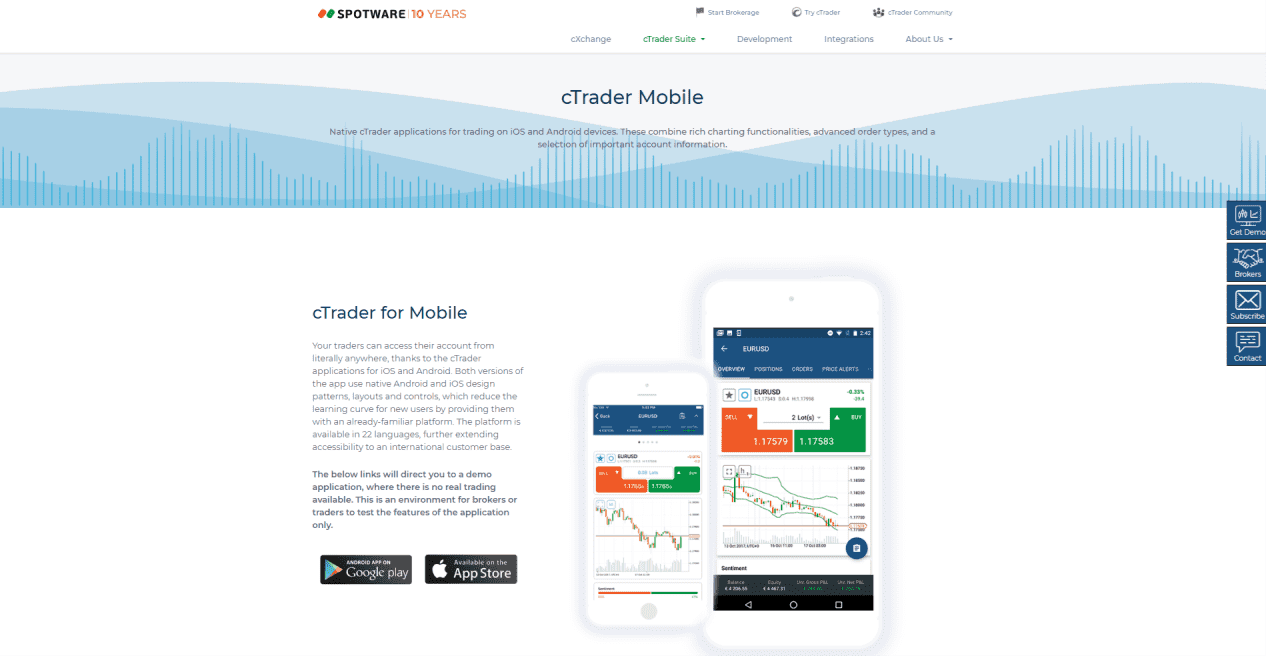

cTrader Mobile Devices

With the popularity of mobile trading among new retail traders, especially millennial ones, the cTrader mobile apps for Android and iOS devices provide a powerful light trading platform with heavy features. Clients from emerging and frontier markets also prefer trading from mobile apps amid the absence of multiple devices. Their primary choice falls on high-powered mobile devices, and cTrader displays a user-friendly mobile trading platform, including fluid charting, order placement, and trade history. The cTrader ID utilizes the cloud and allows traders to sync their trading platform across multiple devices.

cTrader Tools

The cTrader platform has a multitude of excellent trading tools, functions, and custom indicators, adding to a very versatile trading platform suitable for today’s financial markets. It allows traders to implement multi-screen working spaces, offering professional and institutional traders an efficient trading environment. It also extends to retail clients trading for a living, ensuring they have the necessary trading environment to succeed. Besides in-depth order placement and management tools, I believe the below cTrader tools provide new traders with an excellent start to their trading career.

- Charts - cTrader offers nine chart types, six zoom levels and 54 timeframes. It provides traders with the most comprehensive out-of-the-box experience and excellent tools for automated traders and scalpers.

- Lines - cTrader provides technical analysts with multiple drawing tools, including trendlines, horizontal lines and vertical lines. After clicking and dragging the desired lines, right-clicking on them opens a dialogue box with more options like "Extend to infinity", "Snap to chart price" and "Duplicate."

- Equidistant Price Channel - An excellent tool to identify support and resistance levels in an uptrend or downtrend when price action remains between two parallel trendlines.

- Fibonacci - The Fibonacci sequence forms part of most technical trading strategies due to its reliable support and resistance levels. cTrader supports five variants of it.

- Pitchfork - Another well-used indicator, Andrew’s Pitchfork, consists of three trendlines. Analysts select the starting point of an uptrend or downtrend, and the technical indicator reveals support and resistance levels together with potential breakout and breakdown levels.

- Price Alert Setting - Traders can set price alerts delivered via in-app pop-ups, sound alerts or e-mail. Users can create custom notifications and review multiple ones in the Alerts List.

cTrader Preferences

The cTrader trading platform is versatile and supports extensive customizations and modifications. Traders can set and save their cTrader preferences as default options, allowing for a one-time set-up, and eliminating time-consuming adjustments. cTrader supports 50 custom chart templates, offering traders the ability to create and apply different ones for various assets, time frames and technical trading strategies.

Deposits & Withdrawals

While cTrader enables swift deposits and withdrawals, the selection of payment processors, execution times and costs depend on the cTrader platform brokers. cTrader allows financial transactions directly from inside the trading platform.

6 Factors to Consider When Choosing cTrader Brokers

cTrader is an excellent trading platform and established itself as a premium alternative to MT4/MT5 but includes a significantly higher price tag for brokers. It is one reason why almost every Forex broker offers MT4, and only a small group of high-quality ones provide cTrader alongside MT4. While the cTrader trading platform represents an excellent choice, the trading environment depends on the cTrader broker. There are many facts to consider, but I recommend narrowing down the list of cTrader brokers with the ones listed below.

Trusted and Established

The brokerage industry remains competitive, and new ones appear every year. They often provide incentives like bonuses or other attractive offers to gain a foothold and build their client base organically, via poaching existing traders from competitors. With thousands of new traders seeking a home daily, there is plenty of demand. While there is nothing wrong with testing a new and exciting broker, I recommend doing so with limited capital resources. Primary portfolios should stay with well-established and trusted brokers. I do urge traders to ensure their cTrader brokers have a minimum of five years of operating history together with a spotless regulatory track record. I cannot stress enough the ease of mind about your capital and its safety. It ranks on par with a transparent and fair-trading environment and is paramount to successful trading as the trading strategy, cost structure, execution model, psychology, patience, and discipline.

Commissions and Fees

Since cTrader brokers provide traders with raw spreads for a commission, I recommend taking a closer look at commissions. Traders should ignore anything above $7 per lot, while the most competitive brokers offer between $4 and $6, together with a cash rebate program to lower final trading costs. It is best to examine all fees, including currency conversion costs that apply to each trade that is not in the account base currency. Deposit and withdrawal fees and inactivity charges play a secondary role, while swap rates on leveraged overnight positions apply across the board except for Islamic accounts. The commission will have the most significant impact on profitability.

Funding and Withdrawal Methods

All cTrader brokers provide bank wires and credit/debit cards, but traders should consider online payment processors where the processing speed and transaction costs remain lower. Some offer debit cards, providing a superior and cost-effective fund management solution. I recommend determining what suits the individual and then check if a broker maintains modern solutions. The absence of any choices aside from bank-related ones is not acceptable.

Customer Support

Most traders at a well-managed cTrader broker do not need customer support, as all aspects function without problems. Despite it, customer support should exist and assist in case of emergencies. Always make sure that a broker provides a phone number together with live chat or messengers. Traders must have swift access to a representative to address any issues without delay.

Trader Resources Offering

Trader resources are what separates good cTrader brokers from excellent ones. The needs and demands differ between traders, but a competitive research division can add tremendous value. Traders do not have to act based on the research. A broker that deploys resources to provide daily market commentary and trading ideas shows commitment to a cutting-edge trading environment. I also recommend that traders take a look at trading tools to improve out-of-the-box trading environments. While this may apply more to MT4/MT5 brokers than cTrader brokers, the best brokers source third-party add-ons.

Regulation

Never trade with an unregulated broker, regardless of how well they market their product and services. I urge extreme caution with brokers operating out of St. Vincent and the Grenadines. The financial regulator, the Financial Services Authority (FSA), is also responsible for registrations of international business companies (IBCs). Therefore, a Forex or CFD broker remains registered as an IBC with the FSA, but the FSA does not regulate the sector. Every broker out of the Financial Services Authority (FSA) remains an unregulated but duly registered broker. There are legit brokers headquartered there, but they will add security features like a membership with the Hong Kong-based Financial Security Commission (FSC), the first global independent self-regulatory organization and external dispute resolution (EDR) body. The Commission’s Compensation Fund offers protection up to €20,000 per dispute, placing it on par with CySEC-regulated brokers. Always double-check any claim of regulation with the database of the regulator to verify it.

You might also be interested in reviewing the below top brokers: