Editor’s Verdict

Overview

Review

Headquarters | South Africa |

|---|---|

Regulators | FSA, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2012 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4, Sirix |

Average Trading Cost EUR/USD | 1.5 pips ($15.00) |

Average Trading Cost GBP/USD | 2.6 pips ($26.00) |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $0.50 |

Islamic Account | |

Signals | |

Managed Accounts |

CMTrading has grown into one of Africa’s best-known brokers since being established in 2012. Authorized by two regulators, CMTrading offers traders the MT4 trading platform alongside the lesser-known Sirix Platform, which established itself as a viable alternative, especially for copy trading. The asset selection consists of 150+ instruments, and the maximum leverage is 1:200, sufficient for new traders to learn how to trade financial markets without taking on unnecessary risk. The account structure at CMTrading is similar to that of many African Forex brokers. CMTrading also provides research and educational tools.

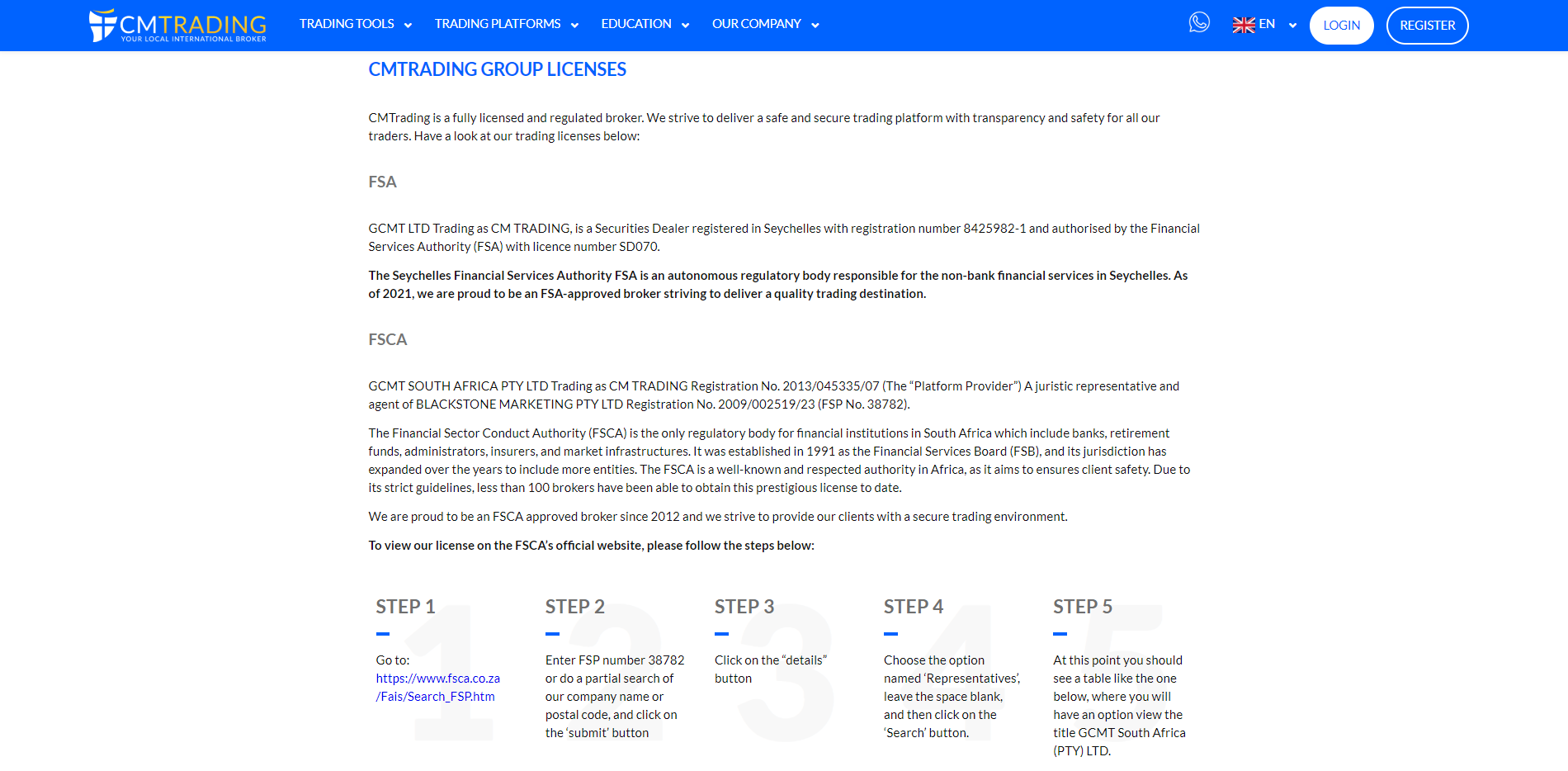

Regulation and Security

The primary regulator of GCMT SOUTH AFRICA PTY LTD since 2012, the owner of CMTrading, is the South African Financial Sector Conduct Authority (FSCA). In 2021, a Seychelles subsidiary, GCMT LTD Trading, caters to international traders with authorization from the Seychelles Financial Services Authority (FSA). Both regulators rank among the most competitive ones, with a trustworthy enforcement mechanism and increasingly positive reputation. The FSCA and the FSA are capable financial regulators expected to lead the Forex industry moving forward, together with a group of others in business-friendly jurisdictions. Therefore, CMTrading remains well-positioned.

The FSCA and the FSA emerged as two of the largest beneficiaries, a trend likely to accelerate. CMTrading segregates client deposits from corporate funds, per regulatory requirements, with top global banks, including Barclays Bank PLC and Nedbank.

CMTrading maintains a clean regulatory track record with two competitive regulators, the FSCA and the FSA.

Fees

Average Trading Cost EUR/USD | 1.5 pips ($15.00) |

|---|---|

Average Trading Cost GBP/USD | 2.6 pips ($26.00) |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $0.50 |

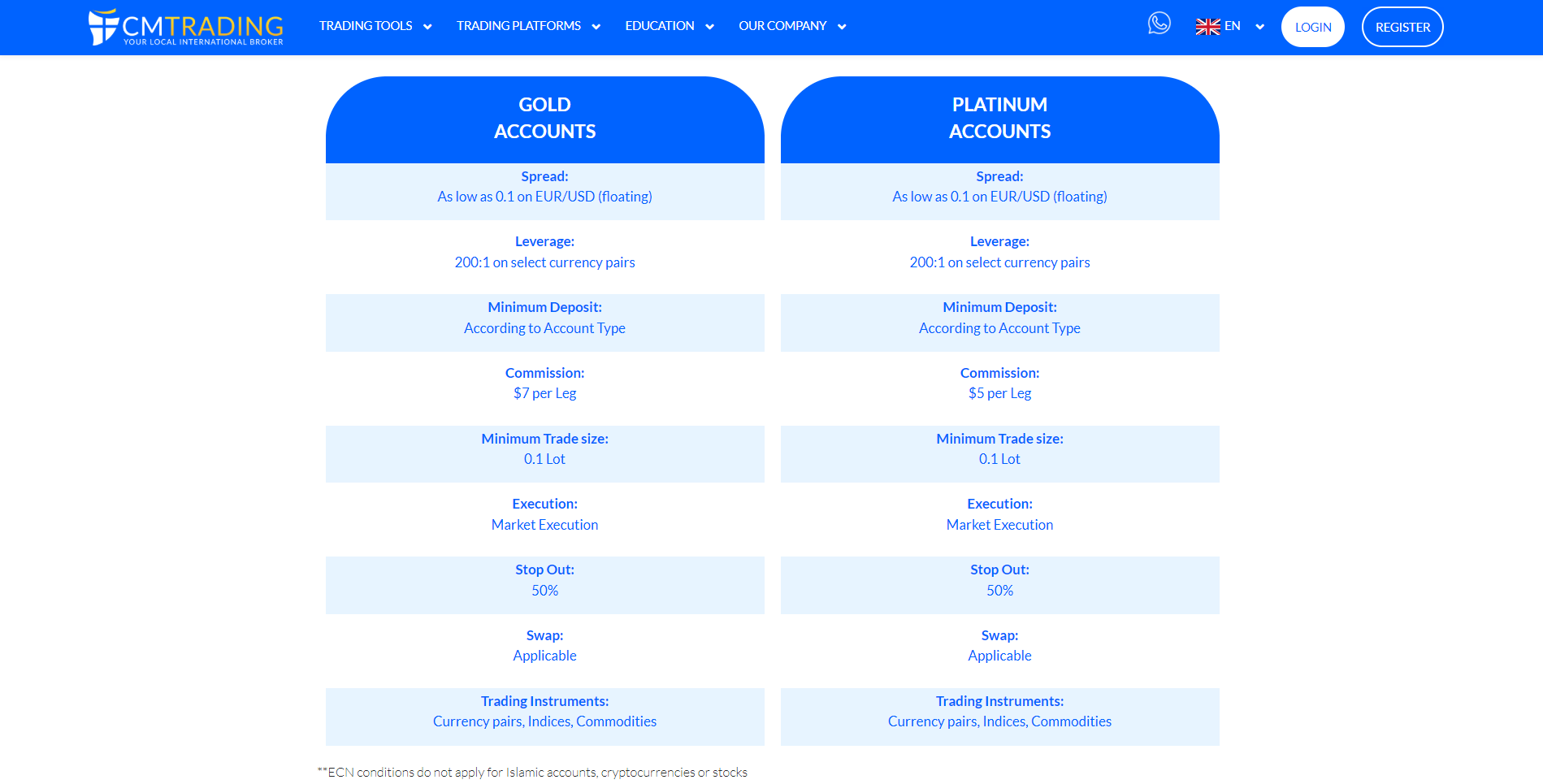

CMTrading offers commission-free and commission-based trading account. For a minimum deposit of $1,000, traders get spreads starting from 1.2 pips or $12 per 1.0 standard lot. The ECN account shows a minimum mark-up of 0.1 pips, with a commission of $7 per lot or $14 per round lot. Swap rates on leveraged overnight positions apply. An inactivity fee of $15 per month applies after 90 days of dormancy. Traders may be subject to third-party payment processor costs, as per industry standard practices. The overall pricing environment at CMTrading remains in line with other African Forex brokers.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

CMTrading Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:05 | Friday 23:59 |

Cryptocurrencies | Monday 00:05 | Friday 24:00 |

Commodities | Monday 01:01 | Friday 23:59 |

Crude Oil | Monday 01:01 | Friday 23:59 |

Gold | Monday 01:01 | Friday 23:59 |

Metals | Monday 01:01 | Friday 23:59 |

Equity Indices | Monday 01:01 | Friday 23:59 |

Stocks | Monday 03:01 | Friday 22:59 |

Bonds | Monday 01:01 | Friday 23:59 |

What Can I Trade?

CMTrading notes 150+ assets across five sectors, consisting of Forex, cryptocurrencies, commodities, equities and indices. It presents a great choice, particularly for new traders.

CMTrading has 150+ assets covering five sectors.

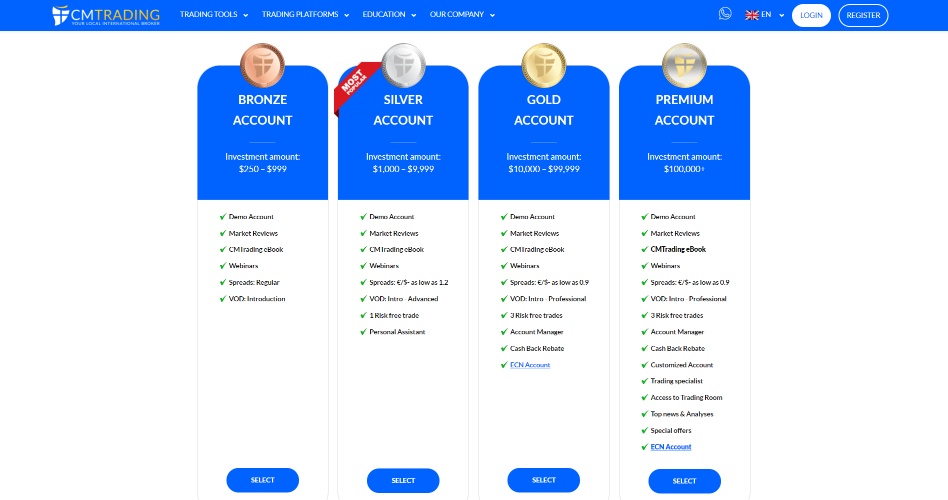

Account Types

The four commission-free and two commission-based trading account types are standard for many African brokers. Additional educational offerings are available to those who deposit over $10,000. Likewise, traders that offer higher deposits will be offered better trading conditions and lower commissions, an approach that is not uncommon though admittedly not ideal. The ECN accounts feature fewer assets than those found in the commission-free accounts. It is our belief after doing a full CMTrading review that the brokerage should consider offering more competitive pricing structures.

CMTrading implements an account structure similar to many African Forex brokers.

ECN accounts are offered as well.

Trading Platforms

CMTrading provides clients with the out-of-the-box MT4 trading platform and the Sirix Web Trader, one of the latest MT4 challengers. Sirix focuses on copy trading versus automated trading at MT4, which also has a built-in copy trading system. The user interface of the Sirix Web Trader is modern and better than MT4. However, since the MT4 infrastructure supports extensive upgrades, it is a superior choice for more advanced traders.

Traders at CMTrading may use the core MT4 trading platform or the Sirix Web Trader.

Unique Features

Copycat, the copy trading tool at CMTrading, functions with the Sirix Web Trader and can provide a crutch for traders who are short on time or aren't yet confident in their own trading strategies. The introduction also notes a Mirror Trader account, another third-party provider catering to social and copy trading. The Copycat system appears to be straightforward and easy to use, though we didn't test it in depth during this CMTrading review, as we focused more on other core features. CMTrading is proud to be home to more than 1,000,000 traders.

Research and Education

CMTrading uploads market commentary and trading ideas to YouTube. It also publishes more than half a dozen trading signals on its website. All research remains brief but has enough data for traders to follow and to make more informed decisions. The CMTrading blog provides well-presented content and trading ideas to consider. The overall research material is informative.

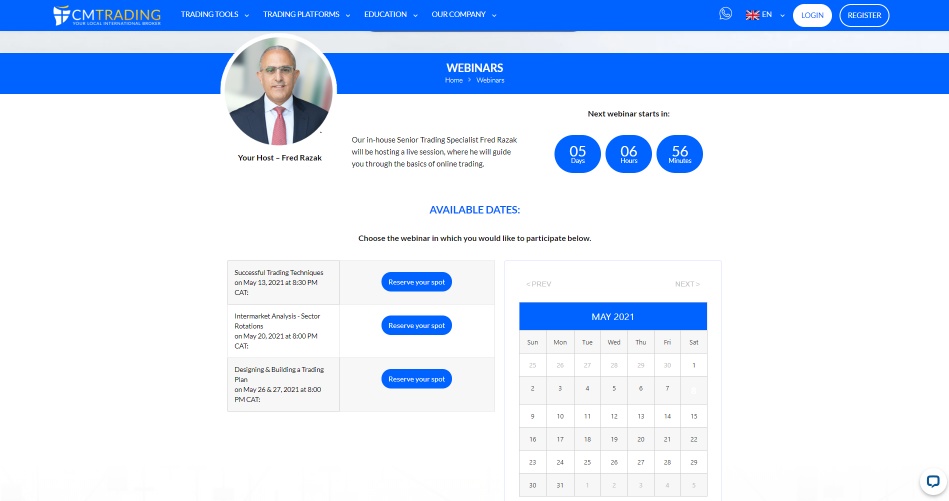

The educational section features 42 videos, while more are available for traders who deposit more than $10,000. What is available provides an excellent introduction to trading. Live webinars hosted weekly add educational value at CMTrading. Four eBooks and the messaging service for clients labeled Forex Guardian Angel complete the services for new traders. The CMTrading educational tools remain very competitive and an asset at this African broker.

The blog at CMTrading offers quality research notes where traders may find actionable trading ideas.

New traders may also benefit from the live webinars at CMTrading.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |   |

CMTrading offers 24/7 customer support via e-mail or phone, for which it lists eleven phone numbers. The registered address of its headquarters in South Africa is available. The most convenient way to contact a support representative may be via the WhatsApp messenger app or the live chat function, both of which should provide faster response time than typical email inquiries. The FAQ section answers many questions, and most traders may require assistance only during emergencies.

Bonuses and Promotions

While CMTrading presently does not list any bonuses or promotions on its website, the Legal Documents section shows two PDFs. One covers the terms and conditions, and the other outlines a refer-a-friend program. Traders interested in incentives may contact a customer support representative for the availability of incentives.

At the time of this review, CMTrading did not list any bonuses or promotions on the site, but two PDFs covering terms and conditions exist.

Opening an Account

A brief online application form offers new clients a hassle-free approach to opening an account. It does not collect unnecessary information and only requires a name, date of birth, e-mail address, desired password, and valid mobile phone number. Account verification is mandatory, as CMTrading complies with regulatory stipulations. Traders usually pass this step by submitting a copy of their ID and proof of residency document.

Deposits and Withdrawals

CMTrading supports bank wires, credit/debit cards, Neteller, M-Pesa and Online Naira as deposit and withdrawal options. A detailed description of each method is available. The minimum deposit is $250, and the minimum withdrawal $20. CMTrading processes withdrawal requests within 24 hours and does not list any costs on its website. Traders may face third-party payment processor fees.

Various deposit and withdrawal methods are offered by CMTrading.

Summary

CMTrading presents itself as the largest African broker with more than 1,000,000 traders. It has a distinct focus on Africa and the GCC and provides traders with the core MT4 trading platform alongside the Sirix Web Trader. An acceptable research section meets a competitive educational offering. CMTrading’s account structure includes various types of accounts, one of which offers numerous features for a minimum deposit of $10,000. The asset selection at 150+ covering five sectors is sufficient, particularly for new traders. The overall trading environment remains above average, and CMTrading presents one of the best choices among African brokers.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

FAQs

Is CMTrading a scam?

CMTrading operates under the oversight of two capable regulators and maintains a secure and trustworthy trading environment.

What trading platforms does CMTrading use?

CMTrading offers traders the core MT4 trading platform and the Sirix Web Trader.

What is the minimum deposit at CMTrading?

The minimum deposit at CMTrading is $250, but higher account tiers require more substantial deposits.

How do I withdraw funds from CMTrading?

Traders can request withdrawals from their back office in an easy-to-use process. CMTrading processes requests within 24 hours.

Who owns CMTrading?

CMTrading is the trading name of GCMT SOUTH AFRICA PTY LTD, which operates out of Johannesburg, South Africa.