For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Axi Editor’s Verdict

AxiTrader (Axi) presents traders with raw spreads from with raw spreads from 0.0 pip for Pro and Elite accounts, and from 0.9 pips for Standard Accounts from the MT4 trading platform, upgraded via the Autochartist plugin. API trading is also available, and there is no minimum deposit at Axi. Meanwhile, clients with an account under AxiTrader are eligible for a maximum leverage of 1:500. I reviewed Axi to determine if the trading environment delivers the edge Axi claims. Should you manage one portfolio at this Australian broker with international reach?

Overview

Axi Overview - A competitive trading environment for algorithmic trading and scalpers.

Summary

Headquarters | Australia |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2007 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | 0$ |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based, ATpro platforms |

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $18 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Axi Main Features

Retail Loss Rate | 75.90% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.4 pips |

Minimum Commission for Forex | $7.00 per round lot |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $0 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | Yes |

Inactivity Fee | Yes (after 12 months inactivity) |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 23 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Axi presents clients with one well-regulated entity.

Regulatory License Number | 318232, 509746, F003742 |

|---|

While the Axi Group of companies has three regulated subsidiaries most international traders are trading under AxiTrader Limited (AxiTrader), which is incorporated in St Vincent and the Grenadines, and registered by the Financial Services Authority. Axi is a member of the Financial Commission, an international organization engaged in the resolution of disputes within the financial services industry in the Forex market.

Fees

Average Trading Cost EUR/USD | 1.2 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $18 |

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.0 pips | $7.00 | $7.00 |

0.4 pips | $0.00 | $4.00 |

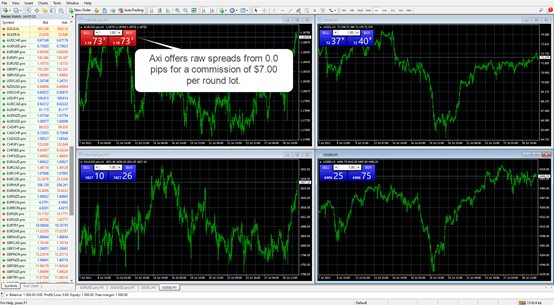

Here is a screenshot of the Axi MT4 Pro trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

Axi advertises a minimum mark-up of 0.4 pips in its commission-free trading account. During the London-New York overlap session, I received a 1.1 pip spread for the EUR/USD or $11 per 1.0 standard lot. It is an above-average trading cost, and I recommend traders avoid it. The commission-based Axi account delivers as advertised, with raw spreads of 0.0 pips for a commission of $7.00 per round lot, which resembles a competitive pricing environment.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. Axi offers a positive swap on EUR/USD short positions, meaning traders get paid money.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based Axi Pro account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | -$3.57 | X | $10.57 |

0.0 pips | $7.00 | X | $0.94 | $6.06 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | -$24.99 | X | $31.99 |

0.0 pips | $7.00 | X | $6.58 | $0.42 |

Axi offers some of the best swap rates industry-wide, something I urge traders to consider who keep positions open overnight, as it makes a notable difference. Axi does charge an inactivity fee, which adds to the excellent cost structure.

What Can I Trade

Axi provides traders with 70 currency pairs, over 35 cryptocurrency pairs, 15 commodities, 33 index CFDs, and 122 equity CFDs on its MT4 platform, whilst significantly more equity CFDs are available on Axi’s MT5 platform. It is noted though that retail investor accounts in some parts of the world are not permitted to trade cryptocurrency CFDs.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Axi Leverage

Clients with an account under AxiTrader Ltd have access to maximum leverage of 1:500. The UK and Australian regulators limit maximum leverage to 1:30. Specifically, the leverage is 30:1 for major currency pairs, 20:1 for minor currency pairs, gold, or major stock market indices, 10:1 for commodities (other than gold) or minor stock market indices, 2:1 for crypto-assets, and 5:1 for shares.

Axi Trading Hours

Asset Class | From | To |

|---|---|---|

Commodities | Monday 00:01 | Friday 23:59 |

Crude Oil | Monday 00:01 | Friday 23:59 |

Gold | Monday 00:01 | Friday 23:59 |

Metals | Monday 00:01 | Friday 23:59 |

Equity Indices | Monday 00:01 | Friday 23:15 |

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

Traders with an AxiTrader account have access to two account types, the commission-free Standard and the commission-based Pro. I advise against the former, which despite the advertised minimum spread of 0.9 pips, carries costs roughly 30% above that and beyond. It is an expensive account, and I recommend traders opt for the Pro alternative. The commission of $7.00 per round lot remains competitive, and spreads start as low as 0.0 pips, an ideal combination for algorithmic traders and scalpers.

Axi Demo Account

Axi offers a demo account with flexible options concerning the account balance, base currency, and leverage. It's a 30-day trial where you can trade in a replica of the live trading environment, including access to real-time spreads and execution speeds. So, although testing applications and trading strategies requires significantly more than 30 days, the demo account offers traders the opportuni

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Axi provides traders with the out-of-the-box MT4 trading platform and upgrades it free of charge with the Autochartist plugin. I like that Axi adds Autochartist, which can assist beginner traders. MT4 is the market leader in algorithmic trading and remains the most versatile trading platform. It is available as a desktop client, where traders get the full functionality of MT4, a light web-based platform, and a mobile app. Another highlight from Axi is that, in October 2024, they launched MT5, with plans to launch MT5 globally within a few months, becoming even more competitive with their offerings. Axi also provided its traders under AxiTrader with the MT4 MAM module for account management.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes (regionally dependent) |

cTrader | No |

Proprietary Platform | Yes (regionally dependent) |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | No |

Unique Feature One | AxiSelect |

Unique Feature Two | Autochartist |

Unique Features

Besides Autochartist, I like that Axi aims to help traders achieve goals. As an algorithmic trader, I appreciate API trading at Axi, as it allows me to connect advanced trading solutions to the Axi trading environment, and VPS hosting is also available.

Social traders may rely on Axi’s Copy Trading App, giving them the opportunity to find top traders around the world, and copy their trades.

Perhaps the most unique feature of Axi is AxiSelect, offered to users trading under AxiTrader Ltd. This groundbreaking capital allocation program gives talented traders the opportunity to get funding of up to $1,000,000 USD and gain up to 90% of the profits. Even though standard trading fees apply, traders can join the program with zero registration or monthly fees, and very importantly, Axi Select uses a Standard or a Pro live account giving traders the same internal controls as Axi’s regular accounts. Moreover, traders can also benefit from Axi Select’s all-inclusive trading environment which includes a leaderboard, a dashboard, unrestrictive trading conditions, an Edge score to evaluate one’s performance, and even an exclusive trading room where traders can connect.

Research and Education

Autochartist provides the bulk of research content at Axi, but the Axi blog also features a weekly market review. It is well written and features charts with easy-to-understand trading ideas.

The Axi blog also features high-quality educational articles, and I recommend that traders of all levels take a look, as there is plenty of thought-provoking content. Five eBooks are also available free of charge, which you can download once you provide your name, country, phone number, and e-mail address. They are required for opening an account and are therefore not an obstacle to new clients. The video library and YouTube channel consist of a wealth of trading -related content. While many of the videos are short, they introduce each topic to new traders. I think beginner traders can start there and then research more online. Overall, I find the educational section at Axi comprehensive and of good quality.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |           |

Axi offers 24/5 customer support via e-mail, live chat, or phone using ten toll-free numbers, but I did not find an FAQ section. Axi explains its products and services well, and I believe most traders will not require assistance. In case of emergencies, Axi customer support is easily accessible in 13 languages. There is also a Help Center with in-depth information about deposits, withdrawals, and more.

Bonuses and Promotions

Axi offers deposit bonuses only at their discretion.

**Bonuses and promotions are available only to AxiTrader Ltd clients. They are not applicable to residents of AU, NZ, EU, or the UK. Terms and conditions apply.

.jpg)

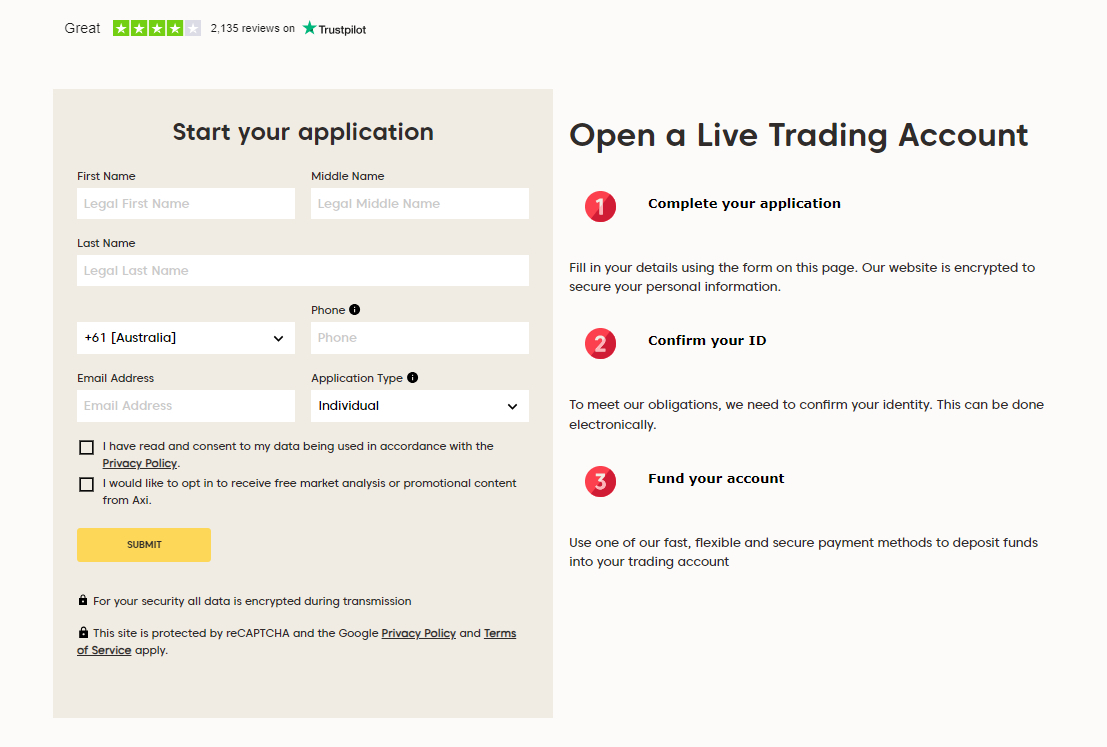

Opening an Account

Opening an account with Axi is seamless. The application form asks for your name, country, e-mail, phone number, and application type. New accounts require verification, following well-established industry practices. A copy of the ID and one proof of residency document generally satisfies this step and completes KYC/AML stipulations.

Minimum Deposit

For clients with an account under AxiTrader Ltd, there is no minimum deposit, which I appreciate, as it gives traders complete control over their deposits and trading portfolio-building strategies. The only minimum depends on the payment desired payment processors

Payment Methods

Axi offers numerous local payment options for most regions, such as bank wires, credit/debit cards, Neteller, Bitcoin, Skrill, Bank Transfers, Paypal, and more.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

Axi accepts traders from over 100 countries around the world. But, according to their website, US traders cannot trade at Axi, nor can traders from countries that are considered high-risk or where trading is not allowed.

Deposits and Withdrawals

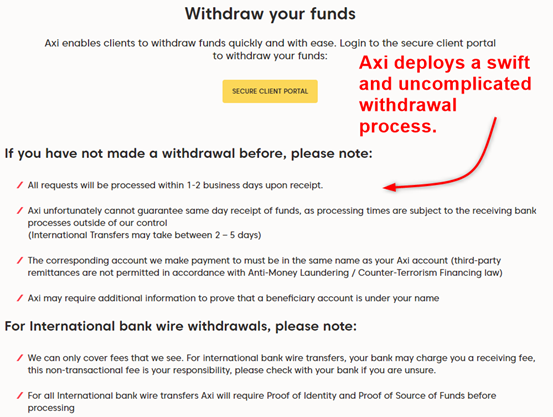

Axi processes withdrawal requests within one to two hours, ensuring traders get swift access to their capital without complications. There are no internal fees, but third-party processor costs apply. I recommend traders check with their preferred one to ensure the most cost-efficient method. Traders must request withdrawals from the secure client portal, and the name of the Axi account must match the one on the payment processor or bank account. I like the hassle-free withdrawal approach at Axi, as it adds to peace of mind when trading.

The Bottom Line

I like the trading experience at Axi as the Pro account offers raw spreads from 0.0 pips for a commission of $7.00 per round lot. I also appreciate the swap rates, which accurately reflect the global interest rate environment, free of excessive broker mark-ups, as evident at many brokers. While the asset selection is limited, I think Axi is an excellent choice for pure Forex traders with 70 currency pairs.

Beginner traders have access to a well-presented educational portal, and I think Axi Select is a real game-changer in the industry. I also like the seamless withdrawal process at Axi, while Autochartist offers a much-needed plug-in for the MT4 trading platform. Overall, I can confidently rank Axi as one of the best Forex brokers operational today.

Risk Warning:

The Axi Group is a global broker, with regulatory licenses in Australia, New Zealand, DFSA and the United Kingdom.

CFDs carry a high risk of investment loss, this content is for informational purposes only and should not be construed as investment advice.

The Axi Select program is only available to clients of AxiTrader Limited. In dealings with clients, AxiTrader acts as a principal counterparty to all of a client’s positions. AxiSelect is not available to residents of AU, NZ, EU, and the UK. For more information, please refer to the AxiSelect Terms of Service.

The Axi Copy Trading App is provided in partnership with London & Eastern LLP. Copying other traders carries inherent risks, such as the possibility of replicating poor trading decisions or copying traders whose objectives, financial situation and needs differ from your own. Any accounts available for copying have not been authorised or approved by Axi.

Axi offers Forex traders a well-regulated, trustworthy, and competitive trading environment. Some industry publications place it among the Top 10 Forex brokers by trading volume. Axi has licenses from the Australian ASIC, the UK FCA, and the Dubai DFIC. Most international traders will deal with the unregulated subsidiary located in St. Vincent and the Grenadines. Axi offers a well-rounded educational program, making it a good choice for beginner traders. There is no minimum deposit at Axi, resulting in applicable requirements based on payment processors.FAQs

Is Axi a good broker?

Is Axi regulated?

Is Axi good for beginners?

What is the Axi minimum deposit?