For over a decade, DailyForex has been the trusted forex broker authority, expanding its expertise to include the rapidly growing proprietary trading space. Our prop firm reviews are based on thorough research, first-hand platform testing, and a commitment to transparency. We evaluate key factors like profit splits, trading conditions, and challenge rules to help traders navigate prop firm offerings with confidence. Learn more about our prop firm review standards and commitment to impartiality here.

Editor’s Verdict

Axi Select is a slightly different offering in the proprietary trading space because it is not a standalone prop firm, but a capital allocation program integrated directly into Axi, a global broker established in 2007. Unlike the industry standard, where you pay a non-refundable challenge fee to trade a demo account, Axi Select requires you to deposit your own capital (minimum $500 to start) into a live account. You then trade your own funds to generate an ‘Edge Score.’ This ‘real-money’ approach is a unique feature that eliminates the conflict of interest found in demo-fee models, as the firm is invested in your success. While the requirement to risk your own funds and the exclusion of major jurisdictions (US, UK, EU, Australia) may limit its audience, the ability to scale up to $1M with up to 80% profit share makes it a great option for serious traders looking for a professional career option rather than a quick payout.

Overview

Axi Select offers a new twist on the current trend for prop trading with an allocation program for qualifying traders who sign up for a brokerage account rather than a challenge model.

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Year Established | 2023 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Minimum Evaluation Fee | $500 |

Profit-share | 40% - 80% |

Daily Loss Limit | 5% |

Maximum Trailing Drawdown | 10% |

Funded Account Options | 10 |

Minimum Funded Account | $1 |

Maximum Funded Account | $1,000,000 |

Axi Select disrupts the standard "challenge" model by offering a performance-based capital allocation program. Instead of paying a fee to pass a test, you deposit $500 USD into your own Axi live trading account. You then trade to achieve an 'Edge Score' of 50 or higher. Once qualified, you enter the "Seed" stage and can begin receiving funding allocation.

Axi Select stands out because it aligns the broker's interests with the traders. Since you are trading live funds initially, they are looking for sustainable risk management rather than lucky gambling. The program calculates performance based on Skill, Risk, and Consistency, and has a clear pathway through 6 stages (Seed to Pro M) with funding multipliers up to 100x. I also like that there are no time limits to qualify, and holding trades over weekends is permitted.

Axi Select Trustworthiness & Reputation

Because prop firms are unregulated entities, traders engaging with them need to be especially diligent in verifying that their chosen provider is reputable and has a well-established reputation for security and fairness when it comes to payouts. Axi Select differs significantly as it is a program run by AxiTrader Limited, a well-known broker with over 15 years of operating history. This backing provides a layer of stability and infrastructure rarely seen in standalone prop firms

Is Axi Select Legit and Safe?

Axi Select is a legitimate product offering from AxiTrader Limited, which is registered in St. Vincent and the Grenadines. Unlike many startup prop firms that can disappear overnight, Axi has been a major player in the retail Forex space since 2007. The program uses a transparent "Edge Score" system to evaluate traders, which removes the subjectivity often found in other evaluations. While the program itself is unregulated (allowing for high leverage and funding), the parent company, Axi, holds licenses in multiple tier-1 jurisdictions (though this specific program is not available under those licenses). Payouts are processed as standard withdrawals from your trading account, ensuring reliability. The firm allows the use of EAs and automated strategies, making it a viable option for algorithmic traders.

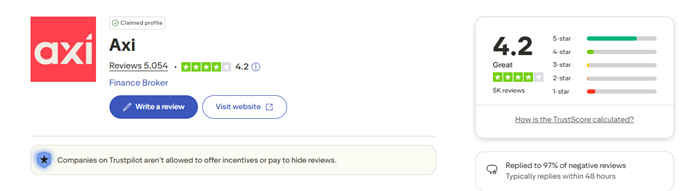

Because Axi Select is an integrated program within the main Axi broker rather than a standalone prop firm, user reviews are found under the main 'Axi' Trustpilot page. This is a positive sign, as it means the program is backed by a 15-year reputation rather than a newly created, unverified profile."

Axi (formerly AxiTrader) boasts an impressive 4.2 out of 5.0 rating on Trustpilot, based on over 4,300 reviews. This classifies them as "Great" to "Excellent," a tier rarely achieved by standard prop firms, which can suffer from review bombing after payout denials or poor support.

What Traders Are Saying Positive Feedback: Most reviews praise the broker's transparency, fast withdrawals, and reliable customer support. Specific to the Axi Select program, users have highlighted it as a "genuine game-changer" and "one of the best services" for mid-to-long-term traders. One Verified User noted: "Personally, I find this program to be one of the best out there. You deposit your money, and even if you hit the 10% max loss, they do not terminate your account. Instead, they just move you one stage back."

Negative Feedback: Some users on Google Play (where the Axi App holds a 3.9-star rating) have noted technical glitches with the mobile app after recent updates (as of December 2025). A minority of Trustpilot reviews mention delays in verification, though Axi's support team appears highly active in resolving these public complaints quickly.

The "Twist" – Broker vs. Prop Firm Reviews

Unlike standalone prop firms where reviews often panic about "scams" or "hidden rules," Axi's negative reviews tend to be relatively innocuous complaints (e.g., "the app froze," "spreads widened during news"). For an experienced trader, this is reassuring; it suggests you are dealing with a technical platform issue rather than a solvency issue.

Google & App Store Ratings:

- Trustpilot: 4.2 / 5.0 (4,300+ reviews)

- Google Play Store: 3.9 / 5.0 (870+ reviews)

- Apple App Store: 4.2 / 5.0 (100+ reviews)

Axi Select Features

Axi Select follows a unique "Capital Allocation" model rather than the standard "Challenge" model found elsewhere in the industry. The most notable features of Axi Select are:

- Zero registration or evaluation fees

"Real Money" qualification: You trade your own funds. Minimum deposit requirement: $500 USD.

- Performance-based "Edge Score"

(Must reach 50 to qualify) 6 Progression Stages: Seed, Incubation, Acceleration, Pro, Pro 500, Pro M.

- Maximum total drawdown

10% (from High Water Mark) Profit split: Starts at 40%, scales up to 80%.

- Maximum funding allocation

$1,000,000 USD Multiplier-based funding (e.g., 50x your equity).

- Platforms

MT4 and MT5 Dashboard includes advanced analytics on Skill, Risk, and Consistency.

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $500 |

|---|---|

Maximum Evaluation Fee | $500 |

Profit-share | 40% - 80% |

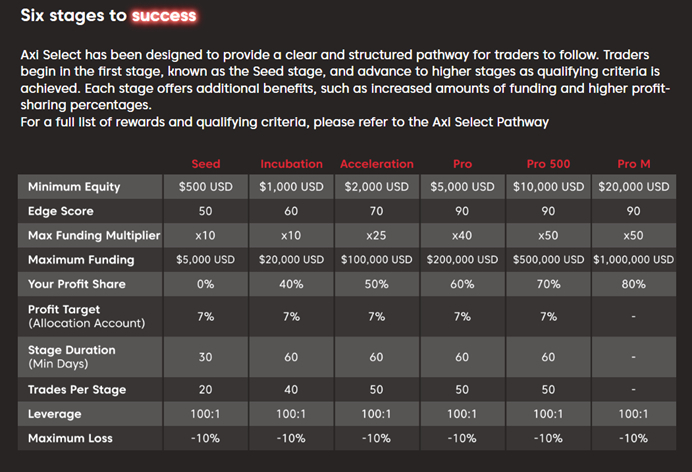

Axi Select has NO evaluation fees. The program is free to join. However, the 'cost' is the capital you must deposit into your own account to participate. This starts at $500 USD. All deposited funds remain yours to trade or withdraw (minus losses). Traders can progress via six stages from Seed to Pro M and start earning a profit share in stage 2. Note the minimum equity required increases as you pass through the stages

Account Size, Seed Stage (Min Equity $500) Incubation Stage (Min Equity $1,000), Acceleration Stage (Min Equity $2,000), Pro M Stage (Min Equity $5,000+)

Traders who qualify and enter the Seed stage start with a 40% profit share. This scales up significantly as you progress, to eventually 80% at the Pro M stage.

The minimum evaluation fee at Axi Select for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $500 to enter seed stage |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | Yes, Swap rates apply |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $500 |

Account Types

Axi Select uses a "Stage" system rather than separate account types. You progress through these stages based on your Edge Score and Equity.

Seed Stage: Requires Edge Score 50+, $500 equity. Offers 10x - 20x multiplier funding. Profit share 40%.

Incubation Stage: Requires Edge Score 60+, $1,000 equity. Offers up to 25x multiplier funding. Profit share 50%.

Acceleration Stage: Requires Edge Score 70+, $2,000 equity. Offers up to 50x multiplier funding. Profit share 50%.

Pro Stage: Requires Edge Score 90+. Equity requirements are $5,000 in equity. Offers up to 40x multiplier funding. Profit share 60%

Pro 500 Stage: Requires Edge Score 90+. Equity requirements are $10,000. Offers up to 50x multiplier funding. Profit share 70%

Pro 500 Stage: Requires Edge Score 90+. Equity requirements are $20,000. Offers up to 50x multiplier funding to a maximum level of 1$ million. Profit share 80%.

What are the Trading Rules at Axi Select?

The Axi Select qualification begins the moment you deposit $500 and start trading to generate your Edge Score.

There is no time limit to reach the required Edge Score of 50. The "Edge Score" is calculated using a weighted average of three components:

- Skill: Ability to generate profit while managing drawdown.

- Risk: Proficiency in managing risk effectively.

- Consistency: Ability to produce steady gains over time. To qualify for the first stage (Seed), you must place at least 20 unique trades.

- Once funded (Allocation Account), the trading rules are:

- Maximum Drawdown: 10% of the account balance (High Water Mark basis).

- Daily Loss Limit: There is typically a 5% soft limit guideline, but the 10% Max Trailing Drawdown is the hard rule to be aware of.

- Multipliers: Your funding is a multiple of the equity in your live account (e.g., if you have $1,000 in your live account at 25x multiplier, you get $25,000 in funds allocation).

- Target profit: Is set at 7% to progress through the stages.

Noteworthy:

- If you exceed the maximum loss, your account enters "Quarantine," and you must rebuild your Edge Score and equity to re-enter.

- Axi Select permits holding trades over the weekend

- EAs and algorithmic trading are allowed

- You must maintain the minimum equity requirement for your current stage (e.g., if you withdraw funds below $500 in the initial stage, you drop out of the program).

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Axi Select offers the two most popular platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This ensures compatibility with thousands of custom indicators and Expert Advisors (EAs). Both platforms are available on desktop, web, and mobile (iOS and Android). All trading is conducted on live accounts.

Education

Axi provides an extensive educational suite, including the 'Axi Academy' which offers courses on forex basics, technical analysis, and risk management. Specifically for Axi Select, the Dashboard provides 'Edge Score Analytics'—personalized feedback on your trading habits (Skill, Risk, Consistency) which acts as an automated trading coach to help you improve.

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | 24/7 |

Website Languages |             |

During my Axi Select review, I found their customer support to be highly responsive, as expected from a major global broker. Support is available 24/7 via Live Chat, Email, and Phone. They offer multilingual support in over 10 languages, including English, Spanish, Chinese, and Arabic. There is a dedicated Help Centre specifically for Axi Select with detailed articles explaining the Edge Score and stage progression.

How to Get Started with Axi Select

The sign-up process is efficient and straightforward.

Interested traders can join immediately by opening a standard Axi live account and opting into the 'Axi Select' program within the client portal.

Master Account KYC Since Axi Select is part of a regulated broker structure (Axi), you must complete full KYC (Know Your Customer) verification when you open your initial trading account. This involves submitting a valid Government ID (Passport/Driver's License) and a Proof of Address (Utility Bill/Bank Statement). Once verified, you do not need to do it again to receive funding or withdrawals.

Minimum Evaluation Fee

There is no evaluation fee. However, the minimum deposit required to generate an Edge Score and qualify for funding is $500 USD. This is higher than the $29 fees seen at some prop firms, but the capital remains yours.

Payment Methods

Withdrawal options |        |

|---|---|

Deposit options |        |

Axi supports a wide range of payment methods for deposits and withdrawals: Credit/Debit Cards (Visa, Mastercard) Bank Wire Transfer Cryptocurrencies (USDT, BTC, ETH, etc.) E-wallets (Neteller, Skrill, Astropay) Local Bank Transfers (depending on region)

Accepted Countries – Axi Select is available to residents of over 100 countries. However, due to regulatory restrictions, it is NOT available to residents of: Australia (AU) New Zealand (NZ) United Kingdom (UK) European Union (EU) United States (US). Additionally, sanctioned countries like Iran, North Korea, and Syria are restricted.

How to Pay the Evaluation Fee?

You simply deposit funds into your own trading account using: Credit/Debit Cards Bank Transfer Crypto (USDT is popular for speed) Neteller / Skrill. There is no need to pay a separate evaluation fee. You can check Axi Select’s site for information about localized payment options.

The Bottom Line - Is Axi Select a Good Prop Firm?

Based on my assessment, Axi Select is an excellent choice for experienced traders who are confident in their ability to manage risk and want to build a long-term track record with a reputable broker. I like that it removes the "dead money" risk of failing challenges; if you trade well, you get funded, and if you trade poorly, you only lose a portion of your own funds rather than a full fee. I also like the fact that a breach of the rules moves you back a stage rather than kills the account. The ability to scale up to $1,000,000 with an 80% profit share is a massive incentive. For those eligible, it offers a refreshing, professional alternative to the often "gamified" prop firm industry alternatives. No, Axi Select does not accept clients from the United States, UK, Australia, New Zealand, or the European Union. There is no evaluation fee at Axi Select. The only requirement is that you must deposit a minimum of $500 USD of your own capital to join. Yes, it is a program by AxiTrader Limited, a broker operating since 2007. It is highly legitimate compared to standalone prop firms. Axi Select is a capital allocation program by Axi broker that funds traders up to $1M based on their "Edge Score" performance in a live account. Profit share starts at 40% in the Seed stage and scales up to 80% in the Pro M stage.FAQs

Does Axi Select allow US traders?

What is the evaluation fee at Axi Select?

Is Axi Select legit?

What is Axi Select?

What is the profit share at Axi Select?