Editor’s Verdict

Anzo Capital presents a tempting offer for seasoned traders, with high leverage, MT4/MT5 platforms, and a true ECN account boasting very competitive trading costs. However, these attractive features are overshadowed by significant concerns about its regulatory standing. The broker's international operations are registered in St. Vincent & the Grenadines, an offshore jurisdiction that provides no meaningful regulatory oversight. Coupled with a seemingly previously cancelled ASIC license and mixed user reviews, it's a high-risk proposition that requires caution.

Overview

Anzo Capital Core Takeaways:

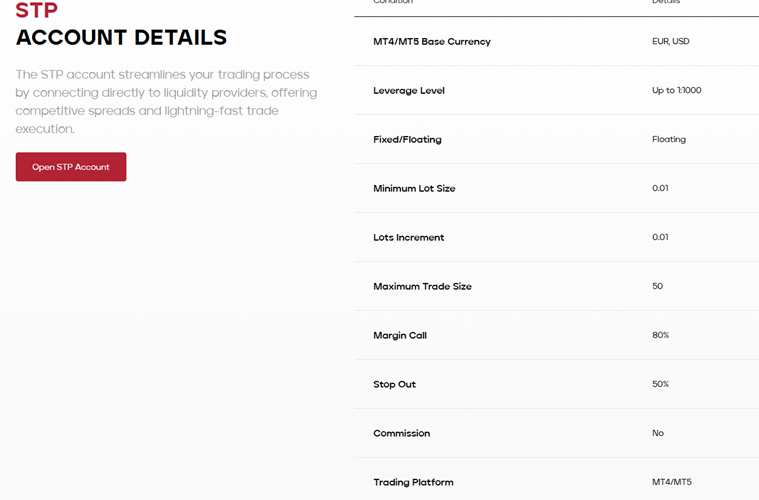

- Hybrid Broker Model: Offers both a commission-free STP account and a commission-based ECN account

- MetaTrader Focused: Provides the globally popular MT4 and MT5 trading platforms and supports upgrades for these platforms

- Unregulated Offshore Entity: The international arm (anzocapital.com/en) is registered in St. Vincent & the Grenadines, and whilst mentioned on the regulator's site, does not appear to be regulated, just registered

- High Leverage: Offers significant leverage, particularly for clients under the international entity

- Traditional Asset Focus: Concentrates on Forex, Indices, Commodities, and a small selection of Stock CFDs.

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Regulators | FCA, FSC Belize |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.6 pips |

Average Trading Cost GBP/USD | 1.8 pips |

Average Trading Cost Gold | States variable |

Average Trading Cost Bitcoin | NA |

Retail Loss Rate | Not stated |

Minimum Raw Spreads | 0.1 pips |

Minimum Standard Spreads | 1.6 pips |

Minimum Commission for Forex | commission and spread options via diff accounts |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Anzo Capital Regulation & Security

When you are choosing a broker, knowing your money is safe is the number one priority. This is where Anzo Capital's setup raises some serious red flags.

Country of the Regulator | Belize, United Kingdom, Saint Vincent and the Grenadines |

|---|---|

Name of the Regulator | FCA, FSC Belize |

Regulatory License Number | 739550, 000331/469, 308LLC2020 |

Regulatory Tier | NA |

Is Anzo Capital Legit and Safe?

Proceed with caution. The international entity that most global clients will use is registered in St. Vincent & the Grenadines. It’s vital to understand that being registered there is not the same as being regulated. The local financial authority (SVGFSA) does not oversee forex brokers, meaning for all practical purposes, this is an unregulated broker. This lack of oversight is a significant risk, as there is no official body to turn to if you have a dispute.

Adding to the concern, a previous Australian (ASIC) license held by Anzo Capital was cancelled in 2023, although I could find no reason for this or any negative press. While there is a separate, active company in the UK called Anzo Global (UK) Limited, which is licensed by the top-tier FCA regulator, its connection to the international brand is not clearly stated on the main website. In any case, its protections would not apply to international clients. Given the negative reviews and the lack of clear, strong regulation for the global brand and unclear ownership structure, I cannot recommend it as 100% safe or trustworthy. So, proceed cautiously.

Country / Region | Regulator | License Number |

St Vincent and the Grenadines | SVGFSA* | 308 LLC 2020 |

*Appears to be registered only

Fees

Anzo Capital gives traders a choice when it comes to costs, offering two distinct account types with different fee structures.

Average Trading Cost EUR/USD | 1.6 pips |

|---|---|

Average Trading Cost GBP/USD | 1.8 pips |

Average Trading Cost Gold | States variable |

Average Trading Cost Bitcoin | NA |

Minimum Raw Spreads | 0.1 pips |

Minimum Standard Spreads | 1.6 pips |

Minimum Commission for Forex | commission and spread options via diff accounts |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | Yes |

EURUSD trading costs

Average Spread (EUR/USD) | Commission per Round Lot | Total Cost per 1.0 Standard Lot |

~1.6 pips (STP Account) | $0.00 | ~$16.00 |

~0.1 pips (ECN Account) | $7.00 | ~$8.00 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are not available.

- Inactivity Fee: An inactivity fee is charged to accounts after a prolonged period with no trading activity.

- The asset selection at Anzo Capital is quite focused and may feel limited for traders looking for broad market diversification. They currently offer around 90 instruments in total.

Overnight Swaps

Swap rates on leveraged overnight positions are an often-overlooked trading cost. Depending on your strategy, these can add up and become a significant fee. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based ECN Account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long (Est.) | Swap Short (Est.) | Total Trading Costs (Long/Short) |

~0.1 pips | $7.00 | -$8.00 | +$2.00 | $16.00 / $6.00 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long (7 nights) | Swap Short (7 nights) | Total Trading Costs (Long/Short) |

~0.1 pips | $7.00 | -$56.00 | +$14.00 | $64.00 / -$6.00 (Credit) |

Noteworthy:

- Withdrawal Fee: A $20 fee applies to withdrawals under $100.

- Inactivity Fee: The broker charges an inactivity fee for dormant accounts.

Anzo Capial Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:01 | Friday 21:59 |

Commodities | Sunday 23:00 | Friday 21:59 |

Crude Oil | Sunday 23:00 | Friday 21:59 |

Gold | Sunday 23:00 | Friday 21:59 |

Metals | Sunday 23:00 | Friday 21:59 |

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Anzo Capital provides a limited selection of assets. All assets are offered as Contracts for Difference (CFDs). The selection is ok, covering all major market sectors.

Asset Class | Available? | Examples |

Forex | Yes | EUR/USD, GBP/JPY, AUD/CAD |

Stock CFDs | Yes | Apple, Google, a selection of US/EU shares |

Indices | Yes | US30, GER40, UK100 |

Commodities | Yes | Gold, Silver, WTI Oil |

Cryptocurrencies | No | Not Available |

Asset Class | Available? | Examples |

Anzo Capital Leverage

Anzo Capital offers remarkably high leverage, particularly for international clients, which is flexible based on account equity.

Maximum Retail Leverage in comparison (FCA/ASIC/CySEC) | Maximum Leverage (SVG- International) |

1:30 | Up to 1:100 |

What should traders know about Anzo Capital leverage?

- Leverage magnifies both potential profits and potential losses.

- Negative balance protection from Anzo Capital ensures retail traders cannot lose more than their account balance; if a loss extends beyond $0 the broker states it will be reinstated to zero.

- Always use risk management tools like stop-loss orders when trading with leverage.

- The firm does not offer guaranteed stops.

Account Types

Anzo Capital provides two main account types to cater to different trading preferences.

- STP Account: A commission-free account with wider spreads, suitable for beginners or casual traders. The minimum deposit is $100.

- ECN Account: An account for more experienced traders featuring raw spreads from 0.1 pips plus a competitive commission of $7 per lot. The minimum deposit is $500.

Anzo Capital Demo Account

A free demo account is available for both MT4 and MT5, allowing you to test drive the platforms and practice your strategies risk-free.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Anzo Capital is a MetaTrader-native broker, offering the full suite of platforms from MetaQuotes.

- MetaTrader 4 (MT4): The global standard for forex trading, loved for its reliability and huge library of custom indicators and EAs.

- MetaTrader 5 (MT5): The successor to MT4, offering more advanced tools, additional timeframes, and access to more markets.

What I'd Like Anzo Capital to Add

Anzo Capital has a solid offering for experienced MT4/MT5 users, but it could significantly improve by expanding its asset list to include cryptocurrencies and a wider range of stock CFDs. Introducing an Islamic account option would also make the broker accessible to a broader audience. For beginners, the addition of copy trading features and a structured educational section would provide a much more supportive entry into the markets.

Research & Education

The firm offers a decent FAQ on the website covering most questions and some basic market information, but it's very limited compared to others in the market.

Customer Support

Anzo Capital offers 24/5 customer support through the following channels:

- Live Chat

Support is available in multiple languages, although it's not specified as a complete list, I did contact support via live chat during my review, and they were responsive.

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 support |

Website Languages |     |

Bonuses and Promotions

Promotions are typically offered through the broker's offshore entity and are not available to UK clients due to regulatory restrictions.

Opening an Account

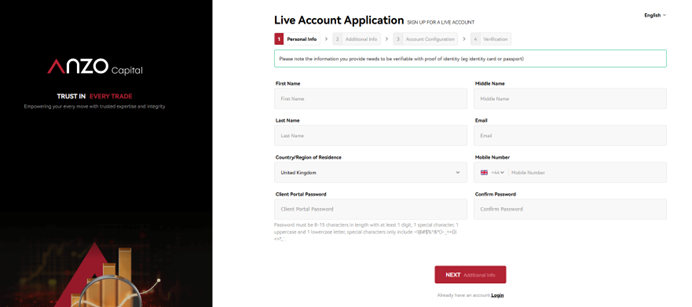

The account opening process is fully digital and follows industry standards, requiring identity and residency verification.

What should traders know about the Anzo Capital account opening process?

- Anzo Capital adheres to global AML/KYC standards.

- Account verification is mandatory and requires a government-issued ID and a proof of residency.

- The entire process can often be completed in under 10 minutes.

Minimum Deposit

The minimum deposit is $100 for the STP account and $500 for the ECN account.

Payment Methods

Anzo Capital supports a range of modern and traditional payment methods, including the list below.

Withdrawal options |        |

|---|---|

Deposit options |     |

Deposits and withdrawal options include credit/debit cards (deposits only), bank wire transfer, e-wallets (Skrill, Neteller, Sticpay), and Bitcoin.

Accepted Countries

Anzo Capital serves a global client base but does not accept clients from the United States, Japan, or certain other sanctioned areas.

Deposits and Withdrawals

The client portal manages all financial transactions securely and efficiently.

What are the key takeaways from the deposit and withdrawal process at Anzo Capital?

- Trustpilot does highlight several complaints about slow withdrawals

- There is a withdrawal fee for amounts less than $100

- Credit and debit cards only for deposits

- Funds should be credited to trading accounts within 30 minutes

Is Anzo Capital a Good Broker?

Anzo Capital is a high-risk proposition for most international traders. While the ECN account offers competitive costs and the MT4/MT5 platforms are excellent, this is overshadowed by the fact that its main international entity is unregulated. The lack of regulatory oversight is a significant drawback that should be carefully considered.