Editor’s Verdict

AMarkets offers traders a trustworthy and competitive trading environment with low fees, upgraded MT4/MT5 trading platforms, a proprietary copy trading service, and generous bonuses and incentives. I reviewed this broker to evaluate if traders get a competitive edge. Is AMarket the best choice for your Forex portfolio?

Overview

A competitive ECN trading environment with audited and verified order execution.

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Regulators | MWALI International Services Authority |

Year Established | 2007 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Retail Loss Rate | Undisclosed |

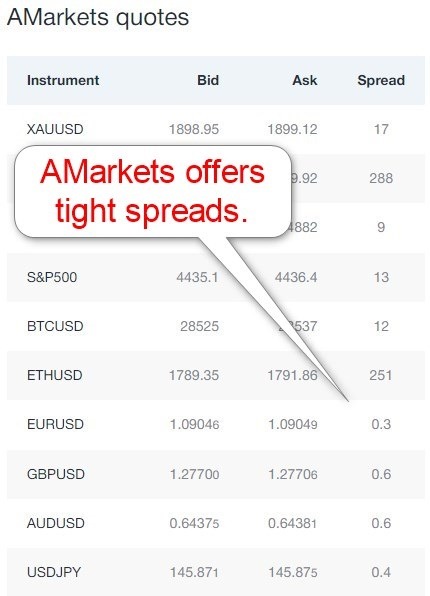

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $5.00 |

Funding Methods | 9 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the AMarkets trading fees in the ECN account and multi-tier leverage system. The Forex and cryptocurrency selection stand out from the well-balanced asset selection, and the volume-based cashback rebates are excellent for high-volume and high-frequency traders. I also like that AMarkets ensures traders operate from a trustworthy and secure trading environment.

AMarkets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. AMarkets presents clients with one regulated entity.

Name of the Regulator | MWALI International Services Authority |

|---|

Is AMarkets Legit and Safe?

AMarkets, founded in 2007, has stood the test of time with a clean track record. It operates with a license from the Mwali International Services Authority. It also has unregulated but duly registered offices in the Cook Islands, registration number LLC14486/2023, and St. Vincent and the Grenadines, registration number 22567 BC 2015.

AMarkets is also a member of the Hong Kong-based Financial Commission, which has a compensation fund of up to €20,000 per client. Verify My Trade and Autochartist company verifies and audits order execution monthly, which traders can access.

My review did not uncover malpractice or fraud, and I rank this broker as a legit and safe brokerage with an excellent score for transparency.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. AMarkets has two expensive, commission-free cost structures and one competitive, commission-based alternative. The fixed-spread account starts with minimum spreads of 3.0 pips, or $30.00 per 1.0 standard round lot, versus the floating-spread alternative of 1.3 pips or $13.00. Both are expensive, but the commission-based ECN option shows raw spreads from 0.0 pips for a commission of $5.00 per round lot.

Swap rates on leveraged overnight positions are also competitive, making AMarkets an excellent choice for all trading strategies as long as they select the ECN option.

Minimum Raw Spreads | 0.0 pips |

|---|---|

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $5.00 |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at AMarkets are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

3.0 pips (Fixed) | $0.00 | $30.00 |

1.3 pips (Standard) | $0.00 | $13.00 |

0.0 pips (ECN) | $5.00 | $5.00 |

Here is a snapshot of AMarkets trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check these before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based ECN account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.00 pips | $5.00 | -$8.90 | X | $13.90 |

0.00 pips | $5.00 | X | $3.90 | $1.10 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.00 pips | $5.00 | -$62.30 | X | $67.30 |

0.00 pips | $5.00 | X | $27.30 | -$22.30 |

Noteworthy:

- l AMarkets offers favourable swap rates in qualifying assets, meaning traders get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

Range of Assets

AMarkets offers 43 currency pairs, a choice suitable for most traders. Traders also get 18 commodities, 16 indices, 27 cryptocurrencies, 2 bonds, and 437 equity and ETF CFDs. I like the overall range of assets, as it provides most traders withall they need to achieve cross-asset diversification.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

AMarkets Leverage

AMarkets has a five-tier leverage system, where the maximum decreases with the portfolio equity. It is an excellent approach that assists with risk management for traders and AMarkets. Forex traders get a maximum between 1:200 and 1:3000. At the same time, cryptocurrencies max out between 1:200 and 1:500, making AMarkets the highest-leveraged cryptocurrency CFD broker I have reviewed. Equity traders get maximum leverage of 1:10, while indices, commodities, and bonds range between 1:20 and 1:100.

Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

AMarkets Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 23:00 | Friday 22:00 |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Commodities | Monday 00:00 | Sunday 22:00 |

Stocks | Monday 09:00 | Friday 22:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5, and cryptocurrencies, which trade 24/7.

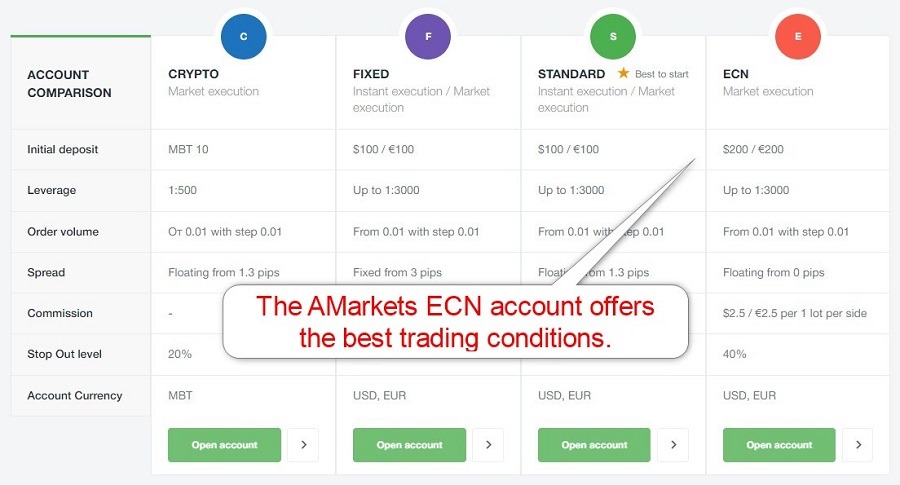

Account Types

AMarkets has four account types, one being a dedicated cryptocurrency trading account. The three commission-based options feature relatively high trading fees, between 1.3 and 3.0 pips or $13.00 to $30.00 per 1.0 standard round lot for a minimum deposit of $100. The commission-based ECN alternative delivers competitive costs with raw spreads from 0.0 pips for a $5.00 commission and requires a $200 minimum deposit.

Supported account currencies are the US Dollar and the Euro, while the cryptocurrency account is a Bitcoin-denominated option. The automatic stop-out level is at 20%, except for the EXN account, which is at 40%.

AMarkets Demo Account

AMarkets offers customizable demo accounts on the MT4/MT trading platforms, but the default balance of $10,000 is high. My review did not uncover a time limit, suggesting that AMarkets understands the requirements of demo trading. I recommend traders use the demo account registration of MT4/MT5 and use similar settings to their preferred live portfolios for a more realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Traders get the MT4/MT5 trading platforms as customizable desktop clients, lightweight web-based alternatives, and user-friendly mobile apps. AMarkets also developed an in-house mobile app, AMarkets App. MT4 and MT5 support algorithmic and copy trading.

MT4 remains the industry leader with 25,000+ custom indicators, plugins, and EAs, but the quality upgrades are not free. AMarkets also has the MT4 MultiTerminal for asset managers and traders with multiple accounts.

AMarkets upgrades the trading experience via Autochartist, which includes automated chart pattern recognition and trading signals.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

AMarkets offers 46 EAs, making it the first Forex broker to provide clients with EAs. VPS hosting supports 24/7/365 trading, while the 0.03 seconds order execution ensures demanding traders have a competitive trading infrastructural for algorithmic trading. The Trade Analyzer helps traders improve their portfolio management via recommendations in five categories, and a sentiment indicator also exists. High-volume traders will benefit from volume-based cashback rebates between $3 and $17 in a five-tier system.

The proprietary copy trading service, which requires a minimum deposit of $100, presents a quality alternative to the embedded MT4/MT5 copy trading services. AMarkets also has a VIP program, upgrading the AMarkets trading experience significantly via up to 30% reduction in trading fees and increased cashback. Still, this requires a portfolio value of $20,000.

Research & Education

Besides research from Autochartist, AMarkets publishes quality in-house research with actionable trading recommendations. It also maintains a Telegram signal service and explains its trades well. I rate the well-structured AMarkets research section among the best in the industry in quality and quantity.

AMarkets offers educational content on its blog, with quality written articles. Still, it lacks a classroom-style step-by-step trading course. It lacks coverage of core topics and provides readers with reasons to trade Forex rather than educating beginners on how to get started. I like its focus on trading strategies, but I need critical educational material.

Therefore, I advise beginners to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

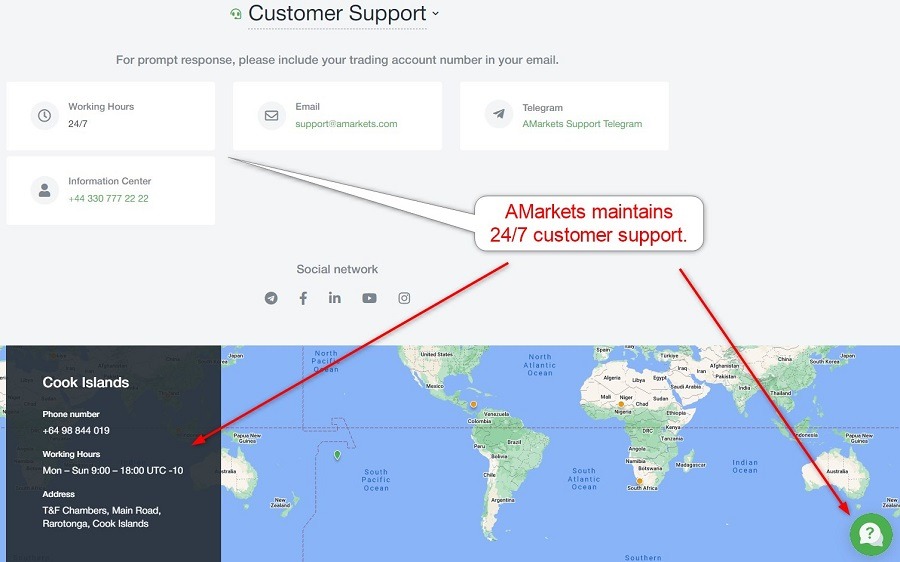

Customer Support

Customer Support Methods |   |

|---|---|

Website Languages |                |

AMarkets offers 24/7 customer support, and traders can reach out via e-mail, phone, Telegram, or live chat. AMarkets explains its services well, and I recommend the FAQ section before contacting support. I miss a direct line to the finance department, where most issues can arise. Still, the overall approach to customer support remains excellent.

Bonuses and Promotions

Besides the volume-based cashback rebate and VIP programs, AMarkets features a promotion allowing traders to earn money, which they can transfer as a bonus to live trading accounts. A 100% deposit bonus exists up to a maximum of $10,000. AMarkets also pays a bonus for traders who switch from another broker and if they want to transfer open positions.

Terms and conditions apply, and I recommend traders read and understand them before requesting any bonus or promotion.

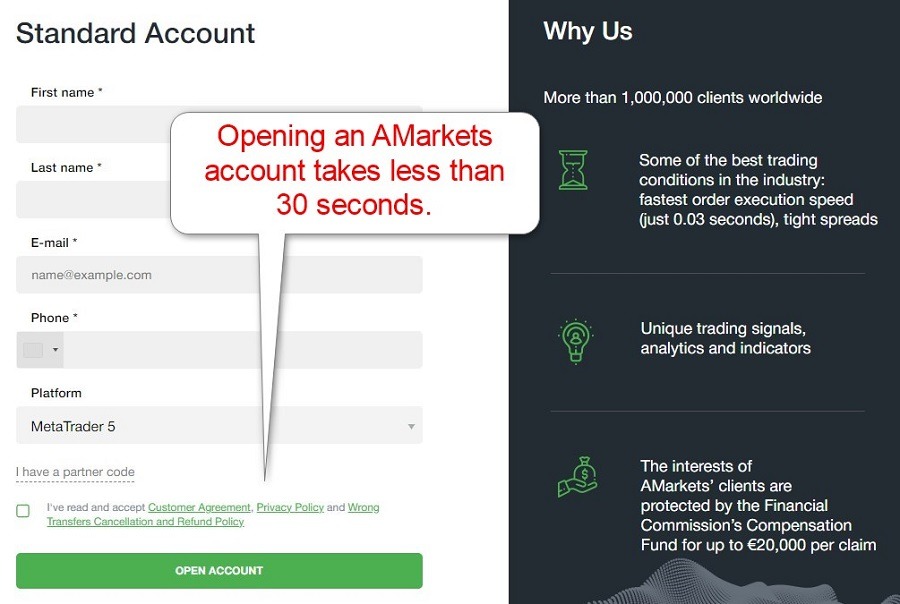

Opening an Account

The swift AMarkets online account application takes less than 30 seconds to complete and asks for a name, e-mail, phone number, and desired trading platform. AMarkets will e-mail the login details. I appreciate that AMarkets does not engage in unnecessary data mining as part of its registration process.

Account verification is mandatory at AMarkets, as it complies with global AML/KYC requirements. Most traders will pass it by uploading a copy of their government-issued ID and one proof of residency document. AMarkets may ask for additional information on a case-by-case basis.

Minimum Deposit

The AMarkets minimum deposit is between $100 and $200.

Payment Methods

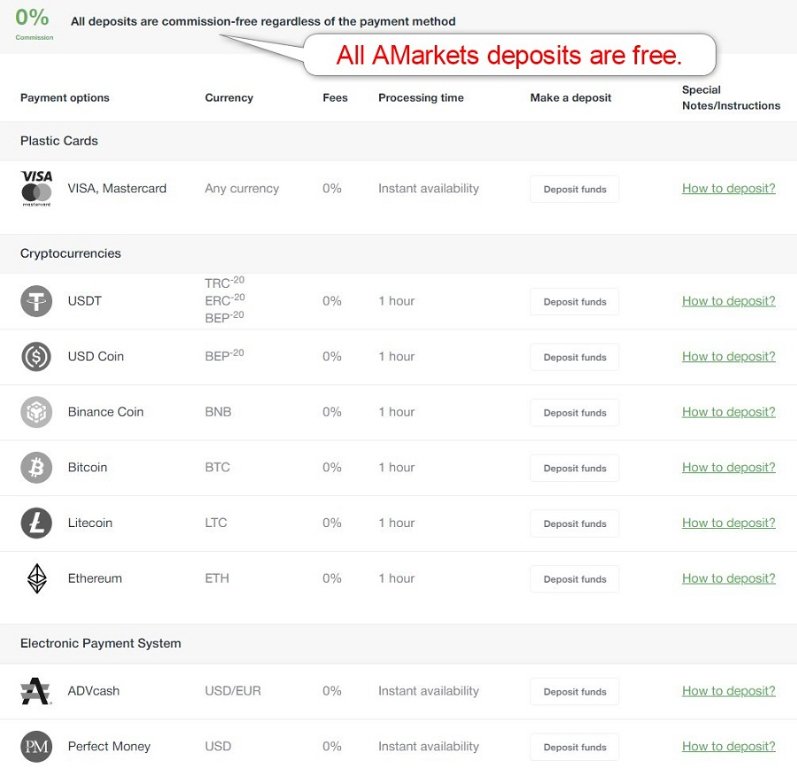

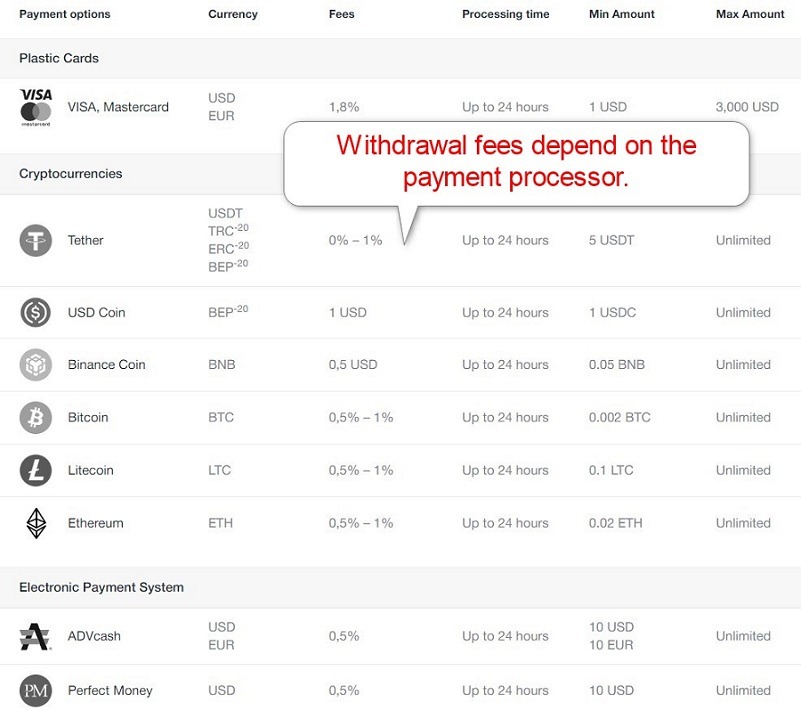

AMarkets supports credit/debit cards, cryptocurrencies, ADVcash, and Perfect Money.

Accepted Countries

AMarkets does not accept traders resident in the following countries:

Angola | Armenia | Afghanistan | Benin |

|---|---|---|---|

Burundi | Cape Verde | Chad | Comoros |

Gabon | Gambia | Grenada | Guinea |

Guyana | Haiti | Honduras | Jamaica |

Kiribati | Kosovo | Laos | Lesotho |

Madagascar | Malawi | Maldives | Mauritania |

Montenegro | Mozambique | Namibia | Nauru |

New Zealand | Nicaragua | Niger | North Korea |

Paraguay | Congo | Senegal | Sierra Leone |

South Sudan | Sudan | Suriname | The UK |

Zambia | Zimbabwe | Austria | Belgium |

Croatia | Cyprus | Czech Republic | Denmark |

Finland | France | Germany | Greece |

Iceland | Ireland | Italy | Latvia |

Liechtenstein | Luxembourg | Malta | Netherlands |

Poland | Portugal | Romania | Slovakia |

Spain | Sweden | Switzerland |

Deposits and Withdrawals

The secure AMarkets back office handles all financial transactions for verified clients.

AMarkets does not list bank wires as a deposit or withdrawal method, which surprised me, but I like the available selection of payment processors. Deposit payment processing times are instant, except for cryptocurrencies, which can take up to one hour. AMarkets reimburses traders 100% of deposit fees.

Withdrawal fees depend on the payment processor, and AMarkets processes all requests within 24 hours. Minimum withdrawal amounts vary based on the payment processors, but all are low. There are no maximums, except for credit/debit cards at $3,000 daily. Deposit and withdrawal currencies are US Dollars and Euros, plus all supported cryptocurrencies. Per AML rules, the name on the payment processor and AMarkets account must match.

Is AMarkets a good broker?

I like the AMarkets trading environment for its low trading fees in its ECN account, VPS hosting, volume-based rebates, and cutting-edge trading infrastructure. Traders get MT4 and MT5, plus an in-house copy trading service. The research section ranks among the best industry-wide, and Autochartist is also available. AMarkets presents a secure and trustworthy trading environment, and I appreciate its transparency and client protection. Over the past 16 years, AMarkets became one of the most competitive Forex brokers. I highly recommend it to all traders, particularly algorithmic and high-volume traders. AMarkets supports credit/debit cards, cryptocurrencies, ADVcash, and Perfect Money as payment methods. The secure and user-friendly back office handles all financial transactions for verified traders, and nine payment processors exist. The AMarkets broker brand is owned by the company AMarkets Ltd. The minimum deposit is $100 for all account types except for the ECN account, which requires $200. AMarkets ranks among the best brokers due to its low trading fees in its ECN, trading tools and services, and superb trading infrastructure featuring fast order execution and volume-based rebates. It is also a rare broker offering EAs to its traders for free.FAQs

What are the payment methods for AMarkets?

How do I withdraw from AMarkets?

Who is the owner of AMarkets?

What is the minimum deposit for AMarkets?

Is AMarkets a good broker?