Editor’s Verdict

5ers is an Israeli-based prop firm that ranks among the most established ones. Traders get the MT5 trading platform and can scale their portfolios up to $4M with a profit split between 80% and 100%. 5ers also has low evaluation fees, but how competitive are the trading conditions? My comprehensive 5ers review evaluated its trading conditions. Is 5ers among the best prop firms?

Overview

5ers has low evaluation fees and scales portfolios up to $4M with a 100% profit share.

Headquarters | Israel |

|---|---|

Year Established | 2016 |

Trading Platform(s) | MetaTrader 5 |

Minimum Evaluation Fee | $39 |

Profit-share | 80% to 100% |

Daily Loss Limit | 3% to 5% |

Maximum Trailing Drawdown | 4% to 10% |

Funded Account Options | 8 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $250,000 |

I like that 5ers offers the lowest evaluation fees I have reviewed among retail prop firms while scaling portfolios up to $4M. Prospective traders have no time pressure to achieve evaluation targets, and 5ers ranks among the most transparent prop firms. 5ers provides 1-on-1 performance coaching, a sign that it cares about its traders' success.

5ers Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation for safety and security.

Is 5ers Legit and Safe?

5ers, founded in 2016, ranks among the most established retail prop firms and has a 4.9 out of 5.0 rating on Trustpilot based on 14,688 reviews.

While a few negative My 5ers reviews exist, I could not verify them. I advise traders to consider the negative comments sceptically, as they could come from traders who have failed the paid-for evaluation challenge or breached trading rules in funded accounts. Therefore, I recommend 5ers, which I rank among the Top Three prop trading firms.

5ers Features

5ers follows best practices established across the prop firm industry, which continued its rapid expansion.

The most notable features of 5ers are:

- Instant funding, two-step, and three-step evaluations (Bootcamp)

- A minimum of three profitable trading days for the two-step evaluation

- An evaluation target of 10% for instant funding

- A profit target of 8% and 5% for the two-step evaluation

- A profit target of 6% for each step of the three-step evaluation

- A maximum daily drawdown of 3% for instant funding, 5% for the two-step-evaluation, and no daily drawdowns for the three-step alternative

- A maximum drawdown of 6% for instant funding from the initial balance

- A trailing maximum drawdown of 10% for the two-step evaluation and 5% for the three-step alternative

- Stop-loss for Bootcamp evaluations cannot exceed 2% risk of the evaluation capital

- A maximum profit share between 80% and 100%

- Cryptocurrency withdrawals

- MT5 without strategy restrictions

- Up to $4M funded accounts per trader

- Low evaluation fees

- A dedicated stock trading program appears under development

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $39 |

|---|---|

Maximum Evaluation Fee | $850 |

Profit-share | 80% to 100% |

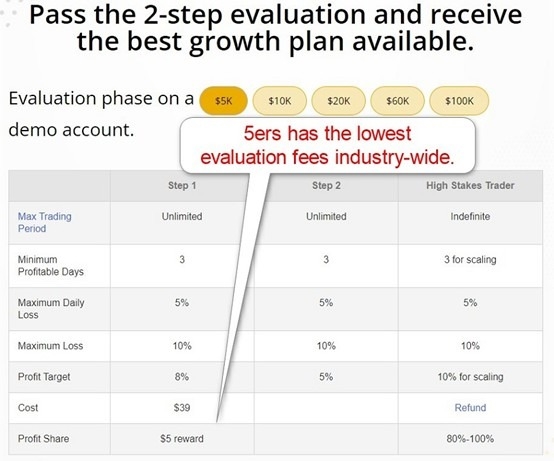

5ers levies a one-time evaluation fee dependent on their desired funded account size and evaluation type, which is the lowest I have reviewed among dozens of retail prop firms.

Prospective retail traders have three instant funding options with evaluation fees between $260 and $850, five two-step evaluation options with fees between $39 and $545, and two Bootcamp options costing $95/$205 and $225/$350. 5ers also features a $20,000 Bootcamp challenge with costs listed as “NA.”

Please note that traders cannot change the account value once approved. Therefore, if they qualify for a $10,000 account, they will manage a $10,000 portfolio. The profit share is between 80% and 100%.

The minimum evaluation fee at 5ers for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $39 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $39 |

Account Types

5ers offers three account choices for instant funding accounts, five for the one-step evaluation, and three for the two-step alternative. Instant funding account sizes are $10,000, $20,000, and $40,000. The two-step evaluation is available for $5,000, $10,000, $20,000, $60,000, and $100,000. The Bootcamp challenge has account options of $20,000, $100,000, and $250,000.

Prop traders can scale portfolios up to $4M. The maximum leverage is 1:10 for Bootcamp, 1:30 for instant funding, and 1:100 for the two-step evaluation.

The maximum daily drawdown is 3% for instant funding and 5% for the one-step evaluation, while Bootcamp has no daily restriction. Instant funding has a maximum static drawdown of 6%, the two-step evaluation has a maximum trailing drawdown of 10%, and Bootcamp has a 5% maximum drawdown with a 2% maximum SL requirement. Weekend holding is allowed on all accounts.

What are the Trading Rules at 5ers?

The 5ers evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. 5ers does not list a maximum time limit but requires a minimum of three profitable trading days for the two-step evaluation. The profit target, daily drawdown, and maximum drawdown equally depend on the evaluation type.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation.

The trading rules for the 5ers evaluation are:

- 6% maximum loss from the starting balance for instant funding

- 10% maximum trailing loss for the two-step evaluation

- 5% maximum trailing loss for Bootcamp with a 2% SL limit per position

- 3% daily loss limit for instant funding and 5% for the one-step evaluation

- A minimum of three profitable trading days for the two-step evaluation

Noteworthy:

- 5ers will not grant access to live trading accounts

- Accepted prop traders will manage demo accounts, and the 5ers software may duplicate them in live trading accounts of 5ers managed by professional traders

- It enhances risk management and compliance for 5ers

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

5ers offers the MT5 trading platform with raw spread trading from 0.0 pips for a commission of $8.00 per 1.0 standard round lot. It transparently provides an MT5 login, allowing traders to evaluate the trading conditions, and features Forex, crypto, commodity, and index trading. It also established a dedicated stock trading prop account.

Education

I appreciate the availability of 1-on-1 performance coaching and its live trading sessions four days weekly. The extensive educational content for beginners remains misguided, as beginners should never consider prop trading. The 5ers educational content features workshops, webinars, trading classes, and courses. While I understand and support the need for educating, it has no place in prop trading, which is for established traders, and I dislike prop firms targeting beginners.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | Sunday to Thursday 07:00 - 15:00 GMT, Friday 07:00 - 12:00 GMT |

Website Languages |   |

During my 5ers review, only e-mail support existed. I recommend the FAQ section as the first point of support interaction, as it answers many questions. I am missing a direct line to the finance department, where most issues could arise. Funded traders can access the live trading room and interact with 5ers staff.

How to Get Started with 5ers

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at 5ers is $39 for the $5,000 account and the two-step evaluation process.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |     |

5ers accepts credit/debit cards and cryptocurrency payments.

Accepted Countries

5ers accepts most traders that are 18 years or older. 5ers does not accept traders from the United States, Afghanistan, Burundi, Central African Republic, Cuba, Congo Republic, Crimea, Democratic Republic of Congo, Eritrea, Guinea, Guinea-Bissau, Iraq, Iran, Israel, Laos, Lebanon, Liberia, Libya, Myanmar, North Korea, Palestinian Territory, Papua New Guinea, South Sudan, Sudan, Somalia, Syria, Vanuatu, Venezuela, and Yemen. The restricted countries are due to reasons 5ers does not control.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via bank wires, credit/debit cards, and cryptocurrencies.

The Bottom Line - Is 5ers a Good Prop Firm?

I like 5ers for its low evaluation fees, profit share of up to 100%, availability of MT5, absence of restrictions on trading strategies, and competitive trading fees. Traders can scale their portfolios to $4M, the three evaluation packages are well-structured to meet the needs of all traders, and 5ers is one of the most transparent prop firms I have reviewed. Therefore, I rank 5ers among the top three retail prop firms and highly recommend it to interested prop traders. The minimum evaluation fee at 5ers is $39, the lowest among competitors. 5ers is a legitimate company registered in Israel and ranks among the longest-operating retail prop firms industry-wide. 5ers is one of the most established retail prop firms that offers paid challenges for access to demo accounts that pay real cash to qualifying traders. 5ers has a profit share between 80% and 100%.FAQs

What is the evaluation fee at 5ers?

Is 5ers legit?

What is 5ers?

What is the profit share at 5ers?