Editor’s Verdict

50k.trade offers a distinct niche for the modern, mobile-first trader whose focus is on commission-free U.S. stocks and ETFs. Its CySEC regulation provides a solid foundation of trust, and the proprietary platform is clean and straightforward. The zero-commission model for U.S. equities is genuinely appealing.

However, this focus creates significant limitations. The complete absence of other asset classes, such as foreign exchange (forex) and commodities, may deter some traders. More importantly, while some fees are clear, the margin rates are high, and the mixed-to-negative reviews are a cause for concern. It’s a platform with a promising concept, but questionable execution.

Overview

When you first land on 50k.trade, it's clear this isn't a traditional Forex brokerage. It’s a specialist, laser-focused on the equities market. If you're looking to trade currency pairs, oil, or gold, you'll need to look elsewhere. This broker is built for one primary purpose: investing in real stocks and ETFs through a simple, app-based interface. It’s a direct competitor to platforms like Robinhood or Trading 212, aiming for traders who value something very simple, and zero-commission trading above all else.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Execution Type(s) | Instant/Market Execution |

Minimum Deposit | None |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Funding Methods | 6 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

50K.trade Core Takeaways:

- Equities-Focused Broker: Its entire business model revolves around offering direct ownership of actual stocks and ETFs, not complex CFD instruments.

- Proprietary Platform: You won't find MetaTrader here. 50k.trade operates exclusively on its own custom-built proprietary platform for web and mobile.

- CySEC Regulated: The broker is based in Cyprus and regulated by CySEC, which offers a good level of security and investor protection for clients.

- Modern Payments: It fully embraces modern payments with instant deposit options like Apple Pay and Google Pay alongside traditional bank wires and credit debit cards.

- Questionable User Sentiment: Despite its features, the broker struggles with a poor reputation on Trustpilot, which is a factor to consider.

50K.trade Regulation & Security

In an industry where trust is paramount, regulation in a reputable jurisdiction is the bedrock of a broker's credibility. On this front, 50k.trade is on solid ground.

Country of the Regulator | Cyprus |

|---|---|

Name of the Regulator | CySEC |

Regulatory License Number | 282/15 |

Regulatory Tier | 2 |

50K.trade Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks | Monday 09:30 | Friday 16:00 |

ETFs | Monday 09:30 | Friday 16:00 |

Is 50K.trade Legit and Safe?

Yes, from a regulatory perspective, it is legit and safe. The broker is operated by a firm regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a well-regarded, Tier-1 European regulator that imposes strict rules on how brokers operate. For the end-user, this means you benefit from key protections, including:

- Segregated Accounts: Client money is kept in accounts separate from the company's operational funds.

- Investor Compensation Fund (ICF): You have eligibility for compensation in the unlikely event of the broker's insolvency.

- Negative Balance Protection: You cannot lose more than the funds you have in your account.

This regulatory oversight provides a significant difference in safety compared to brokers registered in offshore jurisdictions.

Fees

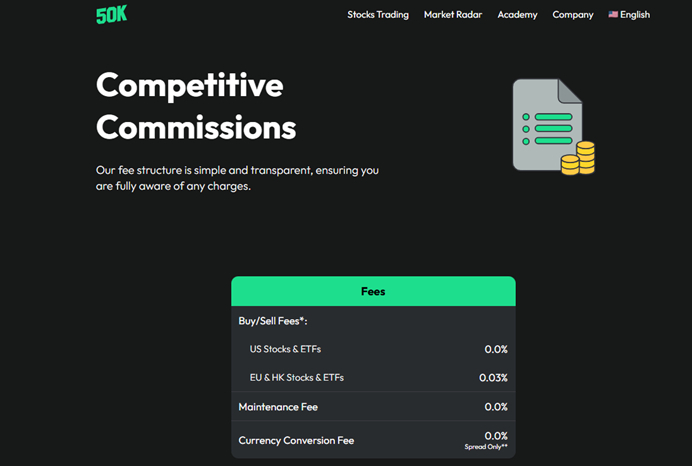

While 50k.trade advertises 'free' trading, the devil is in the details. The costs come from margin rates and currency conversion, which can add up.

Deposit Fee | |

|---|---|

Withdrawal Fee | |

Inactivity Fee | No |

After some digging, the fee structure becomes clearer. The broker's main appeal is its commission-free model for U.S. stocks, but other charges apply.

- Commissions: Trading U.S.-listed stocks and ETFs is commission-free. However, a commission of 0.03% applies to stocks listed on European exchanges.

- Margin Interest: If you trade using leverage, you'll pay a daily interest fee. This is calculated at a rate of 0.033% per day, which currently annualizes to a hefty 12%.

- Currency Conversion Fee: If you deposit in EUR but trade a USD-denominated stock, a currency conversion fee is charged; the firm says this is at a tight and competitive spread but doesn’t specify on the website what the spread is.

- Deposit & Inactivity Fees: There are no fees for depositing funds or for account inactivity, which is a welcome positive.

- Withdrawal Fee: A fee of €20 is charged for withdrawals made via SEPA/Bank Transfer.

This structure mainly benefits long-term investors who fund their accounts in USD and don't use leverage. For active traders, margin users, or those depositing in Euros, the costs can become significant.

Range of Assets

The asset selection at 50k.trade is hyper-focused and will not be suitable for traders’ seeking diversification across different market sectors. They offer real, non-CFD assets, which means you are buying direct ownership of the underlying stocks and ETFs. This is a key distinction from CFD brokers where you are merely speculating on price movements.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

50K.trade Leverage

50k.trade offers a margin loan facility, allowing investors to borrow against their portfolio's value to increase their purchasing power. While this can amplify potential gains, it is a high-risk feature with significant costs.

What should traders know about leverage?

- How it Works: You can use borrowed funds to buy more stocks than your cash balance would normally allow.

- Cost: The primary cost is the margin interest rate of 0.033% per day. This annualizes to ~12%, making it an expensive form of financing.

- Risks: Margin trading magnifies both profits and losses. If your portfolio's value drops, you could face a "margin call," where the broker demands you deposit more funds or forcibly sells your assets to cover the loan.

Account Types

50K.trade provides one main account type, a mobile app accessed via Google play or Apple Store.

50K.trade Demo Account

A free demo account is available for both google and apple devices and can be downloaded via an app with your mobile device.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform |

50K.trade is a proprietary platform that is a mobile app-only option.

What I'd Like 50K.trade to Add

Expanded Asset List: Even for a specialist, expanding the range of available European and Asian stocks and ETFs would make the platform much more appealing to a wider range of equity investors.

Research & Education

The firm offers a decent FAQ on the website covering most questions and some basic market information, and there is an integration with TradingView and a feature called Market Radar. The broker provides some structured educational articles but no videos or webinars, so beginners will need to look elsewhere for learning materials. However, it also provides some useful tools for active traders.

TradingView Integration: This is a significant positive. By integrating world-class TradingView charts directly into its platform, 50k.trade gives users access to a vast array of advanced charting tools, technical indicators, and drawing capabilities. This allows experienced traders to perform sophisticated technical analysis without leaving the platform.

Market Radar: The broker also offers a "Market Radar" feature. This tool is designed to help traders find opportunities by providing daily market analysis, news updates, and trading signals based on technical analysis. It's a useful feature for idea generation, but it should be treated as a supplementary tool rather than a primary source for trading decisions.

While these tools are valuable, they are geared towards traders who already have a working knowledge of the markets, rather than educating new investors from the ground up.

Customer Support

Customer Support Methods |   |

|---|---|

Website Languages |  |

50K.trade offers 24/5 customer support through the following channels:

- Live Chat with the app itself

This is arguably the broker's most significant weakness. While official support channels are limited to email and an in-app live chat, real-world user feedback paints a concerning picture.

The broker holds a "Bad" rating of 1.6 out of 5 stars on Trustpilot, based on over 130 reviews. A staggering 88% of these are 1-star ratings. Common themes among the negative reviews include:

- Severe withdrawal problems, with users reporting long delays or an inability to get their money out.

- Unresponsive or unhelpful customer support.

While all brokers receive some negative reviews, the volume and severity of the complaints against 50k.trade are a potential red flag that potential clients must take seriously. It’s also worth noting that reviews on Apple and Google stores are more positive but number relatively few.

Bonuses and Promotions

At the time of this review, 50K.trade did not offer any bonuses or promotions, other reviews mention a 20$ welcome bonus and deposit match but I could not find this offer.

Opening an Account

The account opening process is fully digital and streamlined, designed to be completed quickly on a mobile device or web browser.

What should traders know about the 50K.trade account opening process?

- The process adheres to CySEC's strict AML/KYC regulations.

- You will need to submit a government-issued ID and a proof of residency (like a utility bill or bank statement) for verification.

Minimum Deposit

The minimum deposit is not officially stated but is likely in the range of $50-$250.

Payment Methods

50K.trade supports a range of modern and traditional payment methods, including the list below.

Withdrawal options |      |

|---|---|

Deposit options |      |

Deposits & Withdrawals: Credit/Debit Cards, Bank Wire Transfer, E-Wallets (SOFORT, Giropay), and Apple/Google Pay.

Accepted Countries

50K.trade serves a global client base but does not accept clients from the United States, nor certain other countries.

Deposits and Withdrawals

The trading app manages all financial transactions securely and efficiently.

What are the key takeaways from the deposit and withdrawal process at 50K.trade?

- Funds should be credited to trading account within minutes.

- Withdrawals are processed within one business day after the request.

- Withdrawal fees are not charged unless you are sending less than $50 by bank wire.

- Minimum withdrawal amounts apply for credit cards $10.

- Profits must be withdrawn by wire transfer.

Is 50K.trade a Good Broker?

50k.trade is a broker of two halves. On one hand, it offers a regulated, commission-free gateway to U.S. stock investing, which is an attractive model. On the other hand, its high margin fees, limited asset range, and some negative user reviews regarding fundamental issues like withdrawals and support make it impossible to recommend without serious reservations.

For a very specific type of investor—one who wants to make occasional, unleveraged purchases of U.S. stocks and is willing to risk potential customer service headaches—it might hold some appeal. For everyone else, the risks and limitations likely outweigh the benefits.

FAQs

What is the minimum deposit for 50k.trade?

The broker does not publish a minimum deposit requirement and appears not to have one. However, it is common for most similar brokers to have a practical starting minimum between $50 and $250.

What can I trade with 50k.trade?

You can only trade real stocks and ETFs. Forex, commodities, indices, and cryptocurrencies are not available.

Is 50K.trade regulated?

Yes, it is regulated by the Cyprus Securities and Exchange Commission (CySEC), with license number 282/15. This provides a significant layer of investor protection.

Is 50K.trade suitable for beginners?

Not really. While the platform is simple, the lack of a demo account for practice, combined with the serious issues reported in user reviews, makes it a risky environment for someone new to investing.