Choosing the right secure and reliable Forex / CFD broker for you can be tough. It might take time to figure out where to start. Rest assured – here at DailyForex, our team of experts has prepared a guide to the best verified and trustworthy Forex and CFD brokers worldwide. Read on to learn more about them and discover which one might be the best for your needs.

Forex Brokers Reviews at a Glance 2025

- FP Markets, ECN trading with leverage up to 1:500.

- Eightcap, 1:500 maximum leverage and cutting-edge trading tools.

- Pepperstone, Great ECN execution on MT4/5, cTader, TradingView and Pepperstone proprietary platform.

- BlackBull Markets, 1:500 maximum leverage with ultra-low trading fees and deep liquidity.

- Plus500, The best pricing environment for futures traders in the USA.

- CFI, Well-regulated long-established low spread broker.

- PrimeXBT, 1:500 maximum Forex leverage with spreads from 0.1 pips.

- Octa, A commission-free broker with a proprietary copy trading service.

- AvaTrade, Highly regulated, choice of fixed or floating spreads.

- XM, Exception range of assets + negative balance protection.

Best Forex Trading Brokers Comparison

|  |  |  | ||

Regulators | ASIC, CMA, CySEC, FSCA | ASIC, CySEC, FCA, SCB | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | FMA, FSA | ASIC, CFTC, CySEC, EFSA, FCA, FMA, FSCA, MAS, NFA, SCA |

Year Established | 2005 | 2009 | 2010 | 2014 | 2008 |

Execution Type(s) | ECN/STP | ECN/STP, Market Maker | No Dealing Desk, NDD | ECN/STP, No Dealing Desk | Market Maker |

Minimum Deposit | |||||

Average Trading Cost EUR/USD | 1.2 pips | 1.0 pips | 1.1 pips | 1.1 pips | 1.1 pips |

Average Trading Cost GBP/USD | 1.4 pips | 1.2 pips | 1.4 pips | 1.55 pips | 1.4 pips |

Average Trading Cost Gold | $0.16 | $0.12 | $0.15 | 0.12 pips | - |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Web-based | MetaTrader 4, MetaTrader 5, Trading View | Other, MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Trading View+ | MetaTrader 4, MetaTrader 5, cTrader, Trading View | Proprietary platform, Web-based |

Islamic Account | |||||

Negative Balance Protection | N/A | ||||

| Visit Website | Visit Website | Get Started Visit Website75-95% of traders on margin lose | Visit Website | Get Started Visit Website79% of retail CFD accounts lose money |

FP Markets

In Summary ECN trading with leverage up to 1:500fpmarkets is an ASIC-regulated Australian brokerage which launched in 2005. For most traders, the unique selling point of this broker is in the extremely wide range of tradable assets offered, providing the opportunity to trade over ten thousand individual stocks and shares including publicly quoted Hong Kong and Australian companies. Ffpmarkets also offers 60 Forex pairs and crosses, 11 equity indices, the major commodities, and 5 cryptocurrencies including Bitcoin. fpmarkets offers an unusual hybrid ECN/STP execution model, meaning their clients can choose between ECN style of execution giving a very high level of speed, and a “straight through processing” execution style which allows for more “natural” spreads.

Pros & Cons

- Choice of trading platforms and auxiliary trading tools

- Very competitive cost structure and excellent asset selection

- Low minimum deposit requirement and leverage of up to 1:500

- Well-regulated and trustworthy

- Availability of Iress geographically restricted

Eightcap

In Summary 1:500 maximum leverage and cutting-edge trading toolsEightcap established itself among the best Forex brokers due to its superb trading infrastructure, excellent order execution amid deep liquidity, competitive fees, and cutting-edge trading tools. Manual traders get a well-designed AI-powered economic calendar. MT5 traders benefit from Flash Trader, while the dedicated cryptocurrency solution Crypto Crusher caters to cryptocurrency traders.

Copy traders get the embedded MT4/MT5 services, and Eightcap connects social traders to the active TradingView community. Beginner traders get an outstanding educational and research offering via Eightcap Labs and Eightcap Trade Zone.

Pros & Cons

- Low minimum deposit and high leverage of up to 1:500

- Competitive cost structure

- Excellent technology infrastructure and seasoned management team

- Daily research and quality educational content

- Limited leverage in some areas

Pepperstone

In Summary Great ECN execution on MT4/5, cTader, TradingView and Pepperstone proprietary platformPepperstone ranks among the best Forex brokers offering Capitalise AI, enabling algorithmic trading in a code-free environment. It also upgrades MT4 with the 28-plugin Smart Trader Tools package and Autochartist. The well-balanced asset selection of 1,500+ assets includes Forex, Forex indices, and cryptocurrencies. Commission-based fees start with raw spreads from 0.0 pips for a commission of $7.00 per 1.0 lot. A volume-based rebate program can lower trading fees.

Traders get ultra-fast order execution with average speeds of 30 milliseconds, and MT4, MT5, cTrader, Myfxbook Autotrade, DupliTrade, and TradingView, plus a proprietary mobile trading app for copy and mobile traders.

Pros & Cons

- Excellent choice of trading platforms consisting of MT4/MT5, cTrader, TreadingView and Pepperstone Platform

- Market-leading MT4/MT5 upgrade package, Autochartist, and API trading

- Social trading support via Signal Start, MetaTrader Signals, Copy Trading by Pepperstone, DupliTrade

- Leverage of up to 1:400 depends on jurisdiction and superb trade execution

- Demo accounts have 60-day time limits

BlackBull Markets

In Summary 1:500 maximum leverage with ultra-low trading fees and deep liquidityBlackBull Markets was founded in 2014 in New Zealand. Like many antipodean Forex brokers, BlackBull Markets is an ECN broker, offering raw spreads and commissions. They are regulated in New Zealand by the Financial Services Providers Register (FSPR) and offer a maximum leverage on some Forex currency pairs as high as 500 to 1. In addition to their global headquarters in New Zealand, BlackBull Markets also has presences in the form of branch offices in New York and Malaysia. BlackBull Markets offers a relatively tight range of tradable assets: 27 Forex currency pairs and crosses, gold, silver, crude oil, natural gas, and 6 major equity indices. That should be sufficient for those traders with more focused strategies not requiring wide diversification.

Pros & Cons

- ECN/NDD execution model with deep liquidity

- Institution-grade pricing for retail traders via proprietary price aggregation

- ZuluTrade and Myfxbook for social trading

- Leverage of up to 1:500

- Limited deposit options

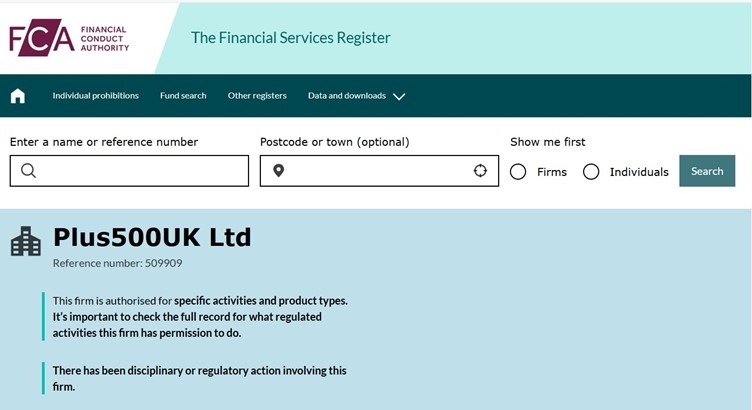

Plus500

In Summary The best pricing environment for futures traders in the USAPlus500 is an Australian company founded in 2008, with main offices located in Sydney. The company’s sophisticated trading platform features over 2000 instruments, and allows clients to trade on movements in the price of shares, indices, forex, commodities, cryptocurrencies, ETFs and options without having to buy or sell the underlying instrument. For the Australian market, Plus500 is licensed to offer CFDs through ASIC (AFSL #417727), and through the FMA (FSP #486026), for licensed CFDs in New Zealand. Plus500 trading services are also available in South Africa (Authorised Financial Services Provider #47546). Plus500 Ltd is listed on the London Stock Exchange’s Main Market for Listed Companies, with de facto headquarters located in Haifa, Israel. In its original form, the Plus500 trading platform was only available to PC users. However, in 2010, Plus500 launched a new web-based trading platform update, which allowed clients to trade using Windows PC, Mac, Linux, as well as most smartphones operating on either iOS or Android. Since its launch in 2008, Plus500 has placed considerable emphasis on its technological development through continuous innovation to obtain a technological edge in the market. In 2021, Plus500 opened a new R&D centre in Tel Aviv, Israel, aimed at increasing its scope, particularly in mobile trading technologies. Plus500AU Pty Ltd holds all client money in a segregated trust account, and offers users the option of a demo account for trial purposes.

Pros & Cons

- Broad asset selection in equities and options

- Free and unlimited demo account

- Advanced, free analytical and risk-management tools

- Globally regulated and publicly listed fintech platform

- No support for automated or social trading

CFI

In Summary Well-regulated long-established low spread brokerCFI ranks among the best Forex brokers. The cutting-edge infrastructure handles over $1 trillion in quarterly trading volume. The in-house AI trading assistant, Kaiana, powered by OpenAI, ensures a unique competitive edge, and traders benefit from competitive, commission-free spreads starting at 0.4 pips. The CFI Card issued by G2P provides seamless financial transactions, and an uncapped partnership program is available.

Traders can use MT5, cTrader, TradingView, the CFI Multi-Asset platform as a web-based option and mobile app, and the in-house copy trading service. Services by Trading Central and TipRanks offer actionable trading recommendations, and CFI maintains over 15,000 assets.

Pros & Cons

- In-house AI trading assistant Kaiana, powered by OpenAI

- Quality trading tools, including TipRanks and Trading Central

- Excellent asset selection of 15,000+ trading instruments

- MT5, TradingView, and a proprietary trading platform

- Demo account valid for 30 days

PrimeXBT

In Summary 1:500 maximum Forex leverage with spreads from 0.1 pipsPrimeXBT offers an excellent environment for Forex and cryptocurrency traders who use manual and copy trading strategies. It is an excellent choice for beginners who get 390+ educational articles, and the $15 minimum deposit ensures accessibility to everyone. With 1M+ traders, the proprietary copy trading service has plenty of signal providers to deliver a competitive choice of strategies.

Active traders benefit from volume-based discounts to the commission-free pricing environment featuring average EUR/USD spreads of 0.9 pips or $9.00 per 1.0 standard round lot. PrimeXBT also offers a generous reward program with $5,000+ in cash bonuses for achieving trading milestones.

Pros & Cons

- Generous rewards program

- €20,000 investor compensation fund

- Proprietary copy trading service

- Good choice of Forex and cryptocurrency pairs

- No algorithmic trading

Octa

In Summary A commission-free broker with a proprietary copy trading serviceFounded in 2011, Octa is a “Straight Through Processing” (STP) broker, which means they do not have an internal dealing desk. They simply connect buyers and sellers directly. With this model, Octa aims to be more cost-effective than anyone else in the market. They offer low spreads and claim 97.5% of trades are executed without slippage.

Octa offers their clients a choice of three Forex trading platforms: the world’s most popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). All of these can be traded as a desktop application, and on Android and iOS devices.

Octa is an unregulated broker but continues to earn the trust of traders around the globe, with more than 1,500,000 accounts opened. One reason for the ongoing success of this market maker is appealing bonus campaigns. This broker paid out almost $3,000,000 in bonus funds. Octa offers traders the MT4 and MT5 platforms, and a proprietary mobile trading platform. Octa additionally grants their clients Autochartist, but traders require a Silver Level in the Status Program. Traders have a choice between fixed and floating spreads, and the overall cost structure remains competitive.

Asset selection remains the distinct weakness at Octa, making it most suitable for new retail traders. A series of short educational articles offers a basic Forex introduction, and this broker maintains an excellent arsenal of research and analytics tools.

Pros & Cons

- Quick withdrawals and deposits

- 0% commission and no overnight charges

- Space with personalised trading ideas

- Customer Support 24/7

- Mobile copy trading services available only for Android

AvaTrade

In Summary Highly regulated, choice of fixed or floating spreadsAvaTrade is one of the largest Forex / CFD brokers and well-known for offering their clients a choice of fixed or floating spreads. They have a very high and strong level of regulation. AvaTrade is directly regulated in Ireland (and by extension, the European Union), Australia, Japan, South Africa, and the British Virgin Islands. Outside the European Union, Ava offers maximum leverage on Forex currency pairs as high as 400 to 1. AvaTrade offers trading in over 55 different Forex currency pairs, 17 commodities, 20 equity indices, 14 cryptocurrencies, plus 66 individual stocks and shares. 2 bonds and 6 ETFs are also on the menu.

Pros & Cons

- High quality educational offering via AvaAcademy

- Excellent choice of trading platforms catering to various trading needs

- Broad asset selection and cross-asset diversification opportunities

- Well-regulated and trusted broker with oversight from a central bank

- Trading costs competitive but nothing special

XM

In Summary Exception range of assets + negative balance protectionEstablished in 2009, XM (XM.com) is one of the largest trading platforms in the world, with over 5 million active clients trading from 196 countries. It is a market maker broker with a very low barrier to entry of only a $5 minimum deposit requirement. XM is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), the Australian Securities and Investments Commission (ASIC 443670) and the Belize International Financial Services Commission (000261/158). XM offers a choice of over 1,000 tradable instruments with spreads as low as 0.6 pips on EUR/USD. XM offers an unusually wide range of European equities.

Pros & Cons

- Outstanding trading tools and loyalty program

- Low minimum deposit, high leverage*, and competitive trading cost

- Excellent research and education

- Trustworthy and transparent with generous bonuses and incentives

- Inactivity fee

How Did DailyForex Choose the Best Regulated Forex Brokers?

Our choice of the best well-regulated, licensed Forex brokers, which are listed here on this page, derives from a straightforward process: We review hundreds of Forex brokers and rank them. The ones listed here are the leading ten that we think most highly of.

We use a team of experts to review brokers, assessing each offering and giving a rank score out of 5 for each of the following categories:

- Regulation & Security

- Fees

- Asset Selection

- Deposit & Withdrawal

- Ease of Account Opening

We also evaluate some secondary factors, including:

- Execution Speed and Reliability

- Leverage and Margin Requirements

- Trading Platforms

- Customer Support

- Educational Resources and Research Tools

Once we have our assessments by category, we generate an overall score, and our experts also individually give their opinions as a grade. We then have a final overall score for every broker we review.

Brokers are increasingly differentiating their offerings between countries, mostly for regulatory reasons. This means that two people with accounts at the same broker living in different parts of the world could have different experiences and might also find that the broker's strengths in their region differ a lot from those in another region. This is why, although we give brokers overall global scores, we also give them different and appropriate scores on individual listing pages.

How to Choose the Best Regulated Forex Brokers?

As an aspiring new Forex / CFD trader or someone with experience looking for a new opportunity, your task is to pick the best Forex broker for you.

The first thing you should always look at when assessing new brokers is whether a regulator authorises it and what regulator certified it. This is because you will make a deposit with a broker and must ensure your deposit is safe. A completely unregulated broker might not keep your deposit safe by mingling it with their funds or could even disappear with your deposit. Well-regulated brokers are much safer. Some of the stronger regulators also either insure or force insurance on brokers, adding an extra layer of safety for their clients.

Forex Regulatory Tiers

Regulators are commonly categorised in “tiers”, with the regulators with the strictest and best reputations deemed to be Tier 1, lesser regulators as Tier 2, and so on, down to the lowest tier, Tier 5.

- Tier 1 regulators are the most widely recognised and reputable globally. They have the highest security standards and maximal protection of clients. Tier 1 regulators include the Australian ASIC, the British FCA, and the European Union regulation.

- Tier 2—Brokers regulated by this tier of regulators can still be described as reliable and well-regulated and can be considered by even very cautious clients. Tier 2 regulators include the South African FSCA and the U.A.E.'s DFSA.

- Tier 3—Brokers regulated by Tier 3 regulators can be described as "average risk." They are certainly not the most reputable brokers if their highest-tiered regulator is Tier 3, but they are also far from being the worst. Clients who are risking relatively small deposits for a good service might have adequate reason to deposit with these brokers. Tier 3 regulators include the Mauritius FSC.

- Tier 4—These are high–risk brokers, but not the very worst ones. Depositing any meaningful amount of money with a broker regulated by this tier as its highest relevant regulation is likely to be a bad idea. The level of regulation in this tier is usually lax. Examples of Tier 4 regulators include Vanuatu's FSC and the British Virgin Islands FSC.

- Tier 5—These are brokers that simply should not be trusted, as the regulation provided within this tier tends to be basically non-existent. They are barely a step up from completely unregulated brokers.

- Unregulated Brokers - Some brokers are not regulated at all. These are usually in offshore tax havens, where they have no meaningful oversight. There is no reason to make a deposit with any such broker. Many of these brokers try to hide their lack of regulation by writing about the corporate entity's standing in a way that is meant to be misunderstood. I have never seen a broker state they are "unregulated" on their client site.

Fees

The second most important factor in choosing the best broker for you is their fees. Are they competitive or not? Remember, different kinds of fees impact different trading styles differently. For example, brokers charge spreads and/or commissions, so you pay a fee every time you enter or exit a trade, but CFD brokers also charge overnight fees on open trades, which can have a major impact on long-term trading styles.

It is important to be sure that a broker's fee structure is not only competitive by industry standards, or at least compared to your best alternatives to that broker, but also cost-effective for your trading style.

Some brokers also charge inactivity fees and additional fees for VPS or data services.

Leverage

Almost all brokers will offer leverage, which allows you to borrow money and buy and sell positions larger than the size of your account. If this sounds dangerous to you, that is because it is – being leveraged will magnify your losses as well as your wins.

Different brokers offer different levels of maximum leverage. In many countries, the maximum leverage that a broker can offer is limited by law. For example, in the European Union, no broker can offer leverage higher than 30 to 1 on Forex currency pairs.

This means that if you want to access a very high level of maximum leverage, you might have to shop around and look for an offshore broker to get it. However, there is no good reason why anyone should want to use such high leverage levels, as it is extremely dangerous and likely to empty your account.

Trading Platforms

Another criterion to consider in choosing the best broker for you is the choice of trading platforms offered. Some brokers offer only one kind of trading platform, while others might offer a choice of four or five different platforms. One thing to watch out for is that usually, where a broker offers a choice of platforms, certain assets can be traded on one of the platforms but not on the others.

It is important to feel comfortable with the trading platform you will use, especially if you are trading frequently or rapidly. However, it is important not to get hung up on trading platforms – everyone has their preferences, but basically, it is just a tool. If you can use it, you will not be advantaged or disadvantaged. Do not think that a particular trading platform will give you an edge.

Customer Support

Another criterion to consider when choosing the best broker for you is how well that broker takes care of its clients. Most brokerage clients only need help sometimes, but when they do, it is important that they are treated fairly and helped promptly. More and more brokers are offering customer support around the clock in various languages.

Range of Assets

Make sure that a broker offers what you want to trade before opening an account and depositing funds! Not all brokers offer the same range of assets. Almost all CFD brokers offer Forex, but only some offer cryptocurrencies, individual stocks, or a very wide range of commodities. Remember that many academic studies show that diversification of assets (trading a wide range of assets) is a key factor in the success of trading styles and strategies.

Minimum Deposit

Most brokers require a minimum deposit size to accept you as a client, but some have no minimum. Relatively small amounts, such as $10 or $100, are common, but brokers are requiring as much as $10,000 or even more. Usually, the higher the minimum deposit, the better the fee conditions you will get.

Ensure you can afford the minimum deposit before opening an account with a broker.

Account Types

In the past, most Forex / CFD brokers were either market maker brokers or ECN (electronic communication network) brokers, with each offering notably different trading conditions that also usually impacted the fee model. Today, brokers are increasingly offering clients a choice of either account type. Other variables can also differentiate between account types.

This means that when you open an account with a broker, you usually must choose between different types of accounts. Before finalising your choice, make sure that you understand the differences between what is on offer and that it suits your trading style and fee expectations.

Deposit and Withdrawal Options

Different brokers offer different payment options. Unless you are stuck using one specific payment gateway provider, this should be a minor consideration for anyone, but it is a very poor factor in determining your choice of brokers. However, if you are stuck between two brokers and there is nothing to differentiate them, picking the one with payment options that suit you better is legitimate.

Experience Level

A final consideration might be whether you are a beginner, intermediate, or experienced trader. It is important for beginners to understand what they are doing when trading, so a beginner should choose a broker offering a relatively simple and easy to use trading platform, and of course a demo account. Almost all Forex / CFD brokers offer demo accounts. For more experienced traders, this will not really be something to worry about.

How Do I Know if My Broker is Regulated?

If a broker is regulated, they will want to publicise this. If you go to their website and scroll down to the bottom of the home page or almost any page, you will likely see details of their regulatory agency, certification, and license. However, geotargeting technology means that you might only see the regulation they have that applies to your geographic area.

Try their website's "About Us" or "Regulation" section for full details about a broker's regulation.

Of course, asking a search engine or a reputable AI whether a particular broker is regulated, and if so, in which countries, should get a relatively accurate answer. This is just part of a broker's public profile, along with their own website.

If you really need to know the full details of the validation, for example, the class of license and time in force, go to the relevant regulator's website and search for the broker's name. For instance, if Broker X is regulated in Cyprus, go to the CySec (Cyprus regulator) website and search for them in the licenses section. This is also a good way to check whether a broker is regulated somewhere when you read an unverified claim that it is.

One problem with these searches is that sometimes, the license is in the name of the underlying company that owns the broker, which could differ from the broker itself. However, the broker's common name will usually show in the search when a license exists. This provides verification of a broker's regulatory status.

Nearly all brokers restrict their offerings geographically; how far they go depends on their regulatory licenses. For example, a broker that is not licensed in the USA or the EU will almost certainly not accept new customers from these regions. Many brokers are not available globally.

How to Choose the Best Forex Trading Platform

The choice of trading platform is not the most important decision you will need to make, and it should be a minor factor when picking a broker. However, you must use a trading platform which feels comfortable to you, especially if you are a frequent or short-term trader. Not every broker gives you a choice of trading platform, but some do. Here is a brief overview of the major retail trading platforms to guide you. Remember that many brokers will offer only one trading platform or a more limited choice.

- MT4 is still the most popular retail Forex / CFD trading platform. It is straightforward, efficient, and intuitive, although the app can sometimes be sticky.

- MT5, the successor to MT4, has a very similar design but more advanced features. It is aimed at the US market and a trading world beyond Forex.

- cTRADER – strong technical capabilities, often favoured by scalpers and algorithmic traders seeking fast trade execution.

- NinjaTrader – this platform caters mostly to futures and options traders seeking advanced market depth and order flow tools.

- Zulutrade – this is specially designed for copy traders looking to be part of a trading community.

- TradingView is one of the newer, more successful trading platforms. It aims to offer great analytical and charting tools, strategy development, trading ideas, and a collaborative community in one place.

- In House (Proprietary) – some brokers offer their trading platform.

Copy and Social Trading

Copy trading is where you automatically link your account to more experienced traders through a platform, and your account makes the same trades they do. You may need to pay a small fee on some platforms to the trade provider.

Social trading complements copy trading by providing an online community platform to share trade ideas, strategies, and analysis.

Both copy and social trading can be profitable and useful, with social trading being an attractive means to learn more about trading and the market. However, there are also major pitfalls to both.

Pros of Copy and Social Trading

- Accessible and cheap

- Endless opportunity to learn

- Allows successful diversification if trade providers carefully chosen

- May save time through learning short cuts

Cons of Copy and Social Trading

- Dependence on others tends to limit personal development

- Difficult for a beginner to pick trade providers accurately

- Challenge of losing money when you are “taking tips” = adverse psychology

- Many platforms push quantity of trades at the expense of quality

How to Choose a Suitable Trading Account Type

Different brokers offer different account types. One of the most important differences is the execution model, meaning how the broker processes your trades. It used to be that brokers chose one model, and you had to go with that if you wanted to be their client, but today more brokers offer a choice of account types in execution style. Here are the main categories you should work out which is best for your needs:

- Dealing Desk / Market Maker: The broker is the counterparty to the client's trades, creating an inherent conflict of interest. This model often offers fixed spreads. It can be prone to slippage and requotes. Despite its weaknesses, it can be a good model for beginner traders and longer-term manual traders.

- No Dealing Desk – the opposite of the above, there are two major types, both offer direct market access:

- ECN (Electronic Communication Network): Trade orders are simply matched between participants, with the broker earning only a commission. The advantages are no conflict of interest, smooth liquidity, and variable spreads, which can be narrow or even inverted. This model is best for scalpers, high-frequency traders, and algorithmic traders who trade frequently and require very fast execution.

- STP (Straight Through Processing) – trade orders are seamlessly passed on to liquidity providers, who are usually larger brokers or banks. What the trader gets in this model is virtually identical to the ECN model.

Account Type | Account Sub-Type | Trade Counterparty | Spread / Commission? | Pros | Cons | Most Suitable For |

Dealing Desk / Market Maker | Broker | Spreads (often fixed) | Can be more reliable and more consistent spreads. | Inherent conflict of interest | Longer-Term Traders / Beginners | |

No Dealing Desk | ECN | Other Trader Clients | Variable Spread / Commission | No conflict of interest, fast execution, often tight or even inverted spreads. | This can be problematic during low liquidity periods. | Scalpers / Short-Term Traders / Advanced Traders |

STP | Liquidity Providers |

How to Choose the Best Leverage Level for You

Leverage is when your broker effectively lends you money to trade with, and you trade a position size bigger than the money or value (account equity) within your account.

For example, let's say I have $1,000 cash in my account. I buy 0.01 lots of the USD/CAD currency pair, where 1 lot is worth $100,000. I have purchased $1,000 worth of USD/CAD, the same as my account size, so I am unleveraged.

Now let’s image I still have $1,000 cash in my account, but I buy 1 lot of the USD/CAD currency pair. My real leverage now is 1:100, because for every $1 I have in my account, I bought $100 worth of USD/CAD.

I would lose my entire account if the trade went against me with just a 1% move. On the other hand, if the trade moved in my favour by 1%, it would double my account equity.

Using leverage magnifies both your losses and wins – it is a double-edged sword.

Many regulators limit the maximum leverage a CFD broker can offer. In the European Union, at most, 1:30 can be offered on Forex currency pairs, while in the USA, the comparable maximum is 1:50.

So, how much leverage should you use? It depends on your risk tolerance. One method many traders use to make this call is to calculate a worst-case scenario of losses and then scale that so at most, it would cause a 20% loss. The scaling then gives you your leverage.

For example, let's assume that I have an account with $1,000 and that the worst maximum drawdown I think I might have is 5%. I just divide 20% by 5%, which gives me a leverage ratio of 1:4.

Keep in mind that in corporate finance, a maximum leverage ratio of only 1:1.3 is typically considered a suitable maximum. Generally, most traders are too aggressive with leverage – you do not need to trade Forex at 1:30 leverage to make money unless you are undercapitalised, which is a separate problem.

What to Avoid When Choosing a Forex Broker or Trading Platform

Avoid opening accounts with Forex brokers that have red flags, such as:

- Unregulated or regulated only in tier 4 or 5 jurisdictions.

- Have recently received multiple fines from reputable regulators.

- Have a shaky corporate structure behind them.

- Have a bad reputation for poor customer treatment and service, as evidenced by many negative reviews which can be verified.

There are only two things worth considering in the choice of trading platform:

- Does it work OK, especially when executing the trades you input?

- Are you comfortable using it? Can you avoid making costly mistakes?

Avoid using that platform if the answer to either or both questions is no.

How to Avoid Forex/CFD Scams

- Do not open an account with any untrustworthy broker with red flags (see the above section for details).

- Do not buy trading robots, coaching services, or trading systems/strategies.

- Do not get involved with anything that looks like a pyramid scheme.

- If you will copy trade or let anyone manage your account, for example, through PAMM or MAMM, carefully verify the track record. If you don't see losses in the history, just lots of steady wins, it is either fake, or it will collapse with a huge loss.

Following these steps should keep you away from any Forex scams. Remember: if something looks too good to be true, it almost certainly is.

Do I Need a Forex Broker?

If you want to trade Forex, then yes, you need an online Forex broker.

Theoretically, you could profit from trading for the long term using a Bureau de Change or bank, but why would you? The trading fees/spreads are much higher, the process is slow, and you will get a bad price. The odds will be more in your favour when you use an online Forex broker.

Tips for Trading with a Forex Broker

- Use a position sizing formula based on your account equity, like 0.25% of the account risk by trade. This will enhance your winning streaks, reduce your losing streaks, and make it much harder to blow up your account.

- Use very little leverage or even no leverage at all.

- Use a strategy you believe in and have personally backtested. If performance is very different from your backtest, it is time to reconsider that strategy.

- Be strict with yourself and never gamble or make an impulse trade.

- Don’t expect to get rich quickly.

- Don't believe everything you hear. If you listen to a different guru every day, you will lose your bearings. Test and read what is out there, but always be sceptical.

- Refrain from taking tips from other people.

- Be brutally honest with yourself – you will pay for any wishful thinking.

- The longer you survive as a trader, the better you will get the more you analyse what you are doing. As a beginner, it can make sense to start using a trading strategy with clearly defined rules but grade each trade on a scale of 1 to 10 before entry. After a while, see if your predictions have any power. When they do, you can become a more discretionary trader.

- Use a demo account to learn the basics of trading and familiarise yourself with your broker, but expect your emotions and execution to change when you finally move to real money.

Trading Tools

Many Forex brokers offer trading tools to improve the trading experience, including advanced charting software, customised technical indicators, economic calendars, and entry and exit signal generators. Also, many trading platforms, such as MetaTrader 4 and 5, offer automated trading, custom indicators, and social / copy trading elements. Other platforms and some brokers offer risk management tools. It is also possible to buy standalone tools from other sources.

Trading tools can be useful, but they are often sold to give traders the illusion they are getting an edge. Such tools may not even be useful or will only be useful in the hands of experts, so don’t get hung up on them. You don’t need flashy trading platforms and tools to profit in the market. You may even do better without them as distractions.

My Take

You need to trade with the right Forex/CFD broker to have a chance to become a successful, profitable trader. If you ensure you only trade with well-regulated, verified, trustworthy brokers who give their customers a fair deal and competitive fees, you are more than halfway towards reaching that point. Avoid red flags, trade conservatively while you learn, and don't be afraid to experiment and to keep learning. You also must be prepared to take some losses: many profitable traders only win a minority of their trades, but their wins are bigger than their losers. Losing trades are inevitable.

Remember that it is often said that becoming an expert takes 10,000 hours of practice. As a trader, you must survive that long in the market to become good at it.

.webp)