Traditional reversal patterns, such as the head-and-shoulders (H&S) or rounded tops/bottoms, can be highly predictive of future price moves, especially new sustained trends. I’ve traded these types of patterns for many years, and I encourage traders to trade them when they find clean examples. However, these types of traditional reversal patterns are incredibly subjective, messy, and difficult to time.

In this article, I will present a candlestick reversal pattern to add to your toolkit. It’s objective, straightforward to spot and easier to trade. I call this pattern the “smart engulfing” reversal setup.

The Smart Engulfing: How Does It Work?

The Smart Engulfing candlestick is a variation of the traditional Engulfing pattern with a few additional rules.

- The Standard Engulfing Pattern

Steve Nison popularized the original engulfing candlestick pattern in his book, Japanese Candlestick Charting Techniques. For anyone wanting to specialize in this area, I think it’s a fantastic and relevant read.

Nison’s definition of the setup consisted of two consecutive candles, where the second candle’s body “engulfs” or covers the price range made by the first candle’s body, and the bodies are in opposite directions.

It’s a bullish engulfing setup when the first candle has a bearish body and the second has a bullish body.

It’s a bullish engulfing setup when the first candle has a bearish body and the second has a bullish body.

Steve Nison’s book states that a pattern is valid only if a trend precedes it. I will discuss this in further detail in the section about how to trade the pattern.

Notice that the definition does not consider the wicks. These can be either long or short or have wicks that are longer on one side than the other. That means the following are all engulfing setups under Nison’s definition:

Example 1:

Example 2:

Example 3:

Example 4:

Example 5:

Even though all the above setups are the same pattern under the standard rules, they have very different appearances and, in my mind, can be saying very different things about the underlying market activity.

For example, a candle with a long wick on one side indicates rejection of that price area, and long wicks on both sides indicate the market’s indecision. The standard definition does not account for these variations.

- The Smart Engulfing Pattern

To account for wildly different wicks and to bring stability to the pattern setup, I instituted an additional rule: the body of each candle must be at least two-thirds of the candle's total length. Stated another way, the length of the wicks of each candle must be less than a third of the candle length. The body lengths of each can vary widely: they could be both long, or short, or a short body followed by a much longer one.

- Why Is It a Good Idea to Have This Rule?

When a candle moves in a direction with short wicks, it represents a decisive move. When two candles do this in opposite directions, it means a decisive move in one direction, followed by a decisive move in the opposite direction, i.e., a massive shift in opinion, that’s difficult to ignore. That is why I believe this pattern is effective.

The Smart Engulfing Set Up Rules

- A candle whose body is a minimum of two-thirds of the length of the candle. In other words, the wicks in total cannot be more than a third of the length of the candle.

- The next candle’s body is in the opposite direction. If the previous candle has a bullish body (i.e., the close is higher than the open), the second candle should be bearish, with a close below the open.

- The second candle must also have a body whose length is two-thirds of the entire candle.

With this additional ruleset, the engulfing pattern looks more standardized:

How Do I Trade the Setup?

Very little in technical analysis can be traded in isolation, or as I like to say, technical analysis is all about context. The Smart Engulfing pattern is no exception, and I rarely trade it in isolation.

I especially like to use it when there is previous support or resistance, or as a method to enter a trend on a pull-back.

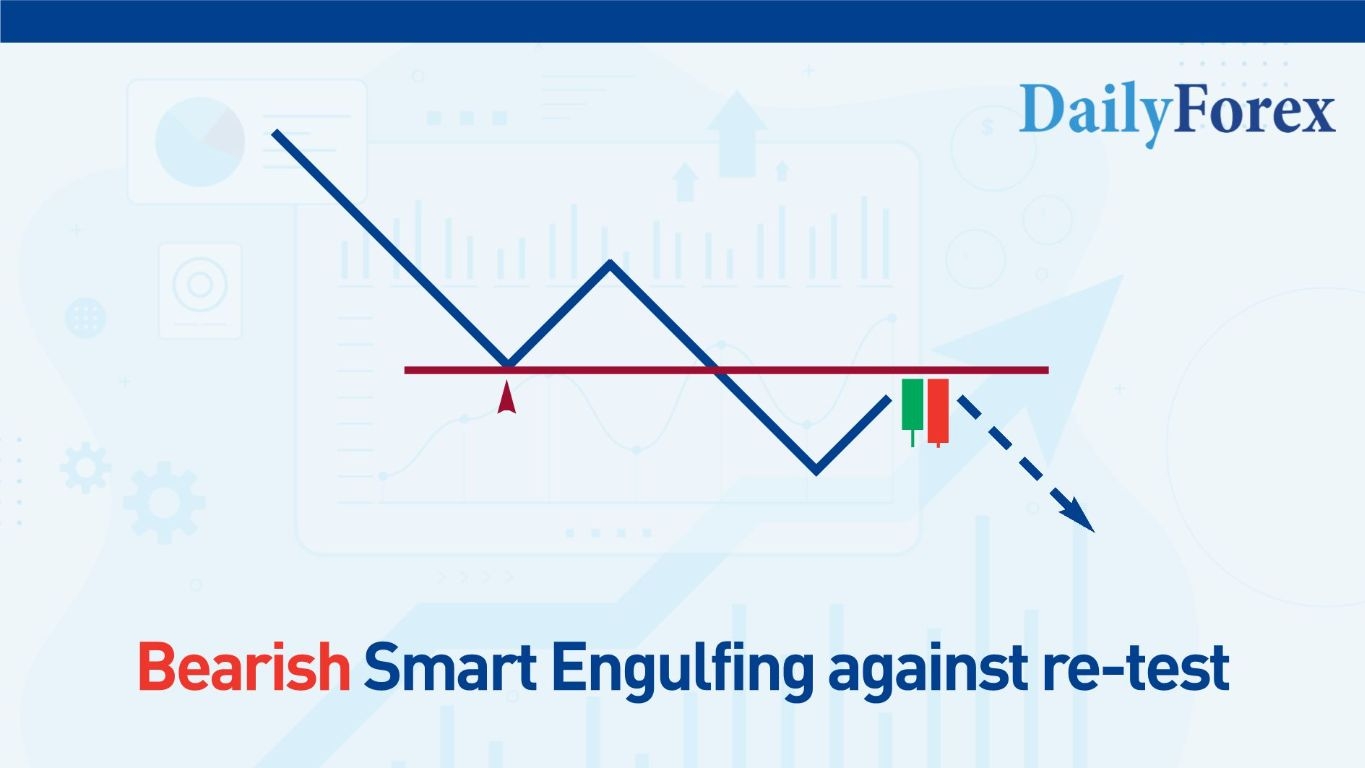

- Against Support and Resistance

Wait for the candle to land against support or resistance as a signal:

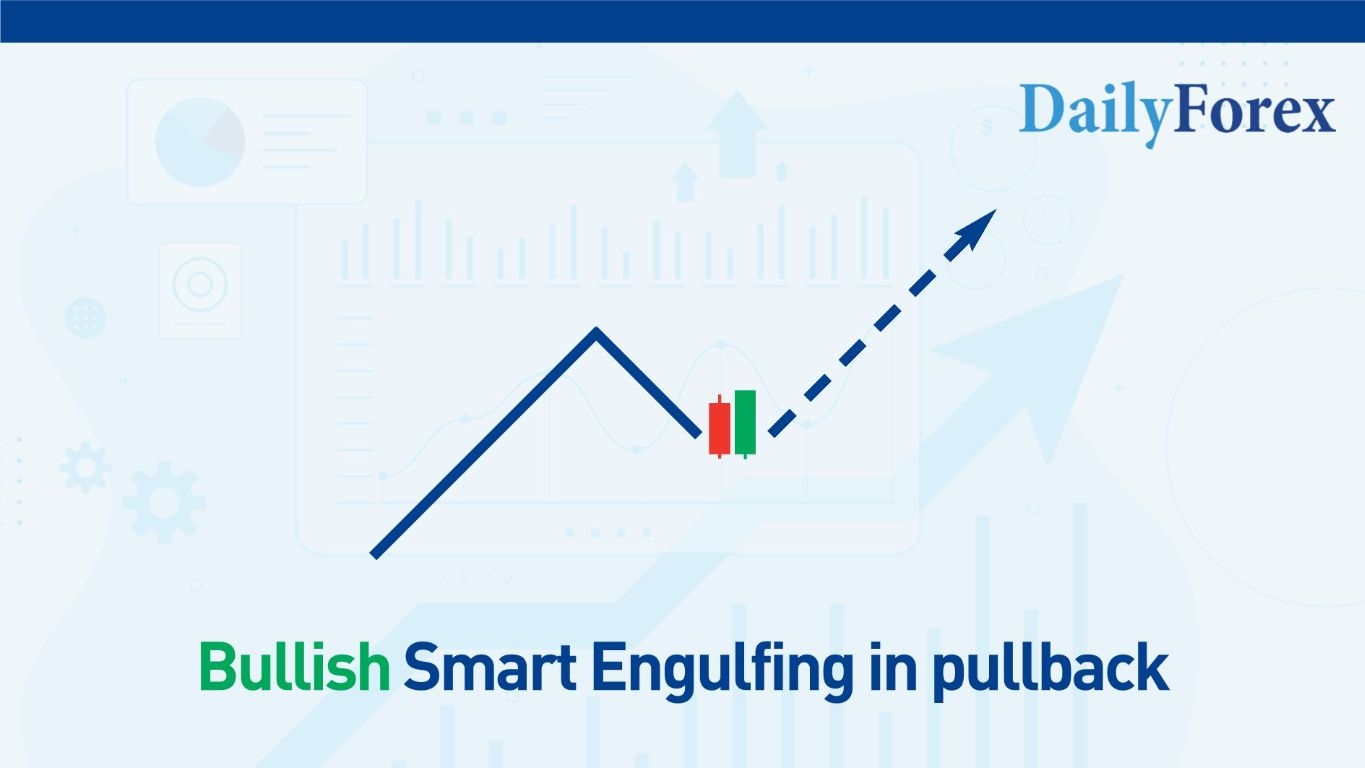

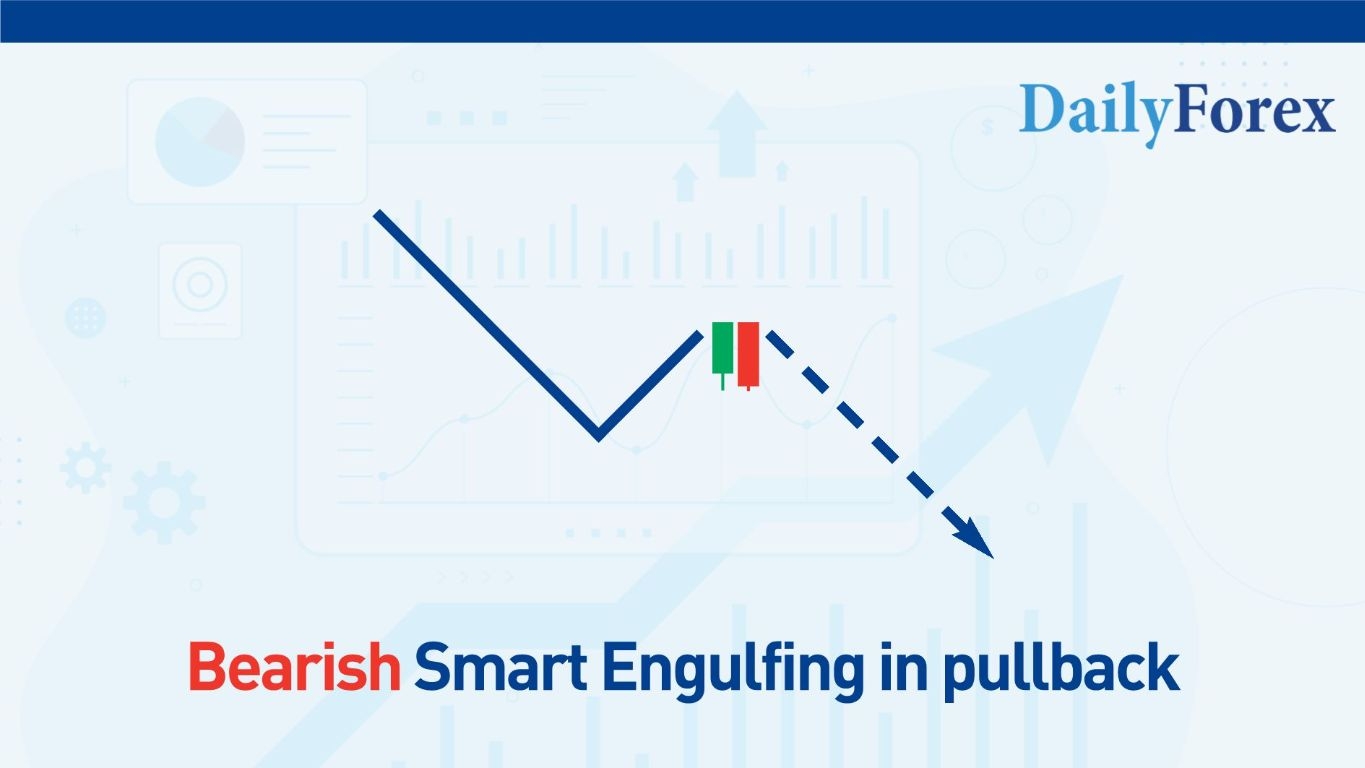

- In a Trend as a Pullback

- Use Multiple Timeframes

Using multiple timeframes allows me to trade in line with a bigger picture, often resulting in sharper entries and higher reward/risk ratios. For example, I may see a support and resistance level on a higher timeframe, e.g., weekly, and see the Smart Engulfing pattern appear on the daily chart. Or I may see the pattern emerge on a weekly timeframe, then switch to a daily or even a 15-minute timeframe to find an entry.

In Which Markets Can I Trade the Smart Engulfing Pattern?

The best Forex brokers enable advanced technical analysis, which relies on crowd psychology and works best in high-volume, liquid markets where it’s difficult for a single buyer or seller to move the market significantly.

I trade it on Forex major pairs, currency futures, some commodities (natural gas, crude oil), and equity indexes, e.g., the S&P 500. There’s no reason I can’t trade it on individual stocks, for example, the top few dozen stocks in the S&P 500.

In What Timeframes Does the Setup Work?

Like most aspects of technical analysis, the higher timeframes produce more reliable setups. However, higher timeframes mean fewer signals, so there’s a balance in managing that trade-off between reliability and the number of signals.

I find this setup particularly effective on the daily timeframe. However, each market may give 2-3 setups a year. So, if you exclusively trade only one market, it can still be a part of your toolkit, albeit a minor part. I trade over a dozen markets, so I see this set up multiple times each month.

I can regularly find these patterns on the 4-hour and hourly charts, but I need to ensure I have plenty of confluence to trade them, such as an established trend or a clear support/resistance level.

The Smart Engulfing Pattern in the Real World

This pattern shows up in real charts, where I have taken real trades. Here are some examples:

Example 1: Smart Engulfing in a Trend on EUR/USD

A pullback in a trend stops and reverses with two consecutive bearish Smart Engulfing patterns, providing a clean entry level in a downtrend.

Example 2: Smart Engulfing in a Support/Resistance Retest on EUR/USD

After breaking support, the price comes back up to re-test as resistance, making a bearish Smart Engulfing pattern, providing an entry to the subsequent down move.

Example 3: Smart Engulfing Against Resistance on AUD/USD

A bearish Smart Engulfing appeared on the weekly timeframe, which nicely aligned with previous resistance. This is one of my favourite examples, because it allowed me to ride a downtrend for many months.

Example 4: Smart Engulfing Against Resistance on AUD/USD

Similar to the previous example, where a bearish Smart Engulfing occurs at a prior resistance level. Notice how the first point in the resistance is also a bearish Smart Engulfing pattern, and the low between the two highs is a bullish Smart Engulfing pattern!

Example 5: Smart Engulfing Against a Long-Term Resistance on USD/CAD

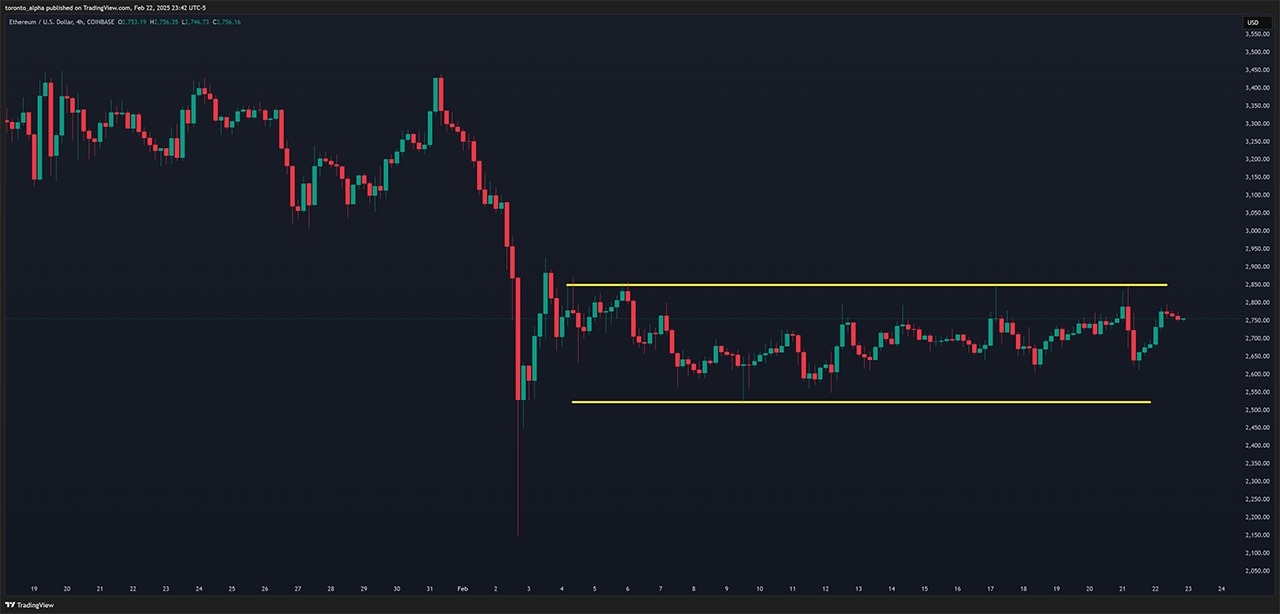

Although difficult to see on this compressed chart, a Smart Engulfing pattern appeared in February 2025 at a long-term resistance level on the weekly USD/CAD going back to January 2016! This simple technical pattern can hold across these timescales.

In Summary

The Smart Engulfing pattern is simple:

- A second candle in the opposite direction of the first (e.g. a bullish body followed by a bearish body, or the other way around)

- The second candle’s body “engulfs” or covers the price range of the first candle’s body

- Both candles’ bodies are at least two-thirds of the candles' lengths.

Trade them when they appear against support/resistance levels, or in the direction of a trend, or within any other setup that you use in your trading. I like trading them on daily and weekly timeframes, but to get more setups, go to lower timeframes.