Price action uses the price chart, meaning it does not use lagging technical indicators or fundamentals, making it the purest form of technical trading. All traders should understand price action trading because it’s the foundation for understanding what the market is doing.

Top Regulated Brokers

In this beginner’s guide to price action trading strategies, I will cover:

- Steps to using price action trading

- What the best Price Action Trading strategies are

- Price action trading pros and cons

What Is Price Action Trading?

There are several definitions of price action trading, but here are the features I use to define it:

- Price action trading only uses price data to trade (usually in the form of a chart).

- It does not use any other technical analysis indicators.

- It also does not use fundamental data. This makes price action trading a form of technical analysis.

Price action trading under this definition has existed for hundreds of years—history’s earliest traders used it to decide when to buy and sell physical commodities such as grains and metals. It became more popular in the twentieth century with books such as “Technical Analysis of Stock Trends” by Edwards and Magee and “Technical Analysis of the Financial Markets” by John J Murphy. These books examined how prices moved in trends and other chart patterns.

Who Uses Price Action Trading?

- Traders of large liquid markets use price action trading. Technical analysis relies on crowd psychology to be predictable. The larger the crowd, the more reliable it is.

- Discretionary traders use price action trading more than systematic traders. Some price action trading systems have fixed rules, but most are discretionary, with subjective entries and exits.

- Longer-term traders use Price Action Trading more than short-term traders because short-term traders often require additional indicators to help time their entries and exits.

- I use price action trading! For years, I have placed trades using only the price chart. It is a practical way to find profitable trades with excellent reward-risk ratios.

Steps to Using Price Action Trading

The first step to price action trading is choosing which price chart to use. There are three types that Price Action traders use:

- Bar charts. Each bar displays that period’s Open, High, Low and Close (OHLC).

Because it’s a daily chart, each bar represents that day’s Open, High, Low and Close.

Bar charts have a simpler layout than candlesticks, and I find them easier to use for spotting support, resistance, and chart patterns.

- Candlestick charts show the period’s Open, High, Low, and Close, similar to bar charts. A candle’s “body” will have separate colours for bullish candles (where the close is higher than the open) and bearish candles (where the close is lower than the open).

Most traders today prefer candlesticks because they make it easier to see the difference between the open and close compared to bar charts.

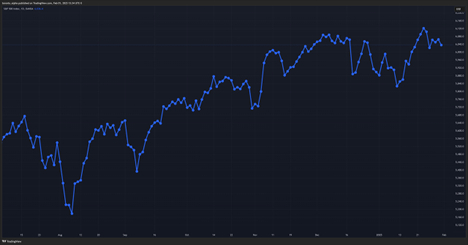

- A line chart connects the closing price of each period with a single line.

Line charts are the simplest format. If I want a big-picture market view, I immediately switch to a line chart because it contains the least noise. I tend to use line charts on daily charts, especially for markets such as equity indices (e.g., S&P 500), because these markets have a fixed daily close with technical importance.

However, because line charts lack a lot of information, I cannot use them alone. I need the level of detail provided by bar charts or candlestick charts.

Charting platforms make it easy to switch between bar charts, candlesticks and line charts. I often toggle between the three types to ensure I have the same market view.

The second step to using price action trading is to find charting software. Luckily, there are plenty available. Two popular ones are:

- MetaTrader 4. This is the most popular Forex charting software. Most brokers offer it free with a demo account.

- TradingView. This is a web-based charting platform and covers nearly every global market. TradingView has both free and paid versions with more features.

Best Price Action Trading Strategies

The following are some of the best price action strategies I have used for live trading.

Triangle “Continuation Patterns” In Trends

A continuation pattern is a chart pattern that looks like a brief pause in a trend. The version I find the most profitable is the triangle pattern.

Step 1: Wait for a trend to form. This could be higher lows (uptrends) or lower highs (downtrends). I ignore triangle patterns in the middle of a range.

Step 2: Look for a pause in the trend where the price contracts into a triangle shape. It does not matter if the triangle is symmetrical, descending (i.e., with a flat bottom side) or ascending (flat top side). More importantly, the triangle should not be large or volatile because this could indicate more indecision in the market rather than pausing before continuing the trend.

Step 3: Enter when the price breaks out of the trend and put a stop-loss on the other side of the triangle. The profit target can be the nearest support or resistance. I only take trades where the potential profit is more than the size of the stop loss, i.e., a reward/risk ratio greater than 1.

Horizontal Support/Resistance Role Reversal

When the price breaks support, it often tests the level as resistance and vice versa. This is known as “role reversal.” It is an excellent way to confirm that a breakout is real rather than false.

Step 1: Look for a horizontal price range where you expect the price to break through. For example, this could be where a trend has stopped and made a range, and you expect the price to continue.

Step 2: Wait for the price to break out and re-test the level from the other side once or twice. The price should test the previous level as precisely as possible.

Step 3. Enter a trade in the direction of the breakout, with a stop loss on the other side of the support or resistance level. The target can be another previous support or resistance level. Do not take the trade if the stop loss exceeds the potential profit.

Smart Reversal Candlestick Pattern

The smart-reversal setup is a rules-based strategy that is easy to learn and test historically. I found it very reliable on the daily timeframe of major Forex pairs, such as the EUR/USD.

Step 1: Wait for two consecutive candles, where: 1. The first candle is bullish and the second is bearish, or vice versa, 2. Each candle’s body (the difference between the open and close) is at least two-thirds of the entire candle length (the difference between the high and low), and 2. The second candle's body covers the range of the first candle’s body.

Step 2: Enter at the close of the second candle or open of the next candle. If the second candle is bearish, I want to follow its direction with a short entry. If the second candle is bullish, I enter a long trade.

Step 3: The target is the length of the second candle. The stop-loss is the top or bottom of the second candle. This means that this trade has a 1:1 reward/risk ratio. An enhancement of this trade is to move the stop-loss to breakeven when the price moves to 50% of its target. This results in fewer losing trades, but some trades get stopped-out at breakeven that would have gone to the full target.

Price Action Trading—Pros and Cons

Pros

- Price action trading does not rely on lagging indicators.

- It has stood the test of time. Traders have been using price action trading across markets for centuries and remained profitable, while many other trading systems became obsolete because they don’t work in all market conditions.

- It works across any liquid market, from traditional markets such as equity indexes to modern markets like Bitcoin.

Cons

- Most price action trading strategies are discretionary. For example, I might see a reversal pattern, but another trader might see a range.

- Price action trading’s subjectivity can make it more susceptible to emotions or biases. For example, if I believe a specific market is overvalued, every time the price pauses, I may see a bearish pattern that does not exist.

- Price action trading requires extensive practice because most price action strategies are discretionary without mechanical rules.

Bottom Line

Price action trading is the foundation of technical analysis because it uses only the price chart without technical indicators or fundamental data to trade. It has stood the test of time for centuries. Other trading systems will come and go, but price action trading will remain reliable and profitable because it taps into underlying psychological concepts. I have used it to trade for over a decade and still find it consistent and profitable. I recommend price action trading even to rules-based traders because understanding price action can help understand the market environment in a way that many trading systems cannot. However, price action trading is subjective and can take a long time to learn.