Unlike most other markets, the Forex market is open 24/7, 5 days per week – from Monday morning in New Zealand to Friday evening in New York. This means that Forex traders can trade at any time of the weekday, day or night, wherever they are.

Forex traders have plenty of choice about when to trade, so in this article I will examine what are the best Forex market hours for traders, to help you decide when to trade to give yourself the best chance to trade profitably.

Top Forex Brokers

Understanding the Forex Market Clock

Knowing which Forex session is currently open can help traders narrow the list of Forex pairs to trade based on liquidity and market movement, which results in tighter spreads, lower trading fees, and higher potential profits. It creates tremendous trading advantages, ideal for scalpers, short-term traders, and high-frequency traders.

The Forex market is an over the counter (OTC) market without a centralized exchange, unlike equity trading. Therefore, banks, brokers, market makers, and liquidity providers communicate in the inter-bank market, the electronic communication network (ECN), and peer-to-peer (P2P) transactions to enable 24/5 trading.

espite the 24/5 availability, the unofficial opening and closing periods and their overlap sessions, representing the most significant trading periods, are the official opening and closing of global financial centers, usually gauged by stock market operating hours.

Which are the four major Forex markets, and when do they officially open and close for business?

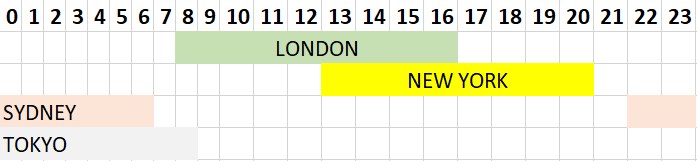

- Sydney opens at 22:00 UCT (17:00 EST) and closes at 07:00 UCT (02:00 EST)

- Tokyo opens at 24:00 UCT (19:00 EST) and closes at 09:00 UCT (04:00 EST)

- London opens at 08:00 UCT (03:00 EST) and closes at 17:00 UCT (12:00 EST)

- New York opens at 13:00 UCT (08:00 EST) and closes at 22:00 UCT (17:00 EST)

Which trading sessions overlap and when?

- Sydney and Tokyo between 24:00 UCT (19:00 EST) and 06:00 UCT (01:00 EST)

- London and Tokyo between 08:00 UCT (03:00 EST) and 09:00 UCT (04:00 EST)

- London and New York between 13:00 UCT (08:00 EST) and 17:00 UCT (12:00 EST)

The graphic below shows each of these sessions in UTC time. Note that local changes to summer time can alter these sessions by an hour.

Forex Market Clock

Noteworthy:

Dealing with time zones may appear confusing, but a Forex market hours chart can be easily built to display Forex market trading hours and show the trading sessions overlap. This allows traders to set their time zone, for example, Forex market hours EST, and display all relevant information. Active traders will easily get come to know how the time in London, New York, and Tokyo relates to their geographical location and time zone and remember it – it doesn’t change, although it can be off for a week twice a year when the US changes its clocks by one hour later than much of the rest of the world.

When Should Forex Traders Trade to Get the Best Results?

Forex overlap sessions occur when two or more major Forex markets operate simultaneously. It creates a liquidity spike, and most daily Forex trading volume occurs during overlap sessions.

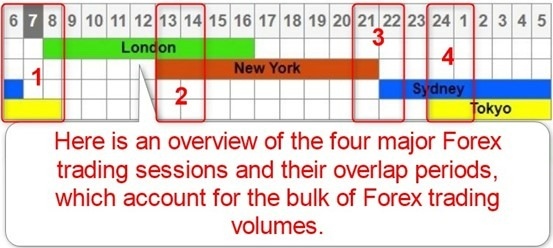

Here is an overview of the four most significant Forex overlap sessions:

1. The Sydney-Tokyo-London Forex overlap session offers the most liquidity during the Asian trading session and starts the European trading session. The London Forex trading session is the most significant period during the day, as London is the global Forex center, which accounts for the bulk of Forex trading volume.

2. The London-New York Forex overlap session is widely accepted as the most significant, as the biggest Forex market, London, and the second-biggest one, New York, operate simultaneously. Liquidity is the deepest during this time, as most market-moving financial firms are open for business. It can also confirm trends, break existing ones, reverse them, or start new ones. Some Forex traders only trade this Forex session.

3. The New York-Sydney Forex overlap session is the third-busiest trading period, but volumes are significantly lower. Many traders, including those from Europe, close their open positions to avoid the uncertainty and added risk of keeping trade open overnight. Please note that traders seeking to avoid swap rates on leveraged overnight positions must close their positions before 17:00 EST (end of day NY). Forex traders consider this period the unofficial close of the Forex trading day.

4. The Sydney-Tokyo Forex overlap session provides a liquidity spark for Asian traders. Forex traders consider it the unofficial opening of the Forex trading day, given the importance of the Japanese Yen, despite Sydney starting two hours ahead of Tokyo.

Noteworthy:

- The Australian Forex session accounts for lower trading volumes, less liquidity available, and often range-bound markets that tent to respect support and resistance levels established during the London session.

- The start of the Tokyo session normally adds the most liquidity during the Asian trading session.

- Traders should monitor the first and last trading hour of each equity trading session in global financial centers, where much of the crucial trading action often occurs.

- The first hour displays more trading volume than the last hour of each session, with few exceptions.

Here are the currency pairs with the highest liquidity during each Forex session:

- London - EURUSD, EURJPY, EURAUD, GBPUSD, GBPJPY, GBPAUD, GBPCHF, USDCHF, EURCHF, EURGBP

- New York - EURUSD, GBPUSD, USDCAD, USDCHF, GBPCAD, EURCAD

- Tokyo - USDJPY, GBPJPY, EURJPY, USDCNY, EURCNY, GBPCNY

- Australia - AUDUSD, AUDJPY, AUDNZD, GBPAUD, EURAUD

Traders should also monitor the following minor Forex markets for the associated currencies:

- Frankfurt - EUR pairs

- Stockholm - SEK pairs

- Zurich - CHF pairs

- Hong Kong - HKD, CNY pairs

- Wellington - NZD pairs

- Bombay - INR pairs

- Istanbul - TKY pairs

- Johannesburg - ZAR pairs

- Singapore - SGD pairs

- Mexico City - MXN pairs

- Moscow - RUB pairs

Given the rise in Forex trading, the below markets can offer a short-term liquidity boost:

- Ryiadh - USD, CNY, RUB, ZAR pairs

- Doha - USD, CNY, RUB, ZAR pairs

What Are the Most Liquid Forex Pairs, and When Are the Best Times to Trade Them?

- The EUR/USD is the most liquid currency pair - London and New York sessions.

- The USD/JPY is one of the most traded currency pairs in Asia - Tokyo session.

- The EUR/GBP is heavily traded, especially across Europe and Asia - London session.

- The GBP/USD is another highly liquid currency pair - London and New York sessions.

- The USD/CHF is another liquid safe-haven currency (CHF) and indirect commodity currency - London session.

- The AUD/USD is a commodity currency (AUD) and a proxy for the Chinese Yuan - Australia session.

- The USD/CAD is also a commodity currency (CAD) primarily for hard commodities - New York session.

- The NZD/USD is the final commodity currency (NZD) primarily for soft commodities - Australia session.

Why is the Forex Market Open 24/7?

Unlike equity or bond markets, the Forex market is necessary for around-the-clock trading. Imagine companies, governments, and even individuals having to wait for the Forex market to open for business. It would disrupt the global supply chain, harm the economy, and make day-to-day necessities impossible.

Reasons why Forex market trading hours are 24/5:

- International trade requires ongoing Forex quotations to settle contracts. We live in an interconnected world with a global supply chain. Without 24/5 Forex trading, the economy would not function efficiently. Since we have more than twenty-four time zones, , the global economy relies on around-the-clock trading to ensure goods and services flow frictionless.

- Central banks require 24/5 Forex trading as they frequently conduct currency swaps, also known as liquidity swaps. The idea is to maintain a stable financial system, especially during times of crisis and volatility. Some central banks also directly intervene in the Forex market. The Swiss National Bank (SNB) is the most active central bank, followed by the Bank of Japan (BoJ).

- Global businesses have operations across time zone with daily capital needs, which require a Forex market operational 24/5. They require raw materials, finished goods, or services outside their domestic market. They also sell their products globally, using various currencies, which they convert to their home currency.

Without 24/5 Forex market hours:

- Factories would deal with raw material shortages

- Ports would face disruptions

- Consumers would find empty store shelves

- Online shopping would not exist

- Governments would have no access to necessary capital

- Our interconnected would disconnect

What enables around-the-clock Forex market hours?

The Forex market is decentralized, lacking a specific exchange or exchanges, taking place over the counter (OTC). Most transactions occur via the electronic communication network (ECN) or other computer networks. The absence of centralized exchanges and usage of computers form the backbone of the Forex market infrastructure. Every aspect of Forex trading remains automated, which is one reason many active market participants, professional and retail, rely on algorithmic trading strategies.

Sometimes, market reporters refer to a currency closing at a specific value. For example, the Euro finished at $1.1650 versus the US Dollar. This just means the latest exchange rate at the end of business in Europe, usually the UK, Zurich, Frankfurt, or Paris. The EUR/USD will continue to trade 24/5.

Final Thoughts

The Forex market is open 24 hours per day, 5 days a week, closing in the retail space only at weekends and some major public holidays. This means that retail traders can choose to access the market apart from at weekends whenever they want, regardless of geographical location. However, the Forex market is most active during the London / New York session overlap, which is widely regarded as the best time to trade Forex, and from the start of the London session generally until the end of the New York session, meaning traders in Europe, Africa, the Americas, and to some extent the Middle East are best placed to trade Forex during the most active sessions. However, Asian currencies tend to move a lot during Asian business hours, so there are Forex opportunities for traders located in Asia even without getting up to trade in the night. It is also quite possible to use many retail Forex broker’s trading platforms for automated trading, where the trader sets the rules for trades which can then be executed at whatever times trade setups may occur.