Everything You Need to Know About Covered Interest Arbitrage

The Forex market is the most liquid financial market globally, and some estimates have it breaching $10 trillion in daily turnover this decade from just shy of $7 trillion now. Given the size and liquidity of the Forex market, traders can use a wide range of strategies unsuitable in other markets. Covered interest arbitrage is among them, but what is covered interest arbitrage? We will explain covered interest arbitrage theory, discuss the importance of covered interest arbitrage parity, and outline why this strategy belongs to exotic ones, allowing you to determine if it is suitable for your portfolio.

Top Regulated Brokers

Covered Interest Arbitrage Explained

Covered interest rate arbitrage is an arbitrage strategy where an investor seeks to profit from interest rate differentials of two currencies and hedges currency exchange risks with forward contracts. It allows investors to generate profits from higher-yielding currencies hedged against Forex fluctuations.

What are the requirements for covered interest rate arbitrage to function profitably?

Some refer to covered interest rate arbitrage as risk-free profits, but it is not that simple. Covered interest rate arbitrage, the opposite of uncovered interest arbitrage, requires certain market conditions to exist. Otherwise, profitability will deteriorate in a strategy that yields minimal profits on a unit base and requires significant unleveraged volume.

The following market conditions must exist for covered interest arbitrage trading:

- Global interest rate environments must differ

- The costs of hedging Forex risk with forward contracts must be less than the returns generated by investing in higher-yielding currencies, hence the term arbitrage

Why do covered interest arbitrage opportunities exist?

Covered interest arbitrage opportunities exist as the covered interest rate parity (CIRP) does not constantly hold. Therefore, market participants are no longer indifferent to where they deploy capital and seek higher yields.

What are the most significant drawbacks of covered interest arbitrage?

Transaction costs eliminate profits, opportunities exist for brief periods before efficient markets correct them, and it requires a lot of trading capital to deploy a profitable arbitrage trading strategy.

How Does Covered Interest Arbitrage Work?

An investor needs to find two currencies with a notable interest rate differential, calculate the theoretical value of forward contracts, compare them to actual rates, and look for discrepancies.

How to calculate forward Forex rates?

Calculating Forward Forex rates is simple. Take the domestic interest rate, divide it by the foreign interest rate, and multiply the value by the spot Forex rate.

Here is the forward Forex rate formula:

- F is the forward Forex rate

- S is the spot Forex rate

- id is the domestic interest rate

- if is the foreign domestic rate

Here is an example:

- The US interest rate is 1.75%

- The Eurozone interest rate is 0.00%

- The EUR/USD spot Forex rate is 1.0510

- 1.0510 (S) x = 1.0329 (F)

A covered interest arbitrage opportunity exists if the real forward Forex rate is below 1.0329, as an investor must convert US Dollars back to Euros. Investors may use spreadsheets to execute a covered interest arbitrage formula and spot if covered interest rate parity holds or if covered interest arbitrage opportunities exist.

A Covered Interest Arbitrage Example

Below is a simplified covered interest rate arbitrage example, excluding compounded interest, transaction costs, and taxes, to illustrate the principle behind this strategy.

Below is a covered interest rate arbitrage example:

- Assume you have $10,000

- The US interest rate is 1.75%

- The Brazilian interest rate is 14.00%

- The USD/BRL spot Forex rate is 5.1259

- The USD/BRL forward Forex rate is 5.7430

- You can invest the $10,000 in the US interest rate environment and earn $175 in one year

- You can also opt to convert your $10,000 at 5.1259 and receive R$51,259

- Investing R$51,259 at 14.00% results in earnings of R$7,176.2600 and a total of R$58,435.2600

- Assume you also spot a forward Forex rate pricing discrepancy and buy a contract at 5.7000 rather than 5.7430

- Exchanging your R$58,435.2600 at a USD/BRL rate of 5.7000 results in $10,251.8000, a difference of $76.8000 versus $10,175 earned in the US

- Exchanging the profits at 5.7430 would result in $10,175.0409, identical to investing US Dollars in the US, but at an actual loss considering trading costs

Here is another covered interest rate arbitrage example:

- Assume you have €10,000

- The US interest rate is 1.75%

- The Eurozone interest rate is 0.00%

- The EUR/USD spot Forex rate is 1.0510

- The EUR/USD forward Forex rate is 1.0329

- You can invest the €10,000 in the Eurozone interest rate environment and earn €0 in one year

- You can also opt to convert your €10,000 at 1.0510 and receive $10,510

- Investing $10,510 at 1.75% results in earnings of $183.9250 and a total of $10,693.9250

- Assume you also spot a forward Forex rate pricing discrepancy and buy a contract at 1.0310 rather than 1.0329

- Exchanging your $10,693.9250 at a EUR/USD rate of 1.0310 results in €10,372.3812, a difference of €372.3812 versus €0 earned in the Eurozone

Noteworthy:

- Traders use currencies with a 0.00% interest rate for carry trade opportunities, borrowing capital interest-free

What is the Difference between Covered Interest Rate Arbitrage vs. Uncovered Interest Rate Arbitrage?

Covered interest rate arbitrage includes a hedge using forward contracts to shield investments from Forex fluctuations. An investor will execute numerous transactions simultaneously. In uncovered interest rate arbitrage, the investor does not hedge the investment, leaving it vulnerable to Forex rate changes. Speculators may wait for more profitable hedges based on their market assessment. It is a riskier arbitrage strategy but can yield notably higher profits.

The drawback is that unfavorable currency movements can result in losses. For example, if profits from the exchange rate differential are 1.75%, and the foreign currency appreciates 2.25%, total profits equal 4.00%. Should the foreign currency depreciate by 2.25%, the investor faces a 0.50% loss.

Covered Interest Arbitrage Opportunities

Covered interest arbitrage opportunities exist when borrowing and lending costs of currencies differ. For example, the US has an interest rate of 1.75% versus 0.00% for the Eurozone, creating the potential for arbitrage if forward contracts remain mispriced.

Borrowing funds at 0.00% interest and earning 1.75% yields risk-free income from borrowed funds, but only if transaction costs do not evaporate profits. The cost of hedging must be lower than the interest rate differential for covered interest arbitrage to deliver risk-free profits.

What Should You Know About Covered Interest Rate Parity?

Covered interest rate parity is a theoretical economic theory that suggests arbitrage opportunities are non-existent across international financial markets. It also assumes two assets remain identical except for their currency denomination. Finally, it states the interest rate differential between two currencies in forward markets equals zero.

As with most theories, reality differs, allowing seasoned market participants with tremendous capital to create arbitrage profits, especially during volatile times and diverging interest rate policies.

Covered Interest Rate Parity Calculation

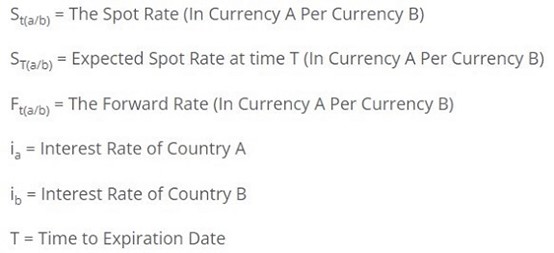

The calculation for uncovered interest rate parity (UIRP) and covered interest rate parity (CIRP) are similar. The only difference is the substitution of the spot exchange rate for the forward exchange rate.

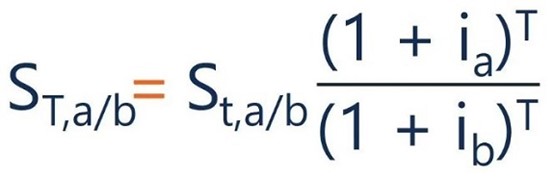

The UIRP formula is:

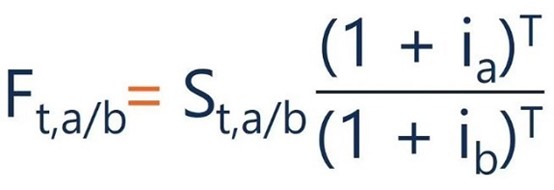

The CIRP formula is:

Covered Interest Rate Arbitrage Conclusion

Covered interest rate arbitrage is an uncommon trading strategy suitable for market participants with deep pockets. Arbitrageurs seek to benefit from interest rate differentials of two currencies and hedge Forex risk via forward contracts. When the covered interest rate differential between two currencies is zero, there is no arbitrage incentive to move financial capital from one market to another.