Different financial instruments do not move in isolation. Instead, the markets are intertwined, and the prices of different assets are related. This concept is known as “correlation.” When asset prices are correlated, traders can compare the prices of one asset to another to make trading decisions.

Correlation trading is a unique and profitable trading method. Two of the most positively correlated assets are Gold and Silver. This article answers the question, “What is the Gold/Silver Ratio?” and how to use it in trading.

Top Regulated Brokers

What Is the Gold/Silver Ratio?

The Gold/Silver Ratio measures Gold’s relative strength to Silver. It does this by comparing the price of Gold to Silver by calculating how many ounces of Silver buy one ounce of Gold.

When the Gold/Silver Ratio increases, Gold becomes more costly relative to Silver. When the Ratio decreases, Gold becomes less costly relative to Silver.

Both Gold and Silver are freely traded commodities against the US Dollar. That means their Ratios are free to move around as market forces change the prices of Gold and Silver.

This was not always the case. In the late 19th and early 20th century, the US was on a “Gold standard,” which ultimately set the value of Gold against the US Dollar. For example, in 1944, the US government set the value of Gold to $35 an ounce. Setting the price of Gold would have limited how much the Gold/Silver Ratio moved. The US government officially left the Gold standard in 1971.

How the Gold/Silver Ratio Works

The Gold/Silver Ratio is a number that can change as the respective prices of Gold and Silver change.

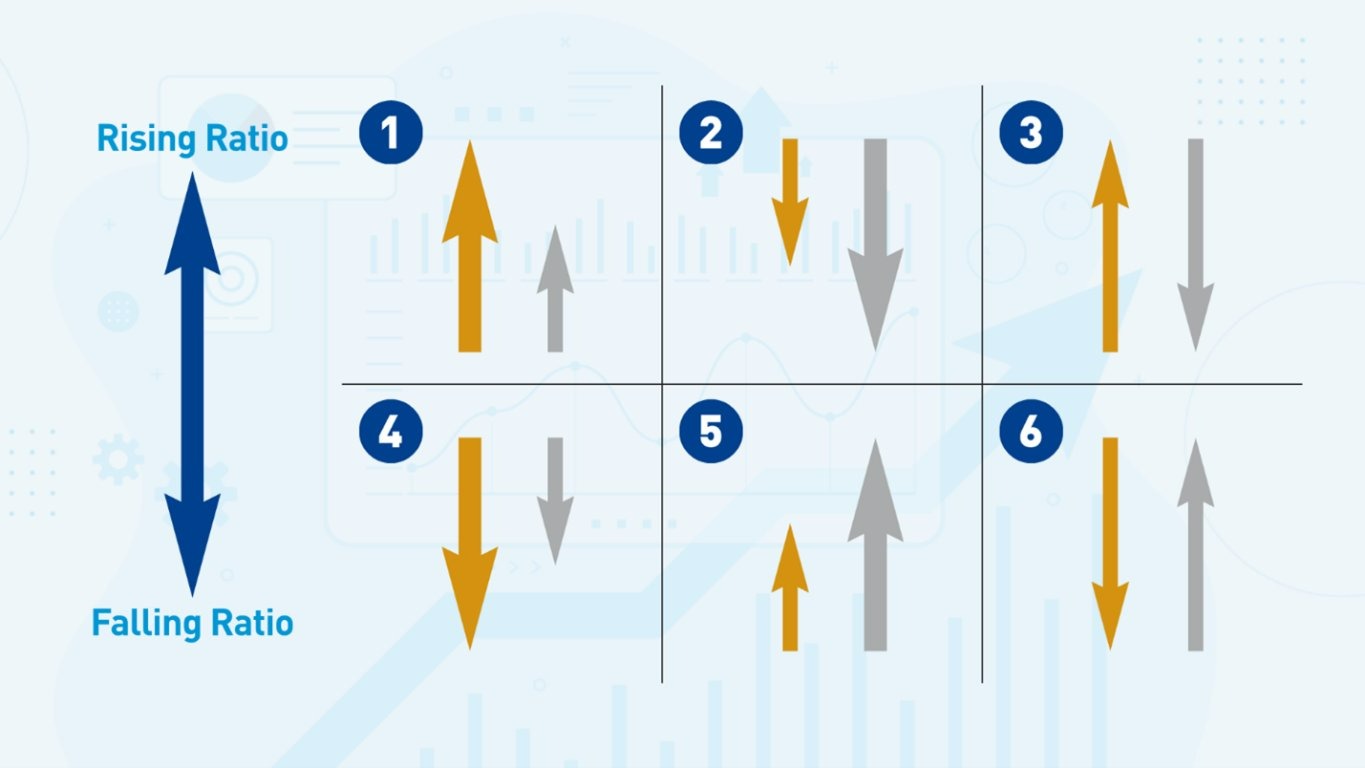

- If Gold’s price increases by a greater percentage than the price of Silver, the Ratio increases.

- If Gold’s price decreases by a smaller percentage than the price of Silver, the Ratio increases.

- If Gold’s price increases and the price of Silver declines, the Ratio increases.

- If Gold’s price decreases by a greater percentage than the price of Silver, the Ratio decreases.

- If Gold’s price increases by a smaller percentage than the price of Silver, the Ratio decreases.

- If Gold’s price decreases and the price of Silver increases, the Ratio will decrease.

Note that the prices of Gold and Silver can move together in one direction, but the Ratio can go in the other direction. So, Gold and Silver prices can both rise, but the Ratio can fall depending on how the metals rise. Or Gold and Silver can both fall, but the Ratio can rise depending on how the metals fall. This is an important feature of the Gold/Silver Ratio because it measures the Gold vs Silver price as a relative value, not an absolute value.

Which Factors Influence the Gold-to-Silver Ratio?

On the surface, the Gold/Silver Ratio is affected by the changes in the prices of Gold and Silver.

The Effect of Silver on the Ratio

Manufacturers and other industries use Silver in production. For example, Silver is vital in producing solar cells and electronics. So, its physical demand is a factor of the global economy. Silver is also bought and sold as a speculative asset.

Silver vs Gold Value

The Silver market is a small market at about a tenth in size of the Gold market, so it is more volatile—it takes less trading volume to push the price in either direction in a smaller market. Historically, Silver is about twice as volatile as Gold.

So, the Gold/Silver Ratio is affected by the volatility of Silver prices and its demand for use in manufacturing and industry. However, that does not tell the whole story.

The Effect of Gold on the Ratio

Gold prices also move and therefore affect the Gold/Silver Ratio. Gold is used much less in industrial production than Silver and is traded chiefly as a speculative asset. A big reason investors trade Gold is that they consider it a safe haven asset, i.e., investors turn to Gold to store value when there is economic turmoil, e.g., during periods of high inflation or stock market downturns.

S&P 500 vs. Gold/Silver Ratio

The S&P 500 Index and the Gold/Silver Ratio are inversely correlated. When the S&P 500 Index rises, the Gold/Silver Ratio typically goes down, and when the S&P 500 Index falls, the Ratio typically rises.

A good example of the inverse correlation was during the stock market downturn in early 2020. The S&P 500 fell into bear market territory with record speed, and the Gold/Silver Ratio simultaneously reached to an all-time high.

Economic Sentiment

Economic sentiment is a significant driver of the Gold/Silver Ratio’s value. Some traders see the Ratio as a leading indicator of economic sentiment. When the Ratio is high, economic sentiment is poor and vice versa.

How to Calculate the Gold-Silver Ratio

To calculate the Gold/Silver Ratio, take the price of an ounce of Gold and divide it by the price of an ounce of Silver. The price of Gold and Silver are most commonly quoted in ounces, but the calculation also works if you use a different unit of measurement, such as grams.

If Gold is $1800 per ounce and Silver is $24 per ounce, the Gold/Silver Ratio will be 1800/24 = 75.

If the Gold/Silver Ratio is 75, it takes 75 ounces of Silver to buy 1 ounce of Gold.

What is the ‘Right’ Gold/Silver Ratio?

The Amount of Physical Gold vs. Silver

Geologists estimate there is about 17 to 19 times more Silver than Gold in the earth's crust. Silver mine output worldwide is about 8 times greater than Gold's by weight each year.

Historical Gold/Silver Ratios

With Silver’s availability around 17-19 more than Gold’s and mining output around 8 times more, many people would expect the Gold/Silver Ratio to be at least lower than 20. However, the Ratio throughout the 21st century has never dropped below 30. Most of the time, the Gold/Silver Ratio has been in a range between 45 and 85.

The Ratio is at an interesting point at the time of publication, because it could potentially stage above the resistance level at 85.

Pre-1900, the Gold/Silver Ratio was around 16, much closer to the physical quantities of each metal on the earth.

A Return to a Historically Low Gold/Silver Ratio?

Some analysts believe the Gold/Silver Ratio will eventually return to pre-1900 levels. For that to happen, the price of Silver must rise relative to the price of Gold, and some analysts cite that as a reason to invest heavily in Silver. However, a falling Gold/Silver Ratio does not necessarily mean Silver prices will rise. The Ratio could still fall even if Silver prices fall as long as Gold prices fall much further.

Example of the Gold/Silver Ratio

The Gold/Silver Ratio has varied considerably over the centuries that civilizations have used Gold and Silver as stores of value.

To recap, the Gold/Silver Ratio is the price of Gold divided by the price of Silver. For example, if the Ratio is 75, it takes 75 ounces of Silver to buy 1 ounce of Gold.

A Recent Low Point in the Gold/Silver Ratio

In the 21st century, the Gold/Silver Ratio dropped to 32 in April 2011. The S&P 500 Index was beginning to recover from the 2008 credit crisis and begin the longest US stock market bull run in history. The low Ratio value of 32 in 2011 signaled confidence in the US economy and the stock market.

A Recent High Point in the Gold/Silver Ratio

In the 21st century, the Gold/Silver Ratio rose to a record high of 126 in March 2020. This was when the S&P 500 Index began its sudden drop due to the market conditions created by covid. The high Ratio value of 126 in the Gold/Silver Ratio signaled a great deal of fear in the US economy and the stock market.

How You Can Use the Gold/Silver Ratio to Trade Precious Metals

Technical Analysis of Gold/Silver Ratio

The Gold/Silver Ratio can be turned into a chart, such as a candlestick chart. I have found that the Gold/Silver Ratio chart has defined support and resistance levels and even chart patterns, such as triangles. That means I can use technical analysis to indicate how the Gold/Silver Ratio might move.

Using the Gold/Silver Ratio to time trades

Let’s say I am bullish on Gold, and I want to place a long trade. To help me find the best time to trade gold, I might examine the Gold/Silver chart to ensure it also looks bullish, for example, if it has recently bounced off a support level. Remember, even if the Ratio rises, the value of Gold could still fall. The Ratio alone does not mean Gold or Silver will rise or fall—you should only use it as additional confirmation.

Using a CFD to trade the Gold/Silver Ratio

Before CFDs were popular, if people wanted to trade the Gold/Silver Ratio, they would have to buy or sell both Gold and Silver in the correct proportions to replicate the Ratio. But today, traders can access CFDs that track the value of the Ratio—a trader can go long or short the Gold/Silver Ratio using a CFD.

Conclusion

The Gold/Silver Ratio tracks the relative value of Gold to Silver by dividing the Gold price by the Silver price. A rising Ratio means Gold is becoming more expensive compared to Silver. A falling Ratio means Gold is becoming cheaper compared to Silver.

The Gold/Silver Ratio typically moves in the opposite direction to the S&P 500 Index. Thus, the Ratio is seen as a form of sentiment indicator, especially because investors consider Gold to be a safe haven asset during troubling economic times.

Traders can use the Ratio to help inform Gold and Silver trades or even trade the Ratio’s value using a CFD. Many trading platforms can produce a chart of the Ratio, and Traders can use technical analysis on the Ratio chart like any other instrument.