Despite many people entering the Forex market with the idea to become millionaires, it is harder than merely opening and closing trades. Just a number: it is known that over 90% of traders lose money in the first six months.

However, with the right combination of effort, study, and advice, you can avoid the guillotine and become a successful Forex trader. In this article, we will take you into the best tips and tricks for short-term forex trading.

Because, as American singer Kenny Rogers said in his song The Gambler, "If you're gonna play the game, boy you gotta learn to play it right."

What is Short-Term Forex Trading or Day Trading?

Also known as day trading, short term trading is a popular investing technique that involves trades and positions opened and closed over a short period of time, usually within the same day.

Most traders consider it very attractive due to the profitability associated with the practice. However, it can also be dangerous as it often encompasses poor risk management and exposure to swings and high volatility.

It provides relatively smaller gains per position but has a higher frequency of trades. In the end, it produces a solid amount of pips every day.

Should you choose short term forex trading or long-term forex trading? There is no single answer to that question as it is all about your trading skills, your psychology, and the money associate to your trading account.

Best Forex Trading Tips and Tricks

In the investment market, it all depends on your trading style and your personality. However, most of the best short-term forex trading tips and tricks will be related to tools that will help you stay in control of your position and, therefore, portfolio.

Here is a list of the ultimate forex tips, tricks, and advice that can help in your trading performance.

1. Know yourself and the kind of trader that you are

Knowing yourself can be seen as an obvious task, but it is not. As every market is different, so is every trader. You have your own personality, emotional reactions, and goals.

Some traders are more comfortable with low-risk positions like a safety net, but others like the adrenaline of betting against the market. Who are you? If you are the kind of person that likes to follow people and leaders, perhaps you would like to be a trend trader.

On the other hand, if you are a kind of renegade person who always looks for a different approach, a hidden agenda, or the round pegs in the square holes. Then, you would fit better as a contrarian trader. Then keep that on your mind when developing your skills.

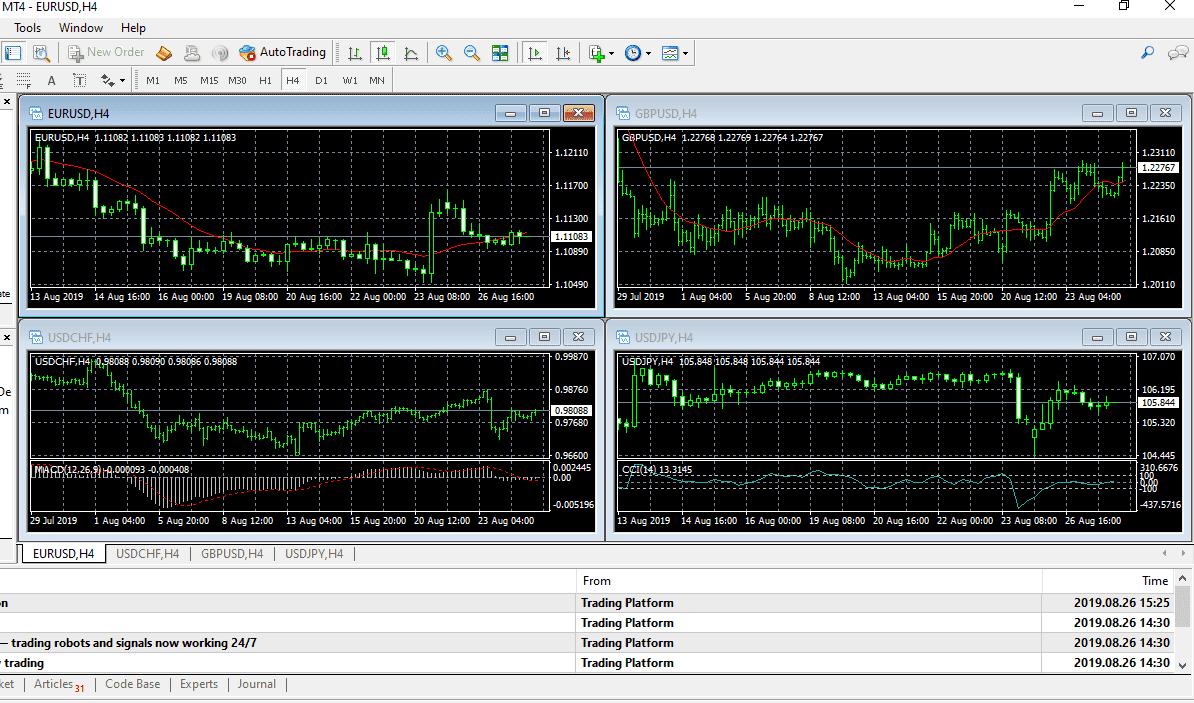

2. Choose the best trading platform for you

There are thousands of brokers in the industry, and each one is different from the other. Some brokers are better for beginner traders, and others are excellent choices for experienced investors.

Do you want automated trading? Do you prefer being extra protected in terms of regulation? Or do you like to trade on the go with mobile apps? Ask and serve yourself accordingly.

Every broker has its own solutions, fees, base currencies, and deposit and withdrawal processing times. The best option to check is to watch for broker comparison tables and after selecting one, opening a demo account to test all of the brokers' features.

3. Get experienced in more than one trading strategy

Mastering the Forex market should be your premise when starting your investment career. You should learn more than one trading strategy that fits your trading skills and styles.

In that way, you will see the market with a more holistic approach. This does not mean you will use hundreds of technical indicators, which is not recommended. But it can help you if you have different strategies to choose the best trading plan at every moment.

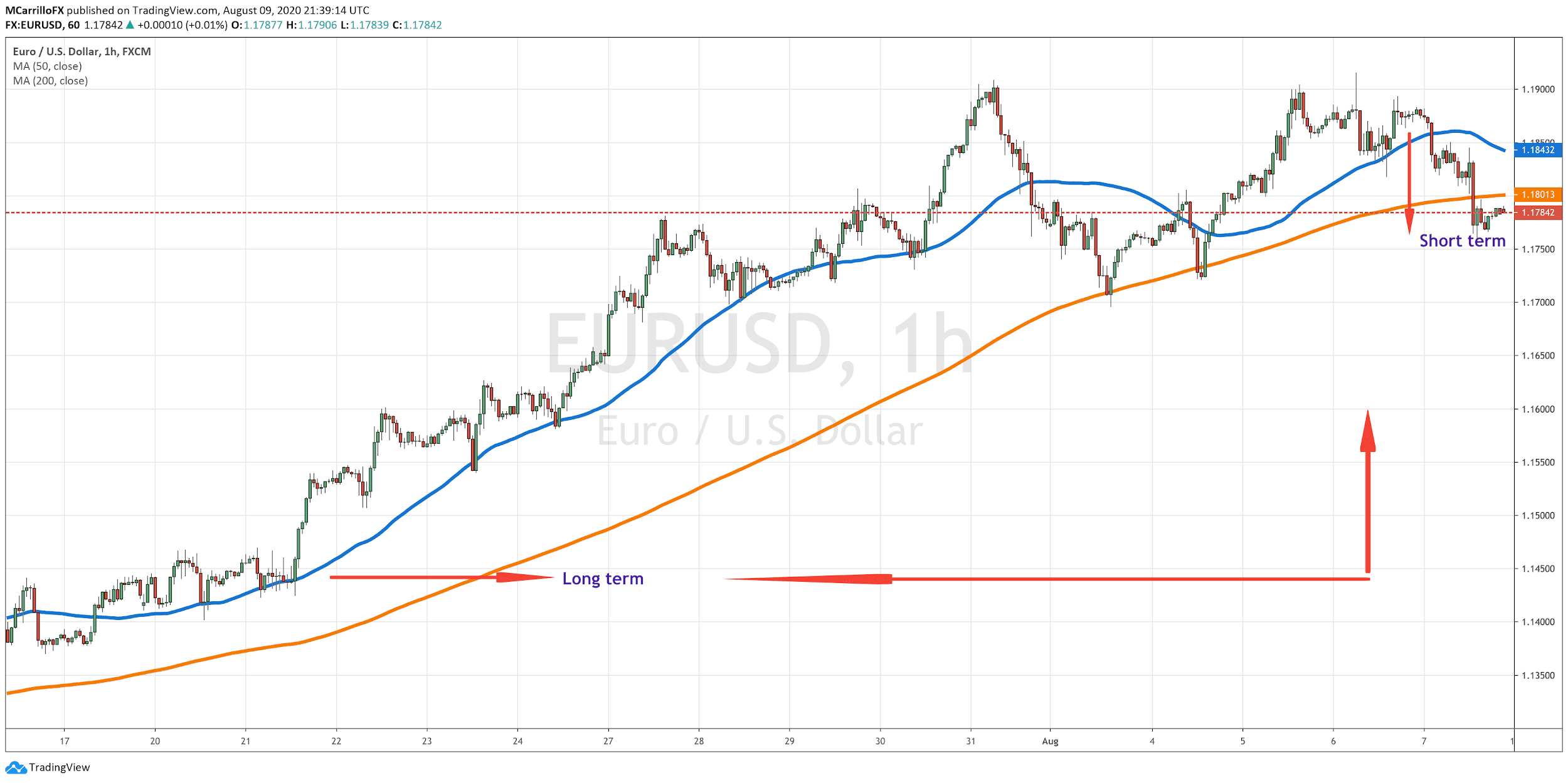

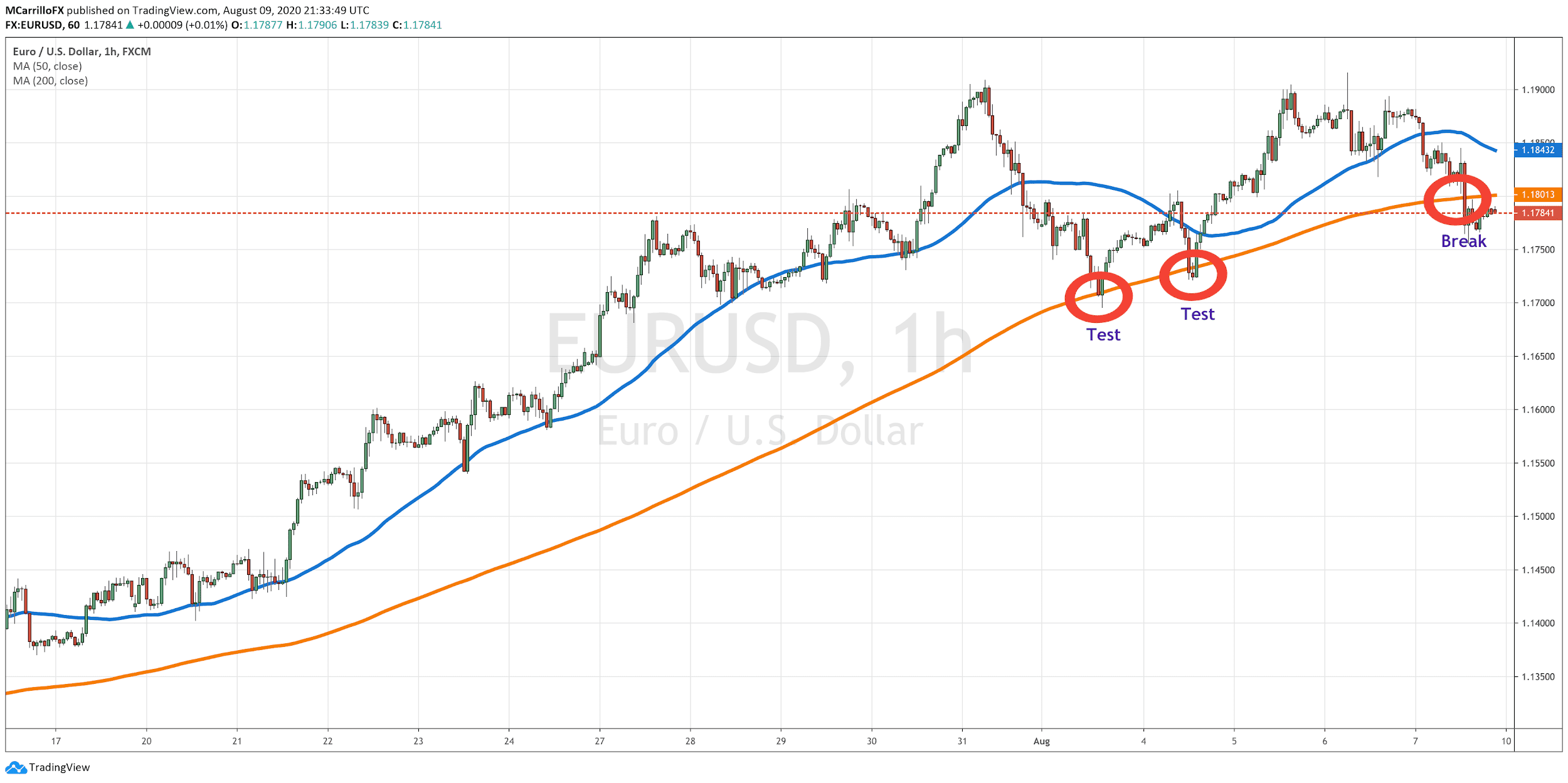

4.Start with a telescope and finish with a microscope

It will help your trading performance if you know what the current tone of the market is. For that, it is good to start your analysis from the bigger timeframe such as weekly or daily charts, and then go into shorter time frames such as 1 hour, 15 minutes, etc.

In this way, you will understand the whole trend and the direction the market is moving. Then, you will be able to identify potential short-term opportunities in market situations such as support and resistances, overbought or oversold conditions, or when it is not a good idea to go short or long.

Remember, the trend is your friend, even if you are a contrarian trader.

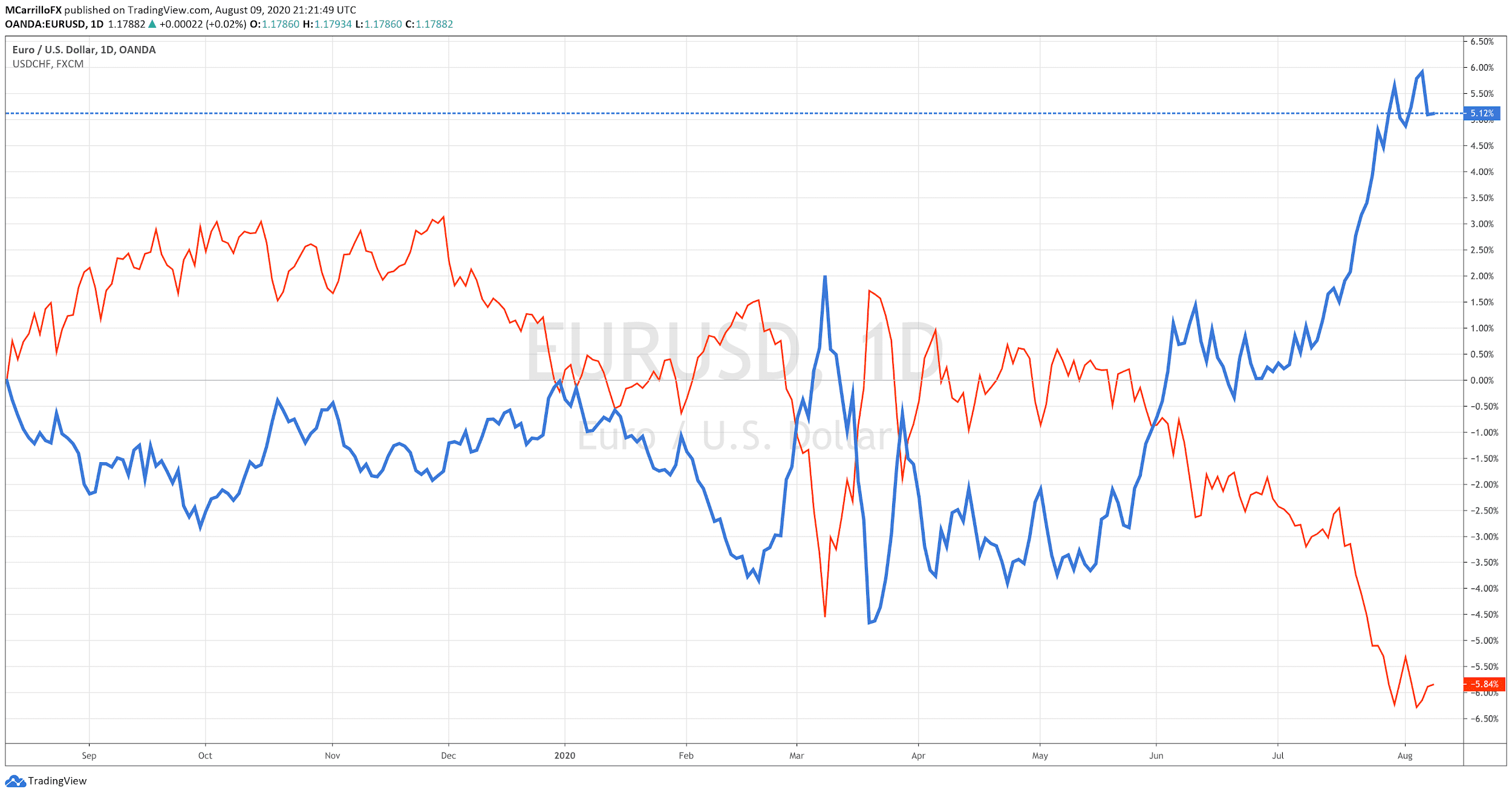

5. Check correlations

Correlations are a powerful tool to confirm trades but also to potentially double profits. Use currency correlations to your advantage and to evaluate the risks and profitability of traders.

Statistical correlation talks about the relationship between two assets. It could be positive, but also negative. It means that when it is positive, one asset tends to mimic the other, for example, the euro and the Swiss franc. On the other hand, when it comes to talking about negative correlation, one security goes the opposite of another.

Positively correlated pairs are EUR/USD, GBP/USD, and AUD/USD. Negatively correlated pairs are EUR/USD against USD/CHF or USD/JPY.

Long story short, you buy gold and also sell the DXY if the greenback is trading down. For instance, when you go long EUR/USD, it is natural to go short on USD/CHF.

6. Make a trading plan

Trading plans are the roadmap you will follow when starting your position. It should contain entry and exit points, stop loss, profit-taking, and risk/reward ratio.

The plan will keep the information about how much you are buying or selling, your potential profits, the levels to watch, and finally, it provides you with an exit point in case everything goes wrong.

Having a trading plan is one of the top items here in this list of Forex trading tips, as it will keep you in line with your objectives. But also, you should understand that the Forex trick is that you should follow your plan.

7. Protect yourself, manage your risk

Protecting yourself and your money is one of the cornerstones in your trading life. Remember that the market will open tomorrow, be sure your portfolio will be there too.

It is essential to calculate the risk associated with every trade and know when to wait and when to start trading. The market provides opportunities every single day, do not rush!

Finally, understand that it is better to stop trading when you are having a streak of losing days and take some days off. It will clear your mind, and you will return to the market with a sharp brain. Last but not least, never trade without stop losses and limit your risks.

8. Trade with facts, not emotions

This may sound basic, but it is not. Trade what you see, not what you hope to see. Wait for the right moment and keep your emotions out of the deal. I know that this is hard but understand yourself and learn how to deal with you.

Two intelligent Forex trading tricks are to maintain a clear trading plan and keep a detailed trading journal.

9. Keep learning Forex and be on top of new technologies

As Isaac Newton once said, "what we know is a drop, what we don't know is an ocean." The Forex market is one of the most challenging enterprises globally, but also, one of the most potentially rewarding.

Forex is hard because it changes every day at every second. What used to work in the past is not going to necessarily work now. It is imperative to keep studying and testing the market with new strategies, research, and both technical and fundamental topics.

Keep an eye on technology and use it for your advantage. Try back-testing software, automated trading, and technical indicators to enhance your trading and research.

Finally, keep a good internet connection that sustains your platform any time you want to use it.

Final Thoughts

According to a 14-year research on the Taiwanese stock market by the University of California and the Peking University, over 75% of participants quit after two years, and 90% of individual traders left the investment world after four years.

The study also showed that investors engaged in more traders after profitable periods due to overconfidence, and finally, they got burned.

This is why it is so essential to govern yourself accordingly and take the market seriously. Following these nine short term forex trading tips and tricks, you will have reliable tools to become not only a trader but a successful and profitable one.

At the end of the day, it all depends on you and how you deal with yourself. Keep your trading in shape with regular study, research, and testing. And win big!

Short-term Forex Trading FAQs

What is the Easiest Forex Strategy?

The easiest forex strategy is the one that fits naturally with your trading skills. More people love support and resistance, but it is all about you and how you like to trade.

What is the Most Profitable Forex Strategy?

That depends. All forex techniques are profitable, and potentially the most profitable forex strategy can be whichever. The secret is that you trade what you feel and fit with your trading skills and style. The money will come naturally.

How Can I Get Better at Forex Trading?

The answer is one: training. Forex evolves every day, so to get better at forex trading you should keep studying, learning new things, and testing different strategies. And finally, trade what you see, not what you hope to see.