Why I Started Trading Forex

In 1993, aged just sixteen, I left school and had no particular career in mind.

I was, though, attracted to the hustle and bustle of the City of London, where fortunes were made and lost every day.

At that time, forex trading was conducted in person by loud boisterous men, surrounded by round open pits, as seen in the hit film ‘Trading Places’, screaming prices and quantities at each another. I was intrigued. For many of those participating on these trading floors, performance was very much dependent on what you knew, whom you knew, and how much risk you were willing to take.

Thirty years later, the objectives and principles remain the same, but the playing field has changed dramatically. Today, trading performance is governed more by speed, technology, and information.

By 1998, open outcry trading floors were slowly becoming a thing of the past. Breakthroughs in technology paved the way for a new, robust, secure, and more efficient means of trading.

Advances in computer software and hardware meant that you no longer needed to call a broker or search through a newspaper to find out the price of a particular currency or stock, it was all there live on screen, updating within milliseconds and free for anyone with access to view and trade.

Trading had now entered a new era. Professional traders were now sitting in front of computers in offices, the game had changed, the dynamics had shifted, and suddenly anyone with a screen and a broker could play. In 2002 I decided that I wanted in.

Trading in the pit early 1990s – taken from cnbc.com all rights reserved ©

Forex Lessons / Coaching

Can you really teach someone how to trade? Whether you are into Forex, Indices, Stocks or Commodities if the objective is the same ‘to profit’, can there really be one lesson, one system, one size fits all? The answer is an unequivocal ‘No’. There are several reasons for this:

- Markets are Constantly Evolving - What worked yesterday can be a disaster tomorrow.

- Humans are Uniquely Different - What suits and works for one personality could be a nightmare for another.

- Secrecy - If you found a winning formula that was consistently paying you, would you really rush to share it with others?

Lessons can be helpful, however the only real way to truly learn is to go it alone and try to do it yourself. This itself will teach you a lot.

I discovered that like a lot of beginners, I often got bogged down with all the external factors of trading, for example, short term price direction, the finer details of trading systems or analytical forecasts’ etc.

Over the years, experience taught me that the key to mastering the art and science of trading lies in focusing on the inner game.

In any given trade you can be right or wrong. Even a successful trader will be wrong quite often. Therefore, a major challenge is how you deal with these outcomes. One of the most valuable lessons you will learn is ultimately your true personality under pressure, and the best way to do that is to use, keep and update a forex diary.

Keeping a Forex Diary

Early on in my trading career, I was fully aware of the importance of writing things down. However, in those early days, my eyes were fixed on my screens trying to anticipate the next move and how I could capitalize on it.

There was so much going on that I had sidestepped this simple task of logging my trades with a few words. Instead, I chose to focus on my Profit and Loss, which I saw as the ultimate barometer of my performance.

I also thought that all the information I would need to assess my performance would be there in my ‘trading history’ tab. What I did not realize is that none of this information was telling me anything about me. It was quite long into my forex trading journey that I decided to start keeping a trading diary.

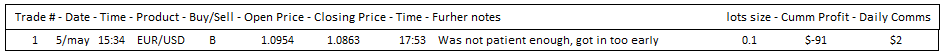

Below is an example of the info I kept from one of my early diaries:

I kept seeing this when I read my diary… “not patient enough, got in too early”. Learning this trait about my trading personality was ultimately more useful in becoming profitable than learning about moving averages or keltner channels.

By keeping a forex diary, you will generate information about your personality and how you react to changing market conditions, data that is enormously valuable and that nobody else can give you.

Psychological Breakthroughs on My Trading Journey

There is No Holy Grail

Get used to being wrong. Get comfortable with being wrong. The most successful traders out there are wrong much or even most of the time. What separates them from the crowd is that they know how to maximize their gains when they are right. This concept sounds simple but is very hard to master.

Make a Proven Trading System Your Own

Once I realized that no system will always be right, I focused on making a system my own. You may want to add or edit an indicator. You may feel like the system you are looking at would work better if combined with some fundamental analysis or the other way around. You might prefer to use one trading platform rather than another in conjunction with your trading system.

Don’t be Too Smart

I found that the less of an opinion I had about the direction of Forex markets, the more likely I was to have the flexibility to change my mind. Being light and nimble will enable you to change your mind rapidly, a unique quality that is often underestimated as a factor in trading success.

Markets tend to lead you down one trail of thought until you are almost convinced of your opinion, only to unexpectedly act unpredictably and do the opposite of what you thought was going to happen. All the information you really need is contained in price and volume.

Why not enjoy the luxury of letting the market tell you what to do, rather than making it the other way around?

Are You Using a Trading System?

I convinced myself that I was using a system when I was not really. The system I thought I had was in my brain, and really it was a sketchy set of rules. When it went wrong, and I was faced with losses my ‘system’ would disappear, and I would search for a new one.

Remember, a good trading strategy does not have to be complicated: the simpler it is, the less can go wrong. Whatever your trading system is, just make sure that you can write it down. If you cannot write your system down in plain English, then you do not really have one.

13 Tips for Your Forex Trading Journey

Do:

- Keep it simple

The market can be very complex. Often the most complex problems require very simple solution. - Trade a system

Prepare and Plan. The fewer decisions you have to make during the action, the less emotional you will be. - Make sure that the system is compatible with your personality

Using a system that bores or overwhelms you is not a good idea. Find a system that suits you, that way, you will be able to stick to it. - Explore technical analysis

Charts are a great way to predict how traders will react at certain price levels given what has already happened in the past.

- Keep a Forex Diary / Trading Journal

Use this to leverage your strengths and minimize your weaknesses. It will help you avoid repeating the same mistakes. - Employ strict money management rules

Strict money management will stop you blowing your account and ensure that you are sizing your bets according to the strength of your recent performance. - Prepare and plan

Human emotion can often lead you to make irrational ‘knee jerk’ decisions that you will regret. Avoid this by preparing a plan before the market even opens.

Don't:

- Pay to use someone else's system

There are plenty of good trading strategies for beginners available for free online. - Pay for education

There is plenty of forex trading education that you can get without paying a penny. - Cling to losing trades

Although this goes against human nature, master the art of being wrong and cutting your losses early. You will be glad you did. Take care of your losses and your profits will take care of themselves. - Follow other people's opinions

Typically, people with strong fundamental opinions about the economy make terrible traders. - Follow what the crowd are thinking

They are usually wrong. That is why few retail traders make money from the Forex markets. Be a contrarian, learn to think for yourself and trade what you see. - Be overconfident or reckless

It is easy after a winning streak to get a big ego. Stay humble. On the other hand, avoid reckless behavior such as chasing losses or making your positions too big.

Final Thoughts

One thing I left out so far: the importance of finding your trading journey enjoyable. There are so many obstacles to overcome in trading that if you do not get any pleasure from any of it, you will find it extremely hard to get real results. The learning curve never ends in trading, and it is important to be able to accept this.

In trading, less is often more. I learnt that the best trades are often the most obvious ones. Compile your research and keep a trading diary, not just of your trades and why you took them, but how you felt and reacted to both wins and losses. This will enable you to keep track of your trades, the performance of your system, and will teach you invaluable lessons about yourself which you can use to grow as a trader.

FAQs

Can you get rich off of forex?

A positive return of 20% annually is an excellent result for any forex trader. Cash gains depend on the amount of capital invested.

How much does it take to start forex trading?

There are some forex brokers that require no minimum deposit, while most ask for $50 or $100 to get started. If the smallest trade size is 1 micro-lot, good money management requires a deposit a little higher than $100.

How much does a forex trader make in a day?

Forex trading tends to bring irregular profits and losses, so there is no typical daily profit enjoyed by traders.

How do I become an expert forex trader?

There is no substitute for practice, study, and analysis of historical forex price data. It is useful to start with a demo account then move on to a small live account when profitable.