Scalping is a type of trading style that seeks to profit by making many fast quick trades, usually for small profits. The Forex market is well suited to it.

Scalping can be a rewarding but very challenging trading style to master.

In this article I explain what scalping is, how to determine whether it is the right trading strategy for you, and how to get started as a scalper trader with the right kind of trading strategies.

Essentials for a Trade Scalper

If you want to become a successful scalper, you need to understand what scalping is, how its done, and what it takes to execute successfully.

What is scalping, and how does it work?

A scalper trader uses the shortest short-term trading strategy available. Rather than focusing on capturing a big move in price action, scalpers rely on making small profits from a large number of trades. A trade scalper often places dozens, if not hundreds, of transactions daily, and needs to have a lot of stamina and determination as it can be a very stressful and even physically demanding activity.

Many successful scalpers prefer to use automated trading to execute trades according to defined parameters, as manual trade placement can be inefficient and overly demanding on the trader.

What are the requirements to profitably execute scalp trades?

All scalpers look for the following to ensure the highest chance of success:

Powerful, flexible scalping trading strategies with good track records of success.

Raw spreads from 0 pips with competitive commissions no higher than $6.00 per 1.0 standard lot.

A volume-based rebate program can help in lowering trading costs and increasing profitability. Trading costs as a percentage of profit are extremely high in scalping.

Deep liquidity and fast order execution.

Many scalpers prefer to use leverage, even relatively high leverage, but this can be very dangerous if taken too far.

Stable trading platform (ideally with support for algorithmic trading), flawless connectivity, and high-quality price feeds.

Detailed economic calendar.

Quiet and clean trading space to facilitate mental calm.

High levels of stamina and commitment to follow strict stop loss and take profit strategies.

Does a scalper trader rely on market analysis for scalping?

Accurate market analysis using technical indicators remains a core requirement for profitable scalping. While scalping focuses on small price movements, being aware of the trend and other technical elements on higher time frames will increase profitability.

For example, a scalper trader will initially identify the trend on a longer time frame like the H4 or D1 chart. Trading only in the direction of the larger frame lowers the risk of losses.

A scalper is also very aware of pending economic reports and data releases which can cause volatility, and generally will avoid being involved in the market during such periods. High volatility is a scalper’s enemy, except in some very limited circumstances. There are two reasons for this:

During periods of higher volatility spreads widen. Scalpers need low spreads to trade profitably.

During periods of high volatility, the tight stop losses used by scalpers are more likely to be hit, meaning even well-placed trade entries will tend to become losing trades.

What is the difference between scalping and day trading?

All scalpers are day traders, but not all day traders are scalpers. While day traders may remain in positions for hours during the trading sessions, scalpers may exit after a few seconds.

Are there downsides to scalping the market?

A scalper trader is under more stress than other traders, as the trade frequency is greater.

Lost opportunity costs are higher, as scalpers usually remain in a trade for seconds, aiming to generate small profits repeatedly during a trading session.

Algorithmic trading can carry a significant upfront investment and ongoing maintenance.

Trading costs are high, and one loss can wipe out numerous profitable trades.

It is the most challenging trading style to execute profitably, so the risk of overall loss or even account wipeout is high, especially if there is a sudden big market move causing a big slip through a stop loss in a highly leveraged trade.

What Traders Must Know to Understand How to Scalp Trade

The first thing to know are the best scalping trading strategies and the trading costs involved, which heavily impact trading profitability. Spreads have a very strong impact on scalpers as they are typically 10% to 20% of the profit target per trade. This means that scalper traders’ profitability is going to depend very much on the spread offered by the broker. If a scalper’s profit margin overall is 10%, and their spread increases for 20% of the average profit to 30%, that will completely wipe out the profit. Spreads are extremely important to scalper traders.

Scalping Strategies Overview

There are three categories of scalping strategies:

Market Making is a strategy where traders aim to exploit the spread of an asset rather than a move in price action, competing with market makers, hence the name.

Ideal for assets with low volatility.

The most complex scalping strategy as traders compete versus market makers.

Profits remain low, and losses may accumulate fast.

Only the most experienced traders with large portfolios can attempt market-making scalping.

High-volume scalping is the most widely used scalping strategy, involving highly liquid assets, and profiting from small price movements, often ten pips or less.

Scalpers focus on a few assets with the tightest spreads.

High leverage is often used.

Profits are typically taken at ten pips or less.

Volume-based rebate programs can enhance results.

Low-volume scalping spreads the risk across multiple assets whenever trading signals appear, like to traditional trading with increased frequency.

Entry-level strategy for beginner scalpers.

Take profit and stop loss distances are often equal, resulting in a 1:1 risk reward ratio.

Traders may use less liquid assets with wider spreads.

The least used scalping strategy.

Which scalping strategies are the best?

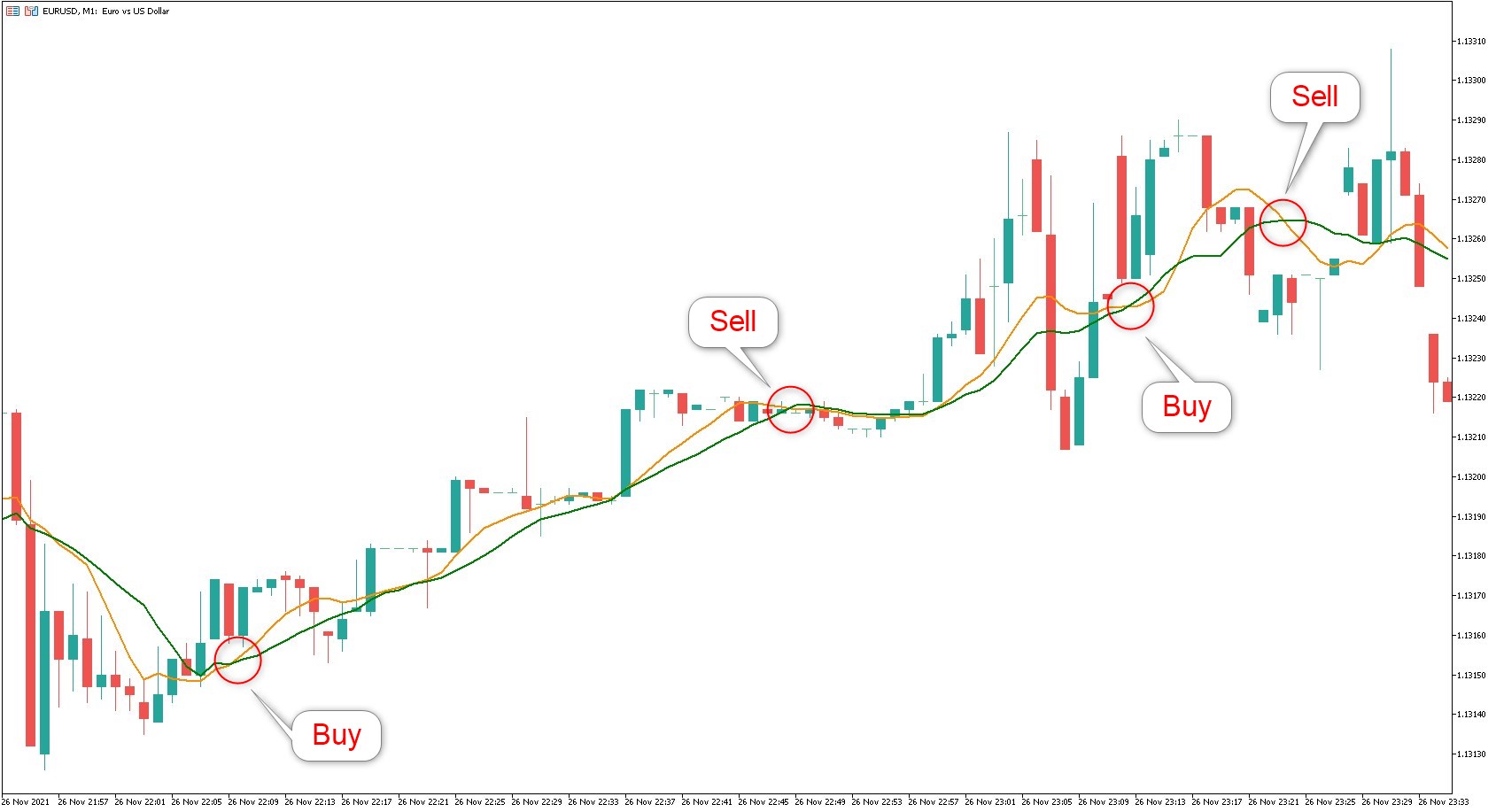

Using a faster and a slower moving average.

Trading in the direction of the longer-term trend, bullish in our example.

Buying on a bullish crossover, where the faster MA crosses above the slower one.

Take profit either during a bearish moving average crossover or once profit reaches a predetermined pip target.

2. Ichimoku Kinko Hyo Cloud

.jpg)

Trading in the direction of the longer-term trend, bullish in our example.

Buying on a bullish crossover when the Tenkan-sen (red) crosses above the Kijun-sen (blue).

Take profit either during a bearish moving average crossover or once profit reaches a predetermined pip target.

3. Stochastic Oscillator

.jpg)

Trading in the direction of the longer-term trend, bullish in our example.

Buying when the Stochastic Oscillator drops below 20 and then crosses back above it.

Take profit when the Stochastic Oscillator moves above 80 and crosses below it or once profit reaches a predetermined pip target.

4. Support / Resistance

Draw key support and resistance levels on a price chart.

Wait for price to retrace to support in a longer-term uptrend, or resistance in a longer-term downtrend.

If the price begins to make a reversal candlestick pattern on a short time frame as soon as it hits the resistance, open a new trade in the direction of the reversal, placing a hard stop loss just the other side of the price action.

Take profit when the bounce runs out of momentum, or once profit reaches a predetermined pip target.

Should Scalping Be Your Main Trading Style?

Scalpers must decide if they want to use a scalping strategy as their primary trading style or use it instead as a supplementary one.

Traders who chose scalping as their primary trading style will typically:

Place dozens or hundreds of trades daily.

Use high leverage and algorithmic trading solutions.

Execute trades based on tick or M1 charts.

Focus on highly liquid assets with the lowest trading costs.

Traders who chose scalping as their supplementary trading style will typically:

Use scalping when markets trend sideways or within a tight trading range.

Utilize manual trade placement.

Execute trades on M15 or M30 time frames, often supplementing their long-term trades.

Consider trading less liquid assets.

Final Thoughts

Before deciding if scalping is a suitable trading strategy for you, you should carefully consider the pros and cons of scalping, summarized below:

The pros of scalping:

Less market risk through ultra-short trade duration.

Highly profitable if executed properly and skillfully. Fast profits allow for compounding effect.

Good amount of trading opportunities.

Non-directional trading strategy applicable in bull and bear markets.

Purely technical approach.

Can suit automated trading.

Scalpers may start with smaller deposits using high leverage, as stop losses are typically very tight.

The cons of scalping:

Very stressful if executed manually.

Expensive trading costs due to high frequency of trade placement.

Not all brokers allow scalping.

Prone to blow up if excessively high leverage is used.

Requires a competitive trading infrastructure not available at many brokers.

Algorithmic trading solutions carry high initial investment and ongoing maintenance costs.

Occasional unexpected losses can wipe out weeks of profits, placing a very high psychological pressure on the scalper trader.

What should new scalpers look for in a broker?

Raw spreads between 0.0 pips and 0.2 pips on liquid assets.

Competitive commissions between $2.00 and $6.00 per 1 standard lot.

Volume-based rebate program, lowering overall trading costs, which can drop commissions to below $1.00 per lot.

Deep liquidity, which results in tight spreads.

Fast order execution without requotes and limited slippage.

ECN/NDD execution and low latency for frictionless trading.

A trading platform that supports algorithmic trading.

FAQs

What is a scalp trader?

A scalper trader uses a high-volume, high-frequency approach to profit from minor price moves.

How much do scalper traders make?

The profitability depends on the trading strategy and skill level of the individual. Most traders lose money, irrelevant of which approach they favor. Scalping is especially challenging to execute successfully, so most scalper traders lose money.

Is a scalper a day trader?

All scalpers are day traders, but not every day trader is a scalper.

How many trades do scalpers place in a day?

Scalpers can place dozens or even hundreds of daily trades.