This article provides a comprehensive overview of momentum trading, a strategy that involves buying or selling assets based on their historical price performance. It explains the fundamentals of momentum trading, describes two primary types of strategies ("Best of" and “Time Series”), and discusses the pros and cons of each approach. Additionally, the article offers practical tips for implementing momentum strategies across various asset classes, including Forex and stock indices, while highlighting the key considerations traders should be aware of when using this method.

What is Momentum Trading

Momentum trading is a trading strategy that calls for buying or selling assets based on their historical price performances. It is a purely technical strategy depending entirely upon technical analysis of historical time series price data.

The basic idea is that assets whose price has been going up are worth buying, on the belief that the price will continue to rise, while assets whose price has been going down are worth selling on the belief that the price will continue to fall.

Momentum trading is a continuation strategy, not a reversal strategy.

Momentum traders will decide upon a “universe” of tradable assets, and the criteria for determining when any of them are exhibiting strong enough momentum suitable for a trade entry.

Momentum Trading Strategies - Types

There are basically two types of momentum trading strategies:

“Best of” Momentum Trading Strategies

Here, the trader monitors their universe of assets, and will look to go long of the asset or assets which are showing the strongest bullish momentum, and short of the asset or assets which are showing the strongest bearish momentum.

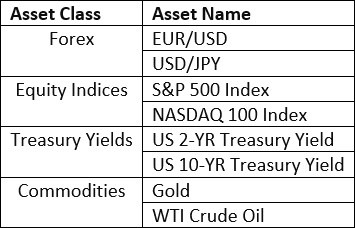

For example, let’s suppose that a momentum trader builds a universe of the following tradable assets:

This momentum trader uses a “best of” momentum strategy where at the start of each yearly quarter, he or she measures the performances of these assets over the previous quarter, and for the following quarter, enters a trade in the direction of the two largest price changes.

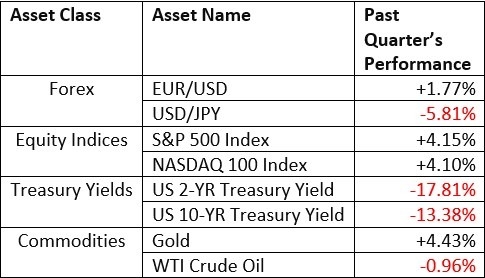

Here is the asset universe again, except this time with each asset’s performance over the past quarter:

So, in this example, the trader would open short trades in the US 2-year and 10-year Treasury Yields and keep them open for a quarter of a year.

Of course, there are many variations on the “best of” momentum strategy. As another example, this trader might decide to go long or short of the strongest performer in each asset class. In this example, he or she would open short trades in USD/JPY and the 2-Year Treasury Yield and long trades in Gold and the S&P 500 Index for the next quarter.

Pros of “Best Of” Momentum Trading Strategies

- Academic studies have shown that this kind of strategy can produce good returns, often outperforming simpler momentum strategies.

- Tends to produce signals only for assets showing relatively strong absolute momentum.

- Entering a small, more focused number of trades can prevent overtrading and market overexposure, as well as higher trading costs.

Cons of “Best Of” Momentum Trading Strategies

- You may miss out on strong momentum moves from the assets within the universe that do not qualify as best performers.

- Requires extra rules to identify best or worst performers that will be a further part of the trading strategy which can go wrong.

Time Series Momentum Trading Strategies

This is the classic, generic momentum strategy. A universe of tradable assets is built and then criteria set for a look-back period over which their historic performance is measured. Then at each trade interval, the trader analyses these performances and will enter long trades in the assets which have gone up over the look-back period and short trades in the assets which have gone down over the same time.

For example, let's look again at our earlier example of assets, except this time, the table will say what type of trade is entered for each in the right-hand column.

Asset Class | Asset Name | Past Quarter’s Performance | Trade Entry |

Forex | EUR/USD | +1.77% | Long |

USD/JPY | -5.81% | Short | |

Equity Indices | S&P 500 Index | +4.15% | Long |

NASDAQ 100 Index | +4.10% | Long | |

Treasury Yields | US 2-YR Treasury Yield | -17.81% | Short |

US 10-YR Treasury Yield | -13.38% | Short | |

Commodities | Gold | +4.43% | Long |

WTI Crude Oil | -0.96% | Short |

Not every time-series momentum trading strategy is as simple as this, of course. Many traders add extra filters. For example, a trader might decide that no trade will be taken in any asset that has not moved by at least 5% in value over the past quarter. In the previous example, this would mean there would be no trade entries in Gold, the EUR/USD currency pair, or the two equity indices. Academic studies have shown that using such a “stretch” threshold in a time series momentum trading strategy tends to improve performance.

Pros of Time Series Momentum Trading Strategies

- Ensures you don’t miss out on exploiting any strong momentum shown by an asset within the investment universe.

- Simple, easy-to-follow, quantifiable trading strategy.

- If the investment universe is sufficiently wide, diversification will be ensured.

Cons of Time Series Momentum Trading Strategies

- It can generate too many trades if no filters are used.

- If the investment universe is not carefully constructed, it may generate so many trades in highly correlated assets that the overall risk level becomes too high.

How Does Momentum Trading Work?

All momentum trading basically works like this:

- The trader decides what assets he or she is going to potentially trade, building a universe of assets to monitor for bullish or bearish momentum. It is a good idea to be diversified across the major asset classes. This is called the trader’s “investment universe”.

- The trader next needs to decide what criteria to use to determine that any of the assets are showing sufficiently strong momentum to be worthy of entering a new trade in the direction of that momentum. This can be done using any of a variety of momentum indicators or simply by observing whether the price is X% higher or lower than it was some time ago. Alternatively, momentum can be assessed by a breakout or breakdown beyond a price point which has not been reached for some time. Momentum indicators which are typically used are:

- MACD (Moving Average Convergence Divergence)

- RSI (Relative Strength Index) – this is my favourite indicator for momentum.

- Stochastic Oscillator

- Rate of Change

- Average Directional Index (ADX)

- Commodity Channel Index (CCI)

- Bollinger Bands

- Moving Averages

- Moving Average Crossovers

Don’t worry too much about the exact indicator you use; when the price is moving strongly in one direction, they will all give entry signals at similar times. The trader just has to decide on the criteria for an entry signal. For example, you might decide to use the RSI and to go long when the 20-day chart RSI crosses above 60 or short when it crosses below 40.

One way of making momentum signals more reliable is to look for them on two timeframes at the same time. For example, if the RSI is above 60 on a 20-week chart, and it crosses above 60 on the 20-day chart of the same asset, that can be a powerful entry signal. This is known as multiple time frame momentum.

- As an entry signal is given, you enter a trade in the direction of the momentum. Most momentum traders risk a defined percentage of their account equity per trade, with the exact position size being determined by the distance to the stop loss.

- Stop losses are usually determined by a measure of average volatility, such as the average true range. For example, if you are generating signals from a daily chart, using the 100-day ATR X 3 as a stop loss is very typical.

- The typical exit strategy for momentum or trend traders is a trailing stop based upon a measure of volatility. While it can be painful to watch floating profit disappear or even turn into a loss, this is the easiest and least stressful exit method to use in trading momentum profitably.

Momentum Trading – Pros & Cons

Like any style of trading, momentum trading has both pros and cons, which are outlined below.

Pros

- Proven Profitability: if we say that momentum trading and trend trading are basically the same thing, then we can say both have been proven to be profitable over time. Trend following funds have outperformed major stock market indices over recent decades, and there is a lot of academic research showing that following the trend or momentum in financial markets has been a basis of a profitable trading strategy.

- Clarity / Ease of Execution: you can decide what you will trade and apply an indicator or indicators to generate entry and exit signals with confidence. This can be automated quite easily, which is another major advantage. Unlike more subjective trading methods, it is possible to trade momentum profitably with simple, hard rules.

- Choice of Short or Long-Term Focus: although market momentum is not purely scalable, strong momentum even on short-term charts can provide opportunities to profit, while longer-term trends with momentum are even more profitable. This means you can use this as a slow end of day or week or month method, or as part of a day trading strategy.

- Works in All Asset Classes: momentum trading can work with all kinds of assets, so it is a method you can apply to almost anything.

Cons

- Low Win Rate: like all trend trading methods, most entry signals turn out to be losers, meaning that momentum traders will need to ensure losing streaks causing periods of draw down. This means that even with some big winners, if they only arrive after major losing streaks, your account may only claw its way back to even before sinking again, at least over lengthy periods.

- Only Works in Certain Market Conditions: markets trade sideways (consolidate) most of the time, and in these conditions, momentum or trend trading has nothing to offer. A good momentum trading strategy will at least keep you out of the market during these periods, but that can become boring or frustrating when such a period has lasted for a long time.

- Complex Strategies Require Monitoring: especially in Forex, many momentum traders devise subjective strategies, which require a lot of monitoring and difficult decisions taken.

- Slippage: as momentum trading strategies will usually only give an entry signal when the price is moving strongly in one direction, trades must be entered at market and will often be executed with slippage. This is a cost but is by no means fatal to a well-crafted strategy.

- Volatility-Based Exit Strategies Can Be Difficult to Optimise: strong momentum moves almost always include retracements, which can sometimes be deep. The important thing is to stick to one measure of volatility as a stop loss, whether relatively tight or large. Either one will have its ups and downs.

Tips on Momentum Trading Strategies

Forex traders should know that it is very difficult, in fact probably impossible, to find a formula that identifies momentum in Forex across the board. Different currency pairs may respond better to different rules. The currency pair that has historically trended most reliably is the EUR/USD, and I have seen customised momentum algorithms that seem to be able to identify a positive expectancy in that pair when it starts to make a strong directional movement.

If you are going to trade momentum in Forex, the best tips I can give you are:

- Trade the most liquid currency pairs. These work the most reliably. They are:

- EUR/USD

- USD/JPY

- GBP/USD

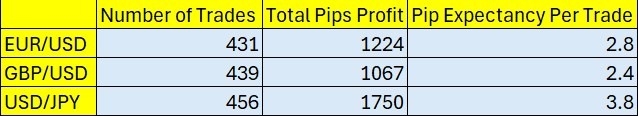

- The best momentum strategy in Forex is to wait for a long-term breakout, which can be more or less identified by a 50-day high or low closing price. This can be traded more precisely on the H4 time frame (use the 300-period high or low). This strategy over the past ten years has shown positive expectancy, as shown in the table below.

- The best times to enter momentum trades in the EUR/USD and GBP/USD currencies pairs are during the London and New York sessions. Using this filter improves expectancy.

- The most reliable momentum tends to happen in major stock market indices on the long side. A great strategy for trading the S&P 500 Index is to go long whenever the 20-period RSI on the 30-minute chart crosses above 70. Exit at the end of the day or whenever the RSI crosses back below 70. This does not happen very often, but it certainly has produced an edge in the past.

The table below shows the results of the momentum strategy in the three major Forex pairs in the ten-year period between August 2014 and the end of July 2024. Entry is made at the first breakout H4 candlestick, trades are exited at the close of the first candlestick which does not make a new long-term low or high. Trading costs and overnight swap fees are not factored into these calculations. It makes sense to use one of the best Forex brokers to keep the cost of trading momentum as low as possible.

Bottom Line

Momentum trading offers a dynamic and potentially profitable strategy for traders who can effectively harness the power of price trends. By focusing on assets with strong directional movements, whether through "Best of" or “Time Series” strategies, traders can capitalise on market momentum across various asset classes. However, success in momentum trading requires careful analysis, disciplined risk management, and the ability to adapt to changing market conditions. While it comes with risks like reversals and slippage, a well-crafted momentum strategy can be a valuable tool in a trader's arsenal, offering opportunities for both short-term gains and long-term profitability.