What is Currency Trading?

The Forex (foreign exchange) market is the market for currencies – whenever anyone in the world wants to exchange one currency for another, this is the Forex market. It is the largest market in the world, with over $6 trillion exchanged daily globally. Most transactions by value involve the US dollar, which is the dominant global currency and the key reserve currency stored by central banks and governments everywhere.

If you are travelling to another country and you go to a bank, bureau de change, or department store to exchange some of your national currency for the currency of the country you will be visiting, you are participating in the Forex market, at least in a small way. At the top of the chain sit the central banks, which control the supplies of their currencies, while most of the currency dealing is done by four major banks who buy and sell from smaller institutions.

Most retail Forex brokers do not actually buy and sell currency on their clients’ behalf, but instead provide a price feed, based on those of the major banks, and allow traders to bet on which direction rates will go, as if they were trading in the real market. In this way, retail Forex brokers are often compared to off-track betting in the gambling industry.

Many retail Forex brokers do buy or sell some currencies, to try to partially cover their net exposure to their clients’ trades.

Currency Trading for Dummies

When you trade Forex, you are betting on one currency rising in value against the other.

For example, you may believe that the euro is going to rise in value against the Russian ruble over the next several weeks, so you buy the euro, while selling the Russian ruble. You end up pocketing the difference, which hopefully will be positive when you close out the position. In other words, if the euro does in fact strengthen against the Russian ruble during that period, you make a profit. However, if it falls in value against the Russian ruble, then you end up losing money.

There are a few major differences when it comes to currency trading compared with other markets such as stocks and commodity trading, which of course is to be expected. The first thing you need to keep in mind is that the Forex market is open 24 hours a day, except for weekends, although a few brokers do allow Forex trading on weekends. Perhaps even more important to keep in mind is that currency trading allows the use of massive amounts of leverage. Leverage is the ability to borrow money to trade a bigger position size than you have in cash in your account.

For example, some brokers will allow 1:50 leverage. This means that for every unit of currency that you have in your account, you can trade fifty until of that same currency. For example, if you have $1,000 in your account, you can trade $50,000 worth of currency. The appeal is that you can make massive profits rather quickly, but the reality is that the leverage also can increase your losses likewise. Getting a “margin call”, which happens when you do not have enough margin to cover the position, is something that traders never want to see. A margin call will cause an immediate liquidation of your trading account, locking in massive losses.

How to Become a Forex Trader

How to start Forex trading: the first thing that any aspiring Forex trader needs to do is find a Forex broker who will allow them access to the foreign currency markets. There are a great many Forex brokers, all of which can allow access to trade the world’s foreign exchange markets. The broker acts as a gateway, much like a stockbroker does when you wish to buy shares in companies such as IBM or British Petroleum. Most brokers either charge a small commission, or a small spread between the buy and ask prices, to get paid as compensation for their service.

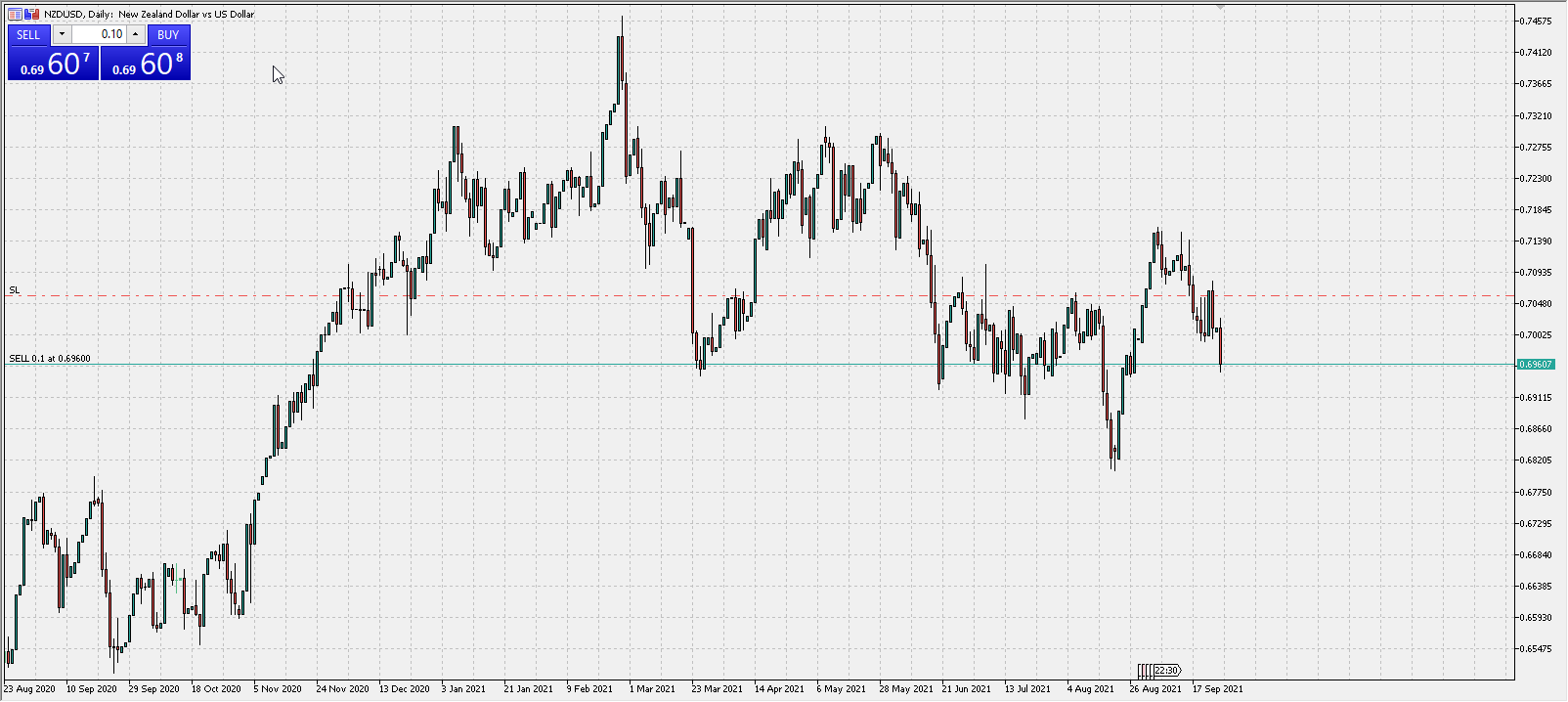

Most Forex brokers also offer a plethora of tools and charting packages, such as the MetaTrader ecosystem, which comes in two versions, MetaTrader 4 vs MetaTrader 5, and is the most popular platform globally. There are several other Forex charting packages available too. Price charts are very commonly used in Forex trading, as technical analysis forms the basis of the method of a solid majority of Forex traders. Reading price charts using Forex candlestick patterns and their price action is more common than analyzing an old-fashioned western bar chart.

Example of a Forex Price Chart in the MetaTrader 5 Platform

Should You Buy Forex Trading Strategies?

There are literally thousands of Forex trading strategies available online, and many of them are available for free. Do not be tempted to pay for “secret” trading strategies as they are probably available elsewhere for free. It is possible to back test these strategies using excel, SQL, MQL5 or other software if you get historical Forex price data: after all, you do not want to use a Forex trading strategy with a consistent historical record of failure! Back testing involves going back and looking how the overall system or strategy has performed. Most of the time, traders should look back over at least 200 trades generated by the trading strategy to see whether it has what is known as a positive expectancy, meaning that the trading strategy has been profitable over the longer term.

The biggest catch with Forex trading strategies is that most people believe that you can simply copy a someone’s trading system and make a lot of money. The reality is that there is a lot of trading psychology involved, both in terms of tweaking the system’s rules from day to day which an experienced trader can do best, and in terms of coping with losing streaks or the stresses of letting winners run. Because of these factors, you should try to customize your own strategy, even if it based on another strategy, using whatever indicators or reasoning that you choose, recognizing that you need to test whether it has historically been profitable. Unfortunately, there are a lot of salespeople out there that claim to have some type of “secret system” and are willing to charge you for it. This is a waste of money and time. The most important piece of advice is to simply do the work yourself, based upon the way the Forex market sometimes tends to trend and sometimes reverts to the mean. That way, you understand how the system works and you also learn to trust it over the longer term. It is vital that you have faith in the long-term profitability of your trading strategy, or you simply will not be able to execute it profitably.

Important Currencies in Forex Trading

There are more than 150 national currencies that are legal tender somewhere, but currency trading globally is overwhelmingly dominated by only 8 major currencies, which in order of volume traded are:

USD (US Dollar)

EUR (Euro)

JPY (Japanese Yen)

GBP (British Pound)

AUD (Australian Dollar)

CHF (Swiss Franc)

CAD (Canadian Dollar)

NZD (New Zealand Dollar)

These currencies together can be paired in 27 combinations, all of which are available at almost every Forex broker. Many brokers also offer trading in several other, smaller currencies – their pairs and crosses are known as “exotics”.

Apart from the exotics, currency pairs are commonly defined as “major pairs” and “minor pairs”. The major pairs have the lowest average trading costs, followed by the minor pairs, and then the exotics which are the most expensive to trade.

The major currency pairs are:

EUR/USD

USD/JPY

GBP/USD

USD/JPY

The minor currency pairs used to be widely defined as other pairs which did not include the US Dollar, but it is more common today to define them as all non-major currency pairs involving the US dollar which do not involve exotic currencies. Using this definition, the minor currency pairs are:

AUD/USD

USD/CAD

NZD/USD

A currency cross is typically defined as all other pairings which do not involve the US dollar.

Understanding Important Forex Terms

Like any specialist field, Forex literature includes terminology incomprehensible to the newcomer. Here is a list of the most important Forex technical terms with basic explanations. Not all of them are exclusive to Forex, but they are all important to know.

Base Currency – this is the first currency named in any currency pair or cross. One unit of the base currency is worth the quoted value of the pair or cross, which is denominated in the quote currency which will be the second currency named. For example, in EUR/USD, the Euro is the base currency, and the USD is the quote currency. If the value of EUR/USD is quoted as 1.2000 this means 1 Euro is currently worth $1.20.

Lot – this is the quantity of currency being exchanged in a trade and is always denominated in the base currency. One lot represents 100,000 units, a mini-lot 10,000 units, and a micro-lot 1,000 units. For example, one lot of EUR/USD is €100,000.

Pip (price interest point) - the smallest amount that a currency pair can move, although almost all Forex brokers now quote including “Pipettes”, or 1/10 of a PIP. Generally, if there are two or four digits after the decimal on a quote, the last one is the PIP. If there are five, then the fourth one is a whole PIP.

Bid and Ask – Forex brokers quote two different market prices. The “bid” is the price at which a currency pair or cross may be bought, the “ask” is the price at which it may be sold.

Spread – the difference between the bid and ask prices. The big may sometimes be zero or even be inverted but is usually positive. It is a profit for the broker if positive.

Swap – almost all Forex brokers charge or pay a small amount to the trader every day a position is held open past the New York close, which is known as “swap” or sometimes “overnight financing fee”. It is usually a charge and can represent a significant cost to longer-term traders. The swap is theoretically based upon interest rate differentials between the two currencies in a currency pair or cross.

Rates – short for interest rate. Every currency has a basic interest rate set by its government or (more usually) central bank which determines the rate at which the central bank lends to other banks. Generally, the higher the interest rate, the more attractive the currency is.

Leverage – Forex brokers allow their clients to trade with more money than they deposit, should they wish to do so. For example, if you deposit $100 and buy $200 worth of EUR/USD, you are leveraged at a rate of 2:1.

Safe-Havens – some assets including a few currencies become more attractive when the market’s risk appetite decreases significantly. These are known as “safe-havens”. Typically, safe-haven currencies include the Japanese Yen and US Dollar.

Commodity Currencies – three major currencies (CAD, AUD, and NZD) are positively correlated with the prices of certain commodities, because those countries are leading producers of commodities. These three currencies are known as the “commodity currencies”. Australia produces gold and other minerals such as ores, New Zealand produces milk and sheep, while Canada is one of the world’s largest exporters of crude oil.

Position Size – this is the quantity of lots which are bought or sold in a Forex trade. The larger the quantity, the bigger the potential profit or loss.

Market Order – an order given to a broker to execute a trade at the current market price as soon as possible. When this order is given, a trader does not know the exact price at which the trade will be executed.

Limit Order - an order given to a broker to execute a trade at a specified price which is lower than the current market price (lower in the case of a long trade, higher in the case of a short trade). There is a risk that the price may not reach this level, or that the broker may not be able to execute it. Both limit orders and stop orders (see below) are pending orders.

Stop Order- an order given to a broker to execute a trade at a specified price which is higher than the current market price (higher in the case of a long trade, lower in the case of a short trade). There is a risk that the price may not reach this level, or that the broker may not be able to execute it.

Example of a Forex Trade

Currency trading is essentially betting on whether the exchange rate between two currencies will rise or fall, although in the case of trading currency options the bet can be more complicated than that. For the purposes of this article and for most Forex traders, we can keep it simple with the following example of a currency trade.

Let’s say Trader A believes that the exchange rate of EUR/USD, which is currently at 1.2010, will likely rise to 1.2100 later in the day. Trader A also believes that the price is unlikely to drop any lower than 1.1975 before 1.2100 is reached. Trader A realizes this is presents a trading opportunity with positive expectancy: at the risk of 35 pips (1.2010 – 1.1975) so expects to gain a profit of 90 pips (1.2100 – 1.2010), an anticipated reward to risk ratio of almost 3 to 1. Trader A has an account of $1,000 and risks 0.25% of this on each trade, which is $25, so needs to risk $0.70 per pip which equals approximately €0.60 for which the correct position size is 0.6 lots of EUR/USD (1 lot of EUR/USD is €10,000).

Trader A opens their trading platform and enters a market order (to be executed immediately at the current bid price) to buy (or “go long”) 0.6 lots of EUR/USD with a stop loss order at $1.1975 and a take profit order at $1.2100. A split second later, the order is executed at $1.2011, and the platform shows the fluctuating profit or loss on the trade, which changes from moment to moment as the market price fluctuates. Trader A is betting that the value of the Euro will rise against the US Dollar over the coming hours.

Trader A decides to forget about the trade until just before 5pm New York time some hours later in the day, as there is a stop loss and profit target.

At 4:55pm New York time Trader A checks the trading platform and sees that the price never reached either the take profit price at $1.2100 or the stop loss price at 1.1975 therefore the trade is still open, and that the ask price is currently trading at $1.2051: a floating profit of 40 pips ($1.2151 – $1.2111), which equals €24 (0.6 lots fluctuates in value by €0.60 per pip).

Trader A now has a few options:

Close the trade and take the profit

Partially close the trade, taking some profit and leaving some of the trade open in the hope the profit target will be hit the next day.

Leave the trade open for the time being.

If options 2. or 3. are taken, Trader A can adjust the take profit target and/or the stop loss.

After a few moments thought, Trader A decides to close the trade and go to sleep for the night. Unfortunately, during these moments, the ask price of EUR/USD drops by 10 pips, so when Trader A presses the “close trade” button, and the broker executes the closure by having Trader A effectively sell (or “go short”) 0.6 lots of EUR/USD at the market ask price, Trader A receives a profit of 30 pips which equals €18, which is credited to Trader A’s cash account balance.

Final Thoughts

It is not that difficult for most numerate people to learn the basics of currency trading or to execute the trades they want to execute correctly. However, it is difficult for most people to make long-term profit trading currencies. Forex brokers regulated within the European Union are required to report the percentage of their clients who have lost money over a recent period, and most brokers report that approximately 71% of their clients lose money.

It is important for anyone wishing to trade currencies to learn the basics before they begin to place trades which risk real money. Yet almost all traders will find that their learning curve never ends, and that they will learn much more valuable lessons by doing than they will from reading. Risking money trading Forex is an emotional process and different personality types will face different challenges in the pursuit of profitability.

It is important to understand that the leverage offered in currency trading even by strongly regulated brokers is very high, with almost all brokers allowing you to trade at least 30 times the cash value of your account. It is very important for a currency trader to control the temptation to try to get rich quickly by the overuse of leverage. Money management is something that is crucial to traders or speculators in any market but is especially important in trading the currency market.

FAQs

Can you get rich by trading Forex?

It is possible, but currency trading is like any other investment, the more you start out with, the better off you are, are you are unlikely to make an exceptional return quickly. It is like any other business; you need a certain amount of input to get large gains or output. However, with the relatively high leverage allowed currency traders, it is possible to make large gains based upon smaller investments in other financial products such as the stock market, or even commodities although they are highly leveraged.

Is currency trading a good investment?

Currency trading can be a good investment. While I prefer trading currencies, the reality is that most investors should probably have a balanced portfolio. In other words, currency should be an asset class to get involved in, but not necessarily the only one. Think of it as like a football team. There are 11 players on the pitch, and each one has a different job. Currency trading is tantamount to a striker, meaning that it can deliver big gains, but also needs a solid midfield and defense. Midfield would be something along the lines of stocks and maybe even some commodities, while defensive posturing would involve bonds and other more stable parts of your portfolio such as rental properties.

Is currency trading legal?

Obviously, it is going to depend on the country that you are in, but almost all countries allow Forex trading, and it is only the most stringent and authoritarian governments that tend to ban the practice. The local laws will have a great influence on how you can trade Forex, for example leverage tends to vary widely depending on where you live. For major currency pairs, you can get 50 times leverage in the United States and 30 times in the European Union, but there are other jurisdictions that allow 100 times leverage, and some even have no restrictions at all. Because of this, it is important to understand the restrictions in your home country.