Top Forex Brokers

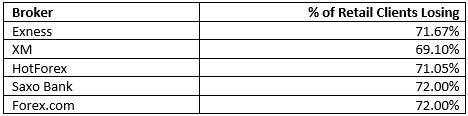

We have all heard statistics quoted such as 95%, 90%, or 80% of people who open an account with a Forex / CFD brokerage blow their account within six months. Some people tend to believe this out of respect for the Pareto principle, which says that 80% of profit is made by only 20% of cases. Is there any way to know for sure whether any of these estimations might be true? Yes, thanks to new ESMA regulations in the European Union, which oblige Forex / CFD brokers to disclose prominently on their websites what their average retail investor’s percentage loss or gain. So, let’s take a look at the current statistics published by some of the biggest Forex / CFD brokers in the world (in terms of trading volume) at the time of writing:

A few important conclusions can be drawn from this self-reported data:

- All the largest retail Forex / CFD brokerages report very similar data, so it is reasonable to assume approximately 70% of all retail CFD traders lose money.

- The percentage of losers is very similar between brokers, suggesting it is the market and the traders themselves, not the brokers, who are responsible for their clients’ long-term losses.

- Although this data includes clients trading non-Forex products, there is no reason to believe results differ between clients trading Forex and non-Forex CFDs.

- Even retail Forex traders seem to be more profitable than is widely believed, as traditional estimations of 80% to 90% as losers appears to be an over-estimation.

Why do 70% of Retail Forex Traders Lose Money?

Now that we have established that for about 70% of people who try it, Forex trading is not profitable, we should ask why. After all, if markets are random as the classic “efficient markets” hypothesis suggests, then shouldn’t winners and losers be divided at roughly 50 – 50?

An even division between winners and losers might make sense if Forex were a zero-sum game, as there has to be a loser for every winner, and vice-versa. Yet retail Forex / CFD trading is not a zero-sum game, it is a negative-sum game, because the retail Forex trader:

- Must pay either a spread, a commission, or both in order to enter and exit a trade.

- Must usually pay an overnight fee on any open trades which are held over 5pm New York time.

This means that the odds are stacked against the retail Forex / CFD trader. However, it is not impossible to overcome these odds, as the 30% of profitable retail traders can testify.

Some years ago, one large retail Forex brokerage released data which showed two clear differences between profitable and losing traders. Traders who:

- Made higher deposits into their accounts, and

- Used lower true leverage

were more likely to be profitable. We’ll examine each of these factors in turn, although they are related, because traders with lower deposits tend to use higher leverage.

Why are Better Capitalized Forex Traders More Successful?

Retail Forex traders who make larger deposits may be more likely to take their trading seriously, because they have more money at stake, and know instinctively that their chance of making a meaningful profit is greater too. For example, a trader who deposits $100 and makes a return of $20 should be just as proud of themselves as a trader who deposits $10,000 and makes a return of $2,000 as it is the same trading achievement – a 20% return. Yet very few people anywhere in the world will be able to get very excited over making $20. So, to some extent, this might be just a question of focus and meaning.

Why are Forex Traders with Lower Leverage More Successful?

A characteristic of retail Forex trading is the relatively high leverage offered by many Forex / CFD brokers, especially those located outside the European Union (Australia allows leverage on Forex as high as 500 to 1). Many brokers also allow accounts to be opened with deposits even lower than $100. This means that a lot of retail Forex traders might deposit $50 and use 400 to 1 leverage to make one trade sized at $20,000. This trader will then either wipe out their account or maybe triple it, which would then probably lead to another over-leveraged trade with a similar result. While there is some logic at work here – a series of winning, highly leveraged traders would a way to make a huge return quickly in theory – the odds against such a gamble resulting in anything except a blown account after a few trades are vanishingly small.

It is also worth remembering that lower leverage makes it easier to control and limit risk, which is a key factor in long-term profitability. This risk issue is best illustrated by the fact that once a trader is down by more than 20% from peak equity, it begins to become exponentially more difficult to recoup the loss. A loss of 20% requires a profit of 25% to be regained; a loss of 50%, a profit of 100%.

How Can I be a Profitable Forex Trader?

Use Very Low or No Leverage

Now we’ve looked at the evidence, the odds are looking better for you. 30% of retail Forex traders are profitable, and that number would surely be considerably higher if it did not include all the traders using overly high leverage. So, the first thing you can do is only use very low leverage or even no leverage. In practice, this means not risking more than 0.5% (ideally 0.25%) of your account on a single trade. Don’t try to be greedy, in Forex trading, it is counterproductive. Forex trading can be profitable, but don’t try to push it too far or it will bite back at you.

Make a Meaningful Deposit

If you can only afford to deposit $100 that is OK, but you have to respect that $100 without getting greedy. If the $100 does not mean much to you, you almost certainly won’t be motivated enough to trade it well.

Use a Realistic Trading Strategy

You can’t expect to just start putting on trades and making money. You need to wait for opportunities where you think the market is putting the odds in favor of either long or short trades, and then take the trades according to your plan. If you do not have a strategy to identify those opportunities, then you will be groping in the dark.

It has been quite well established that markets are not efficient, and that trend-following strategies, if executed carefully, are profitable over the long-run in liquid markets, and that includes major Forex currency pairs such as EUR/USD and USD/JPY. One of the strategies which has worked best in Forex markets over recent decades is to trade breakouts to new 50-day highs or lows on these two major currency pairs, using relatively tight stop losses and some kind of trailing take profit. Pullback trading strategies can also be used to trade Forex currency pairs profitably while they are in strong trends.

Most of the time, Forex pairs range: if the price goes up one day, it is most likely to go down the next day. It is difficult to profit from this, but when it seems obvious that a Forex pair’s price is going nowhere, you might try to trade the bounces from the limits of the range on short time frames, using tight stops to increase the reward to risk on winning trades.

Trading strategies which rely upon fundamental analysis are arguably less successful in Forex, but fundamental analysis can be used to effectively filter trade entry signals generated by technical trading strategies.

Follow Your Trading Strategy and Be Consistent

Having a good, profitable trading strategy won’t help you use any money unless you execute it correctly. It is important not to get depressed or frustrated by losing trades – remember, it is all part of the plan to have some losing trades, and it is not a big problem as long as you are keeping individual trade sizes small. You should expect losing streaks, which you will more than make up for during the winning streaks. Paradoxically, Forex trading can only be profitable when you are prepared to accept the possibility of meaningful losses, even if they are only temporary. Yet, you must be consistent as if you stop taking trades, you will probably miss winners which would have made the difference.

It is important to control your emotions – most traders get emotional, but profitable traders find a way to stop their emotions from ruining trade execution.

How Much Money Can You Make Trading Forex?

In Forex trading, profits tend to come irregularly, so it is best to look at long-term performance as the most profitable performance possible. Results can vary and there is no guarantee of profit, but good Forex traders tend to outperform stock market benchmarks. I’ve looked at the best ways to turn $10,000 into $1 million trading Forex before.

Bottom Line

Although Forex trading is not profitable for most retail traders, you can put the odds of profitability in your favor by using very low or no leverage, keeping your maximum risk per trade low, and following an effective trading strategy without getting greedy or impatient.

FAQs

Can you get rich by trading Forex?

It is possible to get rich by trading Forex, but it is very difficult to do so unless you start with a large amount of money, as 70% of retail Forex traders lose money over the long-term. However, outperforming stock markets over the long-term is a realistic goal.

How much do Forex traders make a day?

A Forex trader may win or lose any amount of money in a single day without worrying about it as long as losses are not excessive. It is long-term performance which counts, as one day’s trading is statistically irrelevant.

Is trading Forex a good idea?

Trading Forex can be a good idea if you are adequately capitalized and trust yourself to follow a good trading strategy over the long term while limiting risk, as it is accessible and can be a diversified investment.