Most traders would probably agree with the proposition that the hardest thing to get right in Forex trading is the placement of stop losses and take profit levels. A great deal of trading education and material that is shared with learning traders focuses on finding the right places to enter trades. Let’s be clear that entry is very important, but good trade management – i.e. using the right stop losses and take profit levels and changing these levels appropriately as the trade progresses – is equally important. It is very possible to be right about entries consistently and to still lose money overall. Assuming that you have a good entry strategy, how can you best exploit it? Is there a better, more dynamic methodology than just setting stop loss and take profit levels and walking away? There is, although this can be challenging as “set and forget” methods are psychologically easier to implement.

What is a Stop Loss?

A stop loss is an order you place with your broker, telling them to close your trade when it reaches a certain price which represents a loss on the trade.

For example, if you entered a long trade in EUR/USD at $1.0500, you might place a 100 pip stop loss at $1.0400. In this case, as soon as your broker’s ask price reaches $1.0400, your broker is obliged to execute an order to close the trade at market.

Note that in fast-moving markets, even in the normally very liquid Forex market, your broker may not be able to get you out of the trade at your stop loss price – by the time they can reasonably execute the order, the price may have got even worse for you. This is known as slippage.

Top Regulated Brokers

Why Do You Need a Stop Loss?

You need a stop loss to limit your risk. Although sometimes stop losses will be executed with slippage, in the Forex market, slippage is not often a meaningful problem as the market is so liquid. This means that with most trades, using a stop loss will effectively define your worst-case losing scenario for any trade, ensuring that your risk is limited. An important part of profitable trading is to cut losses relatively short, and to let winners run – a stop loss help to make this happen.

There is a deeper reason why stop losses are very important in trading. If you look at your most profitable trades, you will probably find that most of them did not move against the entry price by much at all. So, by using a stop loss, you will be sure to profit from the best trades, while cutting short the trades that don’t look like working out so well. Relatively tight stop losses can also be used to keep your anticipated reward to risk ratio high, which is usually another important element in profitable trading.

What Is a Trailing Stop Loss?

To put it simply, a stop-loss order is a “limit” one that will outline the number of losses you’re willing to take on a trade; this is done with the intention of preventing traders from taking too many losses in certain trading positions.

Dynamic/trailing stop-losses follow the asset price in long positions, as well as the fall in short positions at a fixed distance. In most cases, the trailing stop will get updated as your position in a particular market evolves.

Many people use stop-losses when they cannot be aware of the current position, they’re in. Thanks to the automation that this order offers, you will always ensure a profit percentage and avoid getting zero earnings in case the market turns around. Keep in mind that a “stop loss” and “trailing stop” aren’t the same, although a trailing stop is a type of stop-loss order. In essence, a trailing stop will increase its value when the market price increases and will freeze when the price goes lower. On the other hand, a regular stop-loss order will not change whether the asset price rises or falls. The stop loss will stay fixed at the point we set it.

Why Is Dynamic Stop Loss Important?

The reason why a dynamic stop-loss order is important is that it’s one of the most effective risk management tools you can use in times of volatility peaks. Moreover, you will be able to take advantage of unexpected and rapid market movements without risking your current trading position. Moreover, having a stop-loss order set ensures you don’t have to monitor your holdings all the time. As soon as the asset price falls below your stop price, then you can expect your broker to execute a sell order automatically.

To summarize, a dynamic/trailing stop loss:

- Is a dynamic way to manage your risk.

- Helps you reduce risks and secure profits.

- Saves you time.

- Is suitable for all trading styles.

What Are the Advantages of a Trailing Stop Loss?

There are many benefits that come from using a trailing stop loss, and those include the following:

- You won’t put a ceiling on your profits; meaning you will be able to hold your positions as long as the market price of the asset you’re investing in doesn’t fall below your set percentage.

- It will prevent you from taking poor trading decisions based on your emotions; meaning you will be able to focus on your main objectives.

- You won’t have to pay additional charges for placing stop-loss orders.

- You can customize your risk management plan by choosing any stop-loss percentage you consider appropriate.

- It helps if you’re not present all the time on your trading platforms. These orders allow you to sell shares automatically if the market price for your asset drops below the set percentage.

What Is a Disadvantage of a Trailing Stop Loss?

As with everything else in life, you can also expect stop-loss orders to have some disadvantages. Make sure to consider these before making any decision with this tool:

- Some stockbrokers in particular financial markets don’t allow traders to use stop-loss orders, although this may only happen when trading ETFs or particular shares.

- You may not be able to analyze different market dynamics as efficiently as before.

- Trailing stop-loss orders may not be as efficient if the price of an asset falls too fast, as the trader may not be able to place the order in time.

- If the asset prices are too volatile, it may become too complicated to place accurate stop-loss orders, which can cause you to be exposed to certain losses.

What does this mean? In essence, stop-losses are amazing if you use them the right way, although you shouldn’t rely on them for all of your trading decisions, as there are some circumstances where they may not work as intended

Dynamic Stop Loss

It is a good idea to never trade without a hard stop loss, i.e. one that is registered within your broker’s platform for execution, unless you are using extremely small position sizes. This is an essential part of controlling risk in Forex trading.

The stop loss may be made dynamic, as a way to lock in profits on a trade that progresses profitably. However, the stop losses should only ever be moved in the direction of reducing losses or locking in profit. In this way, a trade that performs well will end up giving some profit. This is also a good way to let a trade die a “natural” death, instead of aiming for profit targets that can be very hard to predict.

One example of a dynamic stop loss is the trailing stop. This may be set at a particular number of pips or based upon some measure of averaged volatility. The latter option is the better choice.

Another example would be moving the stop loss level periodically so it is just beyond major highs or lows or other technical indications. The beauty of this is that the trade stays alive as long as it is going well. When a long trade starts to break down through key support levels, then this type of stop is hit and ends the trade. This method is a way of letting winners run, while cutting losers short.

Dynamic Take Profit

First of all it is worth asking the question why it is worth using take profit orders at all in Forex. Many traders like to use them instead of moving up the stops and letting a trade end that way, for the simple reason that the latter method means you always give up some floating profit. But why cut a winner short? You might think the price is only going to level X but what if it steams ahead and keeps going? If you make a list of your last one hundred trades, I practically guarantee that you will see that using some kind of trail on the stop would have made you more profit overall than even your wisest application of take profit orders ever did. Of course, if your trading style is very short-term, take profit orders make more sense. Yet if you are trying to let winners run for days, weeks, or even months, then do take profit orders really do anything except pander to your fear and greed?

There is a possible compromise. You might want to use take dynamic take profit levels set at places relatively far ahead of the current price, which could be reached by a sudden news-driven spike, for example. This could get you some nice profit on the spike, and allow you to re-enter at a better price when the spike retreats. This is the most judicious use of hard take profit orders within non-scalping trading styles.

You might also use soft take profit levels, if you are able to watch the price make a very good, long “climax” candle. These can often be good points for quick exits and re-entries as described above. Be warned though, that this tactic requires real skill and experience to be applied successfully in Forex trading, and is a worthless trail for more novice traders to travel down.

Darwinist Trading

Charles Darwin’s Theory of Evolution suggested that the fittest elements within a species were most likely to survive. We have all seen this when we grow plants in a garden. Usually, the baby plants that look the strongest and tallest are the ones that eventually grow into the best specimens. Expert gardeners pull up the sick and weakly plants and leave the strong ones to grow, and harvest those when they begin to die. Profitable Forex “Darwinist trading” can be achieved in exactly the same way, by using a combination of hard and dynamic soft stop losses / take profit orders to effect the pruning and harvesting by cutting losers short and letting winners run. A stop loss that results in a profit can be called a take profit order, when you think about it.

In Darwinist trading, the strongest trades survive, and the weakest performers are culled.

Case Study

We can demonstrate how results can be improved by using easily quantifiable “Darwinist trading” techniques, using the past three years of the EUR/USD currency pair as a case study.*

Long trades were entered when a fast exponential moving average crossed a slow simple moving average on the hourly chart, provided all the higher time frames were also in alignment (up to and including the weekly time period). An initial hard stop loss equal to the 20 day Average True Range was used.

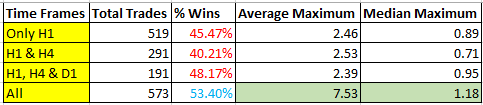

The naked back test results were very positive: out of a total of 573 trades, 53.40% of the trades hit a profit equal to the hard stop loss, and 25.65% of the trades hit a profit equal to five times the hard stop loss, before hitting the hard stop loss. These naked results show why it is so much more profitable to let winners run.

Now, let’s look at how many trades were showing a profit 2 hours after entry. Only 48.31% of the trades fit this category. However, if we look at all those trades which eventually hit five times the hard stop loss, we see that 57.44% of these trades were in profit 2 hours after entry. Five times the average true range is much further than the average volatility of two hours, so there is a momentum factor in play.

In fact, this can be shown even more simply by looking at the results of trades taken when the higher time frames were not showing the same momentum:

Note how the results generally worsen the fewer high time frames are exhibiting the same momentum alignment. Clearly, when a currency pair has been moving strongly in one direction for several weeks, it is more likely than not to keep going.

How to Create Dynamic Stop Loss and Take Profit Strategies

There are many strategies you can consider today for either stop-loss or take-profit orders. Consider the following strategies that will help you set these limit orders more efficiently and ensure profits:

Trade Volatility - You can use factors like the Average True Range (ATR) indicator to determine how volatile a market can get. Then, you can set your stop-loss order at a point you believe the market won’t get to. On the other hand, knowing where the market will potentially get to can help you set a good take-profit order.

Support/Resistance Levels - In essence, support and resistance levels will tell you about some areas on a price chart that could potentially have increased trading activity for either buying or selling. Regarding support levels, these will stop the asset price from going further down, whereas the resistance levels will stop the prices from moving upward. Most traders will try to set their stop-loss orders below the resistance level and their take-profit orders above the support level. These are critical components you should study if you want to make smarter trading decisions.

Risk per Trade - Assessing your risk is among the most basic trading strategies you must consider. Overall, you will consider how much money you’re willing to risk per trade, which could be a percentage of your total capital. In essence, you would set your take-profit order to a point where you can expect a profit that will be higher than your potential loss. On the contrary, you should set your stop-loss levels at the exact percentage you set as your risk per trade. If you set a 5% in potential losses, then you should set your stop-loss at that same 5%.

Trading Indicators -Some of the most popular indicators in trading include:

You can use these indicators to determine where you will set your ST/TP orders. In essence, your take-profit should be set somewhere you believe the price will easily reach, whereas you should set your stop-loss at a point you believe the order won’t get triggered easily.

Conclusion

Both stop-loss and take-profit orders are excellent risk management tools any trader can use to reduce risks and ensure profit gains. Moreover, if you combine these orders with other risk management tools, then you can expect even better results in the long run.

Keep in mind that there are no set rules for using these orders, so make sure you create a unique and dynamic strategy that will get you the results you want. We hope this article has helped you!