Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | FCA |

Year Established | 2001 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Finotec, located in the London, U.K. is a division of leading real-time Internet trading company Finotec Trading Inc. which pioneered the world of online Forex trading in 1998. At that time, they began by managing a Risk Book brokerage business and accumulating a deep understanding of all aspects of the Fxspot leveraged business.

In 2001, they introduced their Forex online trading platform so they could serve clients in many locations worldwide. It now offers real-time Internet trading not only in currencies, but also in options, commodities, CFD’s, and stocks. Finotec is regulated by the Financial Conduct Authority (United Kingdom).

Finotec calls itself a Boutique FX Prime Brokerage and gears itself to investment managers, Hedge Funds and professional traders as well as to retail brokers. Prime brokers enable their clients to trade with multiple brokers, market makers and banks, providing a credit line – based on their margin account – to the LP with whom they have a relationship.

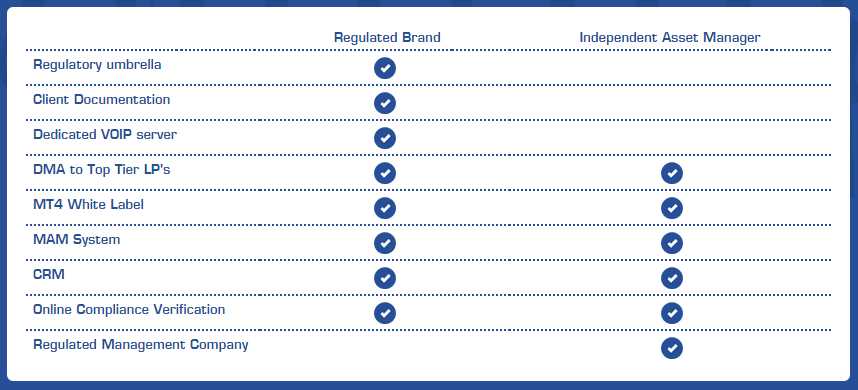

Asset Manager's Features

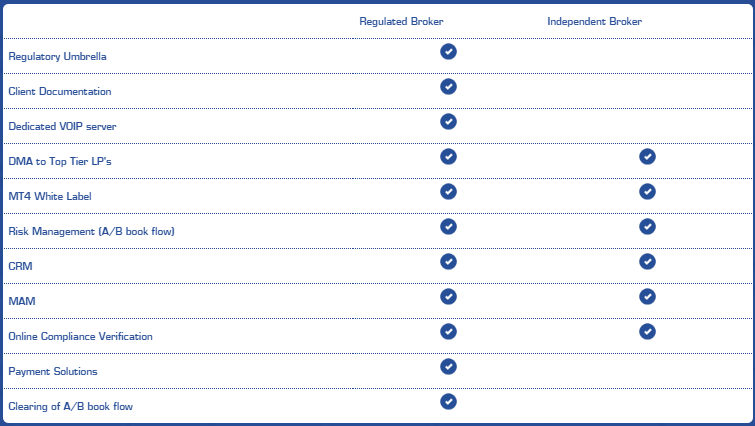

Broker Features

Finotec is not an LP or an ECN broker. They are a boutique FX prime broker that connects their clients with top tier liquidity – giving them consistently competitive pricing. They provide our clients with Direct access to the world’s top tier banks and ECNs, central single margin account clearing solutions and an aggregation of counterparties prices.

Accounts

There are three accounts offered at Finotec. A standard live account, a Demo account and a Partner account. Not much detail is given about these accounts.

Features

Finotec clearing enables all buy and sell orders to be efficiently matched up. It acts as an intermediary, assuming the role of both buyer and seller for transactions and objectively reconcile trade orders between transacting parties.

Professional broker-dealers, and state-of-the-art back office systems and technology provide a seamless clearing process, with processing conducted via real-time routed orders that connect instantly with Forex markets. Full transactional records, updates, and market reports are also provided.

Their back office provides fully integrated and consolidated reporting which is efficient, ease to use and offers real-time and historic performance.

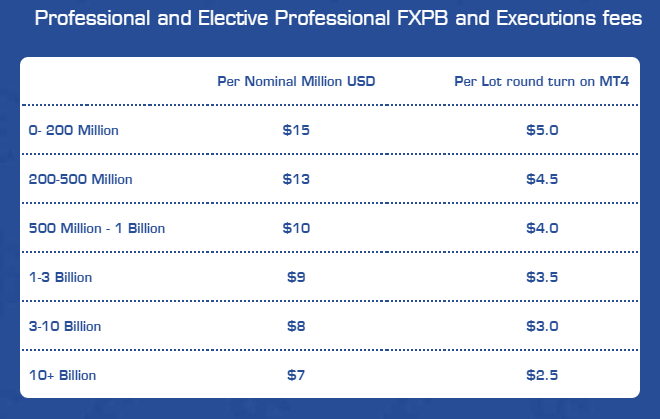

A chart listing the different professional and elective professional Prime Brokerage FX fees per minimal million USD and Per Lot round turn on MT4 is provided.

Finotec Fees

Education

Finotec has developed a series of educational seminars, offering professional traders and emerging fund managers expert tools and knowledge to either set up a fund or expand their current business and realize its full growth potential.

Finotec for Professional Traders

The week-long seminars are delivered by experts in their field and provide strategies and tools for marketing funds and acquiring new customers, managing funds for private and institutional clients, accessing capital and creating an effective risk management strategy.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Clients can contact a Finotec representative at their London office via telephone or email. I didn’t notice a Chat while doing this review. Both customer service and the platforms are available in Arabic, Chinese, English, French, German, Greek, Hebrew, Italian, Polish, Portuguese, Romanian, Russian, Spanish, Turkish and Vietnamese.

Features

Finotec is geared to investment managers, Hedge Funds and professional traders as well as to retail brokers. For over 15 years, Finotec has been providing its clients with optimal trading conditions for their FX activities. They have held fast to their founding principles of acting in their clients’ best interests, sustaining a business model that is consistently fair and transparent. They used their accumulated knowledge to develop a system that would help their clients maximize their profits.

Platforms

Metatrader 4

Clients can choose the ever popular MetaTrader 4 trading platform customized for professional traders.

HotspotFX

Hotspot FX, the first ECN for the institutional FX market, continues to set the standard with deep liquidity, complete anonymity and innovative technology.

Currenex

Currenex is a market-leading technology provider offering the FX community with high-performance technology and deep pools of liquidity for anonymous and disclosed trade execution.

Trading Platform

Automated Trading | |

|---|---|

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |