Editor’s Verdict

Overview

Review

ETX Capital is a competitive firm within the financial service industry with 50 years+ of experience in financial markets. Today, it offers traders more than 5,000 financial instruments from its proprietary trading platform and an upgraded MT4. I reviewed this broker to conclude if their award-winning trading platform delivers as advertised. Is ETX Capital the right broker for you?

Summary

ETX Capital - A well-balanced asset selection and cutting-edge trading platforms

Headquarters | United Kingdom |

|---|---|

Regulators | CySEC, FCA, FSCA |

Year Established | 1965 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

ETX Capital - The first look:

- Cutting-edge proprietary trading platform and upgraded MT4.

- Commission-free pricing environment with acceptable costs.

- Well-regulated and transparent.

- UK-based, Swiss-owned multi-asset CFD broker with 50+ years of experience.

- Competitive asset selection with market-leading Forex and cryptocurrency pairs.

- Premium client package, professional account upgrade, and custom-tailored services for high-net-worth clients.

- Quality educational content for beginner traders.

- Higher trading costs for MT4 traders versus ETX TraderPro.

ETX Capital Main Features

Retail Loss Rate | 72.54% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | 0.10% |

Commission Rebates | No |

Minimum Deposit | $100 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | No |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 5 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. ETX Capital presents clients with three -regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | License Number 096/08 |

United Kingdom | Financial Conduct Authority (FCA) | License Number 124721 |

South Africa | Financial Sector Conduct Authority (FSCA) | License Number 50246 |

Reasons I prefer the UK subsidiary:

- ETX Capital offers identical leverage restrictions across all three subsidiaries, eliminating the potential FSCA advantage.

- Negative balance protection.

- Competitive regulator.

- Segregation of client deposits from corporate funds.

What is missing?

- An operating subsidiary offering higher leverage to retail traders.

Noteworthy:

- ETX Capital has a clean regulatory track record.

- Monecor (London) Ltd, the operator of ETX Capital, is a member of the London Stock Exchange (LSE).

ETX Capital maintains a notable presence in the African market, and becoming authorized by the FSCA, one of the most trusted regulators on the African continent, strengthens its position.

Following the 2018 regulatory changes by the European Securities and Markets Authority (ESMA), brokers have sought to acquire licenses from business-friendly jurisdictions to offer traders competitive trading environments unavailable under the ESMA framework.

The FSCA became a primary destination amid a trusted regulatory environment, with a time zone equal to continental Europe and English as the primary language. The move by ETX Capital displays a deep understanding of the requirements of its traders, and the FSCA license remains a strategic move to ensure it can expand its business.

Since its October 2020 acquisition by Swiss-based private equity firm Guru Capital, ETX Capital has pushed ahead with its expansion plans. It coincides with a surge in demand from retail traders, making the FSCA license a vital step.

Another benefit is negative balance protection and the FSCA mission to educate new retail traders, an essential component to lower the retail loss rate at brokers, presently at 72.54% at ETX Capital.

Fees

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact trading profitability.

ETX Capital offers traders the following cost structures:

- Commission-free Forex trading in the proprietary trading platform from 0.6 pips or $6.00 per 1 standard lot.

- The MT4 pricing environment is 33% more expensive at 0.8 pips or $8.00 per 1 standard lot.

Noteworthy:

- ETX Capital offers its most traded equity CFDs free of charge; otherwise, an industry-average commission between 0.10% and 0.20% applies.

Which pricing environment should Forex traders select?

My observation:

- Algorithmic traders must accept the more expensive MT4 cost structure, but the MT4 cost is unacceptably high.

What is missing at ETX Capital?

- A volume-based rebate program for the commission-based trading account, as the absence of it makes ETX Capital less competitive.

- An equal treatment of traders irrespective of the trading platform used.

Here is a screenshot of ETX Capital MT4 live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD in the commission-free ETX Capital MT4 account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.8 pips | $0.00 | $8.00 |

Noteworthy:

- Traders with deposits of $10,000 qualify for Premium Client Package, featuring lower trading costs.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- ETX Capital offers a positive swap on EUR/USD short positions and other assets where market conditions warrant them, meaning traders can get paid money.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free ETX Capital MT4 account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips | $0.00 | -$14.2182 | X | $22.2182 |

0.8 pips | $0.00 | X | $0.6818 | $7.3182 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips | $0.00 | -$99.5274 | X | $107.5274 |

0.8 pips | $0.00 | X | $4.7726 | $3.2274 |

My additional comments concerning trading costs at ETX Capital:

- Swap rates for buy positions are expensive.

- No inactivity fees.

- No currency conversion fees.

What Can I Trade

I like the 79 currency pairs ETX Capital offers, placing it in the top quintile of brokers, but the seven cryptocurrency pairs remain a disappointment. The commodity and index selections are also competitive.

Equity traders get a well-balanced choice of large-cap and mid-cap CFDs, offering all traders and strategies advanced diversification opportunities across countries and sectors.

What is missing?

- I am missing small-cap alternatives in the equity CFD list.

- ETX Capital does not list ETFs.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

ETX Capital Leverage

Regrettably, ETX Capital restricts maximum leverage up to 1:30 for all retail traders. It limits overall trading flexibility, directly influencing profitability, and may not suit all active Forex traders well, placing them at a disadvantage. Equity CFD traders preferring leveraged accounts get the industry-standard maximum of 1:20, dependent on the individual asset.

Other things I want to note about ETX Capital leverage:

- Negative balance protection exists, ensuring traders can never lose more than their deposit.

- While the maximum leverage for retail traders remains capped at 1:30, the UK financial regulator, the FCA, may increase them since it left the uncompetitive EU trading environment. It remains an area for potential clients to monitor.

- The South African subsidiary can offer high leverage, but ETX Capital has opted to restrict it to 1:30, and traders should check for potential changes.

ETX Capital Trading Hours (GMT+2 Server Time) MT4

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 23:00 | Friday 21:55 |

Forex | Monday 00:00 | Friday 19:00 |

Commodities | Monday 01:00 | Friday 23:58 |

European CFDs | Monday 10:00 | Friday 17:20 |

US CFDs | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading day and are not operational continuously like Forex and cryptocurrencies.

- The asset selection varies between trading platforms, with ETX Capital Pro offering all trading instruments.

- ETX Capital does not provide 24/7 cryptocurrency trading.

- Trading hours vary between MT4 and ETX TraderPro, placing MT4 once again at a disadvantage.

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

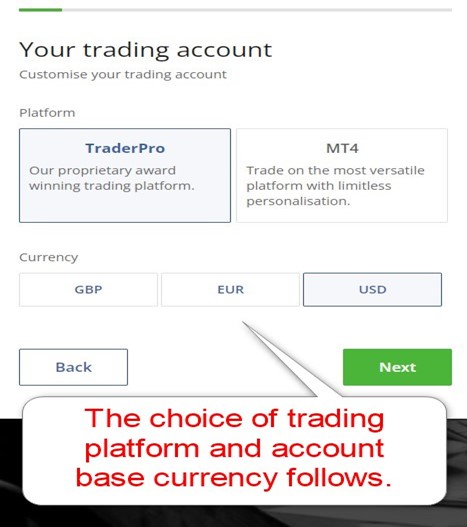

ETX Capital offers all clients the same CFD trading account and conditions. The only difference remains between the MT4 trading account or the TraderPro alternative. Clients who opt for Trader Pro may choose any major currencies, while ETX Capital also caters to specific requests.

Traders must choose between the MT4 and ETX TraderPro platforms.

My observations concerning the ETX Capital account types:

- The minimum deposit is $100, but a Premium Client package is available for deposits above $10,000.

- A volume-based rebate program is missing.

- ETX Capital treats traders who opt for its ETX TraderPro with superior conditions and lower costs while placing MT4 traders at a disadvantage.

- A dedicated accounts page is missing, and traders must source the information from the FAQ section or via customer support.

- Corporate accounts are available.

My recommendation:

- ETX Capital is best suited for manual traders who will use the proprietary ETX TraderPro, while algorithmic traders using MT4 should consider other options due to the high MT4 pricing here.

ETX Capital Demo Account

ETX Capital offers traders demo accounts for both trading platforms, and I did not find a time limit, which I appreciate, as it grants sufficient time for traders to test new strategies. I want to caution beginner traders about using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

My recommendation:

- MT4 offer flexible deposits, and traders should choose a nominal account balance similar to what they plan to eventually deposit in a live trading account.

Trading Platforms

The proprietary ETX TraderPro trading platform offers the best trading experience but only supports manual trading. MT4 supports algorithmic trading and has an embedded copy-trading service but comes with higher trading costs.

MT4 comes as a desktop version for algorithmic traders, a lightweight web-based version for manual traders, and a mobile app. ETX Capital upgrades it via its ETX MT4 Remastered package, but it lags competing brokers.

What is missing?

- API trading for advanced algorithmic trading solutions.

- Realistic pricing for MT4 traders.

- VPS hosting.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes (MT4) |

Social Trading / Copy Trading | Yes (MT4) |

MT4/MT5 Add-Ons/Upgrades | Yes |

Guaranteed Stop Loss | Yes |

Negative Balance Protection | Yes |

Unique Feature One | Competitive proprietary trading platform |

Unique Feature Two | Well-balanced asset selection |

My observations:

- Traders with MT4/MT5 EAs must use the desktop client.

- Eight chart types allow traders to visualize price action in a manner that suits them best.

- Split charting tools are excellent for advanced trading requirements and multi-chart trading strategies.

- Scalpers and other high-frequency traders will benefit from the chart-trading functionality, enabling traders to take advantage of opportunities in fast-moving markets.

- With more than 60 indicators, the ETX TraderPro trading platform offers in-depth technical analysis tools complemented by numerous drawing tools.

- Customized workspaces ensure individual flexibility, a feature that more and more clients demand from a competitive trading platform.

- ETX TraderPro also includes what it labels Dynamic Risk Management, part of each deal ticket and presents traders with all the necessary information and tools to effectively manage risk, one of the most misunderstood aspects of trading.

- Most traders will use the web-based version of ETX TraderPro, also available as a mobile app, ideal for monitoring portfolios on the go and adjusting risk management settings as necessary.

- Automated traders get the core MT4 trading platform with the ETX MT4 Remastered upgrade, consisting of numerous add-ons and improvements, but not as sophisticated as other MT4 upgrades.

Unique Features

The unique feature that stands out is the exceptionally long operating history of ETX Capital, which was founded in 1965.

Research and Education

ETX Capital has an analysis category on its website, but it only provides quality market commentary with a theme-based approach. There are no trading set-ups or recommendations available. The section makes for an informative read, but the overall value for traders remains minimal.

New traders can benefit from the ETX Trading Academy, delivered by the Corellian Academy, and an exceptional webinar series. Nine trading courses increase the educational value at ETX Capital, where traders also find platform guides, eBooks, and a glossary. While the research value offered ETX Capital remains low, the approach to education ranks among the most valuable ones available to new traders, which I highly recommend to beginner traders.

My takeaways:

- ETX Capital offers an in-house research section, which is informative but lacks overall value amid the absence of trading recommendations.

- No third-party research is available, creating a quality gap between ETX Capital and competing brokers.

- The educational content offers quality material for beginner traders.

My recommendations:

- Traders should source quality research elsewhere.

- MT4 offers copy trading and features thousands of EAs, but the relatively poor trading conditions make both a less desirable option at ETX Capital.

- Beginner traders may supplement their educational needs with additional third-party content.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

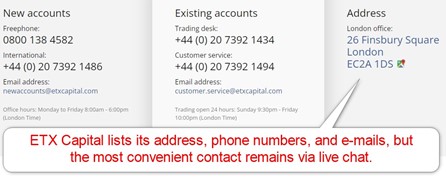

Customer support for non-clients is available Monday through Friday between 8:00 am and 6:00 pm, while existing clients have access to a representative from Sunday 9:30 pm through Friday 10:00 pm.

ETX Capital lists its address, phone numbers, and e-mails, but the most convenient contact form remains the live chat function. An FAQ section answers many of the most common questions, and ETX Capital explains its products and services well on its website. Most traders may only require customer support during emergencies, and ETX Capital ensures swift access when needed.

My recommendations:

- Traders should read the FAQ section before reaching out to a customer service representative.

- For non-urgent questions, I recommend live chat.

- ETX Capital provides phone support, ideal for urgent matters.

Bonuses and Promotions

At the time this review of ETX Capital was conducted, neither bonuses nor promotions were available.

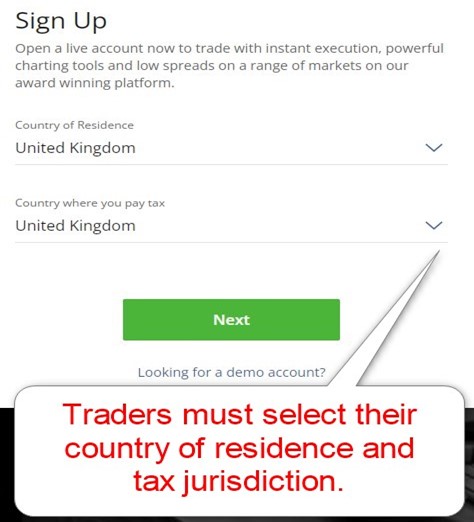

Opening an Account

The online application starts with the residence and tax country, followed by the trading account type and personal information to complete the initial step. The multi-step process takes longer and consists of several unnecessary questions but incorporates the account verification process.

Account verification is mandatory at ETX Capital. As a regulated broker, ETX Capital must satisfy AML/KYC stipulations. Most new clients will complete it by sending a copy of their ID and one proof of residency document not older than three months.

The process bar at the top of each step gives a minor indication of progress, but it consists of numerous steps, while most brokers have a one-page sign-up procedure.

Minimum Deposit

ETX Capital requires traders to deposit at least $100 or the currency equivalent to open an account. It is slightly on the low side for the industry average, making ETX Capital a relatively accessible broker. Traders may deposit in British pounds, euros, and several other more minor currencies, as well as in US dollars.

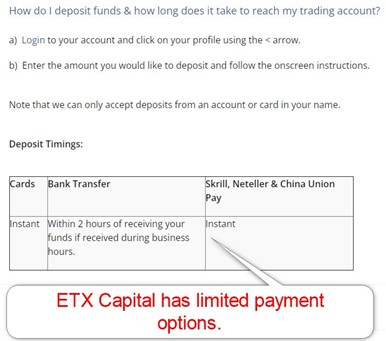

Payment Methods

ETX Capital offers the payment methods of bank wires, credit/debit cards, UnionPay, Skrill, and Neteller.

Accepted Countries

ETX Capital caters to most international traders, including residents of the UK, Bangladesh, the UAE, and South Africa. US persons cannot open trading accounts at ETX Capital, like most international brokers.

Deposits and Withdrawals

All financial transactions take place in the secure back office of ETX Capital, but I find the limited choice of payment processors disappointing.

My observations:

- Most deposits remain free of charge, but third-party processing fees may apply.

- Not all deposit methods are available to all traders, dependent on the geographic location and account base currency.

- Withdrawals below £100, or a currency equivalent, face a £10 levy, with no costs above that for up to five requests monthly.

- Deposit times are instant, but it may take up to three days for fund processing by payment providers.

- The withdrawal processing times depend on the jurisdiction and method and can take between one and seven business days.

- ETX Capital tries to process all requests before 2:00 pm the same day, but there may be some pushback due to further checks.

- Cryptocurrency deposits and withdrawals are not available.

- ETX Capital should provide more transparency or detailed explanations of its withdrawal process.

My recommendations:

- Traders should select the payment processor with the lowest fees.

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

The Bottom Line

I like the trading environment at ETX Capital for manual traders in the ETX TraderPro trading platform. It presents a professional user interface with quality trading tools and 5,000+ assets from a reasonably priced commission-free cost structure. CFDs remain acceptably priced, and overall, ETX Capital remains an excellent broker to consider for manual traders.

While ETX Capital offers its ETX MT4 Remastered upgrade for MT4 traders, it imposes 33% higher trading costs, making ETX Capital unsuitable for algorithmic traders. One of the best assets ETX Capital possesses is the educational section for new traders. It has several high-quality tools, ensuring that beginner traders can understand the fundamentals of trading financial markets. Founded in 1965, ETX Capital is one of the most trustworthy brokerages operational today. It maintains two subsidiaries, one with oversight from the UK FCA and another regulated by the CySEC. Its corporate owner, Monecor (London) Ltd, is also a member of the London Stock Exchange (LSE), and ETX Capital has a spotless regulatory track record. While there are no restrictions against scalping at ETX Capital, the structure does not make it ideal for scalpers. Therefore, traders who wish to scalp the Forex market will find more suitable brokers with an infrastructure that supports it. ETX Capital restricts leverage for retail traders to 1:30. ETX Capital, launched in 2002 by Monecor as TradIndex, was acquired by a joint venture between the UK-based JRJ Group and the Netherlands-based BXR Group. Following the acquisition, the group decided to rebrand TradIndex into ETX Capital. Since October 2020, ETX Capital, part of Swiss-based Guru Capital, purchased the online brokerage from JRJ Group. ETX Capital does deploy the market maker model but does not trade against clients in compliance with FCA rules to prevent misconduct. The minimum deposit at ETX Capital is an acceptable £100 or a currency equivalent. It is low enough for most retail traders but above that of the most competitive brokers, where it ranges between $0 and $10.FAQs

Is ETX Capital legit?

Does ETX Capital allow scalping?

What is the leverage on ETX Capital?

Who owns ETX Capital?

Is ETX Capital a market maker?

What is the minimum deposit at ETX Capital?