Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | FCA, MiFID |

Year Established | 2017 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Destek Markets, a Forex trading website launched in 2017, is a Forex and CFD broker headquartered and regulated in the United Kingdom. The website launch date doesn’t accurately reflect the company’s experience: they are owned by Destek Yatirim, a Turkish finance group which has been in business for over 25 years, so they should not be regarded as new kids on the block. They provide a range of account types, including an ECN account, that offers traders a fairly wide range of assets for trading in Forex currency pairs, major stock indices, and commodities, the latter two categories wrapped as CFDs (Contracts for Difference).

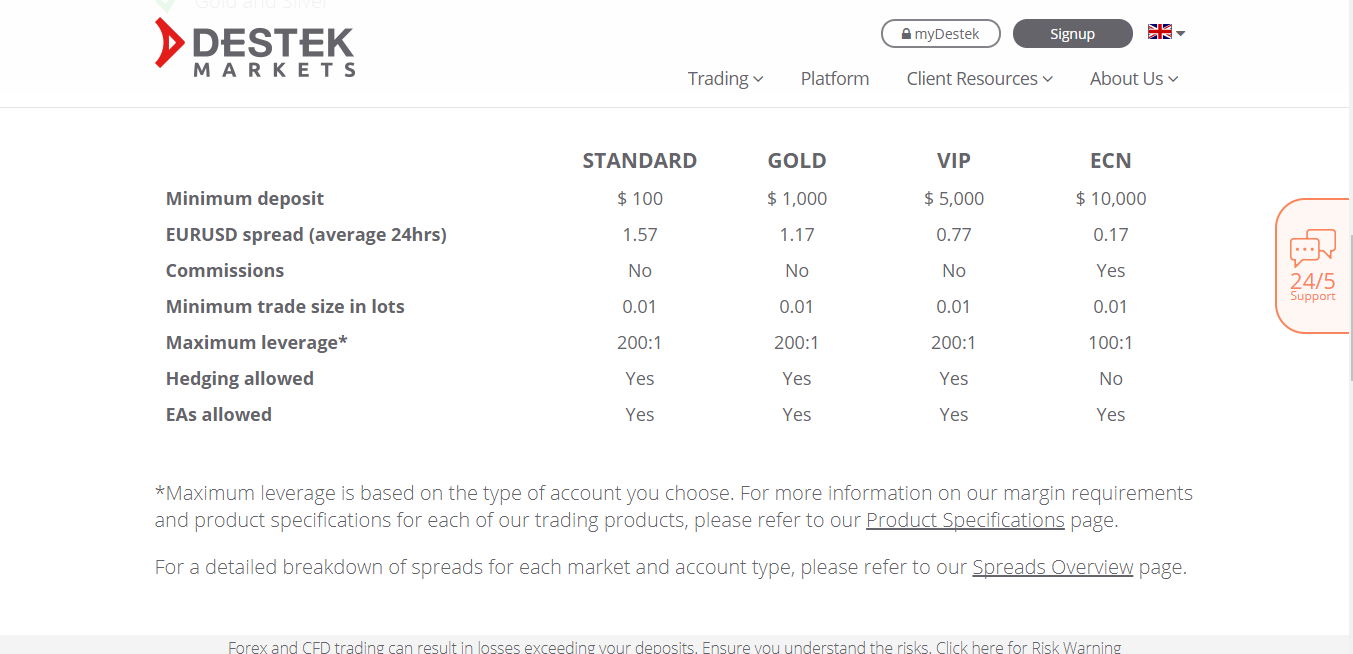

Accounts

There are four different account types to choose from at Destek Markets. The ECN account requires a minimum deposit of $10,000 and allows trading with floating spreads averaging 0.17 pips on EUR/USD under typical market conditions, as well as commission. A maximum leverage of 100 to 1 may be used. Hedging is not allowed with this account type. The Standard account requires a minimum deposit of $100 and allows trading with floating spreads averaging 1.57 pips on EUR/USD under typical market conditions, without commission. A maximum leverage of 200 to 1 may be used and the account is of the market-maker type, both of which apply also to the remaining two accounts described below. The Gold account requires a minimum deposit of $1,000 and allows trading with floating spreads averaging 1.17 pips on EUR/USD under typical market conditions, without commission. The VIP account requires a minimum deposit of $5,000 and allows trading with floating spreads averaging 0.77 pips on EUR/USD under typical market conditions, without commission.

The different accounts are easy to understand and are transparent. The major differentials between accounts are varying average spreads and commissions, maximum leverage, and market maker vs. ECN models. All accounts offer minimum trade sizes of 1 microlot (0.01 full lots).

A demo account is available, as is typical with nearly all spot Forex and CFD brokers.

A wide range of over 40 Forex currency pairs, spot metals (gold and silver) plus several other commodities such as crude oil and a few softs such as coffee and sugar, and 18 major stock indices is offered may be traded with Destek Markets.

Features

One of the most notable features of Destek Markets is that they offer good liquidity and few restrictions on trading, although scalping is not allowed in any account type, and hedging cannot be performed with an ECN account. Automated trading and hedging are possible in their offering. A lot of variety is offered in terms of account types, both in terms of ECN or market-maker styles. This means that traders can choose which offering suits them depending upon how much and how often they trade, as ECN will work better for some traders than others.

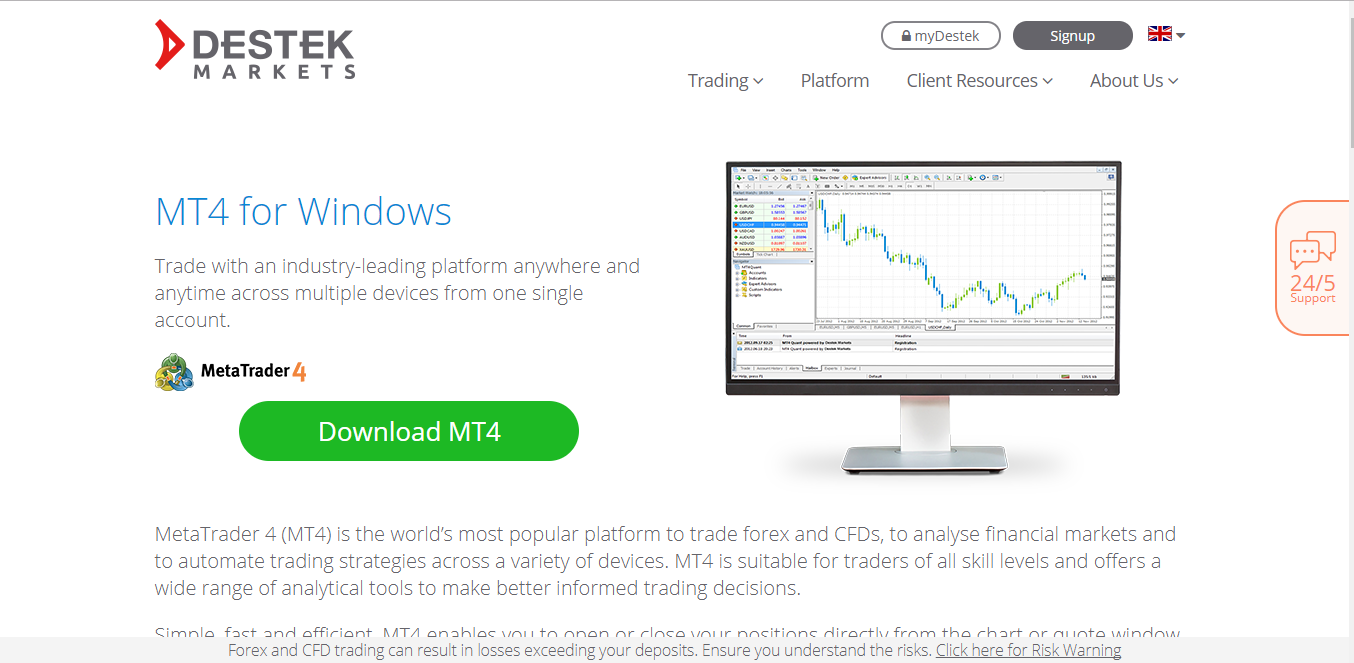

This broker bravely offers no choice of trading platform: if you open an account with Destek Markets, you must use the well-known and popular MetaTrader 4 platform. Expert Advisors can be run through the MetaTrader 4 platform. Frankly, if you are going to work with only a single platform, MetaTrader 4 is the best choice, as the most popular global platform and one that most traders are familiar with. It is easy to use and quite intuitive. In our opinion, many brokers with little to offer may sometimes choose to make a show of offering a very wide choice of trading platforms and other accessories, to distract attention away from what is truly important: trading costs, speed of execution, and ease of use / reliability. Another small but significant reassuring sign from Destek Markets is that they publish their live rollover swap rates for all instruments. It is quite rare for brokers to volunteer to publicize this information, although it can always be seen while trading in the MetaTrader 4 platform.

Education

Destek Markets’ educational offering includes a wide range of video tutorials, e-books, and a blog which is regularly updated. The website also contains several pages of static textual material. It is all well-produced, informative material which should be useful to newer traders. There is also regular current analysis of what is going in within key markets. One on one training, webinars, and workshops are also given.

Bonuses and Promotions

The only bonuses and promotions on offer at the time of writing is a $25 welcome bonus for new account openings. We find the lack of reliance on bonuses and promotions a positive sign, as such gimmicks are often used by inferior brokers to mask poor-quality core offerings, not to mention including onerous conditions that work to prevent or delay the withdrawal of profit.

Deposits/Withdrawals

Depositing funds into a Destek Markets account is an easy and secure process. Funding can be done using credit cards, Webmoney, or wire transfer. Withdrawals can be made to a credit card or by wire transfer to your bank account.

Destek Markets does not impose any minimums requirements on deposits or withdrawals, but the channels themselves may do so.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |     |

Customer support is based in London, offering 24-hour support while markets are open from Monday morning in Australia to Friday evening in New York. Support staff are fluent in other languages besides English.

Conclusion

Destek Markets has a well-rounded and professional offering for traders looking to trade a wide range of assets, particularly Forex currency pairs and global equity indices. Fans of no-nonsense trading looking for a confident and experienced broker, and traders looking for a choice of NDD and ECN type accounts will find their offer especially interesting, and quite possibly attractive enough to open an account.

Most importantly of all, the spreads and rollover swap rates offered seem to be truly competitive.

Features

In terms of features, the stand-out strengths of this broker’s offerings are:

- Competitive spreads and rollover swap rates.

- A wide choice of account types, including both market-maker and ECN-type accounts.

- An ability to use the most popular trading platform in the industry, Metatrader 4

- A reasonably wide range of instruments available for trading: all the major and minor Forex currency pairs, as well as several exotics; also, a good range of global equity indices, plus some commodities.

- Regulated by a very major industry center (United Kingdom) which includes deposit insurance of up to GBP 50,000 per client.

Platforms

MetaTrader4

The MetaTrader 4 is an independent trading platform, developed for trading FX, commodities and other products and is one of the most advanced and easy platforms to use. It remains the gold standard of trading platforms.

In addition to the wide range of markets available to trade, the MT4 platform provides traders with a multilingual interface, instant execution, built in help guides for MT4 and MetaQuotes Language 4, a complete technical analysis package including a wide range of in-built indicators and charting tools, various custom indicators and time periods and more.

Automated trading is also offered through the MetaTrader 4 platform where traders can create and test their automated trading strategies by using the MetaEditor, Strategy Tester and Compiler tools within the MT4 platform.

With this automated trading system clients may create Expert Advisors, software programs enabling traders to constantly monitor the markets. Custom Indicators help traders to predict future price movements by analyzing past and current price information. And the Scripts feature gives traders the opportunity to set up an automatic repetition of specific operations such as closing all positions with a single keystroke.

MetaTrader Mobile

The MetaTrader 4 and platform apps can be used on iPhones, iPads, Multi-Terminal, and all Android devices.