Dukascopy and Swissquote are two of the premier Switzerland-based Forex trading platforms. While Dukascopy is a significantly smaller company than its publically-traded competitor, both have a lot to offer all types of Forex traders.

In this Dukascopy vs Swissquote analysis, we outline everything you should know about the two platforms so you can feel comfortable choosing between the two. We dig in to:

- Features and Platforms

- Available Markets

- Typical Spreads and Fees

- Security and Trust

- Dukascopy vs Swissquote - Verdict

|  | |

Headquarters | Switzerland | United Kingdom |

Regulators | FINMA, JFSA | DFSA, FCA, FINMA, MAS, MFSA, SFC |

Tier 1 Regulator(s)? | ||

Owned by Public Company? | ||

Year Established | 2004 | 1990 |

Execution Type(s) | ECN/STP | Market Maker |

Minimum Deposit | $100 | 1000 |

Negative Balance Protection | N/A | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based | MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.3 pips ($3.00) | 1.6 pips ($16.00) |

Average Trading Cost GBP/USD | 0.8 pips ($8.00) | 1.8 pips ($18.00) |

Average Trading Cost WTI Crude Oil | $0.05 | $0.04 |

Average Trading Cost Gold | $0.32 | $0.47 |

Islamic Account | ||

Signals | ||

US Persons Accepted? | ||

Managed Accounts | ||

| Visit Website | Visit Website |

Features and Platforms

|  | |

MT4 | ||

MT5 | ||

cTrader | ||

Proprietary Platform | ||

Automated Trading | ||

DOM? | ||

Guaranteed Stop Loss | ||

Scalping | ||

Hedging | ||

One-Click Trading | ||

OCO Orders | ||

Interest on Margin | ||

| Visit Website | Visit Website |

Dukascopy

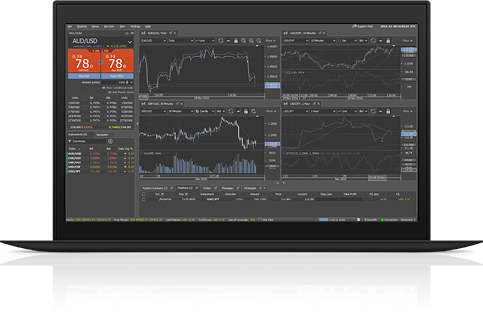

JForex, Dukascopy’s Forex trading platform, is available on Mac, Windows, and Linux operating systems. You can also trade through it online as well as on Android and iOS devices. The platform has 250 chart indicators and every popular chart type that you would expect to find on a Forex trading interface.

JForex also includes an economic calendar and news feed to help you stay up to date with market trends. If automations are part of your trading strategy, Dukascopy allows you to set them up either on your local device or through its Strategy Server. Additionally, you can test your automations against historical data.

Compared to Swissquote, the Dukascopy platform is more complicated; however, the company provides an in-depth guide and video tutorials to teach you the ropes. Additionally, Dukascopy consistently holds seminars and produces video webinars multiple times a week. Similar to other Forex trading platforms, you can trade via APIs on Dukascopy as well.

Swissquote

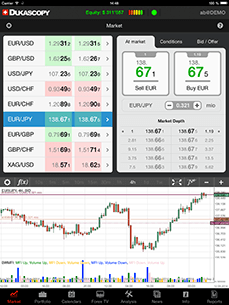

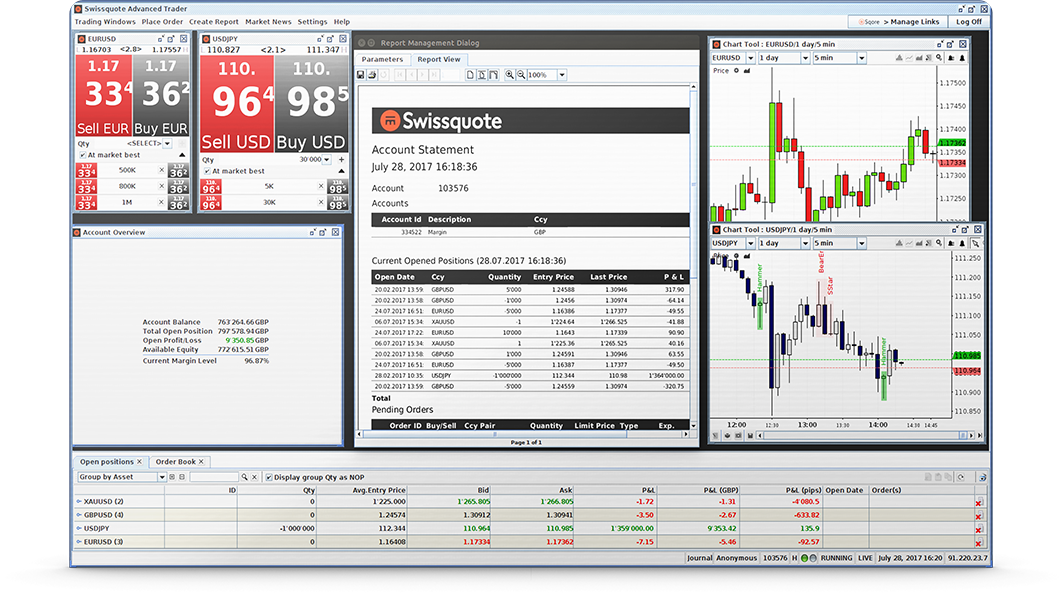

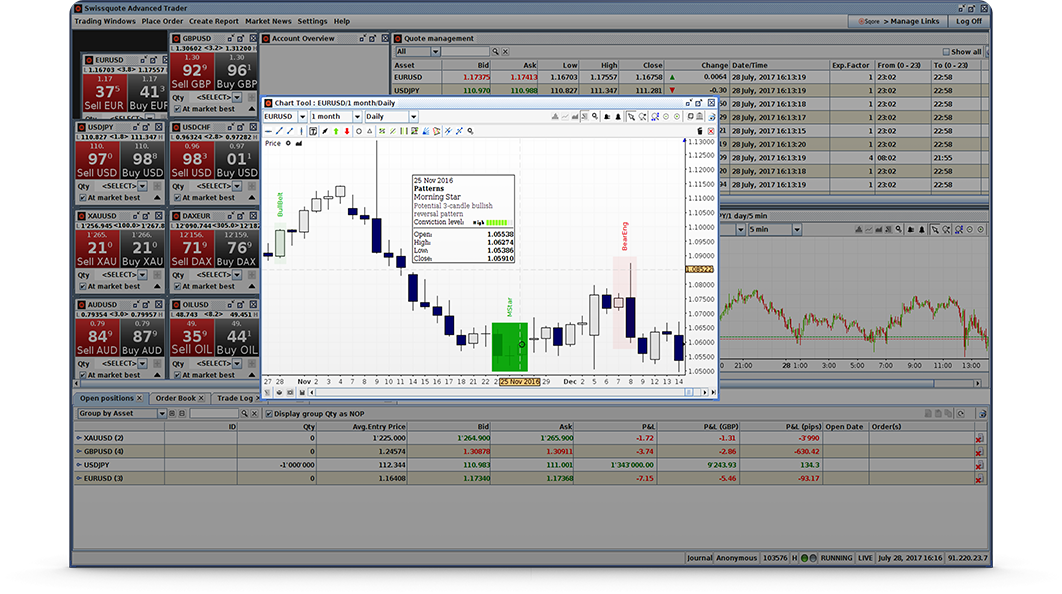

The Swissquote Advanced Trader platform contains all the features you need to become a successful trader. It includes 27 indicators, 17 overlays, and news from Swissquote and Bloomberg directly in the interface.

One of the most interesting Swissquote features, though, is its automatic pattern detection. The platform automatically recognizes and highlights common chart patterns (if they exist) on each chart and displays the pattern strength. For novice traders, this tool is an ideal way to learn the fundamentals of technical analytics.

Swissquote also provides a series of educational videos covering topics from “Introduction to Forex” and “Technical Analysis” to “Risk Management” and “Fundamental Analysis.” Like Dukascopy, Swissquote supports API trading as well.

Available Markets

|  | |

Currency Pairs | N/A | |

Cryptocurrencies | N/A | |

Commodities | ||

Crude Oil | ||

Gold | ||

Metals | ||

Equity Indices | ||

Stocks (non-CFDs) | ||

Bonds | N/A | |

ETFs | ||

Options | N/A | |

Futures | ||

Synthetics | ||

| Visit Website | Visit Website |

Typical Spreads and Fees

|  | |

Average Trading Cost EUR/USD | 0.3 pips ($3.00) | 1.6 pips ($16.00) |

Average Trading Cost GBP/USD | 0.8 pips ($8.00) | 1.8 pips ($18.00) |

Average Trading Cost WTI Crude Oil | $0.05 | $0.04 |

Average Trading Cost Gold | $0.32 | $0.47 |

Average Trading Cost Bitcoin | $73.95 | $2.50 |

| Visit Website | Visit Website |

Because Dukascopy and Swissquote utilize drastically different methods to calculate fees, you should figure out estimates of what rates your trading strategy would fetch on each platform.

Security and Trust

|  | |

Country of the Regulator | Switzerland, Japan, Latvia | United Arab Emirates, Cyprus, Hong Kong (SAR), Luxembourg, Malta, Singapore, Swaziland, United Kingdom |

Name of the Regulator | FINMA, JFSA | DFSA, FCA, FINMA, MAS, MFSA, SFC |

Regulatory License Number | Undisclosed but confirmed, Undisclosed, Undisclosed | Bank license, 562170, Category 4 License, Type 3 License, C 57936, Undisclosed but confirmed, Banking license, 422/22 |

Regulatory Tier | 1, 1, 1 | 1, 1, 2, 1, 1, 1, 1, 1 |

| Visit Website | Visit Website |

Dukascopy vs Swissquote – Verdict

Out of these two Forex companies, Swissquote is notably the least intimidating of the two. It implements less complicated fees, and the overall interface is significantly more comfortable to work with. Combine these attributes with the platform’s more extensive selection of markets, and it’s clear that Swissquote has the edge over Dukascopy.

That being said, much of Forex trading is personal preference. So, we recommend that you try the demo accounts on both platforms to see which one works best for you.