The broker comparison below features two heavyweights in the brokerage industry; Alpari, operated out of Mauritius with a fairly light regulatory touch vs FxPro, authorized and regulated by the Financial Conduct Authority (FCA). Alpari is home to over 2,000,000 clients and heavily focused on PAMM accounts, while FxPro caters to over 1,300,000 traders and remains the market leader in ECN trading.

This broker comparison will focus on the following four aspects plus an ultimate verdict:

- Features and Platforms

- Available Markets

- Typical Spreads and Fees

- Security and Trust

- Alpari vs FxPro Verdict

|  | |

Headquarters | Saint Vincent and the Grenadines | United Kingdom |

Regulators | MWALI International Services Authority | N/A |

Tier 1 Regulator(s)? | ||

Owned by Public Company? | ||

Year Established | 1998 | 2006 |

Execution Type(s) | ECN/STP, Market Maker | No Dealing Desk |

Minimum Deposit | $500 | $100 |

Negative Balance Protection | N/A | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 | Other, MetaTrader 4, MetaTrader 5, cTrader+ |

Average Trading Cost EUR/USD | 1.1 pips ($11.00) | 1.3 pips |

Average Trading Cost GBP/USD | 1.2 pips ($12.00) | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.06 | $0.03 |

Average Trading Cost Gold | $0.27 | $0.29 |

Retail Loss Rate | Undisclosed | N/A |

Minimum Raw Spreads | 0.0 pips | N/A |

Minimum Standard Spreads | 0.8 pips | N/A |

Minimum Commission for Forex | $1.60 per 1.0 standard round lot | N/A |

Islamic Account | ||

Signals | ||

US Persons Accepted? | ||

Managed Accounts | ||

| Visit Website | Visit Website |

Alpari features over 56,000 PAMM accounts with over 550,000 traders and has expanded in the retail asset management sphere with over 20 years of experience. Alpari is currently rebuilding itself as a member of the Exinity group after having some regulatory troubles in recent years. But those seem to be behind the brand, which is now serving traders reliably and entirely favorable.

FxPro functions with an FCA license though a large portion of this broker’s staff operates out of the company’s Cyprus office . This broker has specialized in ECN trading, fully supports automated trading solutions, and continues to innovate from a deep liquidity pool. This broker has invested over $121 million in sponsorships of professional sports teams, where it remains a dominant player.

Features and Platforms

|  | |

MT4 | ||

MT5 | ||

cTrader | ||

Proprietary Platform | ||

Automated Trading | N/A | |

DOM? | ||

Guaranteed Stop Loss | ||

Scalping | ||

Hedging | ||

One-Click Trading | ||

OCO Orders | ||

Interest on Margin | ||

| Visit Website | Visit Website |

Alpari

Alpari offers the MT4 and MT5 trading platforms; it also provides an ECN account.It does not seem that third-party plugins are provided for the MT4 trading platform, which leaves traders with the basic version, and a lack of critical features.

Besides its focus on PAMM accounts, it also advances social trading via its Alpari CopyTrade platform. Alpari does feature webinars for new traders to learn more about trading, and an acceptable assortment of written articles is additionally available. Traders can also access the free research provided by this broker and receive fresh trading ideas. A loyalty cashback program reduces trading costs for active traders.

FxPro

Like Alpari, FxPro provides the MT4/MT5 trading platforms. Here is where FxPro sets itself apart though; ECN trading with FxPro is available via the industry-leading cTrader platform.An upgraded MT4 trading platform will result in a superior choice but requires the proper upgrades. Regrettably, FxPro does not grant any of the essential third-party plugins. VPS hosting is provided, enhancing the support of automated trading solutions.

FxPro presents an excellent educational platform and dedicates an entire section on trading psychology. Video tutorials and trading tests complement the well-designed educational course. FxPro creates in-house market news, and traders have access to a comprehensive analytical suite through a partnership with Trading Central. The primary concern at FxPro remains the 77% failure rate of traders, though Alpari isn’t required to provide this statistic as Mauritius regulation doesn’t require it.

Available Markets

|  | |

Commodities | ||

Crude Oil | ||

Gold | ||

Metals | ||

Equity Indices | ||

Stocks (non-CFDs) | ||

ETFs | ||

Futures | ||

Synthetics | ||

| Visit Website | Visit Website |

Both brokers present over 250 assets across multiple categories, but the principal focus remains the Forex market. Unfortunately, both brokers also offer a weak commodity selection, but FxPro displays a broader selection of equity CFDs, while Alpari entertains a primary selection ofcryptocurrency pairs. Pure Forex traders will find the asset selection in the Forex market pleasing with both brokers, as both offer a solid mix of major, minor, and exotic currency pairs. Cross-asset diversification is achievable in the most simplistic form, but more sophisticated traders will discover the limitations of the overall asset selection at both brokers.

Typical Spreads and Fees

|  | |

Commodities | ||

Crude Oil | ||

Gold | ||

Metals | ||

Equity Indices | ||

Stocks (non-CFDs) | ||

ETFs | ||

Futures | ||

Synthetics | ||

| Visit Website | Visit Website |

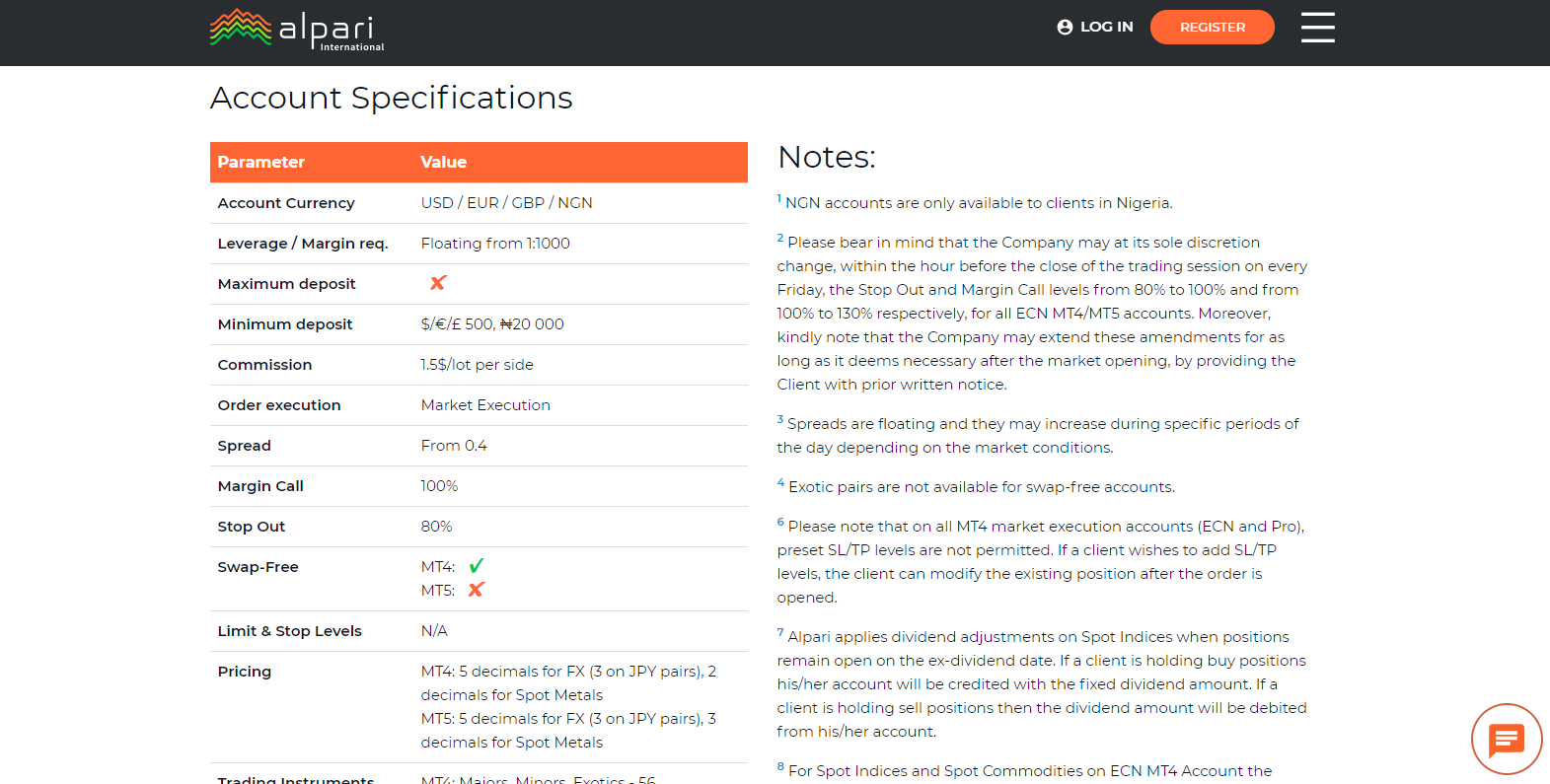

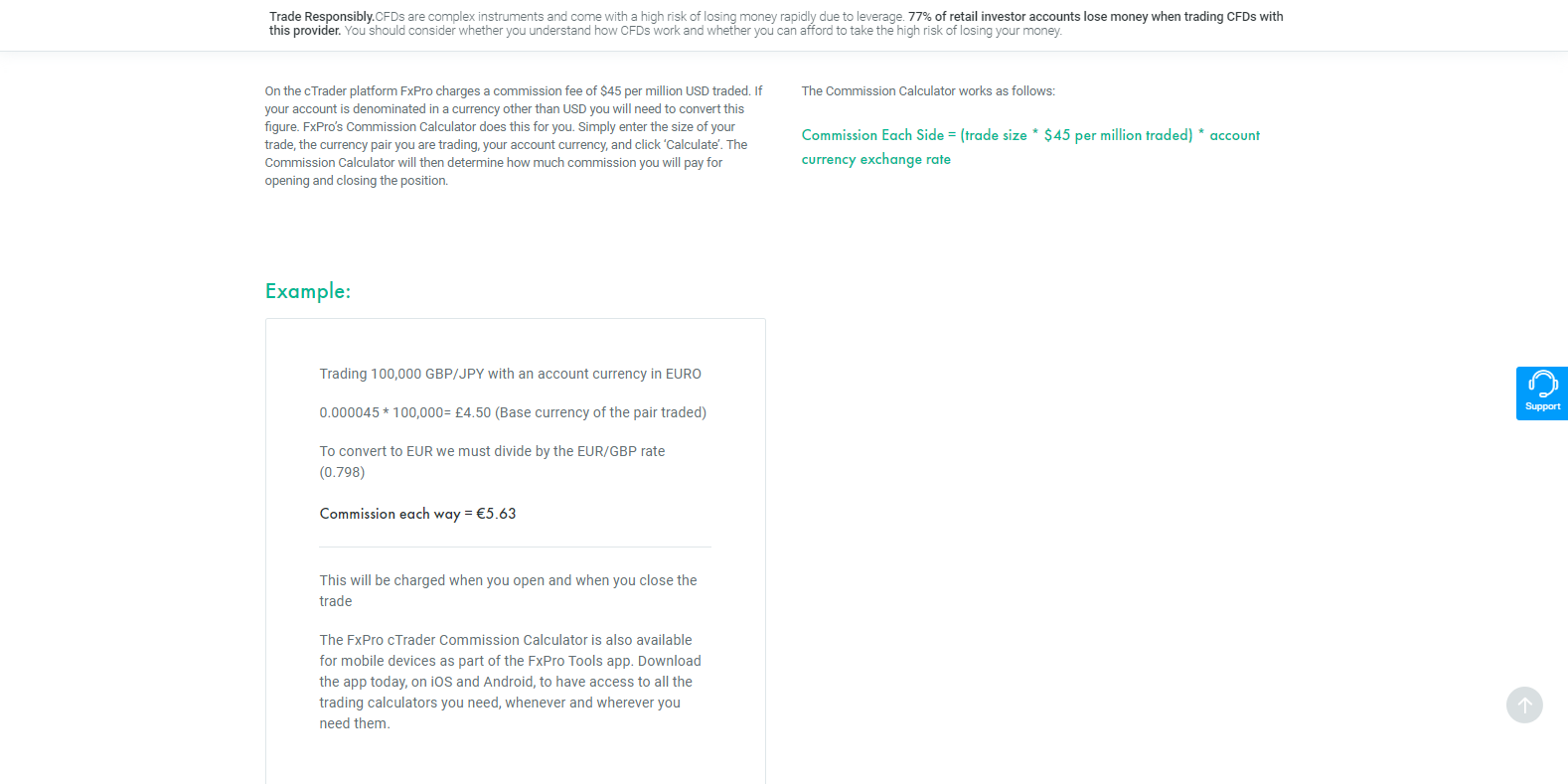

The Alpari Micro account starts from a spread of 1.7 pips, this is lowered to 1.2 pips in the Standard account. The Alpari ECN account carries spreads from 0.4 pips with a commission of $3 per round lot, which outlines a very competitive trading environment. FxPro offers 1.4 pips spread in its MT4 account, and ECN traders can receive raw spreads, as low as 0.0 pips, but for a commission of $45 per $1,000,000. Alpari has a fixed approach, while FxPro uses a dynamic one.

Swap rates on overnight positions are applicable at both brokers, and so are third-party charges on deposits as well as withdrawals. Corporate actions additionally apply, on equity and index CFDs; the amount is credited or debited from the trader's account, depending on the direction of the trade.Broadly speaking, trading costs at Alpari are lower and provide traders with a more favorable pricing environment.

Alpari offers spreads as low as 0.4 pips in its ECN account plus a commission of $3 per round lot; in some sections, the spread is listed as low as 0.1 pips.

FxPro offers spreads as low as 0.0 pips, but a $45 fee per $1,000,000 applies, and the trading costs are overall higher than at Alpari.

Security and Trust

|  | |

Country of the Regulator | Mauritius, Malawi | The Bahamas, Cyprus, United Kingdom, South Africa |

Name of the Regulator | MWALI International Services Authority | N/A |

Regulatory License Number | C113012295, T2023236 | 509956, 078/07, 45052, SIA-F184 |

Regulatory Tier | 4, 5 | 1, 1, 2, 4 |

| Visit Website | Visit Website |

Exinity LTD, the owner of Alpari, is regulated by the Financial Services Commission (FSC) in Mauritius as a full-service investment dealer excluding underwriting services. It additionally participates in The Financial Commission’s compensation fund, offering coverage up to €20,000 per case; this is on par with EU requirements. The Financial Commission is the world’s first external dispute resolution (EDR) mechanism operated out of Hong Kong. Alpari has a past of bankruptcies and market exits but has remained in full compliance with its regulators.

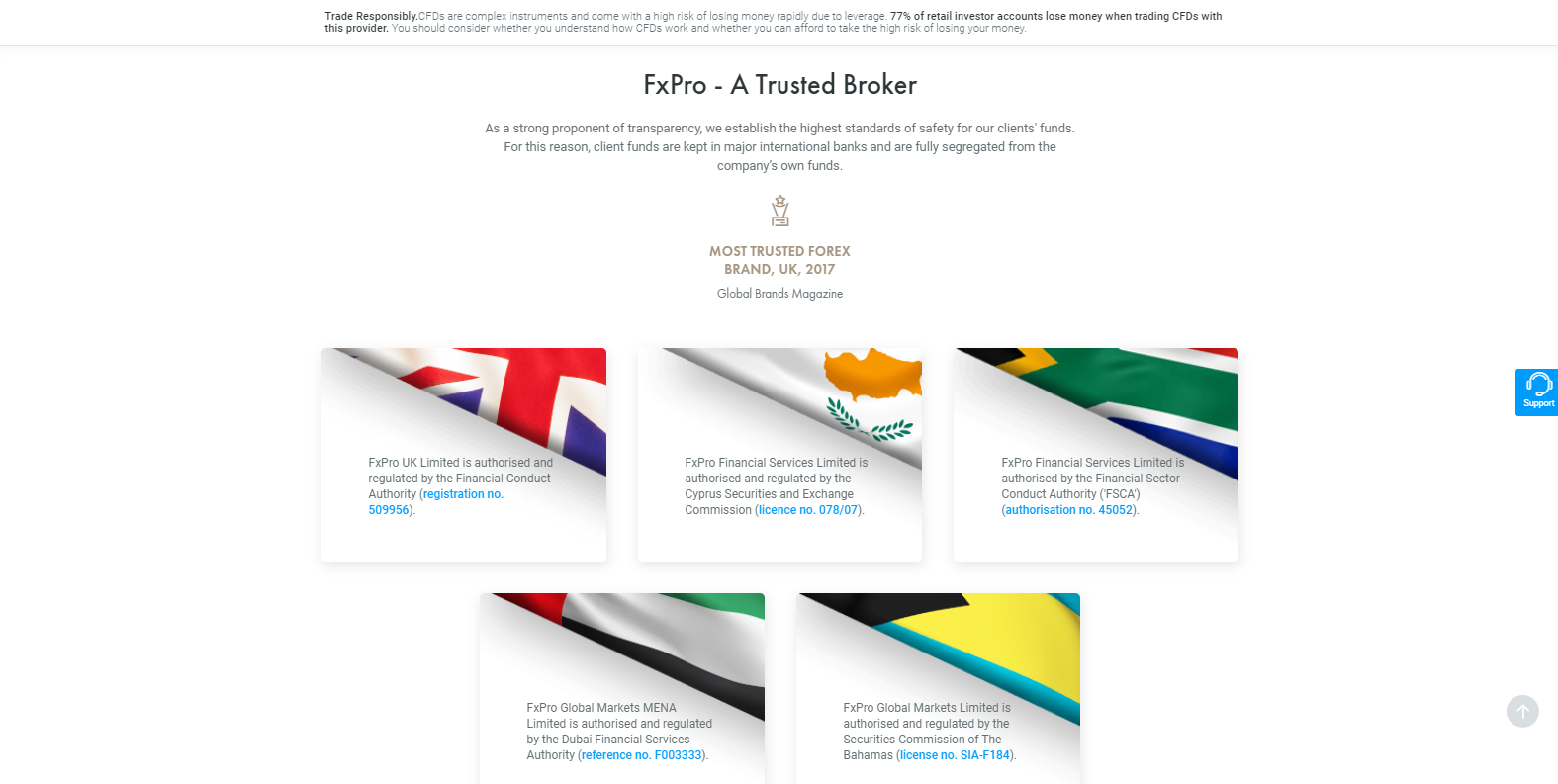

FxPro is primarily regulated in the UK by the FCA, the prime regulator in the global financial system. Traders are protected under the Financial Services Compensation Scheme (FSCS) that reimburses deposits in the event of a default up to a maximum of £85,000. FxPro has a spotless record and remains one of the most trusted Forex brokers in the industry.

Alpari operates out of a smaller regulatory environment, but counters this with protection offered by The Financial Commission.

FxPro operates under the FCA regulatory framework and remains one of the most trusted brokers.

Alpari vs FxPro Verdict

Alpari represents a sound brokerage with a focus on PAMM accounts and is home to over 2,000,000 traders, including 56,000 PAMM accounts with over 550,000 participating traders. It offers a highly competitive trading environment in its ECN account but fails to mention which MT4 ECN bridge it uses. The turbulent past at Alpari should be considered, but broadly speaking, this broker offers a safe trading environment, excellent for retail account management.

FxPro is an excellent broker with over 1,300,000 traders and continues to increase its market share as one of the most trusted Forex brokers. It offers a better selection of trading platforms, and traders are treated to lower spreads, but at a higher cost. FxPro established itself as a market leader in ECN trading, is very transparent about pricing and trade execution, and deserves to be part of any well-diversified approach to trading.

Alpari and FxPro are both genuinely solid brokerages. Asset managers will find a more dedicated approach at Alpari, while FxPro offers an advantage by having its website in 27 languages. It’s a tight race, but Alpari edges in for the win here, as it has lower fees overall, which tips the scale in their favor in an otherwise fairly even pairing.

You might also be interested in reviewing the below broker comparisons:

Which is better, Alpari, or FxPro?

Both brokers offer pure Forex traders with an acceptable choice of currency pairs. Alpari offers cryptocurrencies, while FxPro has an edge in equity CFDs. FxPro offers trader cTrader on top of MT4/MT5, while Alpari supports social trading. An improved cost structure at Alpari meets more in-depth education and research tools at FxPro, which takes a marginal lead over Alpari in the overall trading environment. Both maintain a highly competitive Forex trading- product and services portfolio.

How many Forex pairs and CFDs are available to trade?

Alpari features 60 Forex pairs and 33 CFDs across commodities, equities, indices, and cryptocurrencies, as listed under contract specifications. It remains well below the 250+ noted on the homepage. FxPro offers 70 currency pairs and 185 CFDs covering the same as Alpari minus cryptocurrencies. Therefore, the known asset selection is superior but remains well below many competitors at both brokers.

What about MetaTrader and copy trading?

What are the minimum deposits for these brokers?